Eurozone economy: Growth hits 6-year high, as political risks subside

Published in EIC Outlook Q4/2017 Click here for more detail

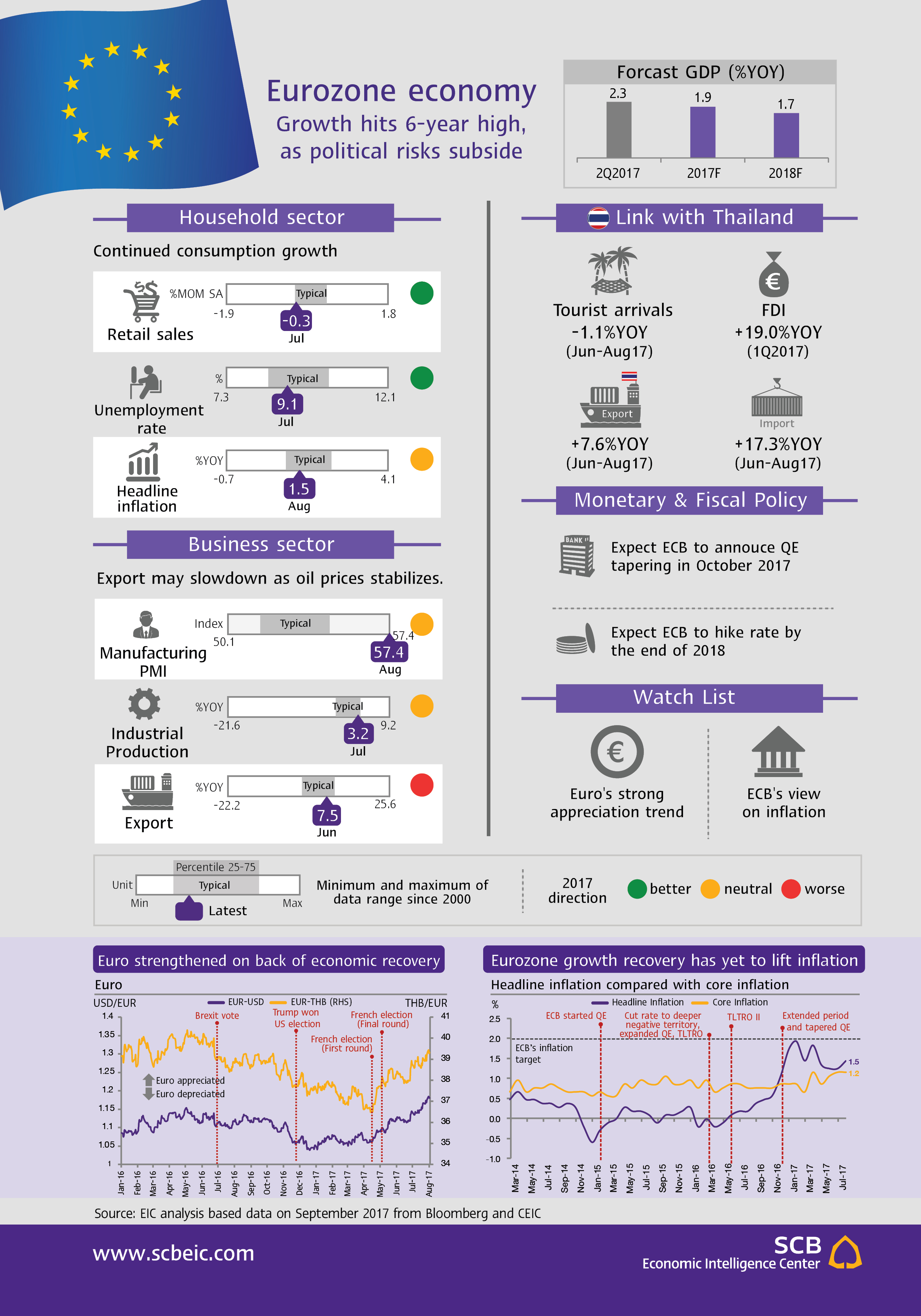

Eurozone GDP grew 0.6%QOQ SA2 or 2.3%YOY in the secondquarter of 2017, the highest rate in six years.The key drivers were household consumption and the rebound in private investment, in line with solid export growth. The Purchasing Managers’ Index (PMI) for the manufacturing sector continued to increase, reaching 57.4 in August, consistent with falling unemployment, which dipped to an eight-year low of 9.1% in July. But the labor market recovery has not yet clearly boosted wages and prices. According to a survey of economists, headline inflation forecasts average at 1.5% in 2017, 1.4% in 2018 and 1.6% in 20193, well below the ECB’s target rate of 2%.

The growth outlook for the fourth quarter remains positive, with political risks abating. Germany’s election, won as expected by pro-EU Angela Merkel, helped boost economic sentiment, and Italy’s general election now appears unlikely to take place this year. The sunnier political outlook was reflected in the Eurozone Consumer Confidence Index, which rose to a 16-year high in July. EIC has raised our forecast for Eurozone growth to 1.9% in 2017, up from 1.6%. The key risk factor for the remainder of the year is the euro’s strong appreciation trend, which may affect exports and tarnish growth in export-oriented countries like Italy and France.

As for 2018, EIC forecasts that Eurozone economic growth will be 1.7% with three key events: (1) Italy’s general election, expected by May, which could stir up anti-establishment sentiment if anti-EU parties win; (2) Brexit negotiations, whose implications may emerge by the end of the year and are likely to impact the Eurozone and UK economies, especially the financial sector; (3) the beginning of the ECB’s QE taper, which might drag on credit growth and overall economic growth. EIC expects the ECB to announce in October that it would taper QE from EUR 60 billion per month to EUR 40 billion per month beginning January 2018 over a period of six months and raise its interest rate by the end of 2018.

Implications for Thai Economy

-

The Eurozone’s impressive growth, bolstered by subsiding political concerns, combined with sharp U.S. dollar weakness has helped strengthen the euro by 12.3% against the dollar or 5.6% against the baht4. However, EIC expects the euro will weaken to 1.17 against the dollar by the end of 2017 due to the Fed’s policy rate increase and a wider differential between U.S. and Eurozone policy rates.

-

Thailand’s exports to the Eurozone expanded 6.9% in the first 8 months of 2017. Recovery of Europe’s household and business sectors may further boost demand for Thai exports, led by computer and parts as well as car and parts.

-

Airbus’s investment plan in the Eastern Economic Corridor, likely to be finalized by the end of 2017, will significantly boost Euro zone direct investment in Thailand.

1 Quarter-on-quarter, seasonally adjusted and annualized rate

2 ECB’s survey of private sector economists

3 Changes in EUR as of September 21, 2017, compared to the end of 2016