CLMV economy: Myanmar expands with internal and external risks.

Published in EIC Outlook Q2/2017 Click here for more detail

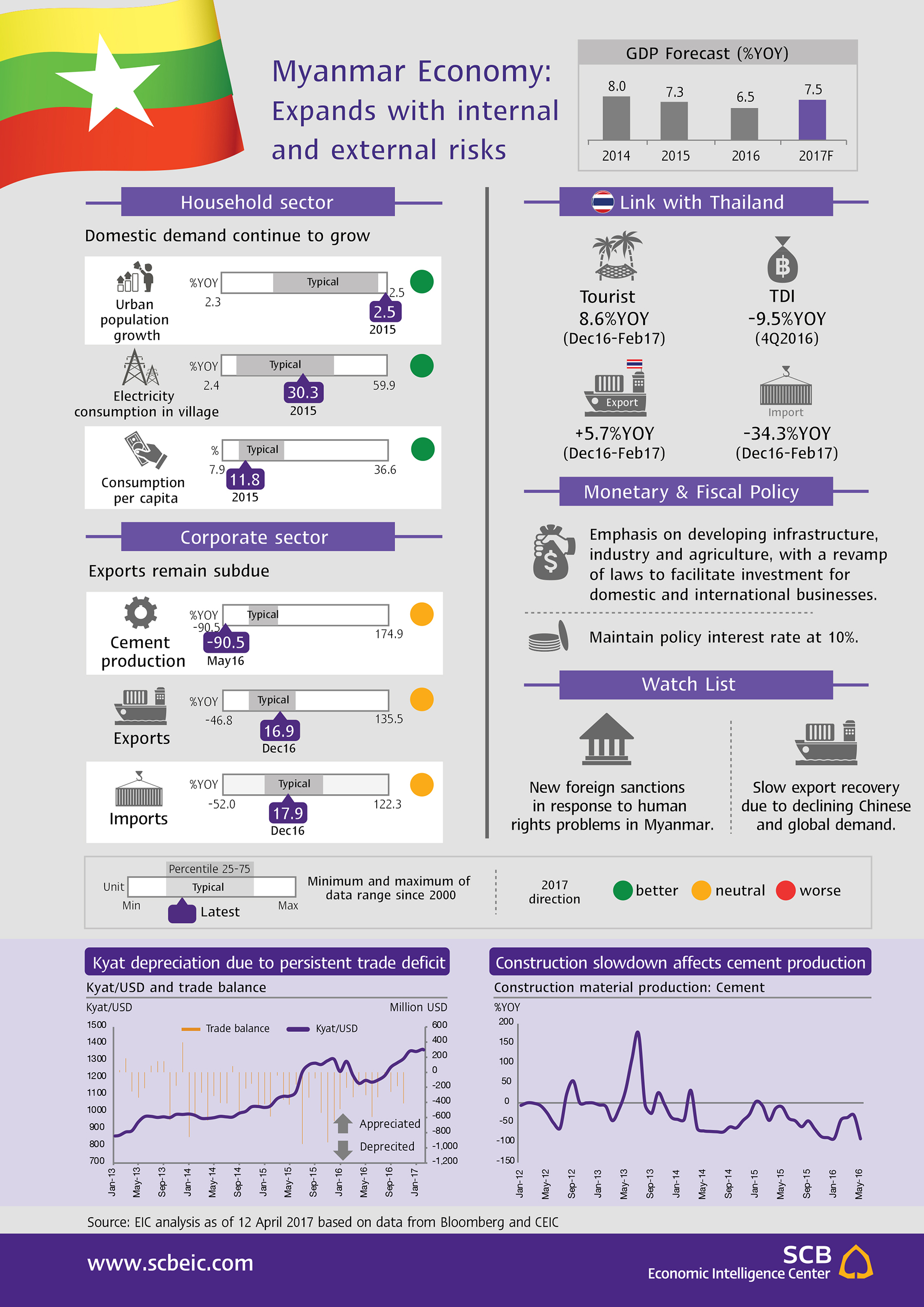

Myanmar’s GDP growth slowed to 6.5% in 2016 amid internal and external risks, but will edge up toward 7.5% in 2017. Last year, the agricultural and industrial sectors faced with a slow recovery from floods and landslides that occurred the year before. Domestic consumption was suppressed by a persistently high inflation rate of around 10%. The slow recovery of the global economy, together with the drop in oil and commodity prices, also affected Myanmar, decelerating exports and FDI. The balance of payments posted a deficit of -0.7% of GDP due to trade deficit and shrinking international reserves. As a result, the Kyat kept depreciating. In 2017, however, the main growth engines will include public and private investment in infrastructure, as well as foreign investment in agro-industry, light industry and the service sector. The agricultural sector will expand by more than 4%. Despite the global rise in oil and commodity prices, crude oil exports might not fully recover, due to flat Chinese and global demand. However, the balance of payments deficit will improve as FDI inflows rebound.

Myanmar is working to expedite regulatory reforms and infrastructure development in order to support investment and business. The new Myanmar Companies Act, Competition Law and Investment Law will be enacted in 2017 to simplify and facilitate business operations in Myanmar. In particular, the new Myanmar Investment Law (MIL) will appliy the same practices for both foreign and local investors in their business operations. Furthermore, the government has expedited the approval of infrastructure projects and development of special economic zones (SEZs) to support future investments.

Another issue to keep an eye on is the international stance on Myanmar’s internal conflicts and human rights problems involving the Rohingya minority group. The U.S. further relaxed its sanctions against Myanmar in 2016 to encourage bilateral trade and investment between the two countries. However, Myanmar’s domestic conflicts intensified at the end of 2016, when The Myanmar Arm Forces (Tatmadaw) undertook a violent crackdown on the Rohingya people in Rakhine State. The U.N. and the U.S. censured Myanmar and pressured the government to rectify the issue. Even though the clearance operation has ended, human rights issues surrounding the Rohingya have not been addressed. Myanmar therefore still risks a new round of sanctions from other countries.

Implications for Thai Economy

-

Thai exports to Myanmar increased only slightly in 2016 due to Myanmar’s economic slowdown. But economic recovery will lift these shipments in 2017. Major Thai exports to Myanmar include beverages, sugar, machinery, oil and chemicals.

-

Thailand was the biggest investor in Myanmar’s energy sector in 2015. In 2016, however, investment from Thailand declined in the second and third quarters by 44% YOY and 14.2% YOY, respectively. Yet, in 2017 the growing number of development projects in Myanmar may crowd in more investment from Thai investors.

-

The Kyat weakened due to persistent trade deficits and slowdown in FDI. In December 2016, the Myanmar currency stood at 1,357.5 MyanmarKyat per U.S. dollar, a record low since the removal of Kyat’s peg in April 2012. Since the beginning of 2017, Kyat slightly depreciated further in contrast with the strengthening of regional currencies.