Lazada under Alibaba’s wings: where is the Thai e-Commerce headed?

EIC Research Series: Alibaba Kingdom

Author: Pimnipa Booasang

As the e-Commerce industry was shaken by Alibaba’s acquisition of Lazada, the deal has raised concerns that Lazada may become a channel through which cheaper goods from China can flood the Thai market. While Jack Ma said that ASEAN SMEs would benefit from selling Thai goods to Chinese consumers. This article will delve into whether Thailand is losing out from the Alizada phenomenon. Are there any products that Thailand stands a winning chance?

ASEAN’s e-Commerce industry has been taken to a new level of competition following the acquisition of Lazada by Alibaba

The rapid income growth outlook among ASEAN’s middleclass and its over 618 million-strong consumer base, most of whom still without access to e-Commerce, have prompted China’s e-Commerce giant, Alibaba, to invest in full strength in the ASEAN market. The acquisition of Lazada, the region’s largest e-Commerce website operating in 6 ASEAN countries1 marks the first step. This move was followed by the announcement of an official partnership between Ant Financial Services - a parent company of Alipay which is China’s No. 1 third-party online payment platform under the Alibaba Group umbrella, and Ascend Money of Thailand’s CP Group. In addition, Lazada has recently announced its plan to invest in Thailand’s Eastern Economic Corridor (EEC), where the company will set up its e-Commerce park and logistics hub, making Thailand its door into CLMV. Furthermore, Alibaba has joined hands with the Malaysian Government to set up the Electronic World Trade Platform (eWTP) in order to holistically promote international trade via the platform and to help SMEs overcome complex regulations, processes and barriers that hinder their participation in global commerce.

It is worth noting that “every step taken by Alibaba in the ASEAN region contributes to building the necessary infrastructure and creating appropriate e-Commerce ecosystem to flourish in the region, paving the way for a holistic provision of e-Commerce services under the Alibaba umbrella.”

Alizada connects the Chinese market with the ASEAN Market.

Jack Ma, founder and CEO of Alibaba, said that the company builds the infrastructure and develops favorable e-Commerce business environment in ASEAN, both in logistics and payment system, in order to make trade between China and ASEAN more efficient. This would allow ASEAN SMEs to enter the Chinese market, tapping into its 1,370 million population, through Alibaba’s Tmall.com2. Moreover, entrepreneurs are able to utilize the platform to expand their markets by trying out new products at a lower cost and without having to shoulder the risk of a direct investment. The more efficient logistics system lowers SMEs’ inventory management and shipping costs. In the future, as sellers start accepting payment through Alipay, Alibaba will maintain a database containing financial information of various sellers which would facilitate credit and lending for better liquidity management.

|

However, a more efficient international trading system reduces the cost of foreign products to a level close to the cost of the domestically-produced counterpart, which in turn subjects the survival of Thai producers to market mechanism.

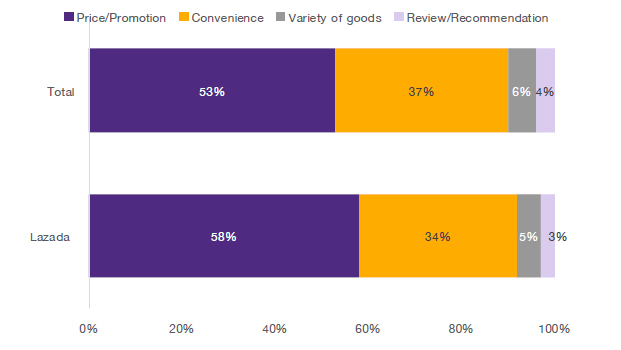

While an easier and more open international trade helps businesses enter into the international market, the businesses inevitably face a stronger competition from foreign imports that would flood the domestic market. “Goods that are mass-produced will be subject to a price war, and the winner would be one with the highest competitiveness or with the lowest production cost.” As an already apparent case in point is cellphone cases which are products that are relatively low cost, making it unlikely to be worth the money to order from outside the country. However, only 2.8% of cellphone cases sold via the Lazada website are shipped domestically. This could mean that over 97.2% were produced at a sufficiently low cost that, even with the international shipping cost and import tax, foreign products are still able to compete with Thai products via e-Commerce. Lower prices and discount promotions are key factors which attract consumers to buy products online. E-Commerce platforms worldwide use this method to attract as many buyers as possible, and sellers need to sell their products via these platforms in order to reach the widest consumer base possible.

