U.S. economy: Growth driven by tight labor market. Keep an eye on fiscal progress.

Published in EIC Outlook Q4/2017 Click here for more detail

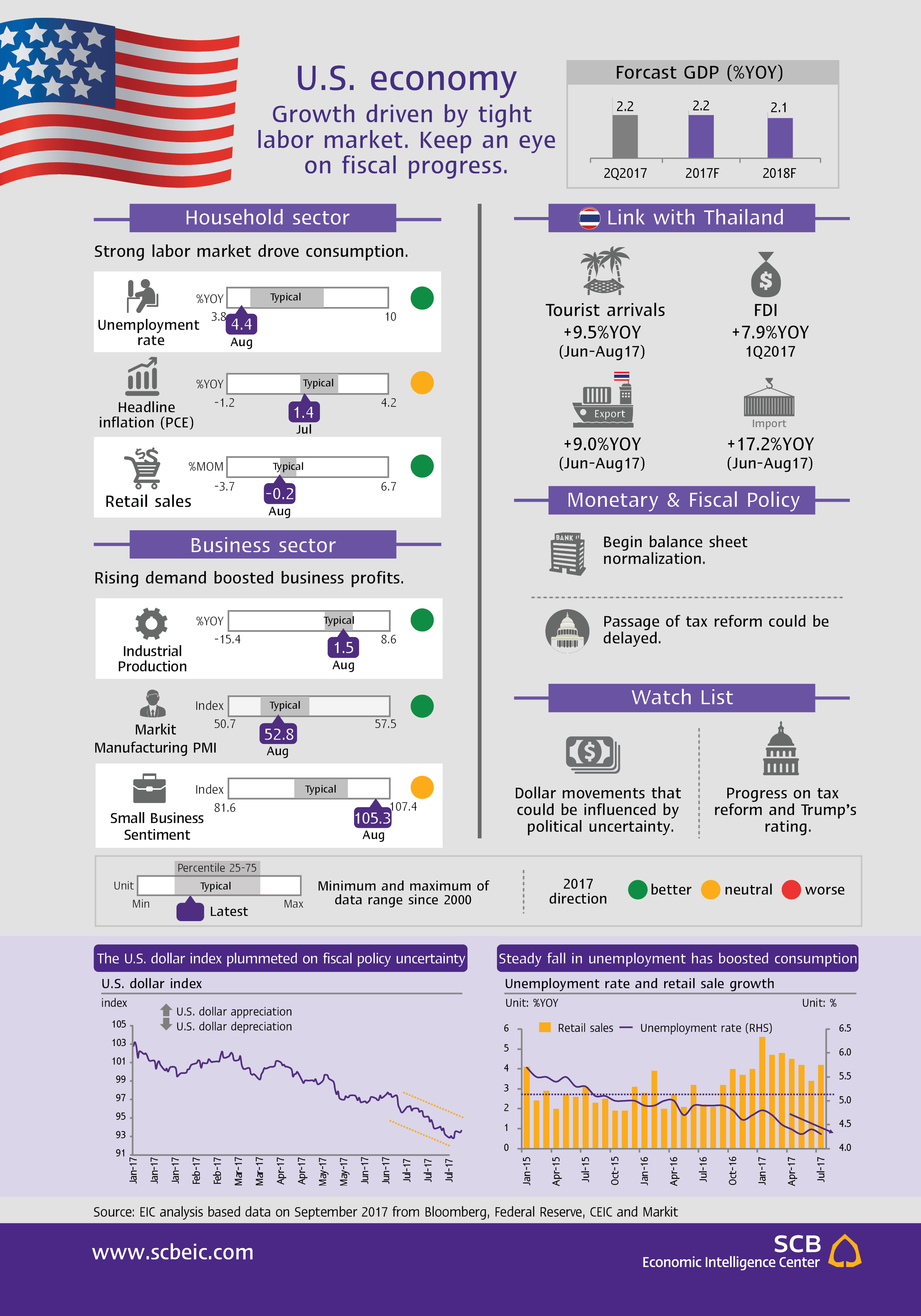

U.S. GDP expanded in the second quarter of 2017 on the back of solid consumption and private investment. GDP grew 3.1%QOQ SAAR1 or 2.2%YOY, faster than in the previous quarter. Growth was led by private consumption which expanded 2.7%YOY thanks to strong hiring. In addition, private investment clearly recovered, with a 8.3%YOY rise in construction investment and 3.1%YOY rise in equipment investment. Public spending remained stable. Wages did not, however, mirror the big increase seen in employment, resulting partly to low inflation.

The U.S. economy might not get as much boost from the fiscal stimulus promised by President Trump, who pledged to boost investment and reduce taxes to benefit the business sector. Cutting taxes would require spending cuts. But the Trump administration has already failed in its big push to cut one spending program, the Affordable Care Act, the health insurance support program known as “Obamacare.” Now the White House is moving on to try to enact tax reforms, but this is likely to take at least a year to formulate, propose and put to vote in Congress. If a tax reform bill can be passed, its impact on the economy is not likely to be soon.

EIC expects that the strong labor market will drive the U.S. economy for the rest of this year and beyond, supporting GDP growth of 2.2% in 2017 and 2.1% in 2018, even without fiscal policy stimulus. Burgeoning employment has underpinned continuing demand growth and will lead toward a gradual rise in wages. Private investment will rise in response to growth in demand. The jobs market is likely to continue to grow, which should lift inflation next year.

The U.S. dollar will strengthen gradually as confidence toward the currency improves. The dollar index (as of Sept 21) fell 11.3% from the beginning of the year, despite two hikes in the policy rate. The currency’s weak performance was driven in part by political uncertainty stemming from the deterioration in President Trump’s popularity. The market’s disappointment over a lack of progress in fiscal policy also played a part, driving funds to other regions. However, if Trump administration can successfully push some fiscal agenda by this year, market sentiment would improve. In addition, another policy rate hike by the end of this year would help support a gradual appreciation of the U.S. dollar by that time.

Implications for Thai Economy

- Political uncertainty in the U.S. has driven the dollar index down over 11.3% since the beginning of the year, resulting in a 7.7% rise in the value of the baht against the dollar. If this concern abates and there is another Fed rate hike by the end of the year, market sentiment would be positive, helping attract funds back into the U.S. The baht would, as a result, weaken to 33.5-34.0 against the dollar by the end of 2017.

- Clearer signs of recovery in U.S. private consumption, coupled with the lack of any real U.S. move toward trade protectionism so far this year, has supported growth in Thailand’s exports to the U.S., up 7.8%YOY in the first 8 months of 2017. The growth outlook is healthy going forward, particularly for electronics and rubber products.

- The stronger jobs markets and rising consumption boosted the performance of U.S. businesses and private investment, helping lift U.S. direct investment in Thailand, which rose 7.9%YOY in the first quarter, primarily targeting real estate, retail commerce and automotives.

1quarter-on-quarter, seasonally adjusted and annualized rate