Chinese steel floods the Thai market: factors and remedies

Although expansion of Thailand’s construction and manufacturing sectors has increased the domestic consumption of steel, this has mostly driven more use of steel imported from other countries, especially from China. Domestic steel sales have fallen dramatically due to lower competitiveness of Thai steelmakers. Therefore, Thai steelmakers need to adjust to respond to both higher demand in the market and stiffer competition.

Author: EIC | Economic Intelligence Center

Although expansion of Thailand's construction and manufacturing sectors has increased the domestic consumption of steel, this has mostly driven more use of steel imported from other countries, especially from China. Domestic steel sales have fallen dramatically due to lower competitiveness of Thai steelmakers. Therefore, Thai steelmakers need to adjust to respond to both higher demand in the market and stiffer competition.

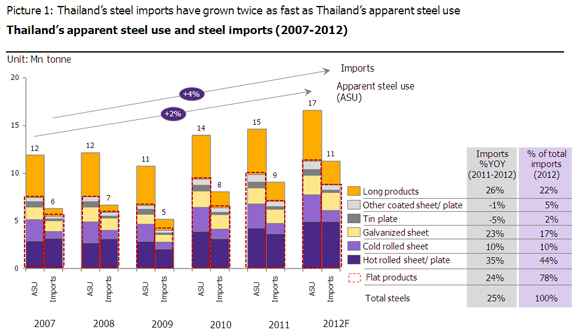

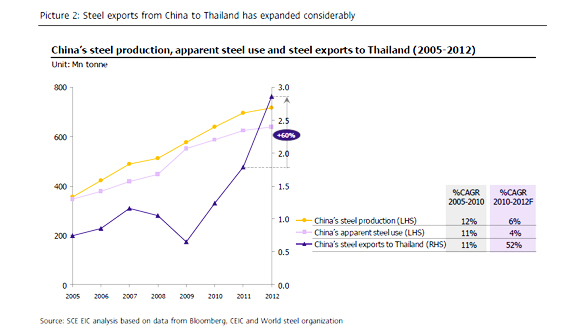

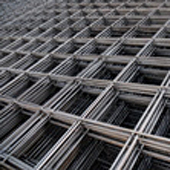

Thailand's imports of steel, especially hot-rolled steel, have increased greatly on the back of higher consumption. Thailand's apparent steel use in 2012 increased by 13% compared to 2011. Demand for flat steel, used in manufacturing industries, expanded by 14%, while consumption of long steel products, which are used in construction, increased by around 12%. Total steel imports increased by 25%, with highest 35% surge in hot-rolled sheet/ plate, which is one kind of flat steel (Picture 1). Increasing imports have crowded out domestic production, particularly flat steel production which declined by 10% from 2011. The highest proportion of Thailand's steel imports come from Japan, which claimed 30% of total steel imports, followed by China, which has 20% share. Most of the steel imported from Japan is high-quality and high-strength steel, used in industries such as automotives that Thai producers are unable to manufacture these kinds of steel due to lack of technology. On the other hand, most of the steel imported from China is similar to that manufactured in Thailand. In 2012, imports of steel from China, the world's largest steel manufacturer, increased by 60% from the previous year (Picture 2), indicating that Chinese steel have rapidly penetrated the Thai market.

