What India benefits from the new GST system

EIC Research Series: Opening doors to India EP2

Author: Yuwanee Ouinong

India’s new tax system called the Goods and Service Tax or GST became effective on July 1st across the country. The transition has not been smooth for businesses in India. Many small businesses unequipped with computer skills are now having to learn how to submit tax forms via digital platform. While large companies have hassled with problems like changing price tags of unsold inventories or forcing their suppliers to register for the GST, so that the companies can claim tax credits for input purchased. Some have even had to cancel purchase from suppliers who are not ready for GST to avoid cascading tax. Such setbacks reflect that businesses and government did not prepare well in time, rather than the problem of the tax system itself. Therefore, India will need time to adjust before the benefits of the new tax system can be fully reaped.

What are the future economic gains from the GST system?

The government: expect more tax collection and lower budget deficits.

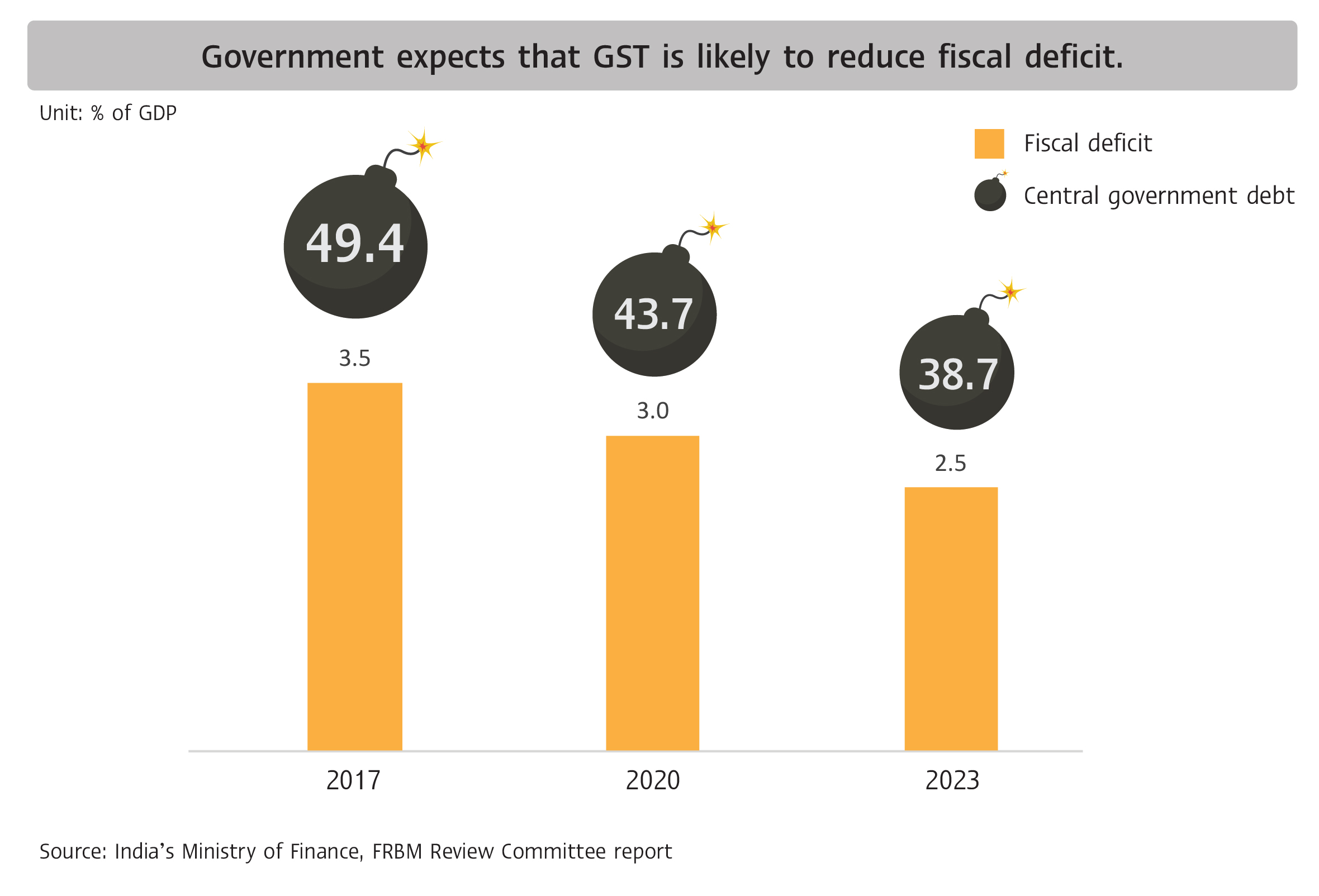

Consolidation of state taxes under the GST will take away revenue previously earned by state governments. However, the new system will expand taxpayers base as more businesses will want to take advantage of benefits like tax credits. The dual tax inspection by central and state governments will also improve efficiency. State governments will also be compensated for loss in revenue over a period of 5 years. As well, higher tax charge on luxury items and services should additionally help lessen such loss in revenue. A report from the central bank of India1 said that GST will have an enduring impact on state finances over the medium term and is likely to reduce the fiscal deficits by 0.7-1.2% of GDP. This is consistent with the Fiscal Responsibility and Budget Management Report that expects budget deficit to fall from 3.4% of GDP to 2.6% in 2023, which will lead a reduction in central government debt down to 38.7% of GDP by 2023 from the current level of 49.4%. Such outcome will allow more fiscal space for further government infrastructure investment going forward.

Private sector: the majority of businesses and population will gain from cheaper products.

Material costs will be lower and so will retail prices. This will boost spending of households and sales. The impact on price may be both directly and indirectly as explained as follows;

