Fiber cement exports: how to crack the market?

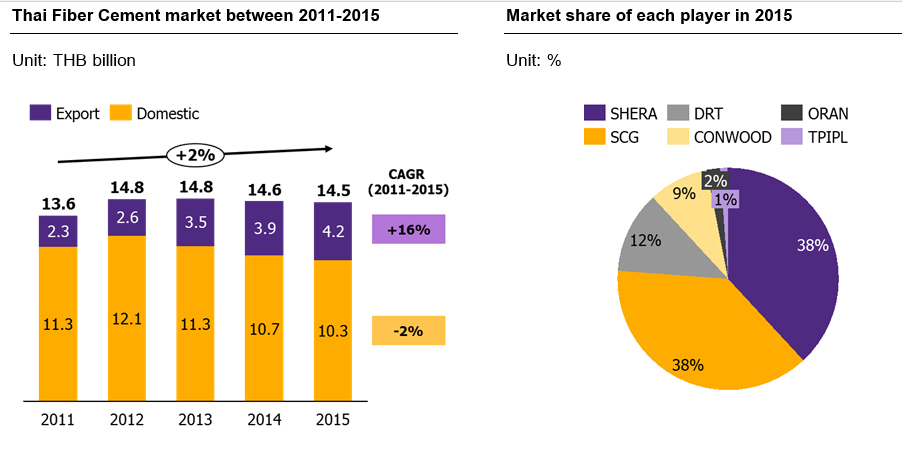

The growth of the Thai fiber cement market is currently driven by exports, which rose at the rate of 16% CAGR between 2011-2015. The expansion can be attributed to rising demand thanks to recovering economic conditions in major export markets, such as the Philippines and CLMV countries.

Author: Kanit Umsakul

|

Highlight

|

Fiber cement is a new type of building material whose popularity has been growing over the past five years. Fiber cement is wood substitute made from portland cement mixed with natural fibers and other ingredients. It is light, durable, non-flammable, resistant to water and insects, and costs roughly the same as actual wood. Because of its superior properties it has become the replacement product of choice in many different contexts, including flooring, siding, roofing and as ceiling boards.

Currently there are six major players in Thailand, with a combined manufacturing capacity of 2.2 million cubic meters and a market value totaling THB 14.5 billion, or 20% of the cement market's total value. Between 2011-2015 the fiber cement market grew 2% CAGR. SHERA and SCG are the two market leaders, each sharing 38% of the market, followed by DRT, CONWOOD, ORAN, and TPIPL, respectively (Figure 1)

While domestic sales have shrunk, growth has been driven by exports to the Philippines and CLMV markets. Domestic consumption makes up 25% of the fiber cement market, with the rest supported by exports. In Thailand, the market for fiber cement, especially roof tiles, has been affected by the relatively low price of metal roofing sheets in the past 5 years. Coupled with more intense price competition after TPIPL's entrance into the market, the domestic market value has shrunk from THB 11.3 billion in 2011 to 10.3 billion in 2015, or 2% CAGR (Figure 1).

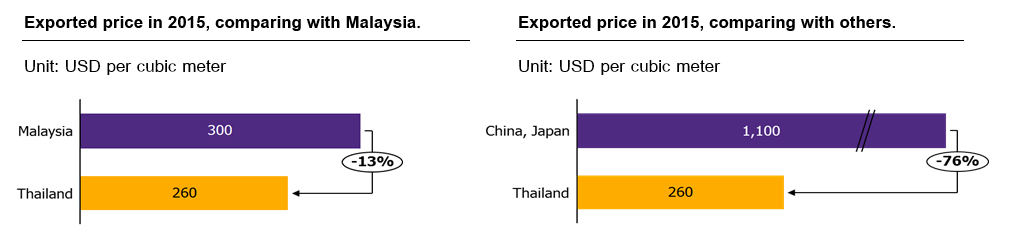

On the other hand, fiber cement exports have been growing steadily, buoyed by 1) better economic conditions in importing countries 2) recognition of Thai fiber cement's quality, resulting in demand and 3) the relatively low price of Thai fiber cement (13% lower than fiber cement from major competitor Malaysia). These supporting factors helped raise the export value from THB 2.3 billion in 2011 to THB 4.2 billion in 2015, or 16% CAGR (Figure 1). The figures demonstrate the potential for more export growth, which can also help compensate for the loss of domestic sales.

