From Appliances to Automobiles

The use of electronic components in automobiles is expected to increase, particularly in ADAS, infotainment, and electrified powertrain systems. The increase has resulted from stricter safety and environmental regulations, as well as the forthcoming ban on sales of automobiles with internal combustion engines in the next 20 to 30 years

Author: Apinya Aksornkij

|

Highlight

|

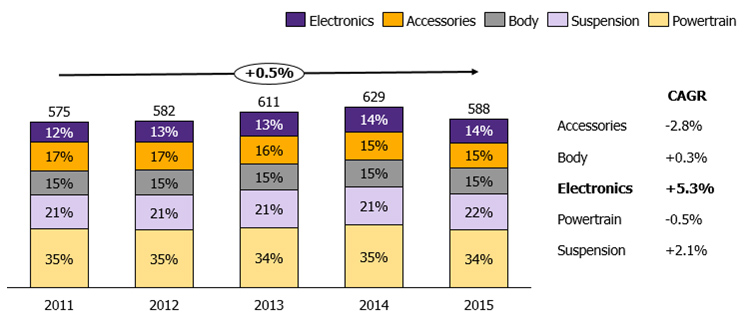

The trend of electronic components in automobiles is constantly increasing ─ a trend that has kicked off in the luxury cars segment. A report on global exports of automobile electronic components between 2011 and 2015 found that the industry expanded at growth rate of 5.3% (Figure 1), higher than exports of other automobile parts such as car bodies, transmission systems, and suspension components. In the luxury car segment, for example, the use of semiconductors is now much more common than in other segments, accounting for an average expenditure of US$ 1,000 per car, ten times the rate of compact cars in developed countries. In addition, it is expected that the use of semiconductors per automobile will increase by 16% by the year 2020. This drastic increase reflects automobile semiconductor industry revenues that are growing 7% annually, from US$ 3.4 billion in 2017 to US$ 4.1 billion in 2020.

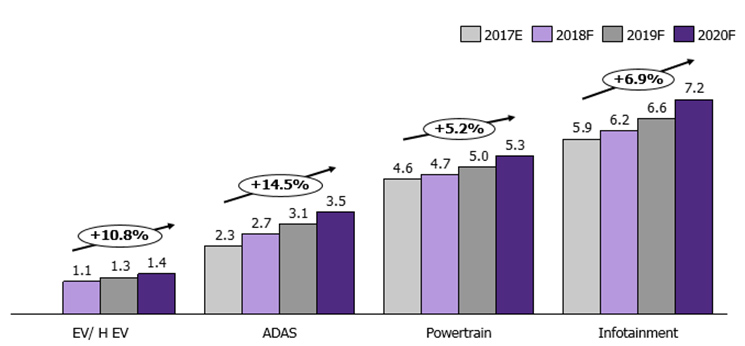

Automobile parts in ADAS and infotainment systems are expected to see the fastest growth, as a result of stricter safety and environmental regulations and new car models designed to provide an enhanced driving experience. In many countries, stricter safety regulations and emission standards such as IIHS in the US, J-NCAP in Japan, and Euro 6 Standards in Europe are driving the growth of advanced driving assistance systems (ADAS), including front-vehicle distance sensors and autonomous emergency braking, which have potential to grow at an annual rate of 14.5% between 2017 and 2020. Moreover, new car models are designed for driving comfort by providing in-vehicle infotainment systems easily and safely connect with the driver’s smartphone or GSP. Communication software can also be updated via the cloud system. These factors prompted high annual growth prospects of 7% between 2017 and 2020 for infotainment systems (Figure 2).

