Airbnb's impact on the Thai hospitality sector

Airbnb's exponential growth worldwide is squeezing hospitality sector revenues, particularly among hotels in the middle-to-low price range. Although stricter regulations are slowing down Airbnb growth, it stands to benefit from being able to enter the hotel market in full force.

Author: Lapas Akaraphanth

|

Highlight

|

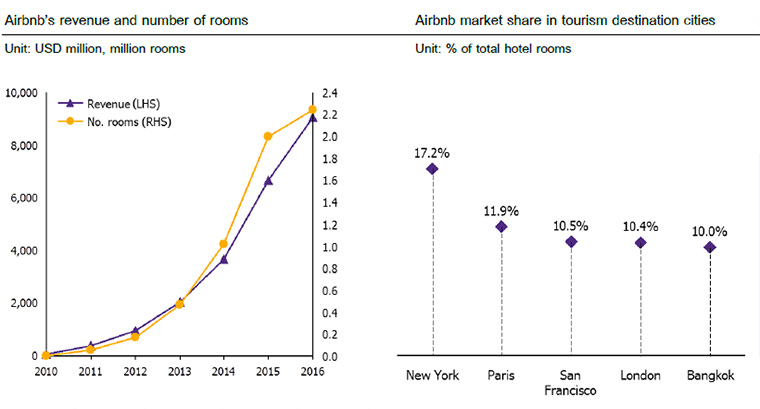

Airbnb's exponential growth worldwide is squeezing hospitality sector revenues, particularly among hotels in the middle-to-low price range. Since its launch in 2010, Airbnb rooms have increased at the rate of 150% per year. It now offers more than 2 million rooms in 190 countries, compared to the Marriott group's 1.5 million (Marriott is the world's largest hotel operator). Still, Airbnb's market share in major cities remains relatively small. For example, around 10% in Paris, San Francisco, and London, but with a more impressive 17% market share in New York. Due to its small market share, Airbnb has strong potential for further growth. In terms of room types, most Airbnb rooms are one bedrooms (50%). Furthermore, average prices tends to be lower than comparable hotel room rates, pitching Airbnb in direct competition with hotels in the middle-to-low range. In London, a room on Airbnb on average costs GBP50-100 per night, compared to an average hotel room rate of around GBP145. In New York the average Airbnb rate is USD173 per night—37% lower than hotels in the same area.

Although stricter regulations are slowing it down, Airbnb stands to benefit from being able to enter the hotel market in full force. Like other disruptive businesses such as Uber or GrabTaxi, their exponential growth has become a cause for concern among regulators in various countries. Airbnb's dramatic expansion may result in 1) disturbance to local residents, 2) safety issues (Airbnb room owners do not have to comply with the same standards as hotels such as fire safety equipment and security staff and an accident involving tourists may damage the host country's reputation), and 3) loss of tax income since the government cannot collect rental income tax from Airbnb room owners. Recently many countries with major tourists hubs have issued new regulations, with stricter room registration monitoring. For example, in Japan the minimum Airbnb stay is now seven nights. In New York and San Francisco each Airbnb room owner may register only one unit. By the same token, however, official public regulations also mean that Airbnb can now compete more openly in the hotel market. Airbnb has also expanded into the business travel sector, cooperating with travel agencies such as American Express Global Business Travel, BCD Travel, and Carlson Wagonlit Travel.

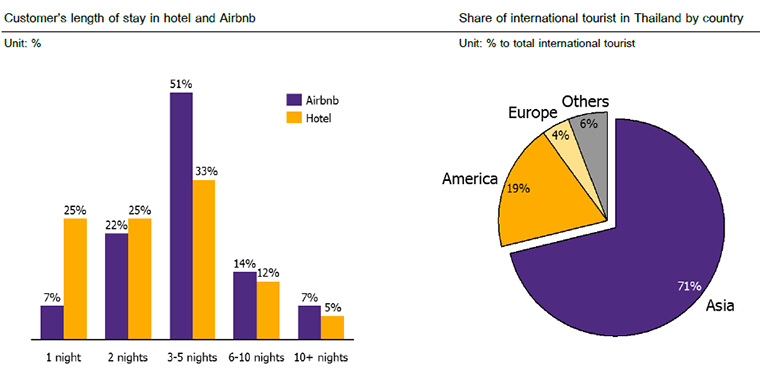

Currently Airbnb's customer base does not overlap with the majority of tourists in Thailand. Thai hotel operators, therefore, have not been much affected by the competition. The majority of Airbnb users are Western tourists, particularly Americans, aged around 35. This group contributes as much as 30% to Airbnb's revenue. The choice of Airbnb may stem from their preference for traveling by themselves and experiencing local lifestyles. As they tend to stay longer, Western tourists also tend to look for accommodation options other than hotels in order to reduce travel costs. As a result, hotels in Thailand are not much affected since 71% of tourists in the country hail from Asia, with an average stay of around 7 nights (compared to European and American travelers' average stay of 14-16 nights). They also prioritized on safety concerns, therefore hotels are preferred.

