Author: Yuwanee Ouinong and Pimnipa Booasang

![94487905.jpg]()

![Event.png]() |

![Event.gif]()

|

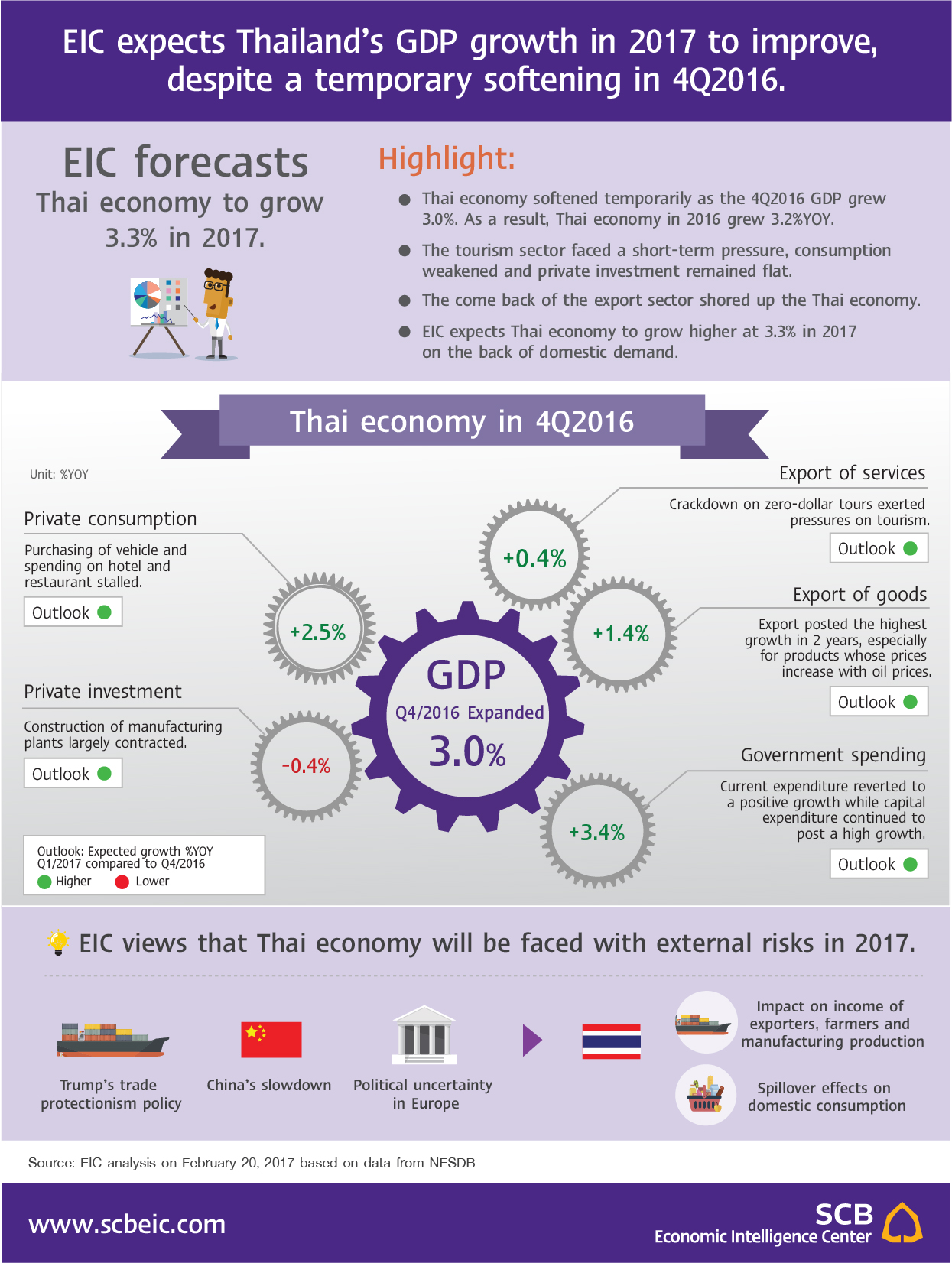

- The National Economic and Social Development Board (NESDB) announced Thailand’s 4Q2016 GDP growth figure to be 3.0%YOY (as compared to the same quarter last year) or a 0.4%QOQ increase from last quarter after seasonal adjustment. As a result, Thai economy in 2016 grew 3.2%YOY.