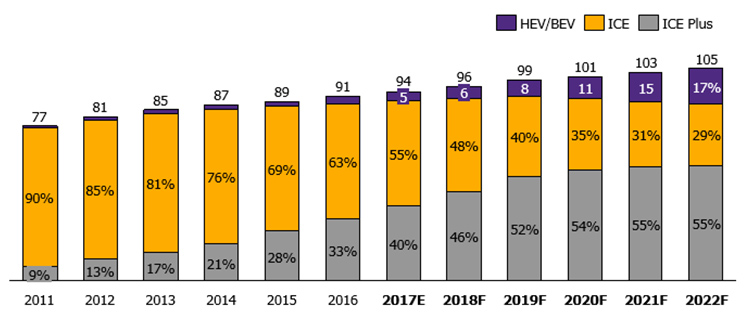

EIC believes that internal combustion engine cars with a start-stop function will gain a significant market share in the next three to five years. Similarly, electrified powertrains will also have a clear growth trajectory in the future. As soon as three to five years from now the transportation sector will undergo a technological transition into electronic systems. Although sales of vehicles with internal combustion engines will not disappear altogether, mid-level and base-level cars in the future will have features that enhance engine efficiency and reduce emission. A report by JP Morgan found that internal combustion engine cars with a start-stop function (whereby the engine stops when idle, and starts again when the accelerator pedal is pressed) will account for 55% of total sales, which is higher than the figure for regular cars that will only account for 29% of the market in 2022 (Figure 3). Moreover, Gartner forecasts that semiconductor industry revenues from electric and hybrid cars will grow by 10.8%, whereas transmission parts will grow 5.2% per annum until 2020. This growth rate may increase even further, given the support that the governments of major car-exporting countries such as India and China have given to electric and hybrid cars. As the world’s largest automobile market, China provides attractive financial mechanisms and tax benefits for electric car owners, such as free parking in urban areas, congestion charge waivers, and free charging stations. Similarly, in addition to providing benefits similar to China, the Indian government is setting a target to ban the sale of cars with internal combustion engines by the year 2030. This target is also in line with the French government, which seeks to achieve the same target by 2040. Similarly, the government of the United Kingdom aims at the same timeframe as ratified in the Paris Agreement

In addition to automobile electronics manufacturers, electronics manufacturing services (EMS) will benefit from greater use of electronics as a replacement for mechanical automobile parts. The introduction of electronics into the automobile supply chain will generate a longer stream of revenues for EMS than consumer electronics manufacturing alone. The cycle of product development is three to five years for the automobile industry, and one to two years for consumer electronics manufacturing. It is expected that revenues from automobile parts manufacturing will expand by 8% per annum until the year 2019. However, revenues from automobile parts manufacturing still constitute a minor portion compared to the gross revenue structure of the EMS industry, where 70% of revenue comes from consumer electronics, such as mobile phone devices, computers, and computer parts, which are expected to grow 4 to 5% until 2019. In fact, manufacturing for the automobile industry is not new for EMS manufacturers. The American company Flex (former name Flextronics) once secured a subcontract with automobile manufacturer Ford, who in 2010 adopted the same strategy as the consumer electronics industry in hiring EMS to design and manufacture their infotainment systems for the MyFordTouchTM model. This system serves as a basis for the SYNC 3TM system, which has been used for Ford’s 2016 models onwards in order to accommodate the use of smartphones and GPS. Apart from Flex, specialist in automobile electronics CTS Corp. has been subcontracted by Toyota, Honda, Fiat, Nissan, and GM to design and manufacture their automobile parts.

However, in order to be chosen as automobile parts subcontractors, EMS manufacturers face competition in product quality assurance. Faulty automobile parts can jeopardize driver safety. Moreover, product recalls can also impact a company’s revenues and reputation. Therefore, safety standards for automobile parts will be of paramount importance in order to ensure that automobile parts can function under the extreme heat, humidity, and constant vibration from driving. Moreover, for EMS manufacturers interested in automobile parts it is important not only to ensure high manufacturing standards, but also to obtain relevant certification. For example, ISO 26262 ensures the manufacturer’s responsibility throughout the automotive development cycle. AEC-Q100 is a stress test qualification for integrated circuits (IC) in automobiles. Similarly, AEC-Q101 is a stress test for semiconductors. Therefore, new automotive electronic manufacturers will face great challenges in multiple selection steps in order to assure the automobile companies of their quality and their ability to meet production demand and cost competitiveness.

|

|

|

|

|

Figure 1: Value of global exports automobile electronics between 2011 and 2015

Unit: USD billion

Source: EIC analysis based on data from UN Comtrade

Figure 2: Semiconductor industry revenues from automobile parts manufacturing (categorized by system)

Unit: USD billion

Source: EIC analysis based on data from J.P. Morgan and Gartner

Figure 3: Forecast of global automobile sales, categorized by transmission system

Unit: million

Remarks: HEV/BED: hybrid and electric cars

ICE: Internal combustion engine cars

ICE Plus: Internal combustion engine cars with Start-Stop function

Source: EIC analysis based on data from J.P. Morgan