Why e-Payment is essential to merchants as Thailand becomes a cashless society?

EIC Research Series: Alibaba Kingdom

Author: Pimnipa Booasang

In recent times, both government and private sector have been promoting the move away from cash towards e-Payment among stores and consumers. The Chairman of the Thailand e-Payment Trade Association estimates the amount of cash transactions will rapidly fall from its current level of 90% down to 50% within just 2 years. Given the above, this article aims to provide answers to questions on the minds of all store owners regarding the benefits of e-Payment, the form of e-Payment that will be most widespread and whether the usage of e-Payment will rise as anticipated.

Government and private sector push for a cashless society.

The Ministry of Finance and commercial banks had a joint initiative under the National e-Payment agenda leading the installation of a total of 550 thousand electronic data capture (EDC) terminals nationwide to support credit/debit card payment. Afterwards, the Bank of Thailand announced its Standard QR code or QR code scheme enabling compatibility of a single QR code with payments from any credit/debit card, bank saving accounts or e-Wallets from domestic or foreign Non-Bank service providers. Meanwhile among private enterprises, large banks renewed their mobile application to enable QR code payment, whilst non-banks such as TrueMoney, m-Pay, AirPay heavily promoted their services in order to draw in more e-Wallet users.

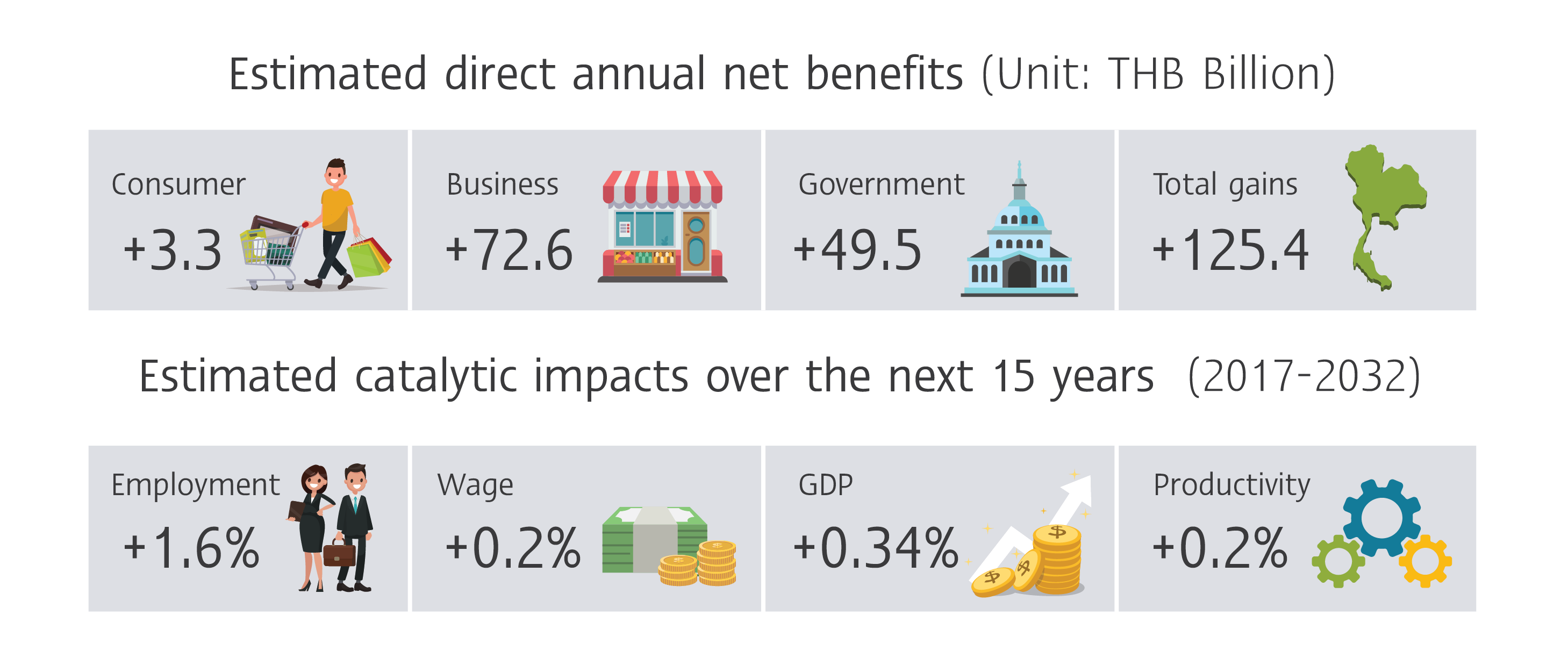

It can be seen that the government and private sector have been encouraging more use of e-Payment between merchants and consumers via credit/debit cards, mobile banking and e-Wallet as the advantages of the move towards a cashless society are enormous. Such transition will lower cost of transactions and cash management as well pave way to other financial innovations. In fact, an analysis by VISA estimates the cumulative benefits of Bangkok becoming a cashless society will amount to THB 125 billion per year, with businesses stand to reap the most gains.