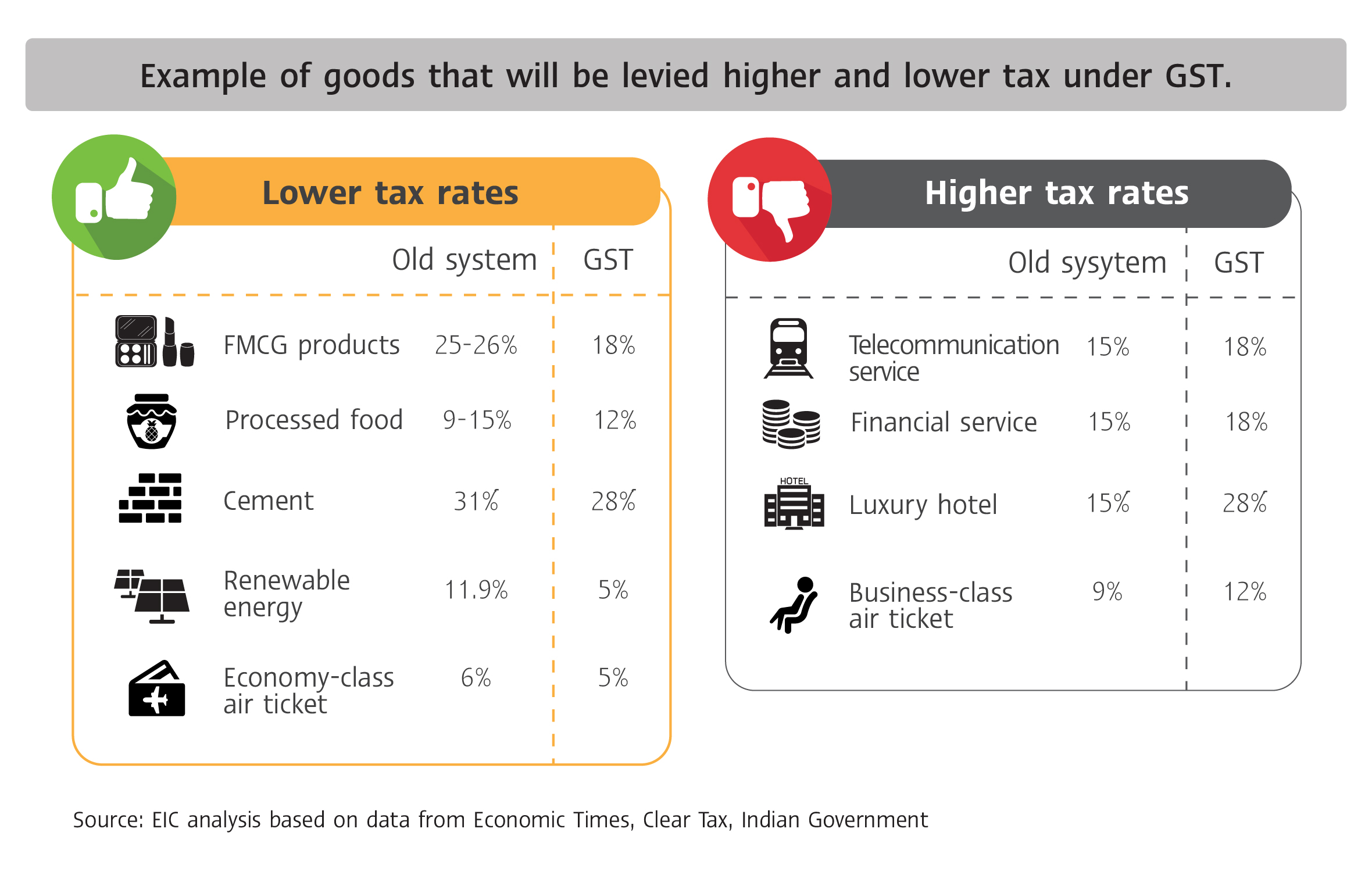

1. Prices fall directly due to lower tax rates under the new system. Up to 80% of products under the GST system will be levied tax below 18%, which is equivalent or lower than the tax rate previously charged. However, luxury items and services, such as telecommunication or financial services, will have tax charged rate raised from 15% to 18% under the new system. Given the population’s diversity, the government designed a 4 steps tax structure that would be more suited than a single tax rate. This would allow lower tax charge or waiver on essential goods to reduce burden of lower income group and higher tax charge on luxury items.

2. Lower cost of production due to indirect benefit of improved efficiency. Monetary savings from transportation will result from more efficient distribution of goods, whilst, time savings will result from improved state-border inspection processes. The World Bank estimates that the cost of logistics will lower by 30-40% if transportation time can be cut in half (See: India’s GST, the biggest tax reform, opportunities for Thai investors). Furthermore, the new tax system will encourage less bribery as most tax procedures will go online, thus removing procedures requiring face to face contact with officers.

Nevertheless, it is not likely that business will be able to transfer such monetary savings into extra profit margins. Rather the government is enforcing that fall in prices due to lower GST should be passed on to consumers. The government will take legal action against vendors not declaring revised retail price after GST.