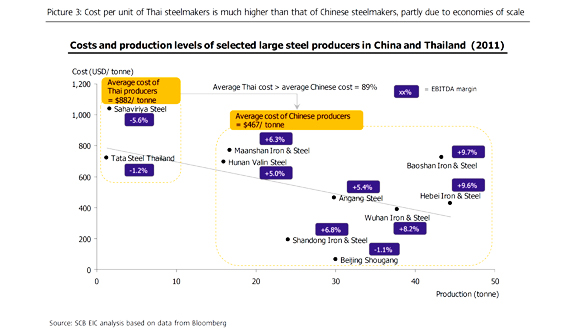

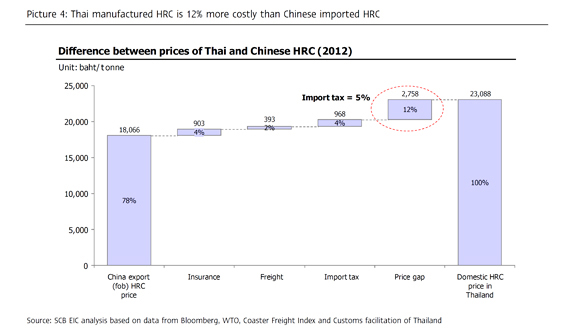

The main reason for rising imports is price: Chinese steel is considerably cheaper than Thai. This is because so many Chinese steel factories are large and have high production capacity. Major Chinese manufacturers can typically produce over 30 million tonnes (also known as metric tons in US English) of steel per year, whereas most Thai operators have much smaller factories, producing below 5 million tonnes each per year. Therefore, Thai steelmakers have much higher cost per unit than Chinese competitors. In 2011, major Thai steelmakers had cost per unit at levels nearly twice as high as those of major Chinese companies (Picture 3). As a result, Thai steelmakers simply cannot compete with Chinese rivals on price. Current price for Chinese hot-rolled coil (HRC), including insurance, freight and import taxes, is approximately 12% cheaper than domestic HRC price in Thailand (Picture 4).

Furthermore, demand from China's real estate and manufacturing sectors has slowed down, while supplies remain high, resulting in the oversupply of steel. This has led to a decline in Chinese steel prices since the beginning of 2012 (Picture 5). Steel prices are likely to remain low due to consistent oversupply. Under this circumstance, storing steel as inventory can cause inventory loss. As a countermeasure, Chinese steelmakers export aggressively in order to sustain their income. Chinese steel companies view ASEAN as a dominant market with higher growth potential than other regions. Thus, China's steel exports to ASEAN rose by 47% in first 9 months of 2012 compared to the same period last year.

Chinese steelmakers are likely to further penetrate the Thai market in the short- to medium-term since slow recovery of China's property and manufacturing sectors will prolong the oversupply of steel. Chinese steel prices should increase gradually but will remain low, which will continue to pressure the margins of Thai manufacturers. Moreover, increasing liberalization of trade will force Thai operators to face additional competition from imports.

Besides that, Thailand unfortunately lacks the capabilities to manufacture high quality steel, especially flat steel, to respond to the demand of downstream industries. This means that Thai steelmakers are unable to take advantage of the opportunities that are now resulting from the large ongoing expansion of the automobile industry here. These opportunities have instead been seized by foreign exporters who ship to Thailand. Flat steel products are crucial for auto manufacturing. Carmakers usually require advanced high-strength steel (AHSS), which Thai companies still cannot produce. This is because AHSS manufacturing requires iron ore with high purity. However, Thailand lacks domestic sources of iron ore, and current manufacturing processes here still use scrap as the main input. Thus, Thailand needs to import flat steel to supply end-user industries.

Moreover, Thailand's importers of Chinese steel are able to find ways to avoid paying taxes by importing alloy steel. At the same time, the Chinese government has established tax rebate policy to support exporters. As a result, Thai steelmakers have urged the Ministry of Commerce to impose policies to respond to dumping but such policies will only solve problems in the short term. Some alloy steel like boron alloy steel plates, which contain boron alloy to increase strength, are considered as high-quality steel, which is mainly used in manufacturing industries such as for automobiles and machinery. Thai steel importers from China are able to avoid import tariffs by importing the minimal boron-added steel, classified as alloy steel, which is exempted from import tax in Thailand, as opposed to regular hot-rolled steel sheets, which are subjected to a 5% import tariff in accordance with most-favored-nation treatment under WTO rules. However, alloying small amounts of boron does not significantly alter the characteristics or price of the steel. Boron-added steel plates from China are therefore very cheap and able to penetrate the Thai steel plate market.

Apart from that, Chinese exporters also gain an advantage from their government's tax rebate policy. The Chinese government has substantially supported steel industry as it is accounted for approximately 10% of China's GDP and is a major source of tax revenue. Thai steelmakers therefore see the Chinese government's tax support as creating an unfair competitive advantage. Hence, they have proposed ministry of commerce to impose anti-dumping measures against Chinese exporters (as well as Korean ones) in which the ministry of commerce has decided to implement anti-dumping measure on boron-added steels by collecting 14.28-19.47% import tax since end of December 2012. This means that Thailand has to import steel at higher prices, resulting in negative effect on downstream industries, which might do more economic harm than good. Protecting domestic steelmakers behind trade barriers does not solve the underlying competitive problem and will not sustainably protect them. This policy only buys time and room for Thai players to be safe and capable to grow. If the Thai steelmakers do not adjust and build up strengths, the problems will persist. Moreover, international trade will likely continue to liberalize, and import taxes on all types of steel will fall to less than 5% in 2018 under the free trade agreement between ASEAN and China so Thai companies have to quickly find solutions for increasing competition.

|

|

|

|

|