China's economy: Government cuts bloated industries, but demand stays strong.

Published in EIC Outlook Q2/2017 Click here for more detail

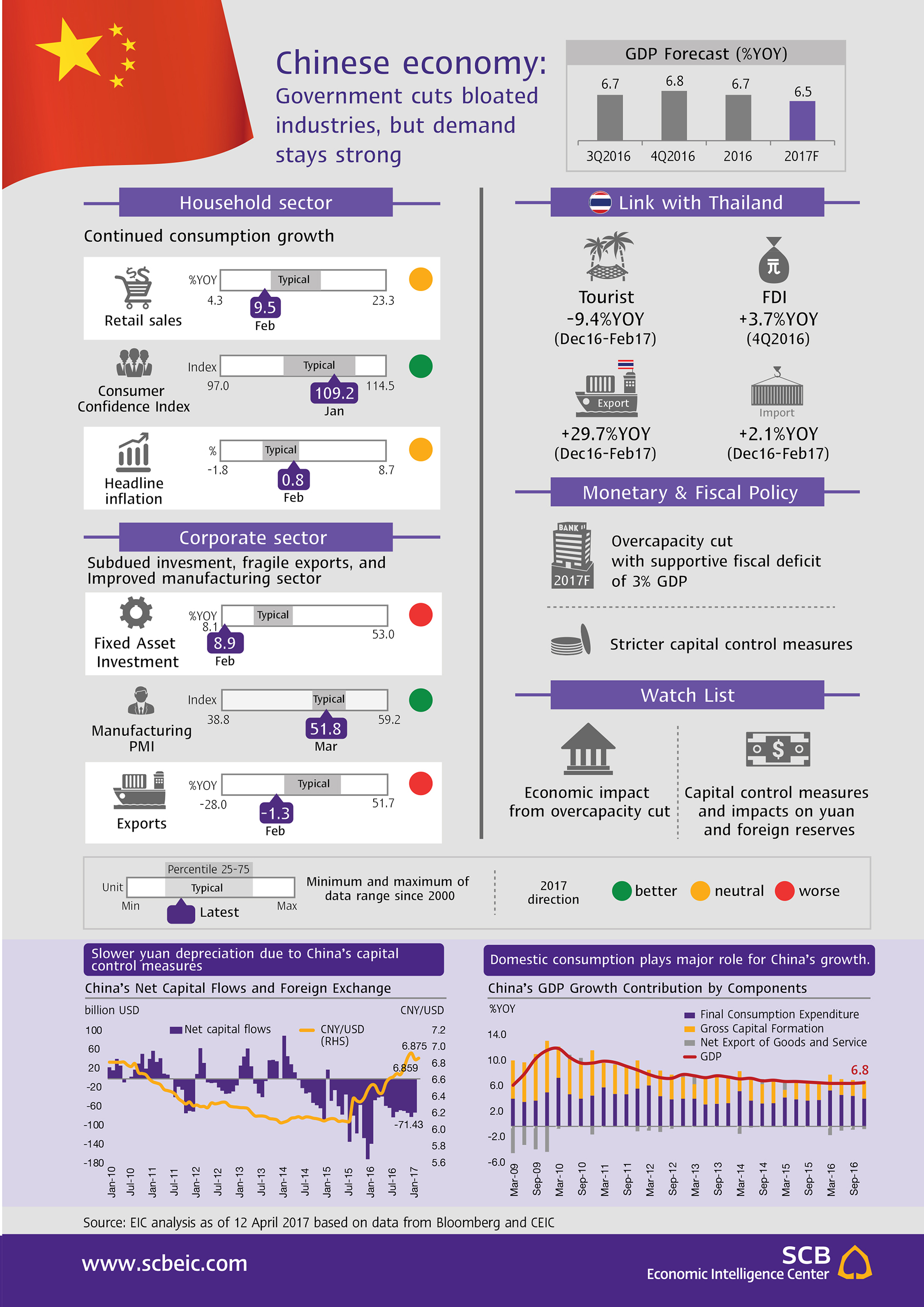

China’s GDP grew 6.7% in 2016, well within the government’s target range of 6.5-7.0%, as Beijing continued its efforts to reform the economy by cutting excess capacity. Growth was strong throughout the year, particularly in the fourth quarter, when it reached 6.8% YOY, the highest rate of any quarter in 2017. Sectors posting solid growth included wholesale and retail trade, transport, and real estate, reflecting strong domestic demand. The construction sector slowed, however, due to the government’s reduction of excess production capacity in the coal and steel industries.

Acceleration in domestic demand is likely to help China’s economy maintain moderate growth of 6.5% in 2017. The consumer confidence index has been rising steadily, reaching a 20-month high in January this year. This indicates higher purchasing power, which will help drive growth in the wholesale and retail sector and support domestic-oriented manufacturing sector. Rising world prices for oil and related commodities coupled with the reduction of domestic production capacity augur well for export prices, which should boost profits for manufacturers. In the latest annual National People’s Congress, held in March, the government announced plans to continue trim excess capacity in coal and steel from last year and extend capacity reduction to cement, glass, aluminum, electronic, and shipping. The government should be able to reach its targets, as it did last year when production capacity for coal fell by 1.2 times the target and for steel by 1.77 times. These reforms will contribute to a decline in overall investment, which makes up 44% of GDP. As a cushion against a major slowdown, however, the government has set its fiscal deficit target at 3% of GDP, the same as in 2016. Its target growth rate for 2017 is 6.5%, a small drop from last year. This figure is in line with EIC’s forecast.

China’s recent capital control measures will likely succeed by slowing down speculative outflows. The government has many policy measures at its disposal, covering both individuals and corporates. As a result, it has become harder for Chinese investors to move money abroad. Moreover, higher domestic interest rates, along with the relaxation of regulations in the Chinese stock market, have also helped keep investment within the country. Capital outflows are likely to decelerate, preventing any large yuan depreciation and ensuring greater financial stability overall. EIC expects the yuan to weaken by 4.5% compared to the previous year, falling to 7.25 Chinese yuan per U.S. dollar by the end of 2017. (Read more in Box: China tightens capital controls to slow outflows)

Implications for Thai Economy

-

The only moderate slowing of the Chinese economy, alongside rising consumption, bodes well for Thai exports to China, particularly consumer goods. Tourism will also benefit, since Chinese tourists now make up 27% of all foreign tourists in Thailand.

-

China’s stricter control of capital outflows will reduce Chinese investments in Thailand, particularly in the real estate sector.

-

Thai businesses should prepare for a rise in costs, particularly from commodities prices, owing to the reduction in China’s production capacity.