Petrochemical business in Indonesia…a challenging opportunity

There are momentous opportunities remaining for investment in Indonesia’s petrochemical industry due to high and continuously growing domestic demand, but few players and low overall production capacity. EIC views that commodity petrochemical investment such as in PE (Polyethylene) and PP (Polypropylene) could address domestic supply gap, as Indonesia currently imports a large share of these products. A joint venture with locals is a recommended strategy to facilitate market entry in Indonesia.

Author: Chanita Suwanna

|

|

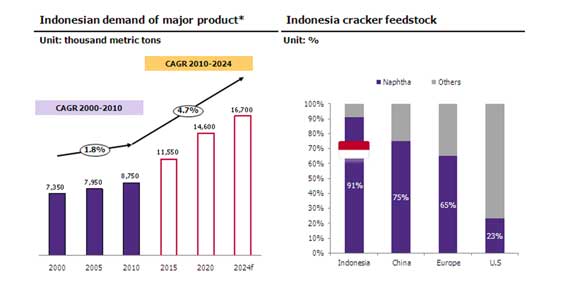

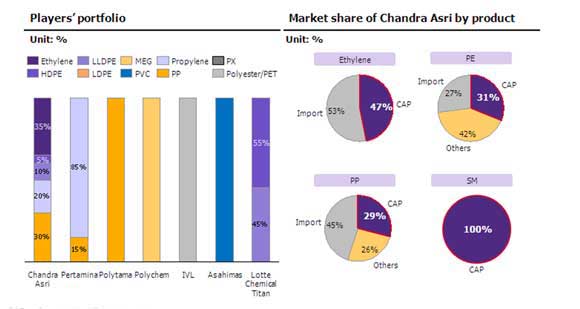

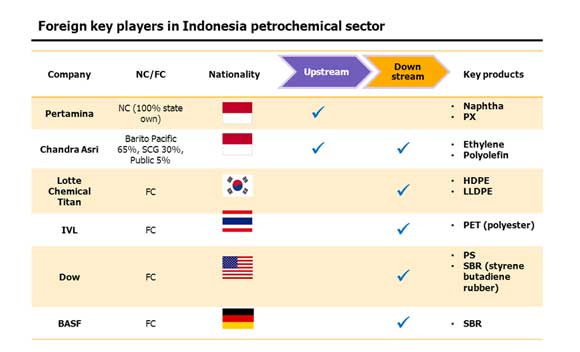

Petrochemical sector contributes to 3% of Indonesia's GDP. Indonesia's petrochemical business has developed slowly, with demand growing by approximately 2% per year and productions are mostly Naphtha based (Figure 1). However, petrochemical demand should soon grow by 5% per year due to Indonesia's economic expansion. Most petrochemical players in Indonesia lack value chain integration, with players only operating in the upstream and downstream segments or some only in the downstream segment. In addition, scarce petrochemical feedstock and weak links to the oil business make Indonesia dependent on petrochemical imports for as much as 50% of domestic demand. Hence, after taking into account higher demand growth and import replacement, Indonesia's petrochemical production market should be able to grow much more than 5% per year. Chandra Asri is a petrochemical producer worth keeping an eye on. The company is the market leader in Indonesia, with revenues equivalent to 40% of Indonesia's petrochemical market. Chandra Asri is the only fully integrated petrochemical company, with operations in every segment of the value chain. The company offers various petrochemical products, ranging from upstream products such as ethylene and propylene to downstream products such as polyethylene (Figure 2). The company's portfolio mix differentiates the company from other Indonesian petrochemical players, as other players only offer specific products in certain segments of the value chain. Currently, There is limited foreign investment in the petrochemical industry, with most targeted at the downstream segment (Figure 3). Large foreign petrochemical companies have invested in Indonesia's downstream petrochemical business targeted to serve demand from petrochemical related industries in Indonesia. These include Thailand's IVL, which established a PET (Polyester) production plant, the USA's Dow Chemical, and Europe's BASF which established joint ventures to open a SBR (Styrene Butadiene Rubber) plant.