Main factors which prompt today’s consumers to buy products online are prices that are lower than the market and discount promotions.

Key factors that attract Thai consumers to buy products online

Unit: % of total online shoppers and Lazada’s shoppers

Source: Survey conducted by EIC

A key question is whether Thai businesses stand to win or lose from the freer trade as a result of the Alizada phenomenon.

Upon learning of the acquisition of Lazada by Alibaba, many are concerned whether Lazada would become a channel through which Chinese goods would flood the Thai market. It is feared that the Alizada phenomenon will further lower the cost of foreign goods to nearly as low as the domestic counterparts, which may lead to an even more intense competition in many sectors. Thailand’s gain from being able to enter the Chinese market may outweigh the loss from the increased competition. However, the EIC views the Alizada phenomenon not as a competition between Thailand and China alone, but rather a competition between ASEAN and China, if the Lazada platform successfully connects shops from the various ASEAN countries with China. Therefore, there may also be other countries in ASEAN that are able to compete with China, which should also be of concern to Thailand, but there may also be certain product categories that Thailand still has a role to play.

|

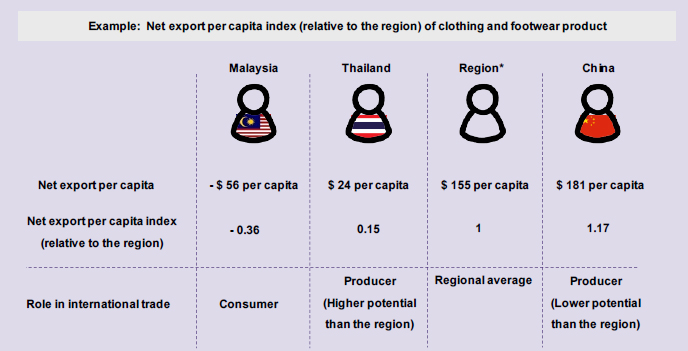

Methodology: This study uses the net export per capita index to measure the competitiveness of each country in the region and the role of each country in international trade. The countries include Thailand, China, Indonesia, Malaysia, Philippines and Vietnam, all of which are currently utilizing either Lazada or Alibaba platforms. The roles in international trade can be divided into 2 categories, namely, (1) the producer, for countries with a trade surplus which would be reflected by a positive net export per capita index, and (2) the consumer, for countries with a trade deficit which would be reflected by a negative net export per capita index. The study has shown that most of the countries in the region are producers. In addition, in order to measure the competitiveness among the producer countries, the net export per capita index is able to identify whether the population of Country A has a relatively higher production capability than the regional average if the net export per capita index is higher than 1.

Remark:: “Region” composed of Thailand China Indonesia Malaysia Philippines and Vietnam, all of which are currently utilizing either Lazada or Alibaba platforms