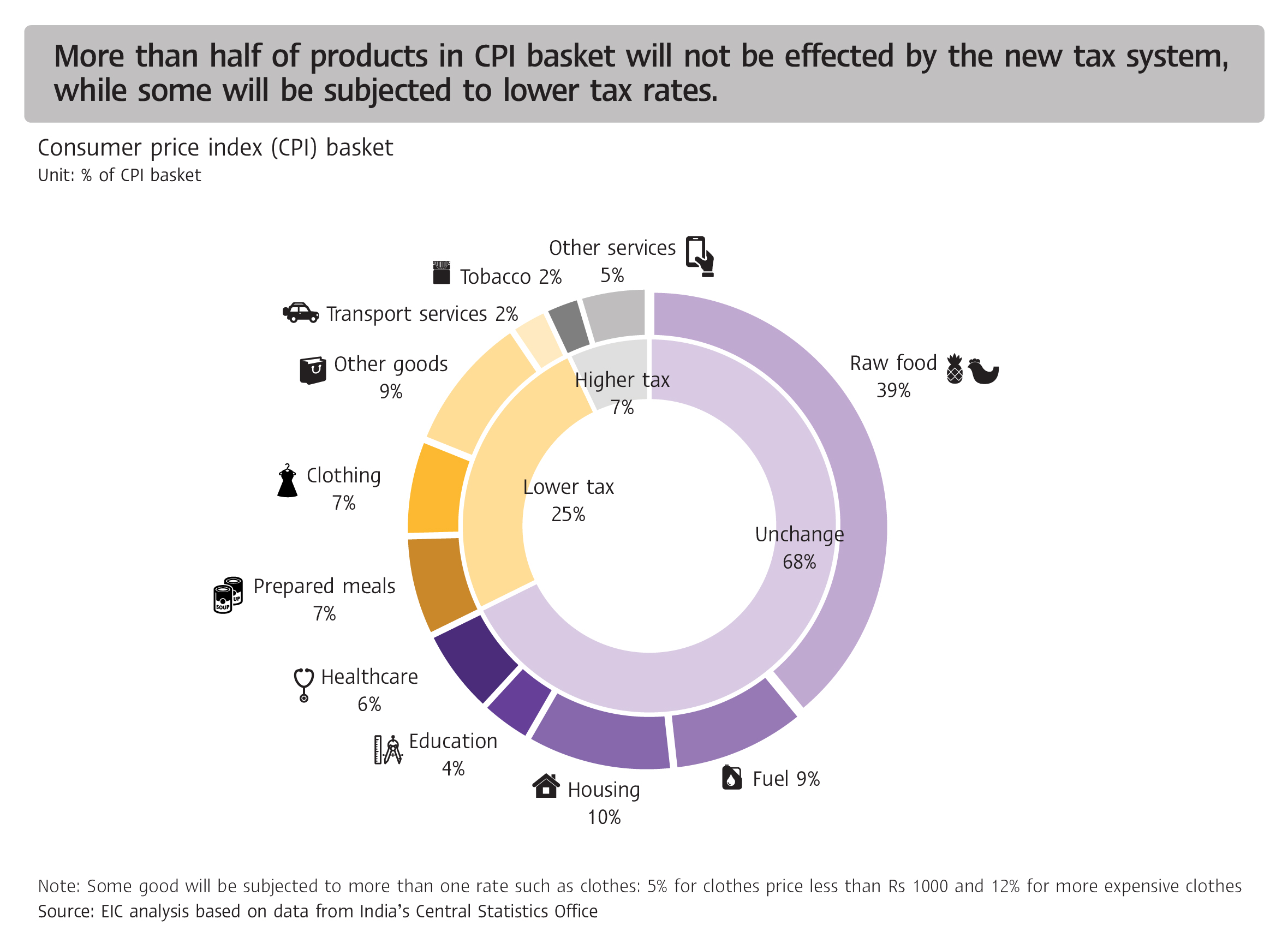

Inflation: is expected to fall with fluctuations in the short run

The composition of the consumer price index (CPI) that indicates inflation shows that over 68% of the products in the basket will not be effected by the new tax system. This is because fresh food, commodities and services relating to education and health are already exempted from tax2 , whilst petroleum is not included in the GST system. The remaining portion of 32% is composed of 1. essential goods such as processed food, personal effects that accounts for 25%, which will be levied the same or lower tax rate than before, and 2. tobacco and other services such as telephone and internet services that will be face higher tax rate but accounts for merely 7% of the CPI basket. As a result, inflation overall will likely drop not only due to cost savings from lower tax levy but also savings from logistics cost that can be passed on to price savings of certain products. In other terms, prices of goods will drop not only among the 25% share of products that benefits from lower tax rates but products already exempted from tax but are becoming cheaper due to cost savings in logistics and management. Such savings once passed on, will be beneficial consumers going forward.

Nevertheless, inflation rates may fluctuate over the short term or around 1 year period, as stores have only begun to change prices of products. Furthermore, smaller businesses that will pay tax for the first time will need time to adjust. Prices fluctuations have occurred in other countries that went through similar tax changes. For instance, in Australia the GST of 10% that became effective in the third quarter of 2000 caused prices to become unstable and inflation to rise to 6%YOY from 3%YOY. However, inflation returned to the same level of 3% by the following year.

The overall economy: more foreign investors will choose to invest in India

India has not been among top choices for investors in search for new export production base. This is due to the complicated tax system which made cost of exporting from India more expensive than other countries. Take for example, a company in Nagur city in central India would be paying more for its transportation from the factory to the port than the shipping cost from the port to China. This also leads material cost bought between states to sometimes cost more than importing the same material. These are factors that have put pressure on India’s manufacturing and export sector. As a result, India’s manufacturing sector only accounts for 30% of GDP, in comparison to the service sector, which accounts for a share of up to 52% of GDP. As for India exports, in 2016 its value totaled to 270 billion US dollar, which is equivalent only to 13% of the total value of China’s exports (or roughly the same value of Thai exports which stood at 210 billion US dollar).

Regardless, the GST system will help to unlock India’s manufacturing sector as it will create a truly single market that allows business operations, logistics, and trading within the country to proceed more smoothly. This will improve the ease of doing business in India as well as encourage more foreign investors to choose India as a base for export production. This will encourage more investments from the private sector and production of exports in India, which will be important economic drivers going forward.

1 Reserve Bank of India (2017), “State Finance: A study of budgets”.

2 Most products and services have tax exemptions under the old and new tax systems, with some exceptions in certain states, where tax was levied under the old system.