Outlook Quarter 4/2017

Three key factors will drive the global economy during the final quarter of 2017 and in 2018. First, private consumption will be the main engine of growth, propelled by the robust hiring recovery in many regions. Second, the continuing global trade recovery, driven by demand from major economies, will position exports to support GDP growth in exporting countries. Third, accommodative fiscal policies will support growth in the future. China’s coming leadership changes, which will take place in October 2017 during the 19th National Congress of the China Communist Party, will be watched for potential policy implications, as five of the government’s top seven leaders are elected, though the changeover is expected to be smooth. Looking into 2018, the major economies, such as the U.S., euro zone, Japan and China, will continue to recover though the inflation rate will remain subdued. Monetary policy tightening will commence, and interest rates will enter a clear upcycle on the back of Fed policy rate hikes, Fed balance sheet normalization and QE tapering by the European Central Bank and Bank of Japan.

- Economic outlook in 2017

- Bull - Bear: Oil Prices

- In focus: Three big trends for Thai business in Digital Era in 2018

- Box: Case study: personalization pattern of C2B model is creating success stories

- Summary of main forecasts

Three key factors will drive the global economy during the final quarter of 2017 and in 2018. First, private consumption will be the main engine of growth, propelled by the robust hiring recovery in many regions. Second, the continuing global trade recovery, driven by demand from major economies, will position exports to support GDP growth in exporting countries. Third, accommodative fiscal policies will support growth in the future. China’s coming leadership changes, which will take place in October 2017 during the 19th National Congress of the China Communist Party, will be watched for potential policy implications, as five of the government’s top seven leaders are elected, though the changeover is expected to be smooth. Looking into 2018, the major economies, such as the U.S., euro zone, Japan and China, will continue to recover though the inflation rate will remain subdued. Monetary policy tightening will commence, and interest rates will enter a clear upcycle on the back of Fed policy rate hikes, Fed balance sheet normalization and QE tapering by the European Central Bank and Bank of Japan.

EIC expects that three key factors will generate global economic risks next year: potential political change in the major economies, volatility in global financial markets due to monetary policy tightening, and geopolitical tensions in the Korean peninsula. With regard to the U.S., politics are the factor to watch in 2018. The government’s stability will be undermined by conflicts within the White House; and Mr. Trump’s sinking ratings may be further eroded as his tax reform bill is delayed or derailed. In Japan, the Japanese prime minister faces a similar threat of deteriorating popularity caused by scandals. Brexit negotiations will affect trade and investment conditions in the United Kingdom and European Union. These political issues will undermine policy implementation and government stability in those countries. In addition, exchange rate volatility and sharp corrections in global financial markets may pose risks if interest rates rise faster than anticipated. Finally, geopolitical risks in the Korean peninsula cannot be neglected. North Korea’s missile tests will continue to undermine sentiment in the region, and the situation might get out of hand, which would erode flows of trade and investment and worsen relations between the U.S. and China.

Thai economy in first half of 2017

Growth during the first six months of 2017 was fueled by exports and spending by middle- and high-income households. Thai GDP expanded 3.5%YOY in the first half, underpinned by the impressive export increase of 8.9%YOY through August. Exports attained the highest rise seen in the past four years, with a broad-based expansion across categories such as agricultural products, food & beverages and manufactured goods. Private consumption climbed 3.1%YOY in the first half, but this upturn was concentrated in certain categories. Car sales rose 13.8%YOY, indicating that middle- and high-income households increased spending. On the other hand, necessities, such as food and non-alcoholic beverages, which more broadly reflect consumer purchasing power, only grew 2.3%YOY, marginally slower than 2.4%YOY in the previous year. The labor market remained subdued, as employment fell 0.2%YOY and non-farm wages dropped 0.1%YOY. Private investment recovered only moderately, with 1.0%YOY growth. Most capital spending targeted the service sector, whereas investment in manufacturing was flat due to low capacity utilization.