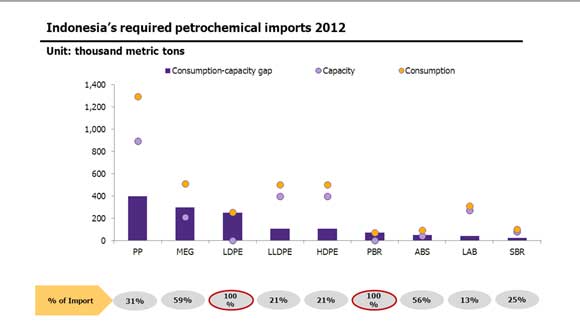

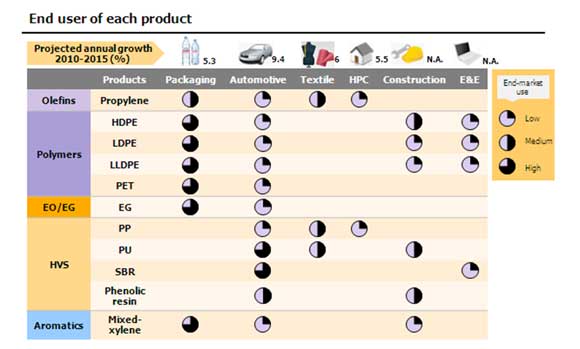

Thailand's large petrochemical players, such as PTTGC and SCG, have now entered the Indonesian market . In late 2013, PTTGC signed a Memorandum of Understanding (MOU) with Pertamina to form a JV to establish a fully integrated petrochemical plant worth USD 5 billion. The plant will produce products such as ethylene and propylene and commence operations during 2018, and it is hoped that it will eventually enjoy a 30% market share. Meanwhile, SCG acquired 30% of Chandra Asri shares via M&A during 2011, in order to seek market expansion opportunities and develop new products to meet domestic demand. One of the main challenges for Indonesia's petrochemical business is scarce feedstock for petrochemical production. Even though Indonesia is a country rich in oil and natural gas resources, the government still limits oil and gas usage despite high demand growth. Because of this, Indonesia is increasingly reliant on oil imports, currently is as high as 30% of domestic oil demand, compared to just 4% in 2004. Furthermore, the petrochemical industry is not a priority sector for natural gas usage. As a result, feedstock availability for petrochemical production is a challenging issue. Such high import dependency lowers the competitiveness of domestic players in terms of costs and increases feedstock supply risk. However, there are 3 reasons investors should not overlook Indonesia's petrochemical industry: 1. Scarce supply of various domestic petrochemical products: Indonesia is currently importing a high percentage of various petrochemical products, such as ethylene and polyethylene, and some petrochemical products are 100% imported, such as LDPE (Figure 4). Meanwhile, average plastic consumption per capita in Indonesia is low when compared to its ASEAN peers. As a result, scarce domestic supply and high demand potential will bring momentous opportunities for business expansion. 2. Government investment incentives for the petrochemical business: Tax incentives such as tax holidays and tax allowances are among the highlights of investment incentives offered in Indonesia. In order for players to benefit, they need to follow additional conditions set by the government, such as a minimum investment value of USD 1.1 billion, with 10% of the value needing to be deposited in Indonesian banks. 3. Continuous petrochemical industry growth: There is a positive growth outlook for petrochemical related industries, especially those that are dependent on plastic usage (Figure 5) such as the automotive, packaging, and construction industries. The petrochemical supply needs to be increased in order to serve higher demand growth from these industries. EIC suggests that interested investors enter the Indonesian market by forming a JV with local partners. Investors should especially consider petrochemical commodities such as PE and PP. Starting a business in Indonesia is not as easy as it is in other ASEAN peers. Cooperation with local partners is one solution that will facilitate market entry and operations. Moreover, partnering will help expedite understanding of market complications and of consumption behavior patterns. Meanwhile, highlighted products are commodity petrochemicals, as they are in high demand, especially the different varieties of PE (HDPE, LDPE, and LLDPE), with import portions ranging from 20-100% of domestic consumption and PP with a 30% import share. The aforementioned products are mainly used in the food & beverage packaging industry and the automotive & parts industry. Figure 1: Going forward, petrochemical demand in Indonesia should grow by 5% per year, with most of the production Naphtha based. * Olefins, polyolefin, derivatives, aromatics and butadiene derivatives

Figure 2: Chandra Asri is the only fully integrated petrochemical player in Indonesia and the market share leader in various petrochemical products Note: CAP = Chandra Asri Petrochemicals

Figure 3: Most foreign investment in Indonesia's petrochemical industry is in the downstream segment

Source: EIC analysis based on data from BMI, PTTGC, CAP and Bloomberg

Figure 4: Indonesia imports a high proportion of various petrochemical products, with some products being 100% imported

Source: EIC analysis based on data from PTTGC

Figure 5: The outlooks for plastic dependent industries are positive Note: HPC=Home and personal care, E&E=Electronics and Electrical |

|

|||