China's economy: Growth momentum continues despite high levels of debt

Published in EIC Outlook Q4/2017 Click here for more detail

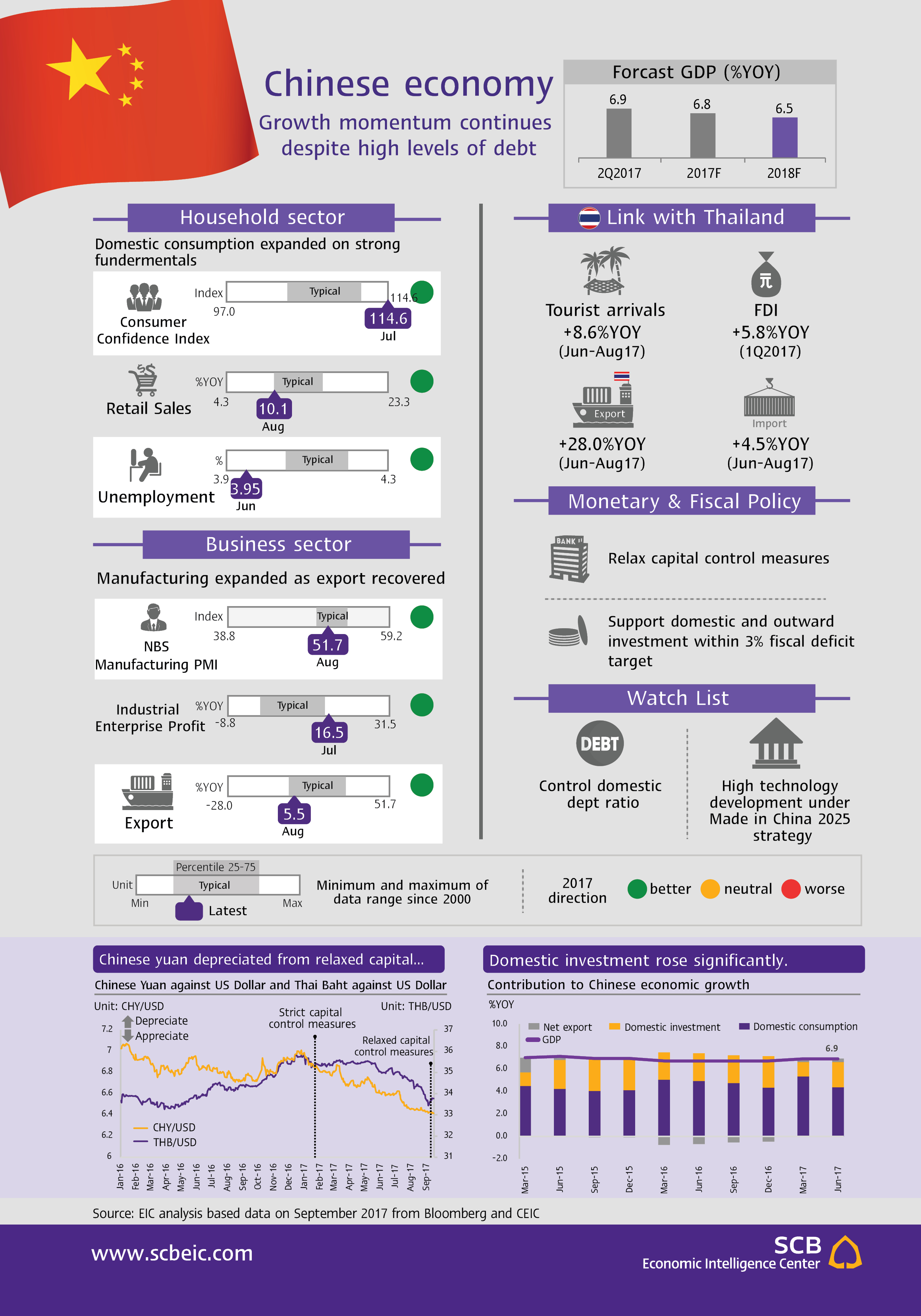

The Chinese economy attained high growth of 6.9%YOY during the first half of 2017, driven by domestic factors and higher exports amid a rebound in global trade. In the first half of 2017, retail sales increased 10.4%YOY, reflecting strong consumer confidence and robust private consumption. Private investment expanded but with slower pace, while public investment grew substantially and will play a larger role in the second half. The manufacturing sector registered robust growth of 6.4%YOY while the service sector expanded 8.3%YOY. Corporate profits rose 18%YOY. Moreover, export growth continued for 2 consecutive quarters, averaging at 14.4%YOY.

EIC has revised up its growth forecast for the Chinese economy to 6.8%YOY in 2017 and 6.5%YOY in 2018, underpinned by strong domestic fundamental factors and the positive impact of economic reforms targeting development of high technology. Low unemployment and the government’s measures to stimulate domestic spending are helping consumption to continue to expand. Overall investment is growing on the back of higher public investment. In the manufacturing sector, government continues its efforts on reducing overcapacity and managing zombie companies. In addition, the efforts to expand high-tech industries and deployment of technology during the first half of the year should continue to benefit the economy during the rest of the year and in 2018. This development is in accordance with the government’s “Made in China 2025” strategy. However, high debt levels still pose a risk to the economy.

One risk to the Chinese economy stems from demand-side stimulus policies that induce more debt. Another is the challenge of managing financial-sector stability. The key economic drivers are private consumption, private investment--especially in the real estate sector--and public investment in utilities infrastructure. Nonetheless, debt has been accumulated and reached 260% of GDP. EIC expects China’s debt to continue rising in the next few years. In September, S&P Global Ratings downgraded China’s long-term sovereign credit rating to A+ “stable”, reflecting concerns on rising loan growth, which pose risks to economic and financial stabilities. However, Moody’s outlook on China’s banking sector changed from “negative” to “stable”, represented the government’s efforts to control credit expansion, curtail shadow banking, and improve banking sector stability, which will potentially slowdown credit growth in medium-term.

Implications for Thai Economy

-

The Chinese yuan appreciated against the U.S. dollar by 6.7%YTD, in the first 8 months. But after the capital control measures were relaxed, the yuan promptly depreciated as demand for outward investment remains high. EIC expects to see a rebound in Chinese direct investment in Thailand.

-

In the first 8 month of 2017, trade between Thailand and China rose 13.1%YOY. Thai exports to China surged 30.1%YOY, driven mainly by manufactured products. Thailand’s imports from China grew slightly 4.2%YOY, as capital goods imports have been falling since the beginning of the year.

-

Foreign direct investment into China edged down to grow just 1.2%YOY during the first 7 months of 2017. Nonetheless, investment in high technology manufacturing and services rose 6.8%YOY and 16.8%YOY, respectively. While Outward direct investment (ODI) by Chinese corporates fell 44.3%YOY as well as Chinese investment in Thailand showed a big contraction of 115.3%YOY. However, Chinese ODI under the Belt and Road initiatives increased 5.7%YOY.