Beauty clinics: from crisis to opportunity

The skin care treatment and cosmetic surgery market has seen growth year in and year out. In particular, clinics offering all-in-one services covering skin care treatment and cosmetic surgery are more likely to grow than their counterparts offering only skin care treatment due partly to increased consumer purchasing power and more advanced technology. However, general hospitals are now also entering the market. As a result, beauty clinics are likely to face increased competition, both in terms of pricing and services (for example, through the quality and variety of treatment).

Author: Tanyaporn Laosopapirom

|

Highlight

|

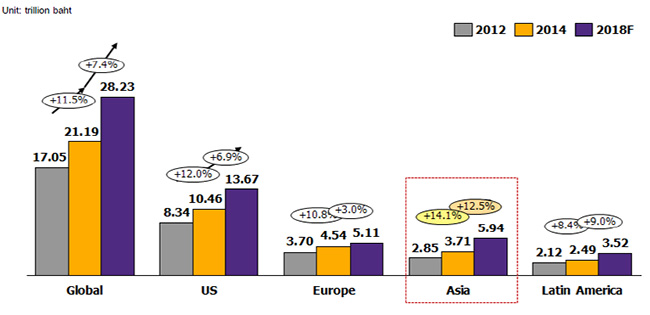

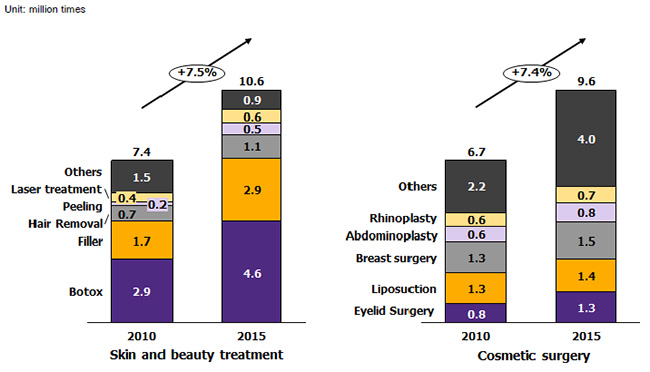

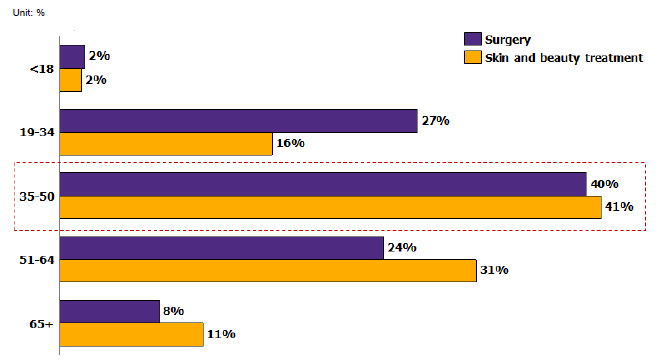

Globally the market for beauty treatment has seen consistent strong growth. In Asia the growth rate was as high as 14% per year from 2012-2014. Supporting factors include health and beauty trends, as well as the advent of an aging society. The global beauty treatment market is valued at 21 trillion baht, posting a growth rate of 7% per year. Asia takes one-fifth of the global market value (Figure 1). The most popular products are found in the anti-aging group, especially Botox and fillers, with the number of customers increasing by 7.5% per year. In the cosmetic surgery group growth is projected at 7.4% per year for services such as eye, nose, and breast surgery (Figure 2). Growth in this sector overall is not limited to one particular age group, but can be seen in all age groups with different types of demand. Working-age professionals constitute the largest group of customers, with the highest level of demand for both skin care treatment and cosmetic surgery at 40%.

