Travel Tech … A Glittering Opportunity for Thai Startup

Globally, travel tech startups have raised over USD 3.92 billion.Many have made successful IPOs or been acquired by other companies.The future for these startups looks bright with high growth potential coming from the increasing number of FITs (Fully Independent Travelers) and online spending growth.

Author: Pharadon Heemmuden

|

Highlight

|

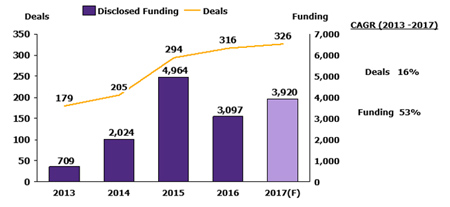

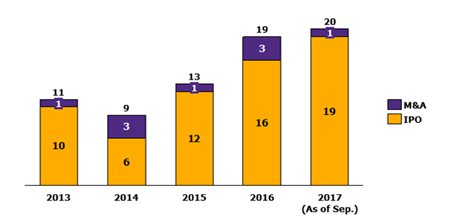

Increase funding, successful IPOs and active M&A deals are signs that the travel tech startup industry is expanding. Travel tech startups can be divided into five categories based on services offered: 1) Travel inspiration and travel planning – startups that seek out the best locations for travel and help travelers lay out their travel schedules; 2) Accommodation and flight-related search and booking services; 3) Other booking platforms, including ticket booking services for activities such as theme parks, shows and entertainment, and ground transportation; 4) Travel-specific social networks such as Travello and Wayn; and 5) Other travel services. The travel tech startup industry has grown steadily, particularly since it has been the target of much global investment money flow. CB Insight data illustrates that between 2013-2017, investment in travel tech startups increased by 53% from USD 709 million to USD 3.92 billion (Figure 1). If we measure the success of travel tech startups by successful IPOs and active M&A deals the numbers have also increased consistently from 11 in 2013 to 20 within the first three quarters of 2017 (Figure 2).

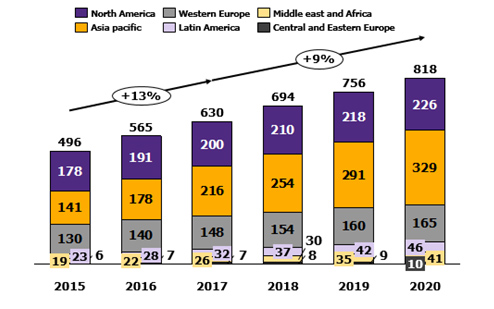

Travel tech startups still have opportunities to expand in the travel market due to explosive growth of global tourism industry, Fully Independent Travelers (FIT) and online travel spend. Yet despite the growing travel market, there are still very few travel tech startups in Thailand. The major contributing factor to the rise of travel tech startups is the growing number of tourists. UNWTO expects that the number of tourists will increase from 1.2 billion in 2016 to 1.8 billion by 2030, with the FIT travel group (vs. group travel) experiencing significant growth. According to the Department of Tourism, out of all the foreign tourist arrivals in Thailand, the FIT group is one that has steadily increased the most over 10 years from 56% of all arrivals in 2006 to 82% in 2016. This group of travelers demonstrates high online travel spend and is likely to gravitate even more towards the use of travel applications in the future to facilitate their travel experiences. Also, eMarketeer reports that the value of online travel spending worldwide is projected to grow from USD 564.9 billion in 2016 to USD 817.5 billion by 2020 (Figure 3), a growth of 11% per year. However, despite the volume of global travel spend that occurs online, CB Insights has found that there are very few travel tech startups in Thailand – based on their data, only 6 out of 601 tech startups. Nearly all of them are Online Travel Agencies or OTAs. On the global scale, Thailand's travel tech startups represent only 0.3% of the global travel tech startup industry, which is around 2,039 startups out of 177,685 startups around the world, reflecting a significant business opportunity since the market competition is not too overcrowded.