|

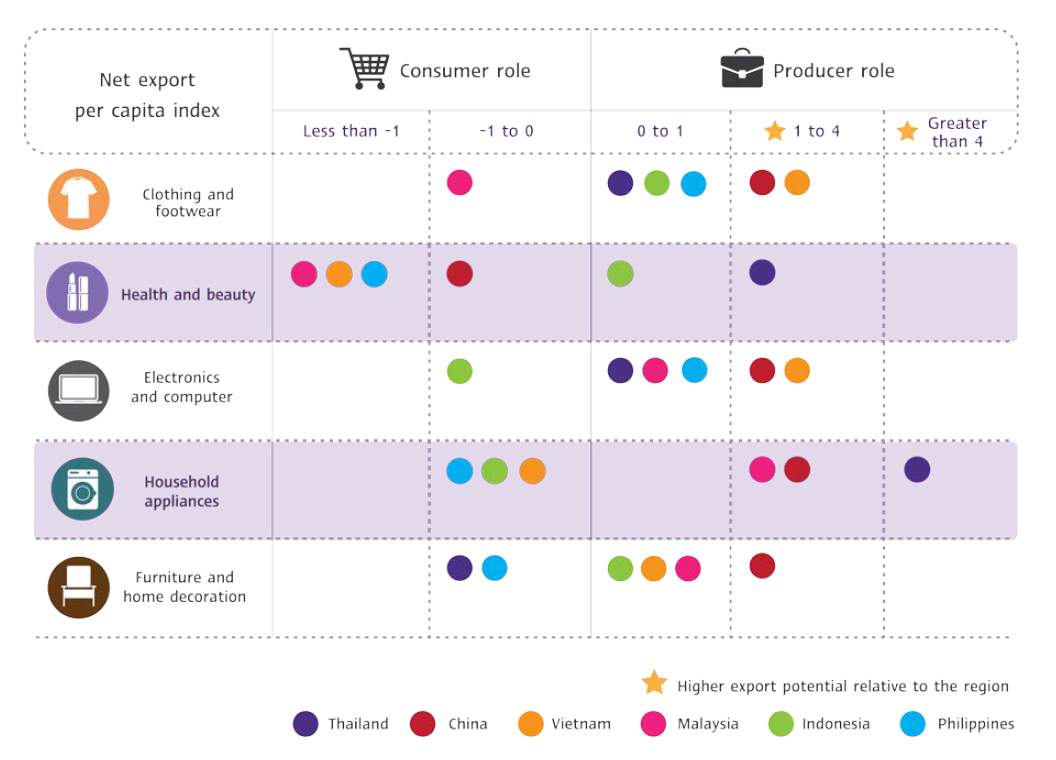

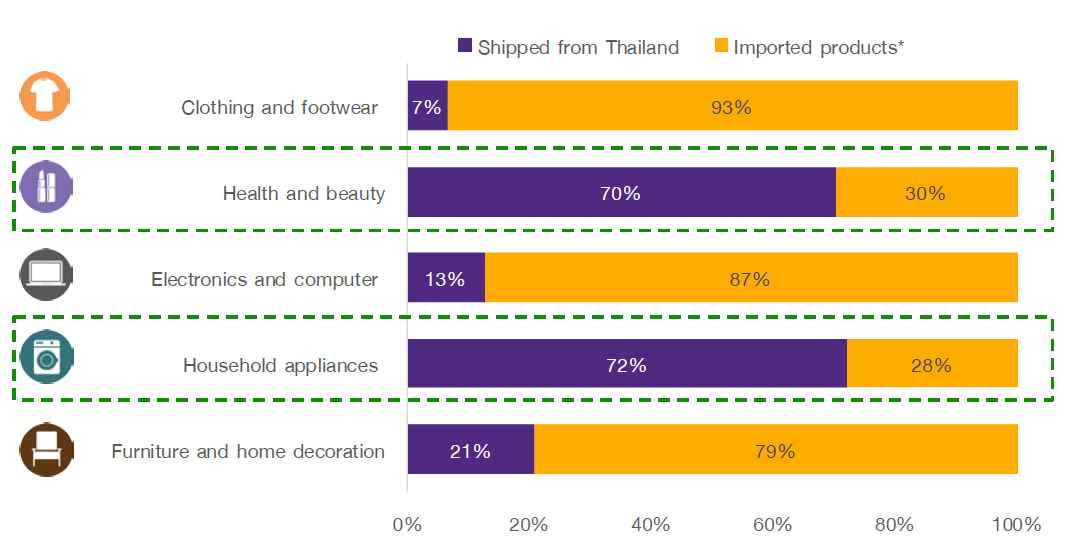

Thai producers lead the market in health and beauty products as well as household appliances.

The study has shown that, relative to the region, Thailand is a producer for almost all product categories except furniture and home decoration. Thailand is a better producer than the regional average in health and beauty products and household appliances. This is consistent with the competitiveness of Thai goods from the Lazada (Thailand) platform, in which Thai products account for over 70% of products in the said categories.

Thailand stands out as the producer of health and beauty products and household appliances while China and Vietnam are main producers of clothing and footwear, electronics and computer in the region.

