Advancing Thailand's green material Industry, backing the green building trend

Although the costs of green buildings are higher than conventional buildings, the benefits from energy-related cost reduction and higher rents have seen both the number of green structures and green construction areas grow significantly over the past several years.

Author: Kanit Umsakul

|

Highlight

|

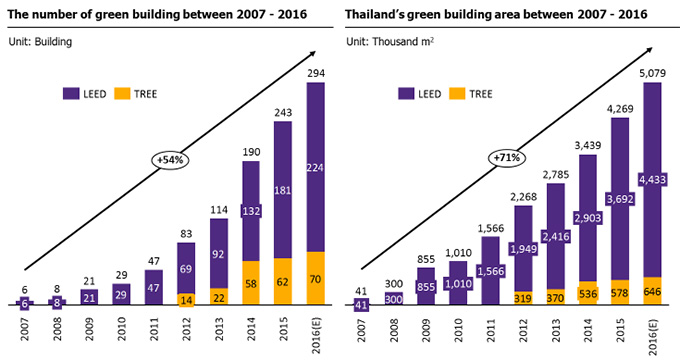

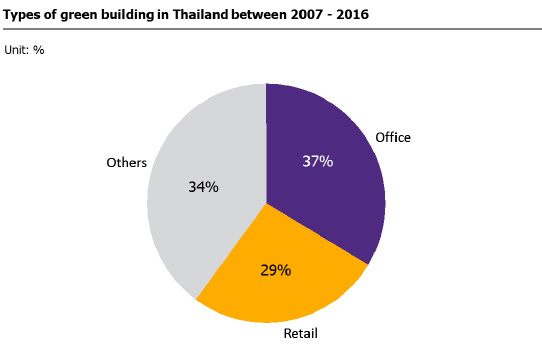

In the midst of today’s environmental movement, green buildings (buildings designed to be environmentally friendly through more efficient use of resources) are popping up more and more in Thailand. Using data from green building credentialing bodies like the U.S. Green Business Council (USGBC), which developed the Leading in Energy & Environment Design (LEED), and the Thai Green Building Institute (TGBI), which developed Thailand’s Rating of Energy and Environment Sustainability (TREES), EIC found that the number of certified green buildings and buildings in the process of accreditation in Thailand has risen substantially, increasing from six buildings in 2007 to 243 buildings in 2015. With EIC’s estimate of 294 green buildings in 2016, the average annual growth rate for green buildings in Thailand is 54%. Thailand’s green building area increased from 40 thousand square meters in 2007 to 4.3 million square meters in 2015, and it is estimated that it will reach 5.0 million square meters by the end of 2016, pushing average growth to 71% per year (Figure 1). Green buildings in Thailand consist of office buildings (around 40%), retail stores and shops (around 30%), and other structures such as factories, residential buildings, hotels, and schools (around 30%) (Figure 2).

