China's economy: Continued growth supported by government policy and strong consumption despite high debt levels

Published in EIC Outlook Q3/2017 Click here for more detail

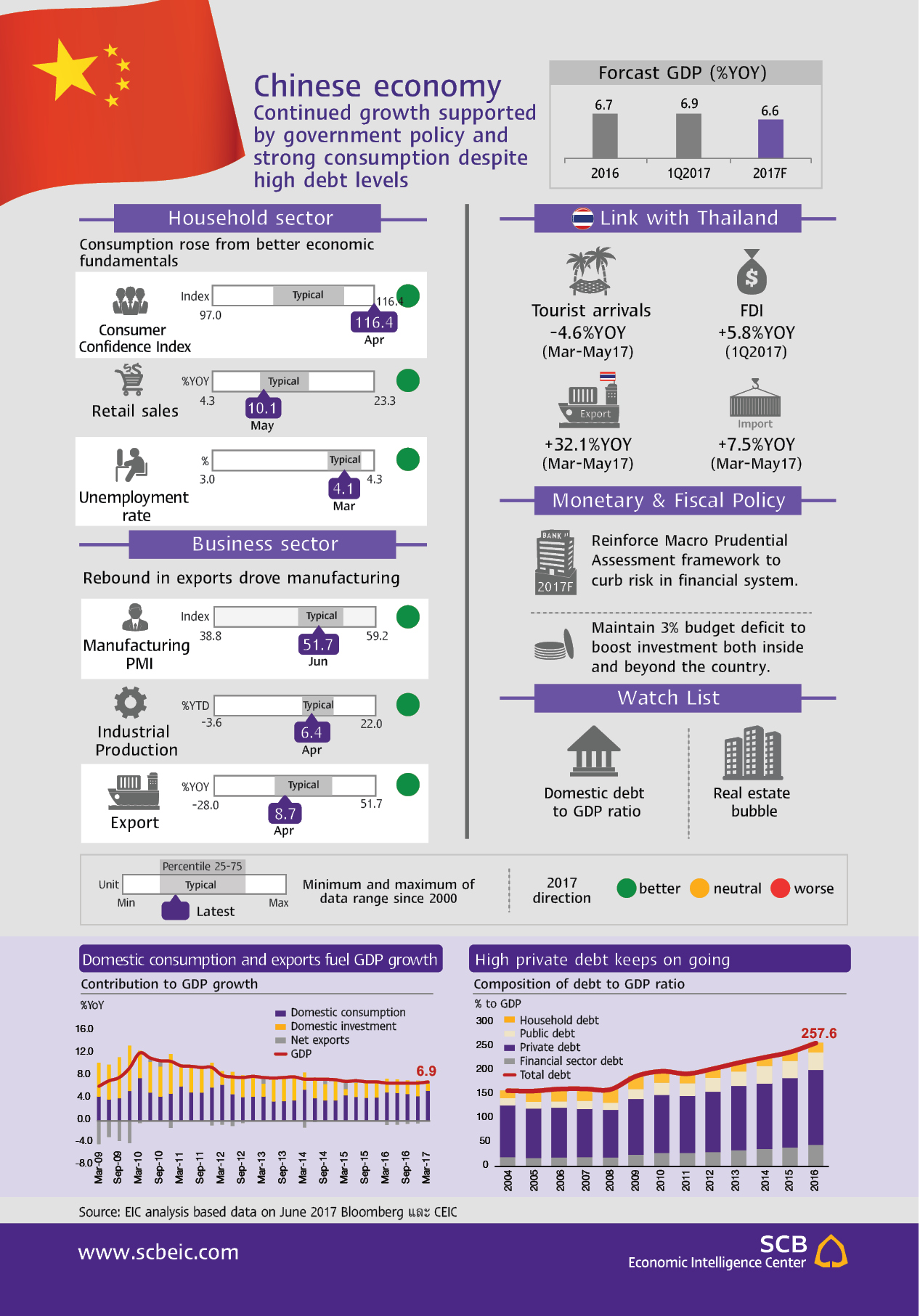

China’s economy grew strongly in the first quarter of 2017 from public spending, domestic consumption and exports. GDP expanded 6.9%YOY in the first quarter, higher than previous quarter’s 6.5%YOY. The main driver was government infrastructure investment project under public-private partnerships, which has been ongoing since late 2015. In addition, private consumption was strong, with retail sales rising 10.9%YOY in the first quarter of the year on the back of rising consumer confidence following government measures to encourage spending. At the same time, exports improved, expanding 8.9%YOY, especially those to major partners like the EU and the U.S., after concerns on the U.S. protectionist trade policies was relaxed.

EIC expects China’s economy to grow by 6.6% in 2017, driven by government policy to stimulate high-technology production and domestic consumption. The key drivers are supply-side economic reforms that support high-tech manufacturing and services as part of the “Made in China 2025” strategy, as well as a rebound in exports in line with global recovery. Domestic consumption will also benefit from better economic fundamentals, such as low unemployment and rising consumer confidence. Even though the government uses economic stimulus measures to encourage spending, it continues to reduce overcapacity in steel and coal mining sectors, to cut real estate inventory in large cities, and to and control risks from high domestic debts by control credit growth as well as deleverage.

China’s high debt level is a key risk to be monitored, but the government remains able to manage the situation. Moody’s downgraded Chinese government bonds issued in yuan and other currencies from Aa3 to A1, reflecting concern about the rising level of domestic debt. In 2016, the debt level reached 257.6% of GDP. The government has by far implemented the following control measures. 1) The People’s Bank of China (PBOC) raised short-term interest rates to slightly tighten its monetary policy. This is intended to control credit creation for businesses in industries with overcapacity, but the measure could increase burden to existing debtors. 2) PBOC has drafted regulations on shadow banking, the investment and fund-raising channel for high-risk businesses. EIC expects these measures to effectively slow down credit growth and maintain financial stability in the long run.

Implications for Thai Economy

-

Compared to end of 2016, the yuan has recently strengthened against the U.S. Dollar by 2.5%, following the same direction as other currencies in Asia, including Thai baht. This, However, will have limited impact on Thai export and tourism sectors.

-

China’s domestic consumption improved, leading to higher demand for such products as consumer goods, medicine, clothing and toys. This presents an opportunity for Thai businesses in these products. Moreover, “Made in China 2025” strategy, which supports high-tech manufacturing, will benefit Thai exports in the supply chains, including machinery & parts, integrated circuits and electronics.

-

Overall Chinese FDI in Thailand has been stable, though with a slight drop in rubber, plastics and construction. There are, however, signs of growth in car sales and maintenance services, motorcycles, electricity generation, natural gas and ventilation systems.