|

Mobile banking is a service provided by a bank that allows its customers to conduct financial transactions remotely using a mobile device such as a smartphone or tablet. |

|

Non-bank’s e-Wallet, such as TrueMoney, m-Pay, AirPay, is an electronic wallet which is used for transactions made online through a computer or a smartphone. |

Estimated annual net benefits experienced by Bangkok if it moves to cashless society*

Remark: Estimated net benefits experienced by Bangkok’s economy if the entire population can move to digital payment usage equal to top 10% of users today.

Source: Cashless Cities Report by VISA

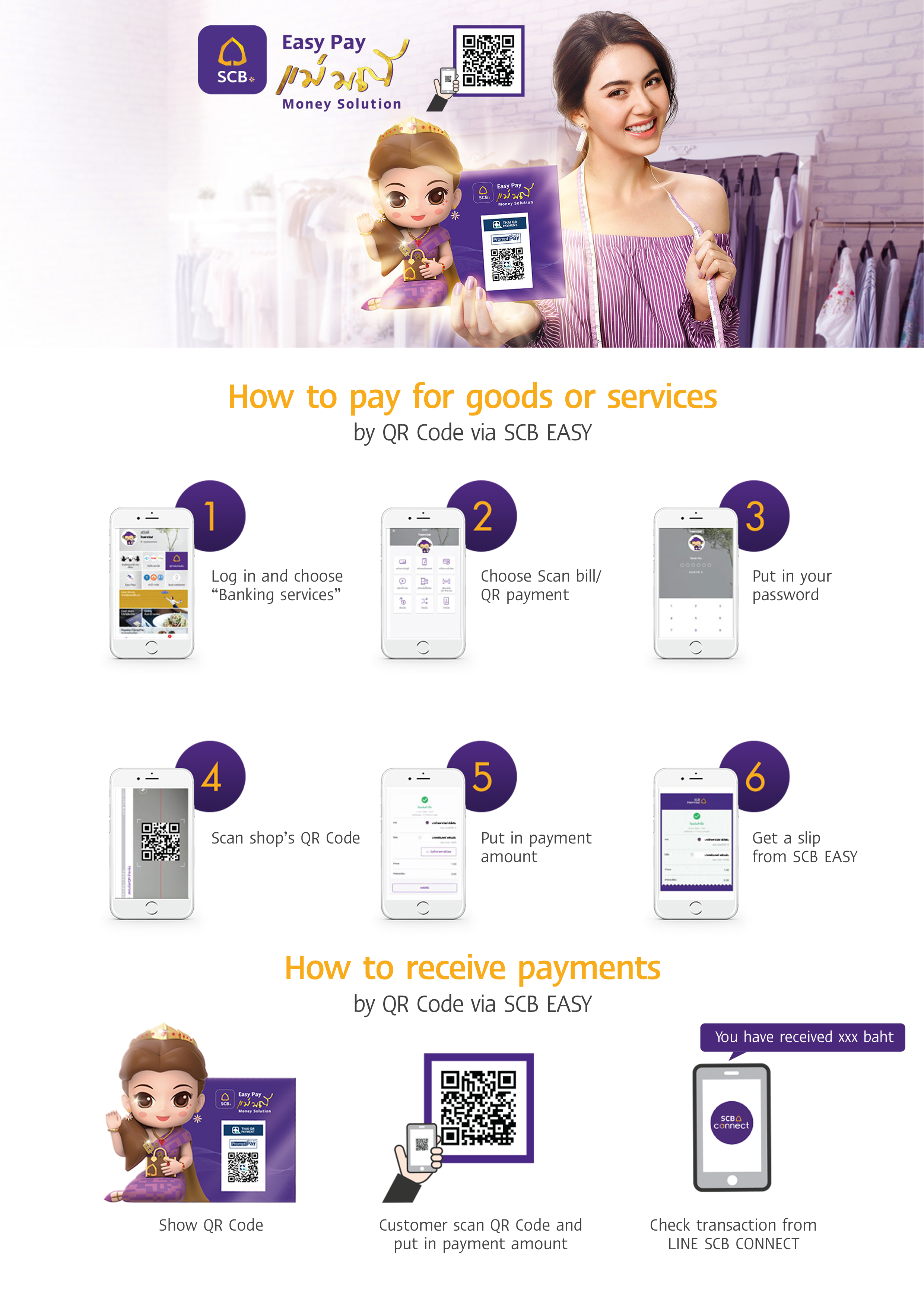

How to pay for goods or services by QR Code via SCB EASY

Bank and service providers heavily promoted their services in order to draw in more users.

