U.S. economy: Temporary weak consumption while private investment remains strong

Published in EIC Outlook Q3/2017 Click here for more detail

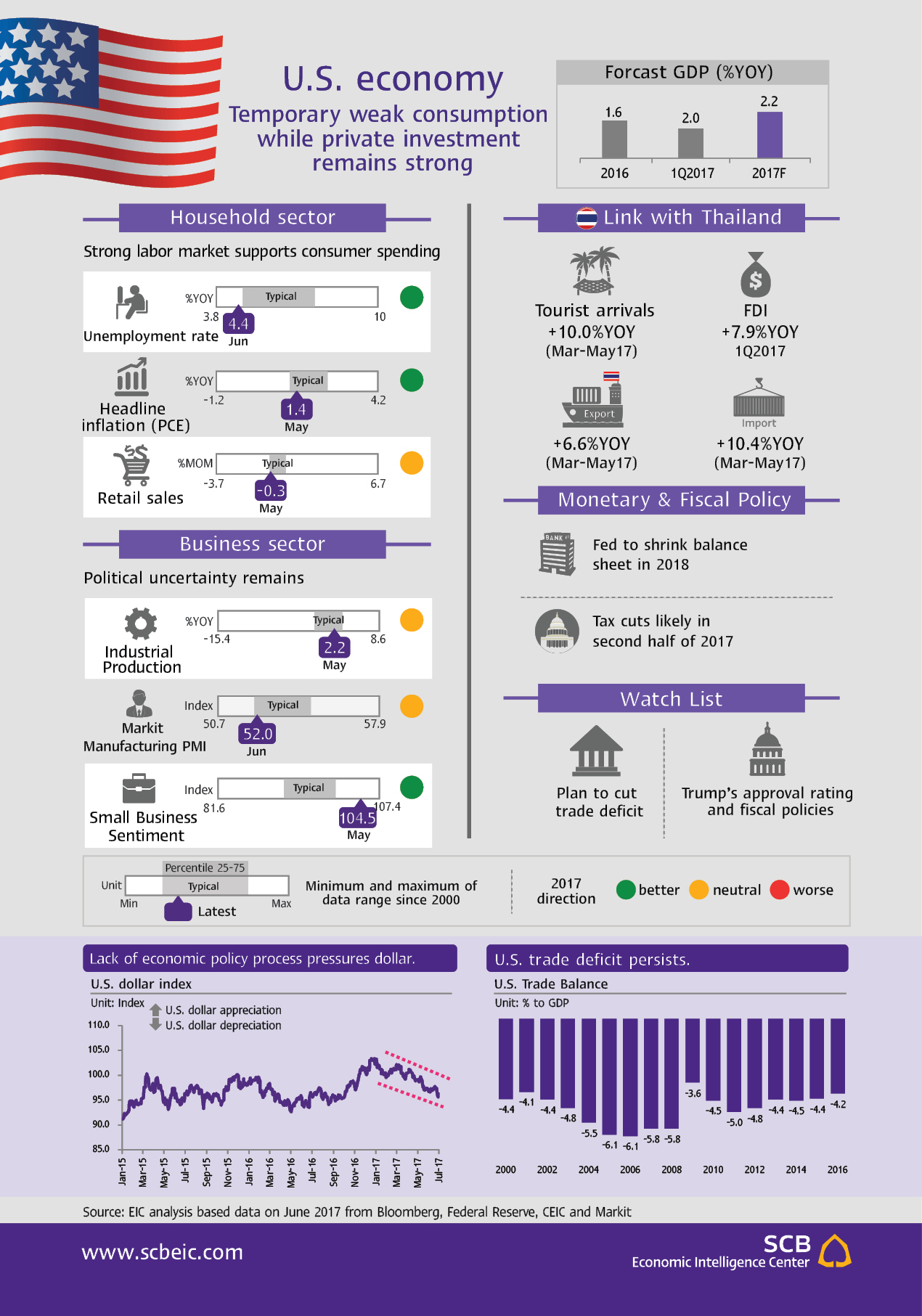

U.S. economic growth was slowed by weak private consumption during the first quarter, but investment remained strong. GDP rose 1.4% QOQ SAAR1 during the quarter, lowest in 3 quarters, or equivalent to 2.1% YOY. Private consumption, especially purchases of cars and homes, slowed alongside lower government spending. These numbers suggest that the first quarter’s slowdown will be temporary. Labor markets are gaining strength, reflected in the unemployment rate returning to a normal level and rising private sector income. Going forward, private consumption growth will then rebound during the remainder of the year. On private investment, it experienced high growth of 3.1% YOY, mainly from the energy industry, which got a boost from the America First Energy Plan policy. This is expected to continue its growth momentum, helping propel the U.S. economy toward a growth rate of 2.2% in 2017.

On the fiscal front, progress on budget spending will provide economic support for the rest of the year, but risks remain. The Senate is considering the draft of the American Health Care Act to replace the Affordable Care Act, also known as Obamacare. This change, along with the proposed federal budget for 2018 that aims to cut spending in such areas as healthcare and welfare, would provide the government the money it needs to implement major corporate tax cuts. These moves would improve business confidence and stimulate investment. However, uncertainty remains, since the draft Act is still in the legislative process, whereby it may be changed or rejected.

EIC projects that President Trump’s executive order to scrutinize the U.S. trade deficit will benefit the U.S. economy. The investigation will examine trade deficits with 16 countries, targeting abuses. The results are likely to help increase U.S. bargaining power on trade. Export products that stand to benefit are U.S. beef, imports of which have been banned by several countries. The U.S. is likely to curb its imports of certain products like steel. However, given its structure, the U.S. economy will continue to rely heavily on imported goods, especially consumer products.

Political uncertainty could hurt confidence. Trump’s approval rating has declined following the media turmoil over his dismissal of James Comey, the former director of the Federal Bureau of Investigation (FBI). His popularity has also been hit by his administration’s slow progress on fiscal policies and his decision to withdraw the U.S. from the 2015 Paris Agreement on climate change. The White House morass could delay or derail tax reforms, hurting consumer and business confidence and slowing the economy.

Implications for Thai Economy

- Steady U.S. economic recovery means higher demand for goods and services from Thailand. However, the Trump administration’s plan to cut the U.S. trade deficit could hurt some of Thailand’s export products such as electricals & electronics and fishery products. Thai businesses

in the agriculture and agribusiness sectors could also lose share in the domestic market, if the U.S. pushes for increased access. (See more in In Focus :Thai exporters in preparation to Trump trade actions) - The U.S. dollar Index declined by 4.9% from the beginning of the year and 10-year U.S. Treasury yields dropped by 0.12% from the beginning of the year to 2.32% as political uncertainty dragged. This shift prompted large capital flows into Asian markets. The Thai baht and other Asian currencies have strengthened as a result. However, as Trump’s tax reform prospects become clearer and the Fed starts the balance sheet reduction program, capital flows should reverse. EIC expects the Thai currency to weaken to 35.0-35.5 baht per dollar by the end of 2017.

1quarter-on-quarter, seasonally adjusted and annualized rate