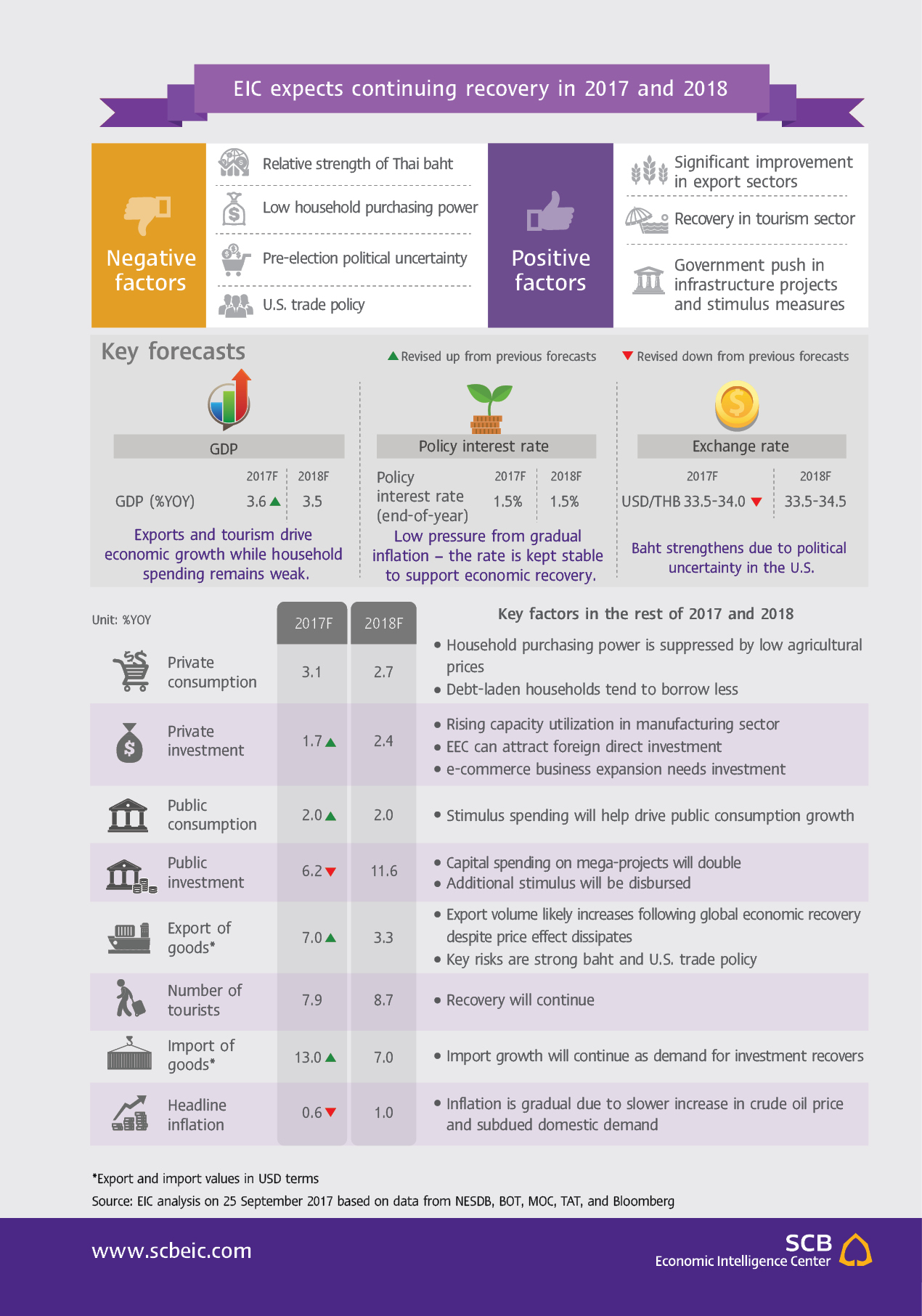

Thailand’s economic outlook in 2017 and 2018

EIC expects the baht to strengthen and depressed agricultural prices will further erode household purchasing power in late 2017.

Prices of major farm products—rubber, sugar and cassava—are trending down from the level seen in the beginning of the year. Lower prices, coupled with a baht that is stronger than in early 2017, are dragging on farm income and export revenue, which will put downward pressure on domestic demand for the rest of the year, particularly in the case of middle- and low-income households. Nonetheless, the Thai economy depends more heavily on exports of manufactured products and receipts from foreign tourists, both of which are expected to continue expanding. The government will undertake efforts to stimulate the grassroots economy, including measures to support low-income households and to fund investment in small, provincial-level projects. All things considered, EIC expects Thai GDP to grow 3.6%YOY in 2017.

As for 2018, EIC forecast the nation’s economy will expand 3.5%YOY, supported by tourism and investments while consumption tends to remain weak. Thai household income is at risk as agricultural prices are expected to stay at a low level while household debt remains high. Thus, household continues to deleverage (see highlight1). Thailand’s GDP growth in 2018 will be driven mainly by tourism and investment. EIC expects arrivals will rise 8.7%YOY, a higher rate of growth than in 2017 (see highlight2). Also, investment will likely expand. On top of the government’s investment in transportation infrastructure, positive signals for more private investment in 2018 have been more evident: rising capacity utilization in the manufacturing sector, interests of foreign investors to take part in the Eastern Economic Corridor (EEC), and the penetration of e-commerce businesses in Thailand. Development in e-commerce will trigger demand for transportation, storage and distribution facilities, as well as data collection and analytics infrastructure. However, labor shortage resulted by the new law on migrants as well as sluggish spending growth by most households will also be key determinants of investment in 2018.

Bull - Bear: Oil Prices

EIC’s view: BEAR

Crude oil prices will increase slightly in the fourth quarter of 2017, but remain low due to higher demand for oil during the winter season and from growing Asian economies, led by China. Nevertheless, oil prices may be pressured downward by a rebound in production among such OPEC countries as Libya and Nigeria that are now recovering from political turmoil. Meanwhile, the pact agreement between OPEC and non-OPEC is becoming less effective in reaching its goal to cut production by 1.8 million barrels per day, as the compliance rate has fallen to 75%. As such, the agreement will not have a significant impact on reducing oil supply. However, it is possible that the supply cut agreement could be extended beyond March 2018 and that the compliance rate could rise. Both of these possibilities should be watched because they are factors that could push oil prices up.

In focus: Three big trends for Thai business in Digital Era in 2018

The global economic context is about to change significantly. Developing nations with high growth potential, especially India, China and the ASEAN countries, will soon become more important. Companies will need to adapt as wireless connectivity among players in the market changes business processes, production processes and consumer behavior. Looking at Thailand in 2018, transformation of the consumer market will be led by global e-commerce businesses. This will give businesses both new opportunities and challenges. Companies need to prepare for the coming changes in order to take advantage of opportunities and manage risks.