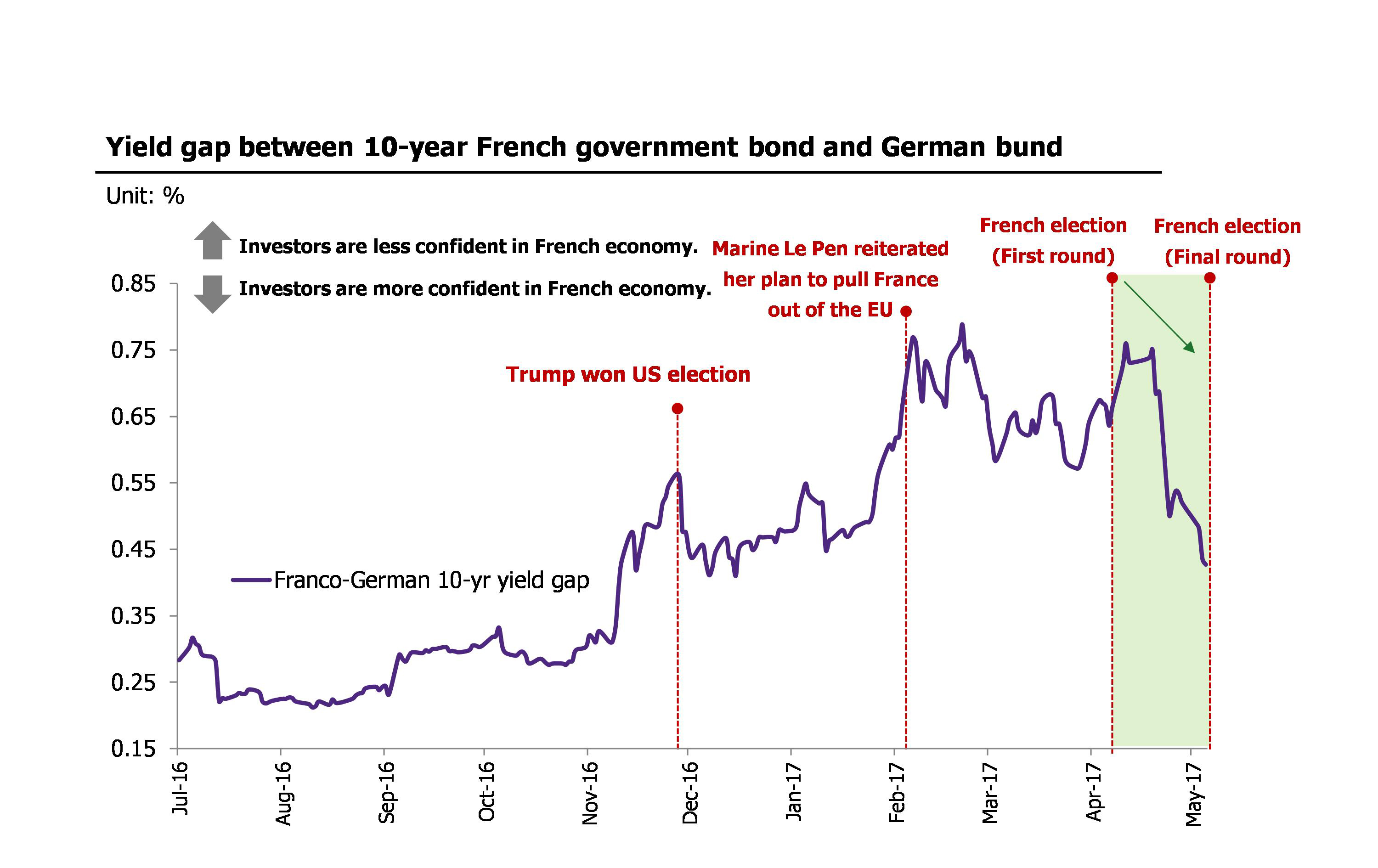

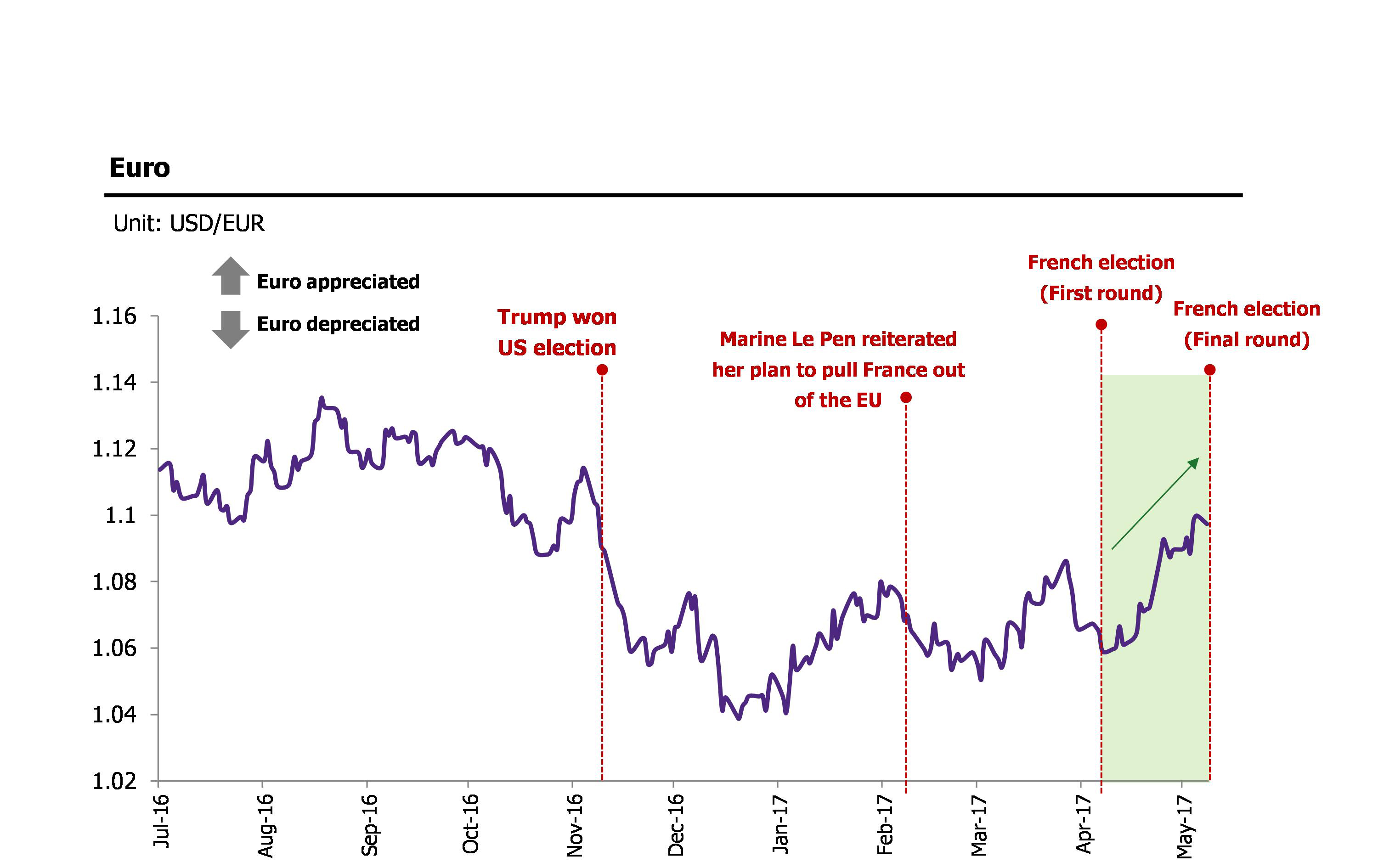

- The euro reached its 7-month high following Macron's win. Since the first-round balloting on 23 April, actual election results aligning with predictions have helped shore up investors' confidence, as seen in the stronger euro and continuously narrowing gap between French and German bond yields, indicating a more positive outlook on the French economy among investors (Figures 1 and 2). Financial markets responded positively, without much volatility, in the wake of the run-off results. Investors expects Macron's policy to bring more stability to the French economy and, subsequently, to that of the EU.

- However, whether Macron can turn the tide of the French economy through his policy remains to be seen, as he still needs to secure enough seats in the Parliament to enact campaign promises

| EU policy |

Pro-reform and sees France's role as one of the EU's main pillars as necessary.

|

| Refugees policy |

Welcomes refugees, promised to process all asylum requests within the first six months of his presidency |

| Security policy |

For anti-terror efforts that don't erode civil rights. |

| Economic policy |

self-employedCorporate tax cut, from 33% to 25%, residence tax cut, and inheritance tax reform. 120,000 public sector jobs to be cut, with public spending to be slashed by EUR 60 billion. Unemployment target of below 7%. More flexible labor laws, protection for the self-employed

|

Although Macron's policy and promised reform bode well for the French economy and the Eurozone, there is a strong possibility of a political gridlock, which would halt his agenda. Macron still needs to gain a majority in the French Parliament in the upcoming legislative elections on 11 and 18 June. It is highly likely that he won't be able to, and will need to form a coalition. Such a scenario means not all of his plans for economic and social reforms will come to fruition as promised during the campaign

