What’s in store for the future of Thai auto industry?

Aside from the emergence of new competitors that costs Thailand's share in key markets, the Thai auto industry is surrounded by many other obstacles such as reliance on new advanced technology and declining foreign direct investment. EIC assesses that expansion of domestic demand wil be key to recovery for the industry in the short-to-medium term.

Author: Sopit Aimpichaimongkol , Nantapong Pantaweesak

|

Highlight

|

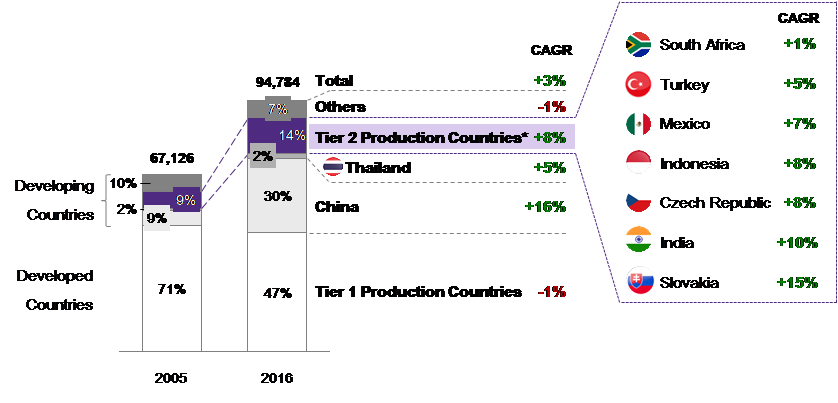

Over the past decade, tier 2 production countries1 have played an important role in the global auto industry. The share of cars made within this group jumped from 9% of global production in 2005 to 14% in 2016, with the growth rate being as high as 8% annually. Among these tier 2 production countries, Mexico and India stand out as they had a combined production level of over 8 million units in 2016, more than half of the production within the group. Other countries like Indonesia, Czech Republic, and Slovakia have also increased their production levels rapidly, growing 8%, 8%, and 15% per year, respectively. Additionally, South Africa has transformed from being a net importer of cars to becoming a major exporter, with 9% of total car production being exported in 2016.

On the other hand, the Thai auto industry, which was once in the lead, is now in decline, with the growth rate of only 5% annually. The Thai auto industry has also lost market shares to competitors like Indonesia and South Africa. Since 2010, the value of passenger car exports from Thailand grew only 8% per year. During the same period, Indonesia's passenger car exports expanded at an annual rate of 17%, taking away from Thailand's market share in Japan, Saudi Arabia, and the Philippines. In addition, Thailand is losing market share of pick-up trucks in the UK to South Africa. In 2016, South Africa was able to increase its car export value to the UK by more than 10 times; while Thai exports to the same market has stabilized since 2015. Overall, Thai exports of cars grew only 5% in 2016, down from 12% in 2015.

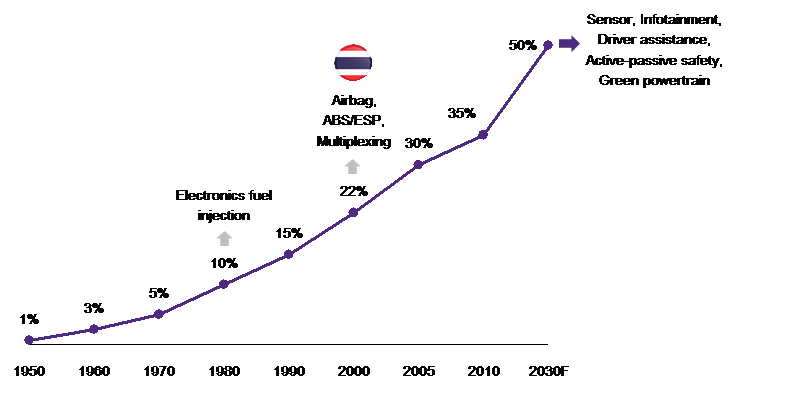

In the future, the Thai auto industry will face many other challenges especially the increasing use and complexity of electronics parts in car production. The use of electronics parts in a car has not only been increasing, but also becoming more complicated. For example, new cars now use advanced sensors and cameras as a part of an automatic brake system and lane-keeping system. Today, however, Thai players still lack the technology needed to produce such parts and can only handle a simpler system such as airbag and anti-lock braking system. Furthermore, a modular platform that allows different models of cars to share parts and structure is being pursued by several major auto makers to create economies of scale. This trend will dictate the future of part distribution across the globe. For instance, the Toyota New Global Architecture (TNGA) project has begun manufacturing New Prius (2015) and CH-R (2016) that share common powertrain, chassis, and transmission parts. In the past, these parts were only produced in Japan. But, Toyota has expanded production to Turkey; while the Prius production base in Thailand was shut down in 2015, causing Thailand to lose an opportunity to be a part of the TNGA production bases.

Furthermore, FDI in the Thai auto industry may barely expand compared to competitors like Indonesia and Mexico. Major car makers, such as Mitsubishi and Nissan, who are Thailand’s key exporters, are forming strategic partnership to share basic car parts production. This collaboration leads to zoning of passenger car and pick-up truck production lines by country. More specifically, Indonesia is likely to become a production hub for passenger cars; while Thailand will only be left with pick-up truck production lines. In addition, Toyota and Ford are planning to invest in factories in Mexico to produce passenger cars, with the investments being as high as USD 1 and 2.5 billion, respectively.

EIC sees that focusing on domestic sales is key to recovery for the Thai auto industry and could bring in more investments from foreign car makers. Thailand's car ownership rate is currently at 227 cars per 1,000 people. This is relatively low compared to advanced economies such as Germany and South Korea who own 559 and 412 cars per 1,000 people, respectively. The governments in both countries have continued to use stimulus measures for car sales such as the Scrappage Scheme. The measure provides tax incentives or subsidies for those who turn in an old car for a new one. It results in a rise of car sales in 2009 by 18% in Germany and 17% in South Korea from the year before the implementation.

Note: 1 Tier 2 production countries include South Africa, Turkey, Mexico, Indonesia, Czech Republic, India, and Slovakia.

|

|

|

|

|

Figure 1: Global car production

Unit: Thousand cars

Source: EIC analysis based on data from OICA

Figure 2: Share of electronics parts per vehicle

Unit: %

Source: EIC analysis based on data from Freescale Semiconductor