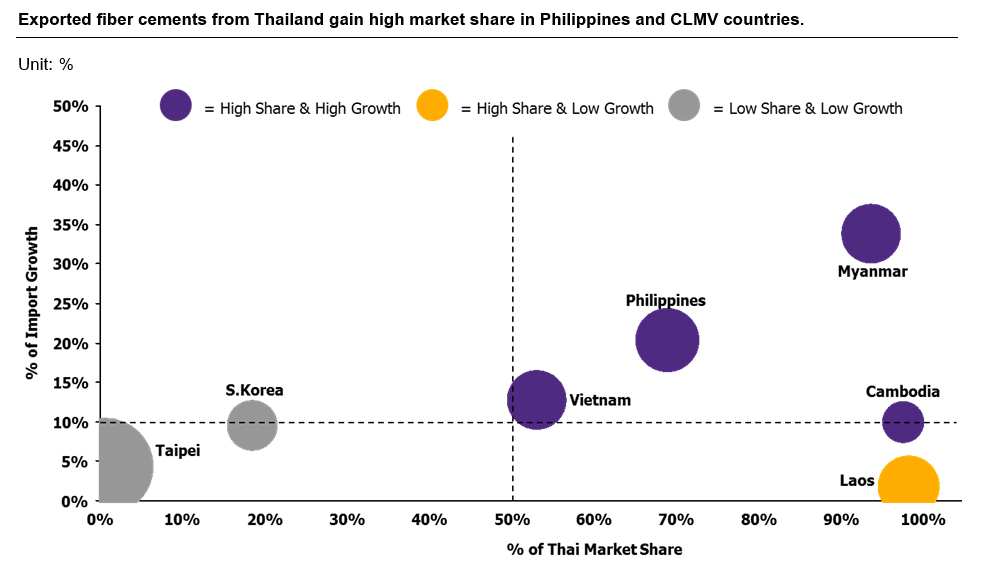

The fiber cement export market can be divided into three segments. Each requires a different marketing strategy. EIC divides the export market based on market share and the rate of import growth. The three groups are 1) “High Share & High Growth”: the Philippines, Myanmar, Vietnam, and Cambodia 2) “High Share & Low Growth”: Lao PDR and 3) “Low Share & Low Growth”: Taiwan and South Korea.

In the High Share & High Growth category, businesses should prioritize the management of distribution channels, including the expansion of branches and management of product stock in order to meet the growing demand in countries such as the Philippines, Myanmar, Vietnam, and Cambodia. Partnerships with distributors with access to a large number of buyers would seem to be the best option, as proven by the success of SHERA in penetrating the Philippine market in 2013 through its partnership with a major local building material modern trade retailer (CW Home Depot), resulting in Thai fiber cement's impressive growth rate of 30% CAGR from 2013 to 2015 in that country.

In the High Share & Low Growth group, businesses should try to keep their current market shares, while looking for growth opportunities. Due to the rather saturated market, businesses don't need to expand their distribution channels further. Rather, they should focus on keeping their market shares for as long as possible through quality control and strict adherence to the latest trade regulations in order to support continuity in marketing. Businesses may also stimulate the market through the development of new products allowing more diverse uses, as well as complementary products such as wood coatings for fiber cement, all of which will bring in more revenue even in a saturated market.

Lastly, in the Low Share & Low Growth group, businesses can compete on price in order to increase their market shares. Currently Thailand's export value in this market is only THB 150 million, or 6% of the total import value (THB 2.6 billion). Thailand's market share is behind major exporters such as Malaysia (40%), Japan (30%), and China (20%). This means more opportunity for Thai fiber cement manufacturers to penetrate the market in the future. Thanks to the ready availability of raw materials, Thai fiber cement costs less. To increase their market shares, businesses should draw on their strength in export prices (average USD 260/cubic meter), which is lower than that of major competitors such as Malaysia (average USD 300/cubic meter), China and Japan (similar at roughly USD 1,100/cubic meter) (Figure 2).

|

|

|

|

|

Figure 1: Continuous expansion of the fiber cement market between 2011-2015, led by SCG and SHERA.

Source: EIC analysis based on data from SCG, SCCC, TPIPL, DRT, ORAN, Trade Map, and Press Search

Figure 2: Thai fiber cement export prices are lower than that of major competitors such as Malaysia, China, and Japan.

Source: EIC analysis based on data from Trade Map and Press Search.

Figure 3: The fiber cement export market can be divided into three groups.

Source: EIC analysis based on data from Trade Map