Outlook Quarter 1/2017

EIC assesses that the Thai economy in 2017 is facing key external risks that have been ongoing since last year and will therefore rely on domestic spending. Protracted economic issues from 2016 will continue to affect the economy in this year. Such include issues in the Chinese and European financial sectors, changes in geopolitics and economic policies in Europe and the U.S., and a slowdown in tourism from the declining number of Chinese tourists.

- Economic outlook in 2017

- Bull - Bear: Oil Prices

- In focus: Trump’s Presidency: What to Expect for Thailand?

- Summary of main forecasts

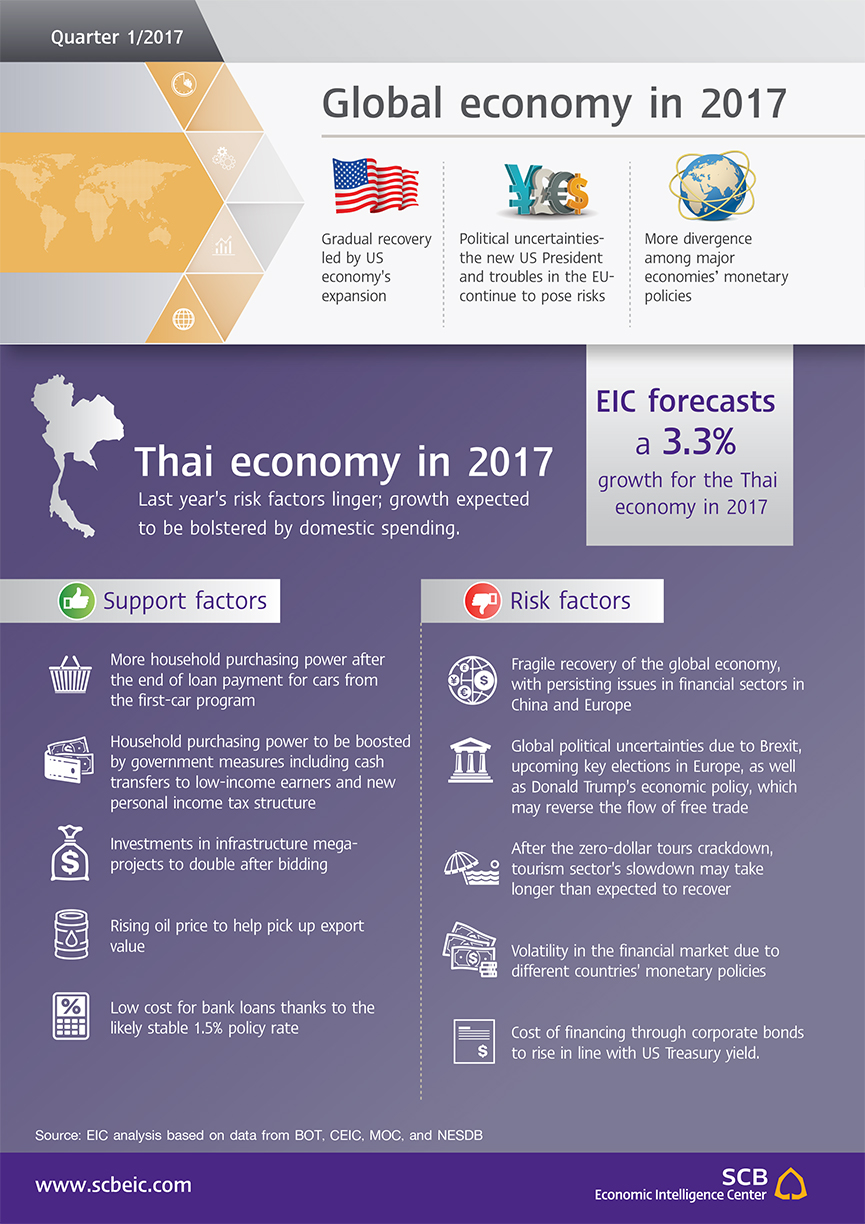

Thai economic outlook in 2017

EIC assesses that the Thai economy in 2017 is facing key external risks that have been ongoing since last year and will therefore rely on domestic spending. Protracted economic issues from 2016 will continue to affect the economy in this year. Such include issues in the Chinese and European financial sectors, changes in geopolitics and economic policies in Europe and the U.S., and a slowdown in tourism from the declining number of Chinese tourists. Nonetheless, the Thai economy will receive a boost from the recovery of domestic household spending. Rising commodity prices help support income of exporters and households in some agricultural sectors. Some Thai households also benefit from an increase in income tax deductions and the end of payment for car-loans initiated during the first-car tax rebate program. Similarly, government spending will also increase on the back of infrastructure mega-project expansion. The budget for public investment projects in 2017 is expected to double in size compared to the prior year. Furthermore, the Thai economy will also benefit from the continued government’s efforts to use stimulus measures. EIC expects household domestic spending and public investment expansion to be key growth engines for the Thai economy to expand at 3.3%YOY in 2017.