|

![Analysis.png]() |

![Analysis.gif]() |

- A short-term setback in the tourism sector held back growth. Export of services grew 0.4%YOY, down from a high 7.7%YOY growth in the previous quarter. This was in line with the slowdown in hotels and restaurants on the production which only grew 4.8%YOY. The impact of government’s crackdown on illegal tours undermined overall tourism during 4Q2016 in addition to the low-spirited consumption atmosphere in the same period.

- Consumption weakened and private investment remained flat. Private consumption in 4Q2016 expanded 2.5%YOY, down from 3.0%YOY in the previous quarter. Spending on durables reverted to a negative growth territory after an acceleration in earlier periods. In particular, spending on vehicle contracted 9.8%YOY. Meanwhile, private investment has not recovered, falling 0.4%YOY. Investment in manufacturing sector remained weak. Construction of industrial factories largely shrank by 11.2%YOY while investment in machinery and equipment fell by 0.4%YOY. Nonetheless, investment in residential construction slightly expanded by 1.9%YOY. This reflected the private sector’s low confidence on the economy overall.

- The come back of the export sector shored up the Thai economy. Thai exports in 4Q2016 steadily recovered with 1.4%YOY growth, the highest growth over the past 2 years. The export outlook looks promising especially for products whose prices are trending up along with oil prices.

|

![Implication.png]() |

![Implication.gif]()

|

- EIC keeps the forecast of Thai GDP growth unchanged at 3.3% in 2017. Despite 4Q2016’s lowest growth rate in a year, EIC maintains its views on Thailand’s GDP growth at 3.3%YOY in 2017. The economy should recover as temporary factors wane off. Higher growth will gradually resume after the tourism sector improves coupled with support from domestic spending. In fact, the number of foreign tourist arrivals in January, 2017 bounced back to grow 6.5%YOY, after a 0.9%YOY contraction in 4Q2016. As for private consumption, growth should continue thanks to higher income of exporters and farm households. Their income prospect is improving as commodity prices have been recovering since November, 2016.

- Growth in the second half will be higher than the first half. Greater household purchasing power is expected to rise after some households lift off debt burden from the first car scheme. Its effect should be more evident in the second half of the year. Also, the government is likely to inject more stimulus into the economy. A new upside includes a mid-year budget in 2017 of 190 billion baht that was approved on January 27. The actual amount expected to reach the economy is around 140 billion baht, or around 1.3% of GDP at current price. The budget will be spent on investment on small projects in various provinces across the country. EIC expects this additional budget to be disbursed in the second half of the year. This can pose an upside risk to the current forecast.

- The year 2017 is still full of external risks that can pressure exports to underperform. Trump’s trade protectionism policy, if implemented on China, can stall Thailand’s export recovery. Thailand is part of China’s supply chain for exported products to the US as Thailand’s export of intermediate goods to China accounts for 43% of its total export to China. At the same time, China is faced with a slower economic growth and stability issues in the banking sector. While many believe the Chinese government can manage the situation but the worst case scenario is not entirely impossible. Moreover, political uncertainties in Europe can heighten as Brexit negotiations and the upcoming elections in France, Germany and Italy take place. While Brexit has not directly impacted Thailand, the fragile unity of the European Union following such elections can lead to a significant drop in sentiment. Global financial markets can suddenly turn volatile and Thailand’s 3 major trading partners may face a lower growth. In such scenarios, commodity prices and global trade volume will stall and eventually hit Thailand’s export sector. This can impact income of exporters, farm households and manufacturing production. Private consumption may slow down more than expected.

|

![EIC_Infographic_EN_GDP4q2016.jpg]()