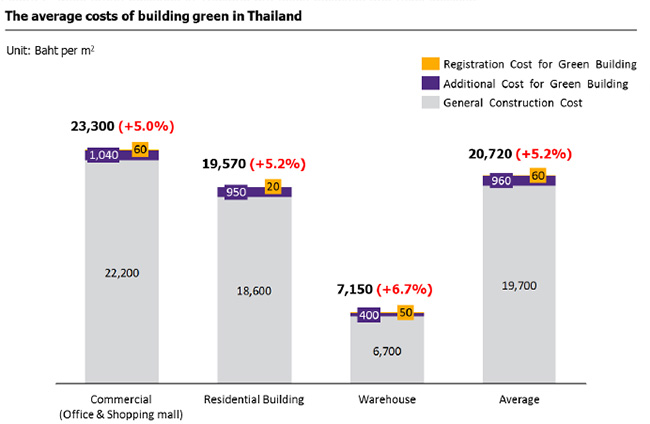

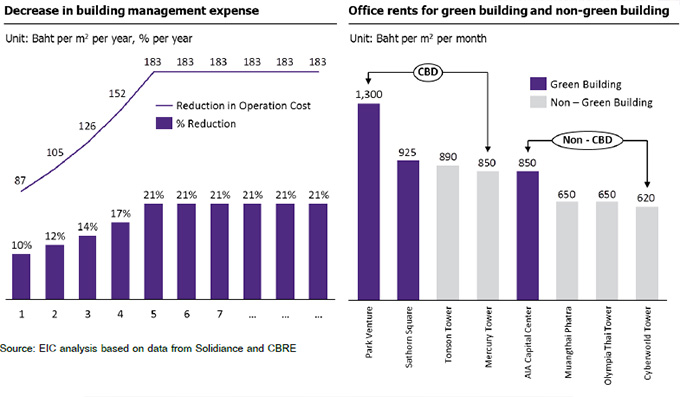

Although the costs of building green are higher than construction costs for conventional buildings, it is the benefits they offer that are responsible for the expansion of green structures today. The average cost of building green in Thailand is 20,700 baht per square meter, which is about 5.2% higher than the average conventional building cost of 19,700 baht per square meter (Figure 3). This is because building green involves more restrictions in choosing materials and in designing building systems, as well as additional fees for obtaining LEED or TREES credentials. However, owners can gain both monetary and non-monetary advantages from green buildings. Monetary benefits include a decrease in building management expenses like electricity and water costs that can be reduced by 10% or around 90 baht per square meter per year, and up to about 21% or 180 baht per square meter per year by the fifth year after the completion of the project (Figure 4). These numbers are comparable to the decrease in energy costs of well-known green building Energy Complex. The Energy Complex building contains 192 thousand square meters of utility space and has reduced building management costs per year by about 28 million baht, or about 146 baht per square meter per year. Another monetary advantage for green building owners is increased rents. Rents for green buildings are around 30% higher than those of conventional buildings in the same area, or about 230 baht per square meter per month (Figure 4). Non-monetary benefits include significantly higher worker productivity in green buildings compared to conventional buildings, deduced from sick day records and illnesses caused by sick building syndrome.

Building material businesses should adjust and develop products that can meet LEED and TREES standards to answer the rising demand for green materials that follows the expansion of green buildings. Related businesses should consider three areas in adjusting and developing new products. The first area involves energy and atmosphere (EA) aspects. For example, they could produce energy efficient glass that can deflect heat from the building but still let light in, helping to reduce energy consumption in both air-conditioning and lighting systems. The second area is material and resources (MR). Producers should look to increase the recycled content of their building materials, or obtain Forest Stewardship Council (FSC) certification to ensure that their timber products come from responsibly managed forests. The third area concerns indoor environmental quality (IEQ). Materials like decorative paints, timber, and insulation should release low levels of volatile organic compounds (VOCs) since VOCs cause respiratory diseases and fatigue. EIC found that some domestic manufacturers already make products that adhere to these standards, and thus can be called green materials. These products include mixed concrete, insulated low-e glass with heat deflecting properties, low-VOC paint, and FSC-certified timber.

Few building material producers in Thailand communicate to consumers that their products are green, while some other green materials still have to be imported. Regarding building materials like cement, concrete, timber, and ceramic tiles, EIC found that only SCG has communicated to customers that their products are green. Among decorative paint businesses, only TOA clearly states that their paints have low VOCs. With regard to glass materials, local manufacturers can produce insulated low-e glass (a popular pick for green projects). However, some green building projects in Thailand prefer to import the material. For example, the AIA Capital Center project chose to import glass from the US, reasoning that the imported material is of higher quality.

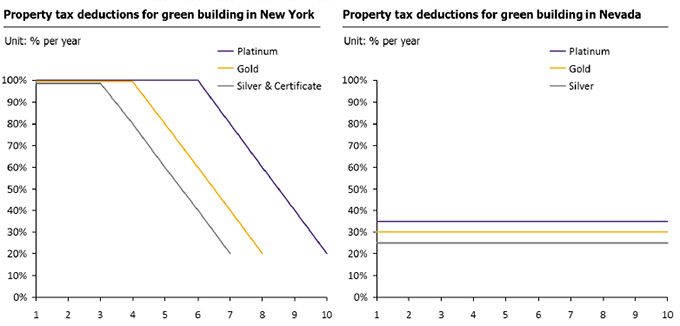

Finally, the lack of clear support from the government can hinder the development of green buildings and green materials in Thailand. The US offers an example of a country with clear policies encouraging more green buildings, where the government employs measures such as income tax and property tax deductions for green building owners, whether in the form of step deductions in the state of New York or in the form of constant deductions in the state of Nevada, depending on the level of LEED certification and the maturity of the building (Figure 5). Non-tax measures include fast track approvals and a floor area ratio (FAR) bonus for green building construction. The City of San Diego has shortened the approval process for constructing green buildings by about 7-10 days. The City of Arlington allows green buildings to have more floor area per site area through an increased floor area ratio (FAR). These incentives have helped boost the demand for green materials in the US from 40 billion US dollars in 2013 to 44 billion US dollars in 2014, with a prospect of 69 billion US dollars by 2019, or annual average growth of 9.5%. Other countries support green materials manufacturers through tax benefits. For example, China offers VAT exemption and income tax deductions to manufacturers of recycled concrete. Thailand, however, only gives buildings that adhere to TGBI’s TREES standards a higher Floor Area Ratio without other incentives like tax benefits or fast track approvals.

|

|

|

|

|

Figure 1: The number of certified green buildings and buildings in the process of accreditation in Thailand rose substantially between 2007 and 2016.

Source: EIC analysis based on data from USGBC and TGBI

Figure 2: Most green buildings in Thailand are office buildings and retail facilities.

Source: EIC analysis based on data from USGBC and TGBI

Figure 3: The average cost of green buildings is around 5% higher than conventional buildings.

Source: EIC analysis based on data from the Thai Appraisal Foundation, USGBC, Solidiance

Figure 4: Despite higher costs, green buildings reap many benefits.

Source: EIC analysis based on data from Solidiance and CBRE

Figure 5: Green buildings in the US receive property tax deductions for the first ten years.

Notes: Green buildings in the US can qualify for 4 levels of LEED certification: Platinum (most qualified), Gold, Silver, and Certified. Different levels of certification are eligible for different government incentives.

Source: Data from the United State Department of Energy