Net export per capita index – by product category and country

Unit: Index, >1: Higher export potential relative to the region

Source: Analysis by EIC using data from Trade Map

Health and beauty products and household appliances are products which Thai businesses have clear roles on the Lazada (Thailand) platform.

Source of goods sold on Lazada (Thailand) platform- by product category

Unit: % of total products sold on Lazada (Thailand) platform

Note: Imported products are products which are not shipped from a domestic location.

Source: Analysis by EIC using data from Lazada as of June 24, 2017

Health and beauty products from Thailand have high potential and are very popular among ASEAN and Chinese consumers.

Thailand’s health and beauty products, especially cosmetics, are popular among ASEAN and Chinese consumers. Thailand has the largest share of the cosmetics market in ASEAN of over 30%3. Thailand also has a success case of the Thai cosmetic brand, SNAIL WHITE, which is ranked No.3 brand name cosmetic import in the Chinese market in 2015. While other import origins of cosmetic products into the Chinese market include France, South Korea, USA and Japan.4 Moreover, a survey found that other Thai cosmetics brands are also popular and have high sales volume in the Chinese market, including Beauty Buffet, Ele, Herb Basics and Mistine. At present, foreign consumers usually purchase Thai products from agents who import the products into their countries, and tourists usually buy a large quantity of products back home Therefore, the development of e-Commerce infrastructure as a result of the Alizada phenomenon presents a good opportunity for Thai businesses to gain access to more foreign consumers and to rapidly expand their market. Countries which are the consumers in the health and cosmetics product category to which Thai businesses should expand into potential consumer countries including Malaysia, Philippines, Vietnam and China. In addition, businesses should also pay attention to additional countries which may start gaining access to e-Commerce platform in the future, such as Cambodia, Myanmar and Lao PDR. Nonetheless, Thai products should focus on medium-to-high-end market and seek to develop unique selling points. Choosing to focus on the low-end or the mass market may force the business to face a fierce competition in the long run, as the product format and quality would be easily duplicated, especially by the Chinese competitors.

Household appliances : a strength which Thailand should not be complacent.

Thailand is currently an important production base for household appliances in ASEAN, making it a strong producer in this product category. Consumers, e.g. Vietnam, prefer Thai products to Chinese ones as they trust in the Thai quality and appropriate pricing. However, looking into the future, Thailand’s competitiveness would be dependent on the producer company’s policy, most of whom are international firms which would be ready to relocate its production base away from Thailand if they are presented with lower wages, better labor force or investment benefits in other countries. For example, Vietnam could potentially attract international firms to move their production base from China and Thailand to Vietnam. Therefore, Thai companies with experiences in producing household appliances for international companies may cease the opportunity presented by the Alizada phenomenon by gearing up its R&D to produce innovative products or products with unique functions that differentiate themselves from products from other countries. They can use the online platform to increase their sales and expand their markets to meet growing demand in the region.

China and Vietnam are key producers of clothing and footwear, electronics and computers.

Although Thailand is a producer for all 3 categories of products which consumers tend to purchase online, namely clothing and footwear, health and beauty products, and electronics and computer, it was found that Thailand’s share in the clothing and footwear category and the electronics and computer category on the Lazada (Thailand) platform are only 7% and 13% respectively. This means that Thai businesses are competing with foreign goods which make up over 90% of the products in these categories. This is consistent with Thailand being a producer with lower production capability than the regional average. Countries with leading roles are China and Vietnam. Most foreign products that are competing in the Thai market are currently from China, but in the future, as trade between China and ASEAN are better connected, Thailand may have to also watch out for competitors from Vietnam.

In conclusion, China has a production capability higher than the regional average in nearly all product categories except health and beauty products. We may be able to conclude that “a more open trade via Alizada is likely to be very beneficial to China, with the health and beauty products being the only category that Thai businesses may be able to enter into the Chinese market.”

