CLMV economy: Tourism takes center stage in Cambodia’s growth

Published in EIC Outlook Q4/2017 Click here for more detail

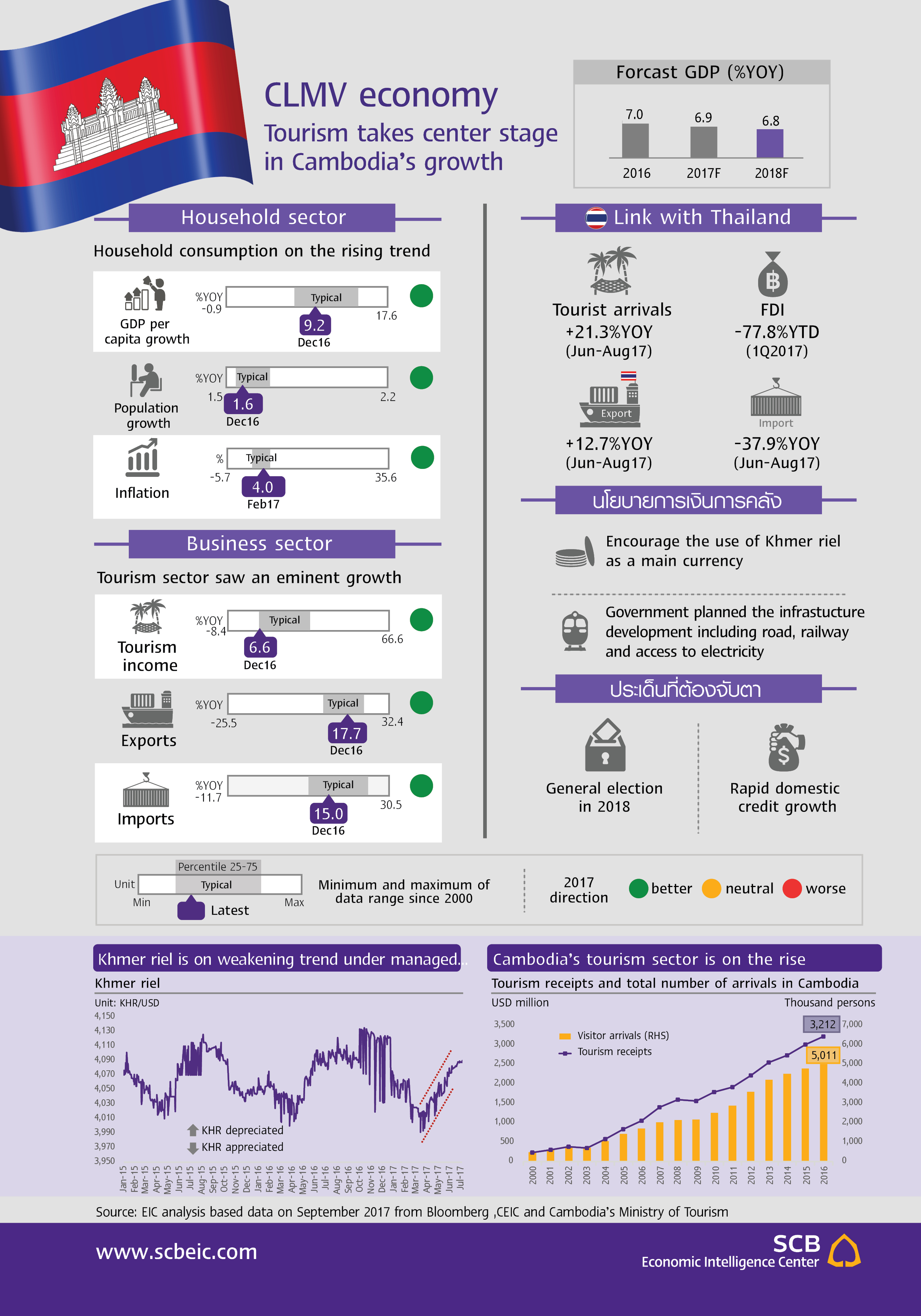

Cambodia’s economy showed strong growth last year and so far in 2017. GDP grew 7% in 2016, boosted by domestic demand. Manufacturing rose 10% and the service sector climbed 6.8%. Incoming foreign direct investment jumped 34%, driven by China. A smaller trade deficit lifted foreign reserves to a level covering 7.7 months of imports. In 2016, the World Bank upgraded Cambodia’s development status to the lower middle-income level in 2016. The government aims to raise the economy to the upper middle-income threshold within 2026-2027.

EIC expects Cambodia’s economy to grow by an average of 6.8% per year during 2017 and 2018. Domestic factors would remain the key growth drivers particularly investment in such infrastructure as roads, railways, power plants and tourism facilities. Cambodia is currently working with the Asian Development Bank to improve rail lines. The country also plans to build a USD-800-million train system linking Phnom Penh and the capital’s international airport in cooperation with Japanese investors.

Tourism will be a key to Cambodia’s growth. Tourism receipts accounted for 16% of GDP in 2016 and have grown by an average of 9% per year during the past decade. In July 2017, UNESCO officially registered Sambor Prei Kuk as Cambodia’s third World Heritage Site. To seize the opportunity, Tourism Ministry plans to boost the number of tourists via this new archaeological site. Foreign tourist arrivals are expected to reach 7 million per year by 2020, up from 5 million per year in 2016.

Major risks to Cambodia’s economy are its exposure to external conditions and rapid credit growth that could affect domestic financial institutions. Rapid changes in the U.S. dollar could greatly affect consumption and business operations due to dollarization of the economy. Export revenue could receive negative impact as well since Cambodia relies heavily on just a few major exports, mainly apparel, which accounted for 74% of total exports in 2016. Moreover, Cambodia’s financial sector has surged during the past few years. Numerous micro-finance institutions (MFIs) have emerged, giving low-income people access to banking services. In March 2017, the National Bank of Cambodia issued measures to curb credit growth by capping MFI lending rates at 18%, down from previous 20-30%. This will induce MFIs to become more cautious about lending because risk compensation, as reflected by lending rates, is now lower.

Implications for Thai Economy

-

The Khmer riel weakened by 1% against the U.S. dollar, under the central bank’s managed float regime. The National Bank of Cambodia intervenes in the market by purchasing U.S. dollars and supplying riel. However, riel fluctuation has only a limited impact on the economy due to persistent dollarization of Cambodia’s economy.

-

In the first 8 months of 2017, Thai exports to Cambodia grew 19%YOY, with refined petroleum, jewelry, sugar and beverages as the main products. The rise of the middle class in Cambodia is the main factor driving imports from Thailand, since most Cambodians view Thai products as having good quality with affordable price.

-

Thailand and Cambodia are working together on a tourism promotion campaign dubbed “Two Kingdoms, One Destination.” Since Thailand serves as a connecting hub for travellers in the region, stimulating tourist arrivals in Cambodia should benefit the Thai tourism sector as well. Thailand expects to receive revenue from transiting visitors who pass through to Cambodia and other countries in the region.