e-Payment will raise sales and lower cost for businesses

Research by Roubini ThoughLab found that receiving cash via e-Payment can help boost sales for businesses. On average, a small business can increase sales by up to 17% after adding e-Payment option as it reduces lost sales from consumers that do not have enough cash on hand and also allows them to expand market reach towards online consumers. As for large businesses, adding e-Payment can increase sales by up to 22% because they can take advantage of e-Payment data to gain better understanding of their customers’ preferences. Such analysis can then support appropriate setting of prices and promotions to each customer group as well as loyalty programs that will increase returning customers. Nevertheless, such added benefits of e-Payment are not restricted to larger businesses, for instance stores in China used payment services via mobile phones to engage with customers by encouraging them to follow store’s page so that they can send out discounts coupons and promotions to customers directly.

How e-Payment help raise sales for businesses

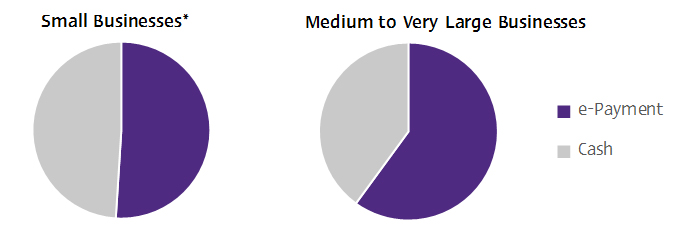

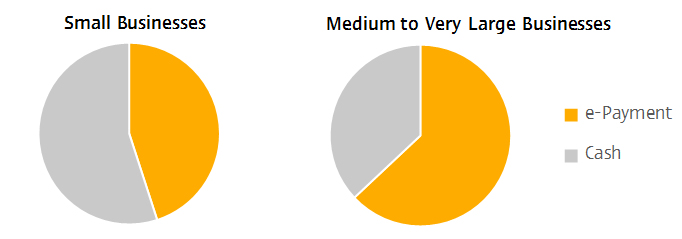

Moreover, the replacement of cash with e-Payment will help businesses save time in doing cash transactions and cut cash management cost like cost in hiring staff to cash checks, cost in cash handling in stores as well as cost of monitoring or guarding cash from robbery. The study by VISA found that medium to large firms within Bangkok are more like to use e-Payment than their smaller counterparts as more than half of these small firms still rely of cash because they have few employees that are mostly daily hired and are more familiar with using cash. Regardless, small businesses can still save time and lower cost in handling cash with use of e-Payment.

Proportion of incoming payments (value) received digitally

Proportion of incoming and outgoing payments (value) received digitally

Remark: business sizes are based on number of employees. Small businesses: less than 20 employees, Medium businesses: 20-50 employees, Large businesses: 50-200 employees.

Source: Cashless Cities Report by VISA

QR code payment is inexpensive for merchants and will be more popular among consumers.

Stores adopting QR code system face lower cost than EDC terminals that are used to support credit/debit card payments because EDC machines and systems need proper installations and charges a fee of 1.5-3.5% to the seller. On the hand, payments using QR code requires only a mobile phone and a PromptPay account, which does not charge any fees for transfers below THB 5,000. Furthermore, as banks and service providers compete to become stores’ main receipt accounts, most of them have waived fee charges and thus stores do not have to set a minimum amount for users wanting to pay by credit card. Services such as transfers alerts are also being offered free of charge, which further enhances the convenience of QR code payment system. As for consumers, use of QR code is expected to become more prevalent in tandem with rising PromptPay accounts and greater use of mobile phones. To attract more customers, banks and non-banks are also set promotions and benefits such as cash backs or discounts for QR code payments.

Growth of e-commerce will drive use of e-Payment among consumers.