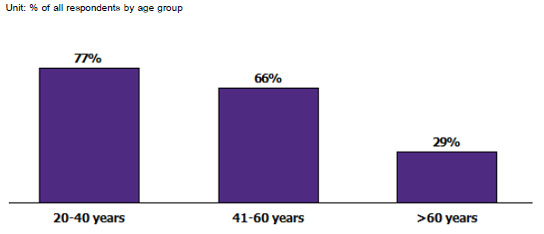

The beauty treatment market in Thailand is likely to continue expanding. Clinics offering all-in-one services covering both skin care and cosmetic surgery are likely to see better growth than those offering skin care treatment alone. The Thai beauty treatment market is likely to see continuing strong growth driven especially by working-age customers, who are increasingly paying attention to health and beauty issues. An EIC survey has found that up to 60-80% of the working-age group are interested in beauty-related products and services. Moreover, customers are paying attention to health and beauty issues at a younger age than before. At 77%, the 20-40 year old group shows the highest level of demand for beauty products. Higher income also correlates with demand for more advanced service than skin care alone, corresponding with the spike in demand for anti-aging treatment and cosmetic surgery. Social mores regarding beauty have also shifted, resulting in a growing acceptance of cosmetic surgery. In addition, thanks to more advanced technology and the wider availability of trained cosmetic surgeons, getting cosmetic surgery is nowadays relatively hassle-free.

The market for cosmetic surgery and anti-aging treatment in Thailand stands to benefit from medical tourism and therefore has great potential for even better growth. Thailand is well-known for quality cosmetic surgery service. The International Society of Aesthetic Plastic Surgery (ISAPS) ranks Thailand eighth in the world in terms of reputation. Thailand also ranks 25th globally in terms of the surgeons-to-population ratio. Thailand offers efficient, good service at a lower price than competitors. For example, an upper blepharoplasty (eyelid) procedure costs 3-4 times less in Thailand than in South Korea. Domestic and international customers thus find Thailand an attractive option. Medical tourism data from Phuket, which has a high potential for specialist medical service, shows that cosmetic surgery-related services are the most popular, at 48%, followed by anti-aging treatment at 34%.

However, the beauty treatment market's strong growth has resulted in excess supply and therefore fierce competition. The market's good growth has been a major draw to new investors. Many new clinic branches have popped up, along with new operators in the market, including beauty clinics, hospitals specializing in beauty treatment and cosmetic surgery, and regular hospitals opening centers for skincare, cosmetic surgery, and anti-aging treatment. Most of these offer similar types of service using similar equipment. Pricing competition has become intense, as evidenced in the drop in the average profit rate of this market over the past 3 years, from 11% to 3% 1. Increasingly, operators are turning towards niche markets, trying to differentiate themselves by offering specialist services such as sex-change operations, for which Thailand has in recent years become well-known.

Thai beauty clinics can continue growing through expansion into the international market, particularly in neighboring countries, as well as through new product line designs. The international market is promising, particularly CLMV countries such as Myanmar and Cambodia, due to the locals' increasing interest in and demand for Thai beauty products. A survey of Cambodian consumer behavior in the beauty product and related treatment categories found that 39% of Cambodians use skin care products consistently, 21% use cosmetics daily, and 40% consider consultations with dermatologists important for cultivating a good appearance. All of these augur well for Thai operators, who can penetrate the market by opening branches or selling beauty products. They can also, relatedly, penetrate the beauty products and cosmetics market, which is a large market with consistent growth averaging 4-6% per year. In addition to offering in-house treatment, a highly competitive market, Thai operators can leverage their brand recognition and expertise in developing new product lines responding to a variety of demands, thereby differentiating themselves from competitors.

1Based on the average profit rates of the biggest three beauty clinics as determined by revenues

|

|

|

|

|

Figure 1: Beauty treatment market value by region, 2012-2018

Source: EIC analysis based on data from International Master Courses on Aging Skin.

Figure 2: Frequency of service by type in the global beauty treatment market, 2010-2015

Source: EIC analysis based on data from International Society of Aesthetic Plastic Surgery

Figure 3: Proportion of services by age group

Source: EIC analysis based on data from American Society of Plastic Surgeons

Figure 4: Proportion of beauty product use by age group

Source: EIC analysis based on data from survey results of beauty product use by age group