Outlook Quarter 2/2017

The global economy improves but with high risks. Global economic fundamentals continue to improve in 2017, led by a steady expansion in the U.S. and recovering commodity prices. These factors contribute to a recovery in international trade since the end of last year. However, the global recovery could stumble given risks in major advanced economies. In particular, the EU is facing the strongest economic threat this year from political uncertainty and weak banking stability. Similarly, the U.S. still grabbles with uncertainty from Trump’s economic policies especially on trade protectionism. Such risks will add volatility to the global financial markets during the time that central banks in major advanced economies are normalizing their easy monetary measures, led by the Fed’s earlier-than-expected rate hikes.

- Economic outlook in 2017

- Trump’s first 100 days

- Eyes on Europe’s elections in 2017 and the survival of the euro

- Premium Friday The Japanese leave work early campaign

- China tightens capital controls to slow outflows

- Bull - Bear: Oil Prices

- In focus: Eye on Vietnam: Opportunities and Pressures as Economic Partner Outpaces Thailand

- Summary of main forecasts

Thai economic outlook in 2017

The global economy improves but with high risks. Global economic fundamentals continue to improve in 2017, led by a steady expansion in the U.S. and recovering commodity prices. These factors contribute to a recovery in international trade since the end of last year. However, the global recovery could stumble given risks in major advanced economies. In particular, the EU is facing the strongest economic threat this year from political uncertainty and weak banking stability. Similarly, the U.S. still grabbles with uncertainty from Trump’s economic policies especially on trade protectionism. Such risks will add volatility to the global financial markets during the time that central banks in major advanced economies are normalizing their easy monetary measures, led by the Fed’s earlier-than-expected rate hikes.

EIC maintains Thailand’s 2017 growth forecast at 3.3%YOY, expecting a more broad-based recovery. Improving global economy and rising price levels will help support Thai producers who struggled through 2016. In particular, for farmers, crop prices are on the rise and severe droughts continue to abate this year. Industrial manufacturers who faced shrinking exports in the past several years will benefit from higher oil prices and returning export orders given recovery in global trade. At the same time, the Thai service sector maintains its strong growth momentum. More specifically, construction will gain from expansion in public investments in infrastructure projects. Tourism also rebounds from short-term pressure at the end of last year. As for private investment, EIC sees Thai businesses continue to invest abroad especially in neighboring countries with rapid economic growth.

Bull - Bear: Oil Prices

EIC’s view: BEAR

Crude oil prices will stay flat during the second quarter of 2017. While both OPEC and non-OPEC producers managed to cut production to a level close to their agreed target, the oil market still faces an excess supply of around 0.4 million barrels per day. Plus, U.S. oil producers are expected to pump more, as indicated in the recent surge in rig counts. Together, these factors will continue to suppress oil prices. However, we will closely monitor the OPEC meeting in May. If OPEC can prolong the agreement to cut production until the second half of 2017, oil prices might edge up.

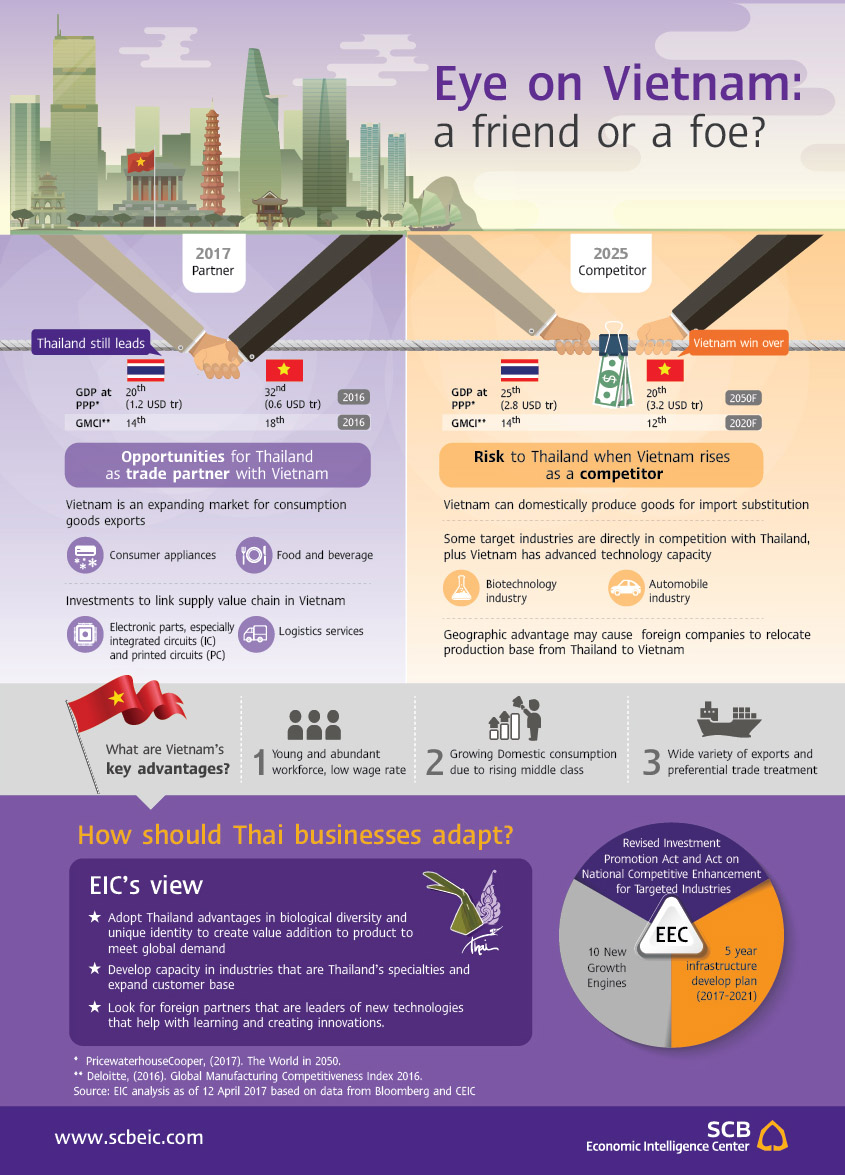

In focus: Eye on Vietnam: Opportunities and Pressures as Economic Partner Outpaces Thailand

Vietnam has emerged as a rising star among emerging markets, both in terms of foreign direct investment and exports. Its rapid development and continued economic growth at 6% on average per year have helped Vietnam become a new major export market for Thailand. Looking ahead, however, as Vietnam’s potential improves and new waves of industry arrive, it might displace Thailand as a more attractive destination for FDI. The two countries will not only compete to attract foreign investment but also increase their direct rivalry in certain industries. With this in mind, how should Thai businesses cope when Vietnam becomes a full competitor?