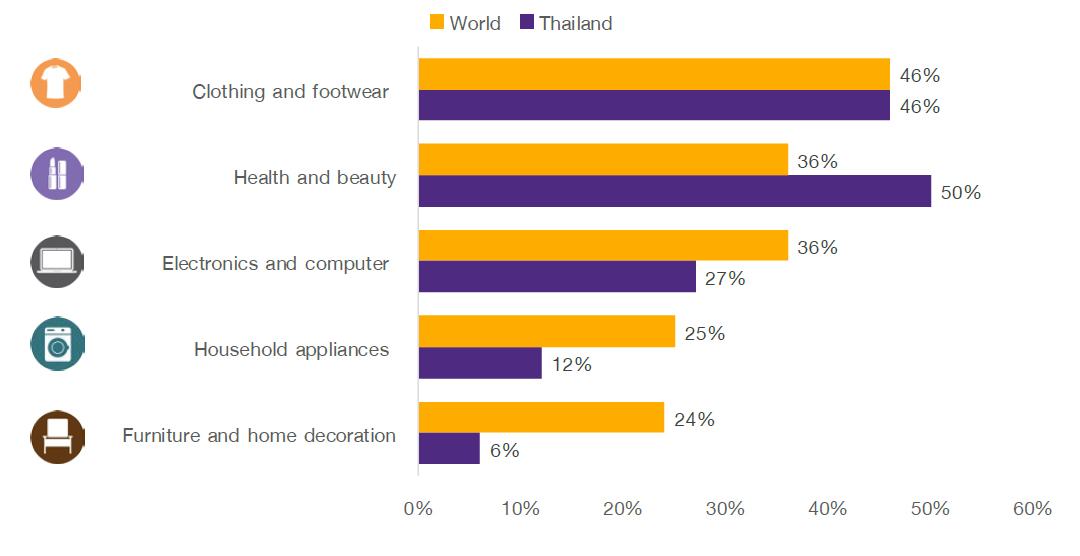

Clothing and footwear, health and beauty, and electronics and computer are goods which are often purchased via online platforms.

Popularity of online products among Thai consumers compared to the world – by product category

Unit: % of total online shoppers

Source: Survey conducted by EIC and PWC Total Retail Survey (2016)

|

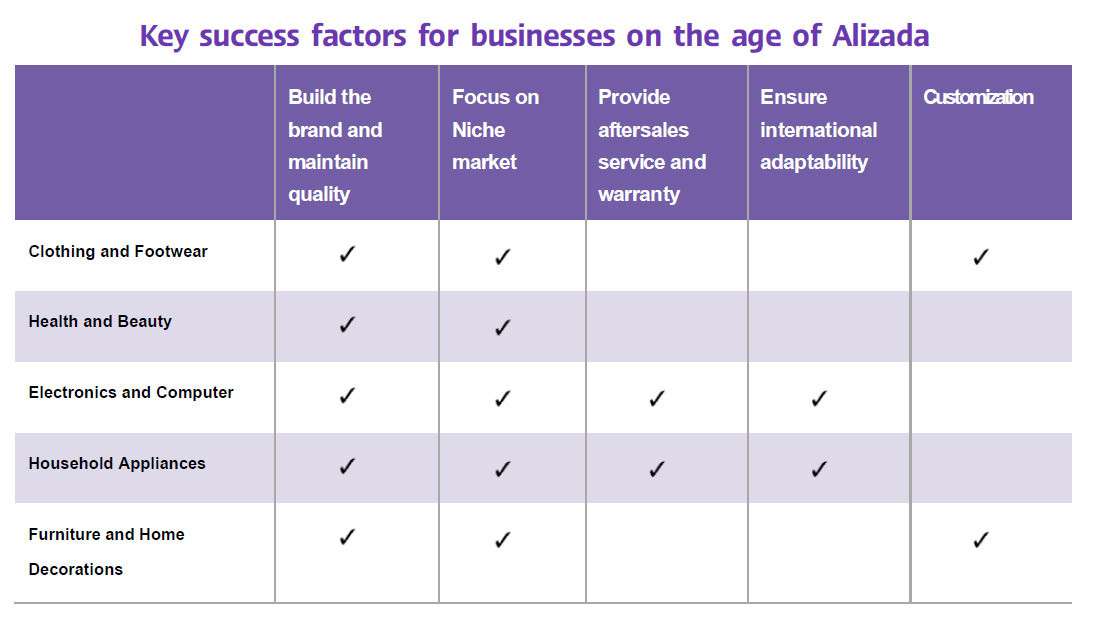

Small e-Commerce businesses can survive in this battleground if they can differentiate their products and build strong brands.

