Japan economy: Growth momentum sustained by consumption and investment

Published in EIC Outlook Q4/2017 Click here for more detail

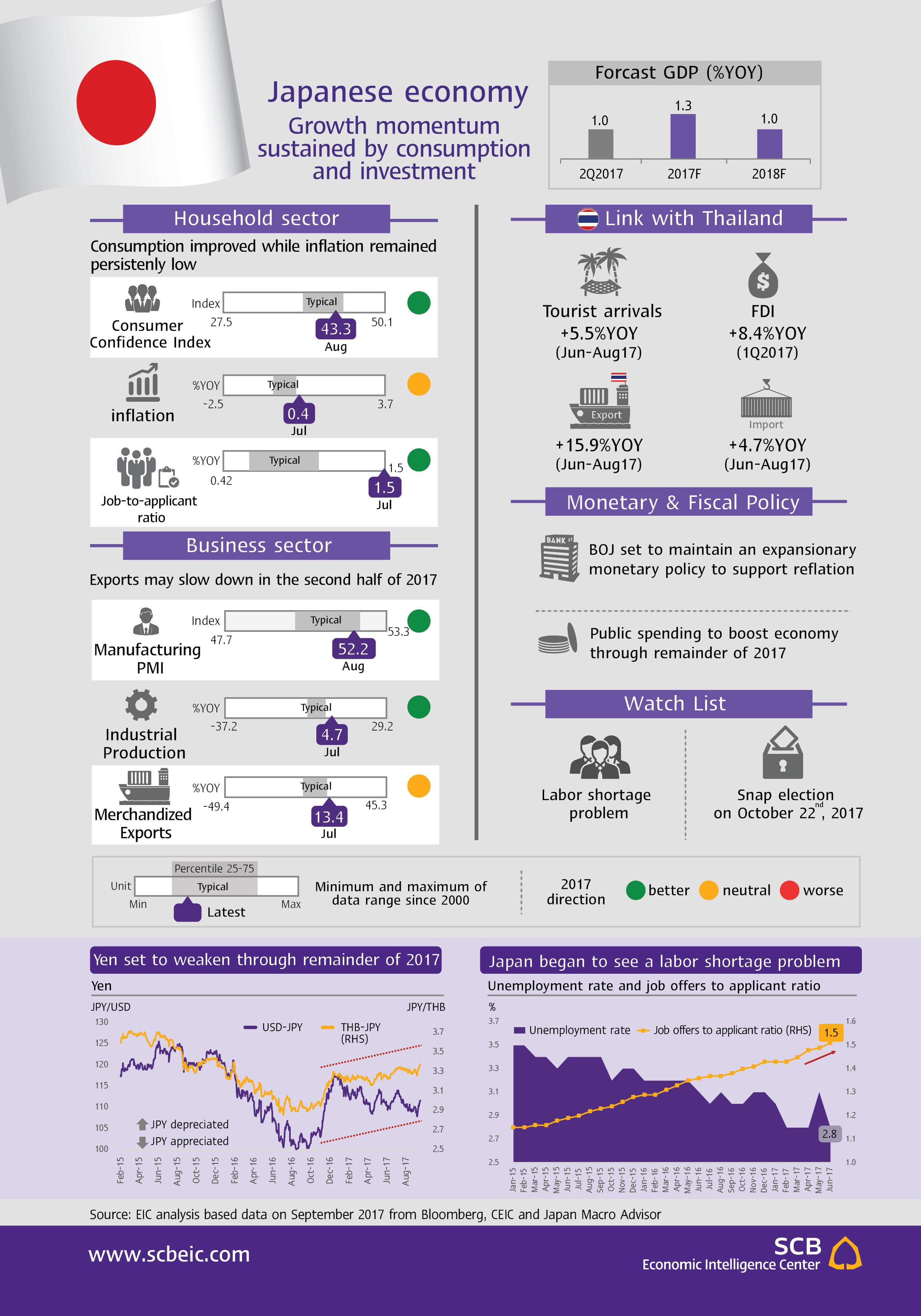

Japan’s economic growth beat expectations in the second quarter of 2017, supported by domestic demand. GDP grew 2.5%QOQ SAAR5 or 1.4%YOY. Private consumption, which accounted for two-thirds of GDP, grew 0.8%QOQ SA6 on the back of higher spending on durable goods, e.g., cars and household appliances, while private non-residential investment rose 0.5%QOQ SA and public investment climbed 6%QOQ SA. The outlook for the second half of this year is for continued expansion, underlined by infrastructure investments for the 2020 Tokyo Olympics and solid household spending. The Consumer Confidence Index has shown improvements since the beginning of this year. In addition, the tourism sector’s high growth will help support GDP growth, which is expected to reach 1.3% in 2017.

EIC expects Japan’s economy to grow 1% in 2018, driven mainly by domestic demand – household consumption, private investment and public spending. Meanwhile, the successful conclusion of the Japan-EU Free Trade Agreement (JEFTA) in July will boost trade, especially exports of auto parts, sake, green tea and soy sauce, which received immediate duty exemptions. However, growth will soften slightly in 2018 compared to 2017 as momentum from public and private investment abates and export growth decelerates, in line with the maturing technology product cycle, which passed its peak in the middle of 2017.

The key risks to Japan’s economy are low inflation and labor shortages, which will impede overall GDP growth. July’s inflation rate was 0.4%, just marginally higher than in the beginning of the year and much lower than the 2% target. Therefore, BOJ is expected to maintain an accommodative monetary policy stance to encourage inflation. Moreover, the continuing increase of the job-to-applicant ratio, together with the fall of unemployment rate to the 23-year low, signals emerging labor shortages that stem from shrinking working-age population and arrival of an aged society. A tight labor market will pressure Japanese companies to raise wages in the near future. This will be positive for inflation going forward.

PM Abe called for a snap election by October 2017. EIC anticipated the re-election of Liberal Democratic Party (LDP), the current ruling party, as the cabinet approval rating recently rose on the back of tension over the Korean peninsula. If LDP wins a general election, Japan’s economy will be benefited from a continuity of government policies and support for the BOJ’s accommodative monetary policy stance. This will raise business confidence and financial market sentiment as well.

Implications for Thai Economy

-

As of September 21th,the yen appreciated 4.6%YTD. EIC expects the U.S. policy rate hike will pressure the yen to drop to 114 against the dollar by the end of 2017. However, the Korean peninsula conflict and uncertainty over U.S. policy could attract fund flows into yen as a safe haven, thus driving yen appreciation.

-

The recent expansion of Japan’s manufacturing output has boosted its demand for Thai products. In the first 8 months of 2017, Thai exports to Japan increased 8.6%YOY, with high growth in telephones & components.

-

Japanese direct investment to Thailand increased 8%YOY in the first quarter of 2017 and looks set to rise further. A Japanese Chamber of Commerce survey reveals that 44% of Thai-Japanese joint ventures plan to increase investment in Thailand. Moreover, a recent visit of Japan’s government and investors would create greater opportunity for Japanese investment especially in EEC. The official visit was held during 11-13 September, participants are representatives from Ministry of Economics, Trade and Investment of Japan (METI) and around 600 Japanese investors.