ASEAN-4 economy: Malaysia’s robust growth pushes nation toward high-income status by 2020.

Published in EIC Outlook Q4/2017 Click here for more detail

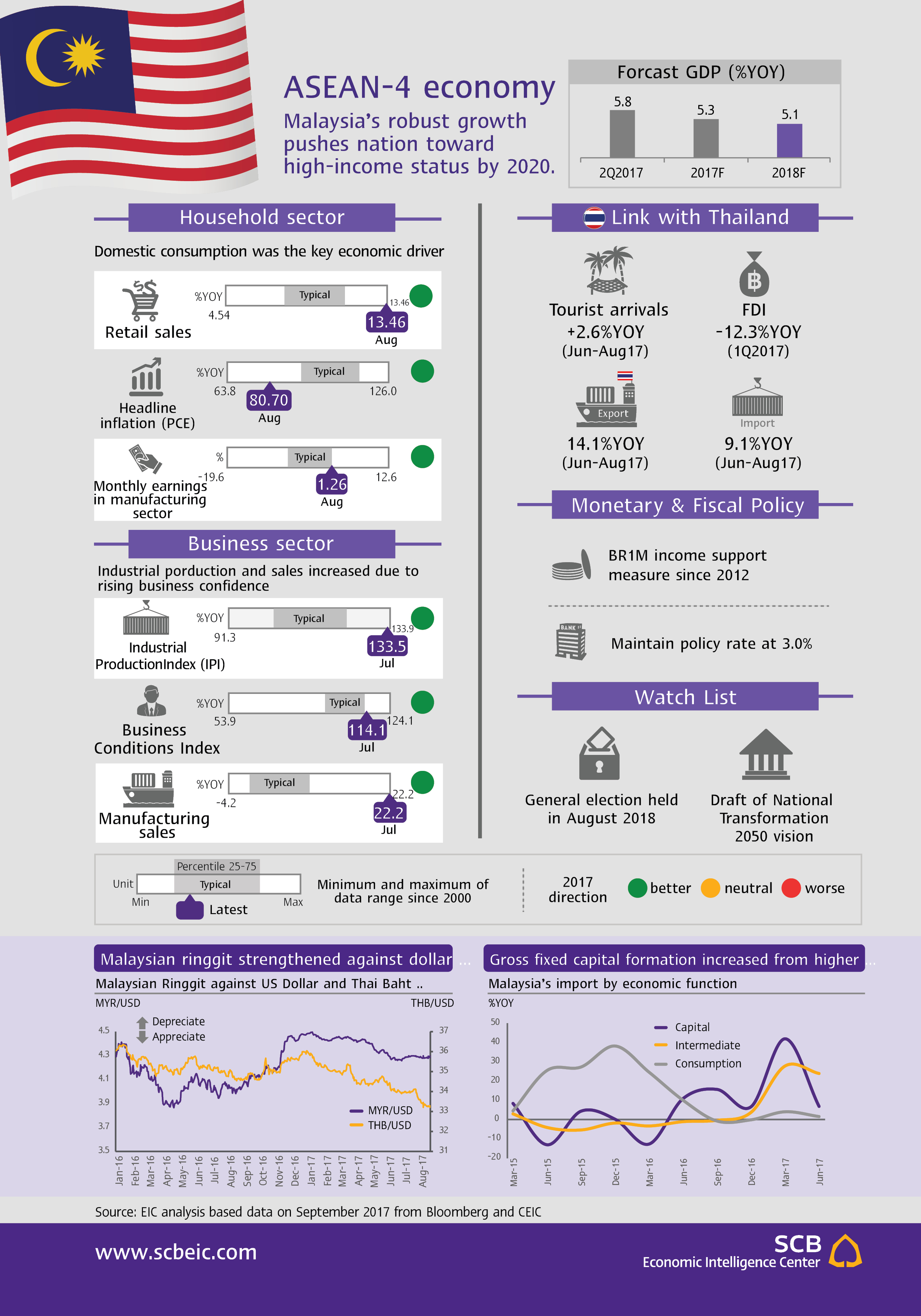

Malaysia’s growth in the first half of the year exceeded expectations due to strong domestic demand. In the first and second quarters of 2017, growth registered 5.6%YOY and 5.8%YOY, respectively. Private consumption growth gained traction, up 7%YOY, driven by higher wages and government measures to bolster household incomes. Public expenditure also showed a large expansion of 5.4%YOY. Private investment rose 12.9%YOY in the first quarter before easing to 7.4%YOY growth in the second quarter. Gross fixed capital formation increased by 7%YOY on average, particularly from imported capital goods and intermediate goods, making imports grow 23%YOY. As a result, the current account surplus fell slightly despite the high 20%YOYgrowth of exports during the year’s first half.

EIC expects Malaysia’s GDP to grow 5.3%YOY in 2017 and 5.1%YOY in 2018. Domestic demand remains a key driver of the economy, led by steady growth in private consumption and private investment. Public spending and infrastructure projects are also lending support to economic activity in the second half. At the same time, manufacturing output, construction, the agricultural sector and services sector are improving in line with better economic conditions at home and abroad. On the other hand, Malaysia faces risks from volatility of prices for oil and commodities, uncertainty surrounding trade partners’ economies, and high household debt of 88% of GDP.

Malaysia expects to become a high-income country by 2020 and one of the world’s top 20 economies in line with the government’s National Transformation 2050 Vision. By 2020, Malaysia aims to reach developed status, in terms of both economic and social. Among the government’s successes are economic reform, which has enabled the private sector to play a key role in driving the economy forward, and reducing poverty to just 0.6% of the population as of 2014. This was a result of the 1Malaysian People’s Aid (BR1M) program that provided monetary support to 7 million low-income households, or around 40% of Malaysia’s total population. However, a major challenge remains for Malaysia to raise annual income per capita to USD 15,000 over the next three years, from USD 10,010 today. Beyond this target, the government’s Vision 2050 aims to continue developing the country to become one of the world’s top 20 economies by 2050. The plan is to put greater emphasis people’s voice and to deliver clearer government’s policy targets. The ongoing process of drafting the Vision 2050 should be completed by 2018.

Implications for Thai Economy

-

As of September 21st, the ringgit rose by 6.6% against the U.S. dollar and will likely stabilize to 4.3 per dollar in the second half of the year. But it slightly depreciated against Thai baht, affecting Malaysian tourist arrival in Thailand and Thai export to Malaysia only little. Slowdown in 2 sectors are expected to continue in 2017.

-

Thai export to Malaysia rose 4.1%YOY in the first 8 months of 2017, while import grew at faster pace of 10.1%YOY. Thailand-Malaysia trade is expected to continue expanding in the latter half of the year. Key Thai exports to Malaysia include rubber products and computers & parts.

-

Malaysia’s incoming foreign direct investment (FDI) rose by 6.3%YOY during the first half of 2017, while its outbound FDI climbed 10.2%YOY. Nonetheless, Malaysia’s FDI flows into Thailand contracted 64%YOY during the same period, particularly in the agricultural sector and service sector.