Businesses that will likely thrive in a world of price competition are big businesses that benefit from economies of scale5. Therefore, the path to survival for small e-Commerce businesses that do not want to compete on price is to differentiate or innovate their products to supply a niche market. E-Commerce platforms such as Lazada help increase the competitiveness of niche products, as consumers can look for specific and unique products by using the filter available on the platforms. This function helps SMEs that supply niche products to gain low-cost access to a large customer base and more easily reach their target consumers. However, small businesses that are not yet well-known should secure customers’ confidence by providing after-sales support and product warranty.

Moreover, businesses must build a strong brand because it is a long-term investment that adds value to the products, enabling businesses to attach premiums on their products. Nonetheless, one disadvantage of online platforms like Lazada is the large number of products available, turning almost every product into a mass product. This makes it difficult to display the products’ unique selling proposition or set a price higher than those of competitors. Hence, businesses should establish additional sales channels, such as social media or company’s own website, in order to build stronger brand awareness and brand identity. This way, businesses can take advantage of the widespread and extensive daily use of social media among Thais. Moreover, consumers who make purchases through social media are often motivated by advertisements on social media, which utilize a recommendation system to display products that is likely to attract greatest interest from each consumer. Customers on social media are thus different from buyers in other platforms who already possess the desire to purchase the products before searching for them.

|

Do Day Dream Plc., the manufacturer of SNAIL WHITE products, started off as an OEM to acquaint itself with the cosmetics business. Later on, the company tried to create a unique selling point different from other companies and eventually picked up snail serum as a raw material to be used for a niche market. SNAIL WHITE then launched a marketing strategy in the first year by building brand awareness on social media and through product reviews, which incurred a low cost but delivered great result. The outcome was a company’s sales revenue of THB 90 million in the first year, with 95% of its sales through social media. In the second year, SNAIL WHITE made use of TV advertisements and increased its sales to THB 450 million, and subsequently THB 1 billion in the third year. However, after its products had gained a growing reputation, counterfeits began to emerge. SNAIL WHITE tackled the problem by putting a QR code on its products for consumers to verify that they are genuine. SNAIL WHITE emphasizes that the key to maintaining a strong brand is to sustain the product quality.

|

Amid the raging business war marked by intensifying competition, building brands and maintaining product quality are essential for long-term business growth. New businesses seeking to fulfil a gap in the market need to innovate new products with unique selling points. In addition, businesses selling electronics, computers and household appliances can foster a strong relationship with Thai customers by providing after-sales services and product warranty – an area in which Thai businesses are often superior to foreign companies thanks to a greater understanding of and access to customers. Businesses looking to export products overseas need to recognize whether their products are compatible with the foreign markets. For example, they need to consider different electrical voltages across countries and should create manuals that are suitable for and accessible by foreign consumers. Moreover, clothing and footwear, furniture and home decoration are products that consumers tend to prefer customization, which could be an opportunity for small businesses.

1 Including Thailand, Indonesia, Malaysia, the Philippines, Singapore and Vietnam.

2 Tmall.com is the online shopping website for sellers worldwide to sell to Chinese buyers. Only sellers with registered businesses are allowed on the website.

3 Data from Yano Research Institute, Japan

4 Top 10 brand name cosmetics import to China in 2015 are : 1. L’Oreal Paris (France) 2. Innisfree (South Korea) 3. SNAIL WHITE (Thailand) 4. Olay (USA) 5. CLARINS (France) 6. Shiseido (Japan) 7. Kanebo (Japan) 8. L’OCCITANE (France) 9. Clinique (USA) and 10. Biotherm (France). Data from the Thai Trade Center, Chendu, People’s Republic of China

5 Economies of scale is the cost advantage that arises with increased output of a product. Economies of scale arise because the fixed costs are spread over a larger volume of production, e.g. cost of land, machinery, management, etc. making the production more efficient and more competitive.

![GettyImages-468120908 [Converted]-01.png](https://www.scbeic.com/stocks/product/o0x0/p1/ax/eri0p1axei/GettyImages-468120908_%5BConverted%5D-01.png)