Growth of e-Commerce can boost use of e-Payment because it can make purchases of goods faster and more convenient. A case in point is China that transitioned into a cashless society within merely 2 years. Its transformation kick started from the use of e-Wallets like Alipay and Wechatpay that are used for online purchases and as it became more popular, a number of offline stores later had to adopt QR code payment system in order to compete and boost sales. As for Thailand, e-Commerce market value is estimated to grow at 13% per annum during the next 4 year, from THB 60 billion in 2017 to reach THB 100 billion by 2021, providing an important opportunity for consumers to become more accustomed to the use of e-Payment.

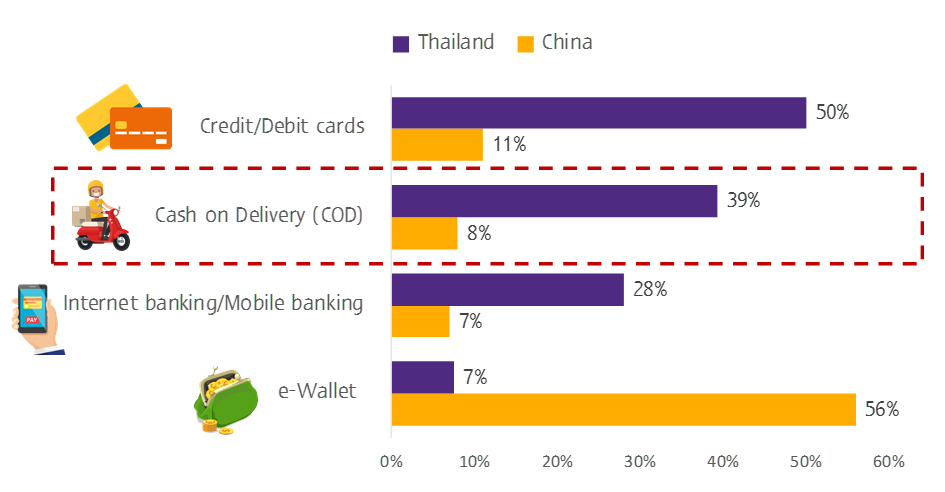

However, as up to 39% of Thai online consumers preferring cash on delivery (COD) compared a share of only 8% in China, such may pose as a challenge to the growth of e-Payment among e-Commerce in Thailand going forward. Nevertheless, in future when COD adopts use of QR codes, e-Commerce businesses will be able to reduce their cost as payments are more secure and allows cash payment limits to be removed.

Majority of online purchases in Thailand are paid using credit/debit card and COD

Unit: % of total respondents who bought products via online channel

Source: Survey conducted by EIC as of February 2017 and Worldpay

Cash on Delivery (COD) payments via QR code

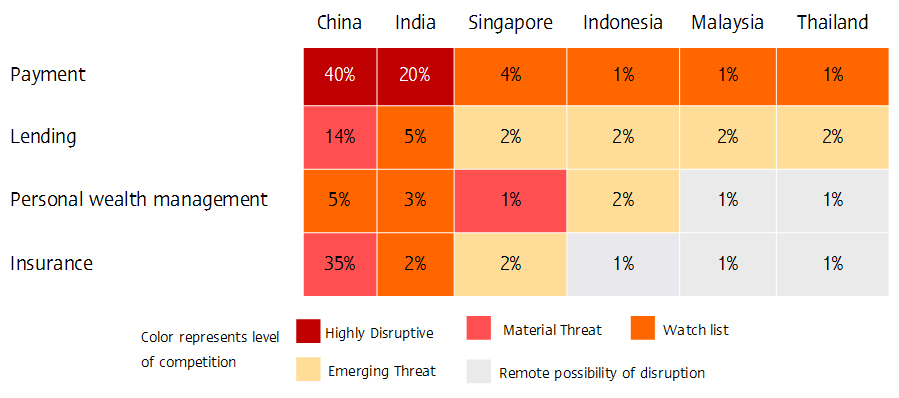

Cashless society to spark development of fintech

The example of China and India shows that increased use of e-Payment will enable creation of financial database of SMEs and consumers. Information such as amount of money circulating within bank accounts, the type of transactions, and timing of flows in and out of bank account can be used to develop credit scoring or data that provides basis for financial institutions that want to provide nano-financing or other additional financial services such as private wealth management and insurance. In sum, with improved access to various financial services among consumers and businesses, this can support growth of SMEs, enhance people’s personal financial planning and streamline relevant data to government that can be used to design appropriate and effective policies.

Development of e-Payment will enable other types of fintech

Unit: % of banking/financial services customers using fintech services

Source: DBS Bank, 2016