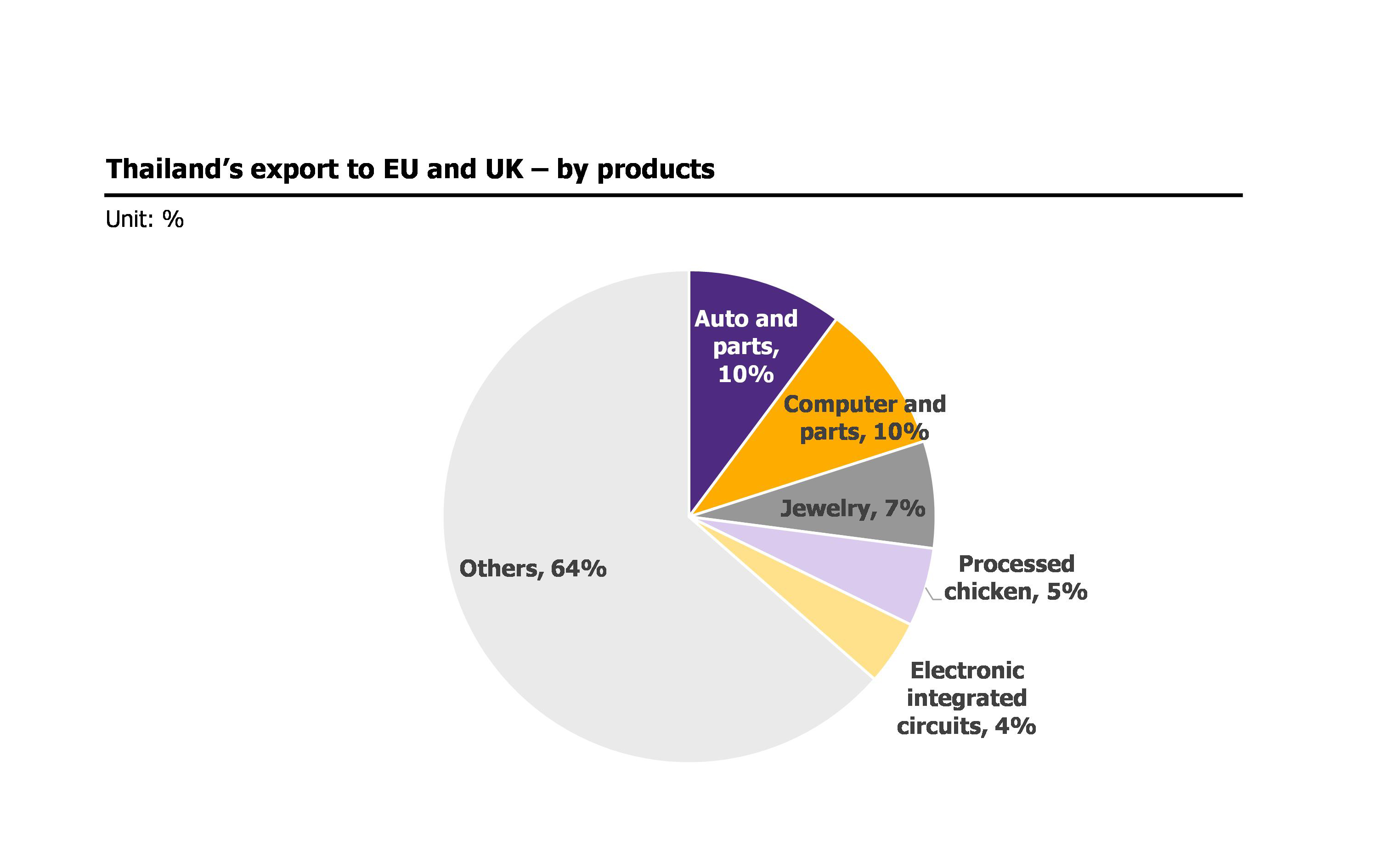

- Macron's victory puts more pressure on Brexit negotiations. One of Macron's key agendas is EU reform and strengthening. He believes the UK should not be able to walk away from the EU without difficulty, to prevent another member-state from following suit. Such thinking puts more pressure on negotiations, and it is likely that the process won't be as smooth and fast as Theresa May, the UK's Prime Minister, hopes. On 29 April, EU leaders convened to discuss Brexit strategy and presented a united front: the EU will not let the UK leave without financial costs (no “Free Brexit”) or to pick and choose conditions. According to the Financial Times's analysis, upon Brexit the UK may be billed as much as GBP 100 billion by the EU.

|