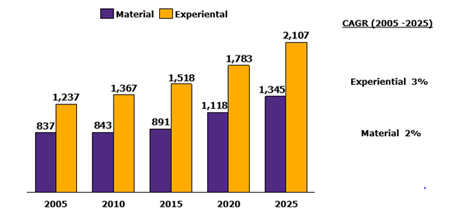

Since it has higher growth than mass segment, luxury travel segment is more attractive for business because luxury traveler are willing to spend money buying superior travel experience. Therefore, luxury travel is a trend to for Thai startups to watch, because it incurs higher costs and travel spend per head than the typical mass tourism. One of the most amazing elements of growth in the luxury sector is that “experiences” now are now worth double the market value of luxury items (Figure 4). According to Allied Market research, the global luxury travel market value in 2016 is estimated to be USD 795 billion. It is also expected to grow by 6.4% (during 2016-2022), so that the market value will total USD 1.154 trillion in 2022. Luxury travelers spend an average of 35,000 baht a day, more than seven times higher than the amount typical tourists spend which is only 5,240 baht a day. According to global travel giant Amadeus, the number of luxury trips is expected to grow by 6.2%, a rate of growth which is higher than the expected overall growth of the tourism trips (approximately 4.8% per year during 2015-2025). The growth of luxury travel results from providing value and superior experiences for tourists who want something particularly unique that cannot be found elsewhere.

While European and American tourists are the main markets for luxury travel. EIC sees India and China market as potential clients as number of luxury travelers from these two countries will achieve high growth in the upcoming year. Nowadays, there is also a growing global middle class with higher incomes who allocate more towards travel spend and dare to buy luxury travel experiences to reward themselves on special occasions (Special Occasion Luxury Travelers). They have become another target for luxury travel beyond the group of tourists who always prefer luxury travel (Always Luxury Travelers) and Bluxury tourists – business travelers who like to travel in luxury. According to Amadeus, European and American tourists are the main markets for luxury travel, accounting for 64% of the total consumers. However, considering the size of the Big Four or BRICs, it is expected that India will also experience a growth in the number of luxury trips, the highest rate possible rate being 12.8%, followed by China at 12.2% during 2015-2025.

EIC recommends Thai travel tech startups to strive to target luxury travelers by offering a superior travel experience which will lead to increased income. Most of the existing luxury travel platforms in Thailand are international players such as Butterflied and Robinson from Canada who offer trips in Chiang Mai and Chiang Rai, such as authentic Lanna-style travel experiences or curated wellness tourism packages such as that of Pure Lux Travel from Australia which has offers a special detox program interspersed with elements of Thailand’s traditional Ayurveda medicine. One of the most successful luxury travel techs in the world is Secret Escapes, the UK's OTA platform that sells personalized tours (Bespoke Holidays) designed by professional trip designers, as well as offering luxury hotel reservations at discounted prices. It has already received over USD 191 million in investment money. EIC analyzes that Thai startups should focus on designing activities to meet the needs of each customer. The trip designer should be experienced in the selection of hotels with high-quality services, and beauty that reflects local charm coupled with exciting activities such as a trip on the Eastern and Oriental Express train, which has been voted one of the world’s top 25 trains. Boosting the experience with yachts or cruises on the Andaman and Gulf of Thailand, experiences where Thai cuisine is presented in a unique way, and opportunities to experience “Thai-ness” should be considered by Thai travel startups for inclusion on their online platforms making such experiences accessible to travelers around the world to further build their business value in a unique way.

|

|

|

|

|

Figure 1: The value and number of deals of Venture Capital investing in Travel Tech Startups has expanded

Unit: Millions of US dollars, Deals

Source: EIC analysis based on data from CB Insight

Figure 2: Number of Travel Tech Startups exiting due to increased support from global VCs

Unit: Number of deals

Source: EIC analysis based on data from CB Insight

Figure 3: Online travel sales volume continues to grow

Unit: Billions of US dollars

Source: EIC analysis based on data from eMarketeer

Figure 4: Market value of global spend on experiences is now higher than the purchase of luxury goods.

Unit: Billions of US dollars

Source: EIC analysis based on data from Amadeus