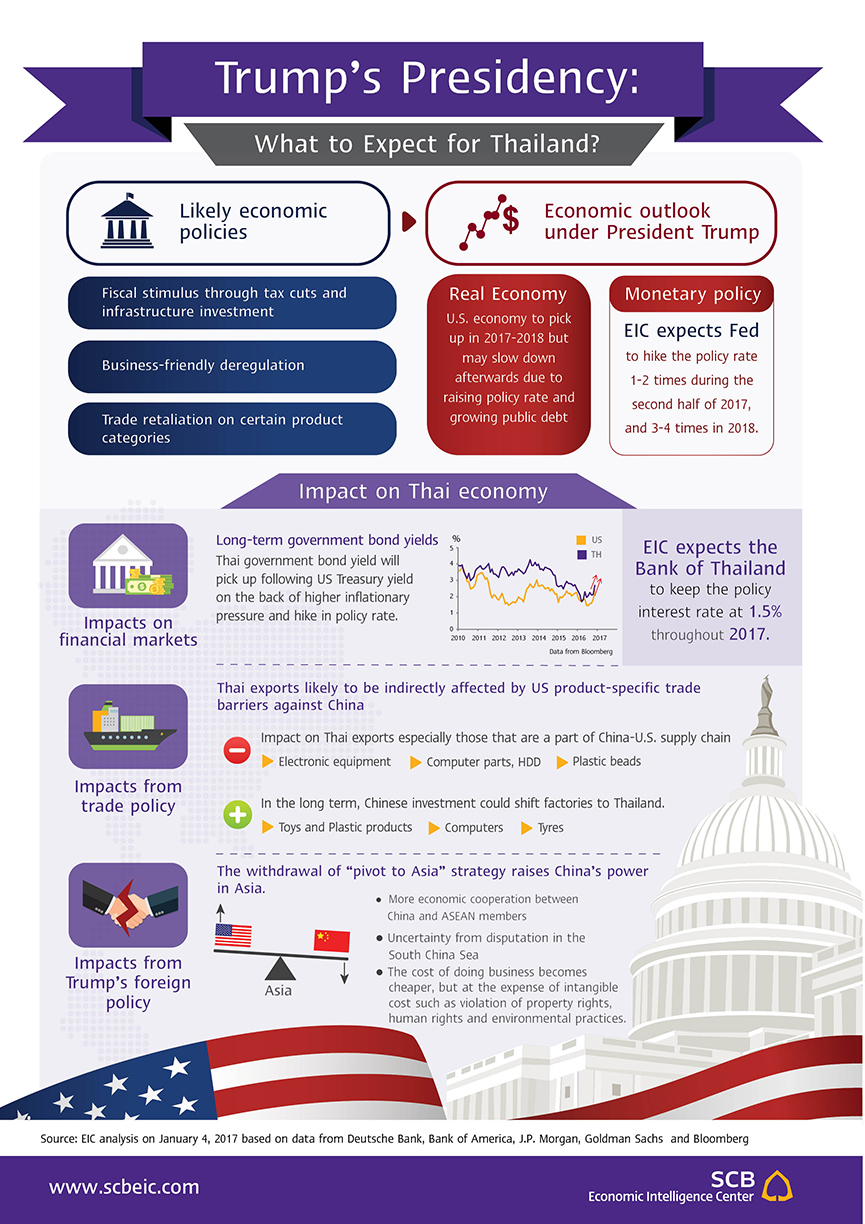

Global financial markets in 2017 remain volatile from monetary policy shifts in major economies. Monetary policy divergence will become more apparent with the Fed continuing to normalize its policy interest rate in line with the U.S. economic and inflation outlook. EIC forecasts that the Fed will raise its policy interest rate 1-2 times this year. On the contrary, other major economies including Europe, Japan and China will still face with domestic economic issues and cannot tighten their monetary policies in the same direction as the Fed. The divergence will lead to an uneven recovery in the global economy with sporadic volatility in the financial markets. In this environment, emerging economies including Thailand may experience additional capital outflows that lead to higher long-term bond yields. However, Thailand’s economic stability remains sound. EIC expects the Bank of Thailand to hold its policy rate at 1.5% throughout 2017 and the baht to depreciate to 37 THB/USD at the end of the year.

Bull - Bear: Oil Prices

EIC’s view: BEAR

In the first quarter of 2017, crude prices are expected to edge up but remain at a low level due to excess supply in the market. Despite OPEC’s decision to cut its production quota, EIC does not expect that it will significantly slow global oil supply. Past experience suggests that both OPEC and Russia have exceeded their quotas, ignoring production agreements. However, if OPEC can actually lower production and push prices up, shale producers in the U.S., which have a break-even cost of USD55 per barrel, will reactivate and expand production and increase oil supply. All in all, the rebound in oil prices will thus be limited.

In focus: Trump’s Presidency: What to Expect for Thailand?

Epitomizing the feisty, anti-establishment sentiment that has taken hold around the world during the past year, Donald Trump’s stunning presidential election victory has upended the U.S. economic outlook. It has also introduced a real risk that the government of the world’s largest economy might adopt extreme policies, such as the launch of a trade war against China or mass deportations of illegal immigrants, based on fiery threats Trump made during his campaign. Even if these proposals were not aimed directly at Thailand, they would have indirect consequences for the Thai economy if enacted as uncertainty regarding policy could lead to instability in financial markets, and decline global trade if the U.S. were to adopt a protectionist stance.