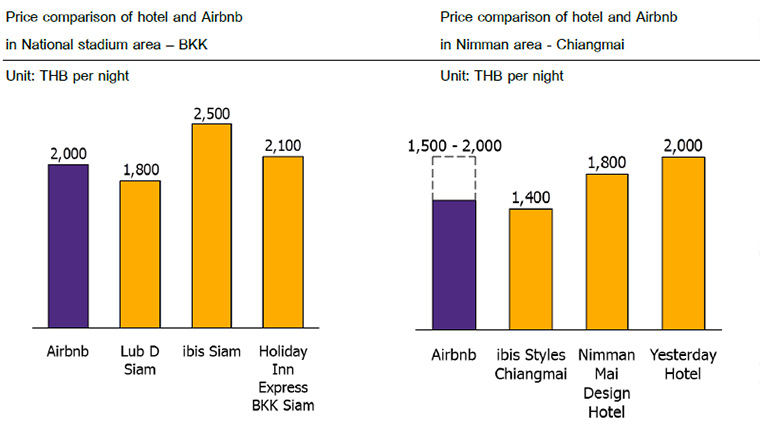

Hotel rooms in Thailand cost about the same as Airbnb rooms. As a result, travelers are likely to choose the former. Hotel rates in Thailand are relatively low compared to other countries. The price difference between hotel rooms and Airbnb rooms in Thailand is not significant. In Bangkok, Thailand's major tourist market, a room in a 3-star hotel near the National Stadium costs on average THB 2,500 per night. A comparable room on Airbnb costs around THB 2,000 per night. In Chiang Mai, the price range for both hotel rooms and Airbnb is THB1,500 - 2,000 per night. Travelers are therefore likely to choose hotels over Airbnb as hotels offer more in terms of amenities, safety, and cleanliness, not to mention the availability of reception staff.

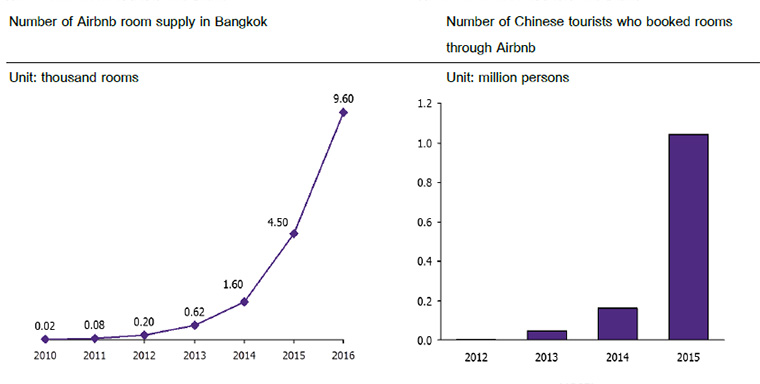

Airbnb is poised to become a major competitor in the hotel market, however. More than one million Chinese tourists are booking rooms through the website. Airbnb room availability in Bangkok is expanding by more than 100%. Chinese consumers are open to innovation, including a sharing economy. Data from China's Information Center indicates that more than 500 million Chinese consumers have used sharing economy services. In 2015 Airbnb teamed up with Union Pay and Alipay as part of its aggressive push into the Chinese market, resulting in a dramatic 500% uptick in users. Since Chinese travelers make up 27% of the Thai tourism market, Airbnb won't have much difficulty increasing its market share in Thailand. Moreover, Airbnb continues to expand in Thailand, they currently have around 9,000 rooms in Bangkok compare to last year of around 4,000 rooms. Airbnb also offers what comparable hotels can't, for example, bigger rooms at similar prices and kitchens.

|

|

|

|

|

Figure 1: Airbnb's exponential growth worldwide is squeezing hospitality sector revenues, particularly among hotels in the middle-to-low price range

Source: EIC analysis based on data from Barclay Research and UBS Research

Figure 2: Currently Airbnb's customer base does not overlap with the majority of tourists in Thailand. Thai hotel operators, therefore, have not been much affected by the competition.

Source: EIC analysis based on data from UBS Research and the Department of Tourism

Figure 3: Thai hotel room rates are comparable to Airbnb. Travelers are therefore likely to stay in hotels.

Note: Based on comparison of hotel and Airbnb one bedrooms on 24 November 2016

Source: EIC analysis based on data from company websites, Airbnb, and Agoda.

Figure 4: Airbnb is poised to become a major competitor in the hotel market in Thailand, with more than one million Chinese tourists are booking rooms through the website and Airbnb room availability in Bangkok is expanding.

Source: EIC analysis based on data from Airdna and Airbnb