Food Industry 4.0…A new era of consumer empowerment

Industrial revolution 4.0—using Big Data as a tool for developing business—has generated much interest in Thailand and abroad. EIC sees the downstream food industry as an especially promising candidate for a 4.0 upgrade, more so than their upstream or midstream counterparts. This is due to the fact that downstream businesses have better access to consumer data, enabling them to present products and services in myriad ways and respond efficiently to consumer preferences. This business model is likely to lead to ever more specific yet diverse food consumption behaviors. As such, other players in the food industry supply chain will have to adjust accordingly in order to enhance their capacity and expand beyond their current limits towards sustainable long term growth.

Author: Narithtorn Tulaphol

|

Highlight

|

The food industry cannot afford to overlook the coming of Industry 4.0. Although food manufacturers today are able to produce large quantities of products efficiently, technology is still limited, as seen in defects due to production processes or time-lagged downstream data input resulting in the failure to implement timely production process adjustments. All over the world, the business sector is paying close attention to the next industrial revolution led by what has been termed Industry 4.0: The use of digital technology to enhance communications between all players in the supply chain. This new technology is not only limited to production processes, but also covers everything from raw material sourcing to final delivery. Digital technology can vastly enhance all of these processes. For example, manufacturing equipment will be able to communicate with objects and sort different types of food packaging, which will greatly reduce errors. Consumer preferences for different types of foods can also be incorporated into mass customization processes with speed and efficiency.

In the 4.0 era, Big Data will be a key driver of competitiveness. It can allow businesses to analyze consumer spending based on credit card and retail store membership card data. Businesses will be able to identify consumer behavior patterns by segment and age using the data. It will also help them add value to their products and services, differentiating them from competitors. For example, analysis of consumer credit card usage can let midstream food producers know which of their ready-to-eat meal products are popular. They may then invest in the expansion of automating production processes for those particular products, instead of relying on labor and facing continually increasing labor costs. New technologies like this will not only help to cut costs but can also save time and reduce errors. Automated food production equipment may also be further enhanced through the use of contamination detection technology and specific food demand sorting capability in order to meet future demands (mass customization).

Downstream businesses hold the most advantages due to their direct access to consumer data, which can be further analyzed and used in conjunction with the development of new technology leading to products and services that best respond to market demand. One of these downstream businesses is the modern trade. Key players in the global market, such as Amazon, Tesco, and Wal-Mart, as well as local players such as Big-C, Central Online, and Tops, are allocating many more resources to online stores than in the past, as they require much less investment than opening new branches. Online stores also allow businesses to collect basic consumer data, such as age, education, income, and types of frequently ordered foods, among others parameters. The data can then help stores improve quality or develop new services. For example, Tesco South Korea has started building virtual shops in underground train stations in order to drive up purchases by office workers. The company opened virtual shops because data indicated that office workers tend not to shop at retail stores but also do not shop online, as most of their time is spent working. Data also showed that most office workers use the underground train daily. Tesco thus saw the opportunity to provide a new type of service that would respond to the needs of this customer group. Products ordered at virtual shops can be shipped directly to customer’s house, so they no longer have to go to retail locations. Indeed, in the future EIC expects new technologies to further improve services, such as the use of screen-based Hologram or Augment Reality (AR), be it through smartphones or virtual screens that can display 3-D information to customers from the cultivation process through to material sourcing, production processing, and delivery. These predictions are not pipe dreams, thanks to the rapidly advancing development of new technologies. Better data processing systems will also facilitate online food menu recommendations and targeted nutritional advice by experts.

New consumer behavior, as well as new downstream business models, means upstream and midstream businesses will also have to adjust. Take, for example, Moley's use of artificial intelligence to create a robotic kitchen, which can cook according to the user's wishes, while displaying the food and its nutritional value on its screen. Users can also upload recipes. The kitchen can even learn how to cook a specific dish by imitating the user's cooking. Midstream players, such as producers of food ingredients and seasoning packaging, will have to develop new products that include microchips that will allow communication between their products, the robotic kitchen, and other AI-enhanced cooking utensils. Moreover, consumers today have become fastidious in their food choices and more knowledgeable about food than in the past, and they adjust their eating habits accordingly. There are consumers who are allergic to particular foods, seniors who wish to avoid high-fat foods, or fans of organic produce. Changing consumer behavior means that upstream players will also have to upgrade their manufacturing processes accordingly, such as organic producers having to invest in linking together chemical detection and elimination systems, humidity detection systems, soil quality measuring equipment, various types of seeding machines, as well as automated watering systems, in order to process the data centrally and accurately calculate the yields. Their systems will also have to be able to track stock and predict consumer demand based on downstream data in order to grow and deliver fresh organic produce to retail stores in a timely manner, reduce waste from overstock, and satisfy health-conscious consumers.

Nonetheless, in upgrading to Industry 4.0, businesses will also have to strike the right balance between the use of new technology and the local context of Thai food and identity, including products and services. The food industry is more complex than many other industries due to the myriad types of products, services, and dining experience. Creativity or innovation is not only limited to the development of new products, but also includes new presentation methods leading to new customer experiences. For example, 3-D printing technology may be used instead of skilled labor to carve food in specific shapes, which normally is very time-consuming and requires great care. The use of 3-D printing will shorten preparation times and increase product consistency. Chefs will then prepare final flavoring adjustments before serving to customers. Nanotechnology can also enhance packaging, for example, by displaying different colors reflecting the quality of the food inside. This will not only prevent consumers from eating foods that have gone bad, but allow them to better manage their soon-to-expire stock. Investments in these advanced technologies are necessary and cannot be overlooked in the 4.0 era if businesses want to ensure their competitive advantage in the long run.

|

|

|

|

|

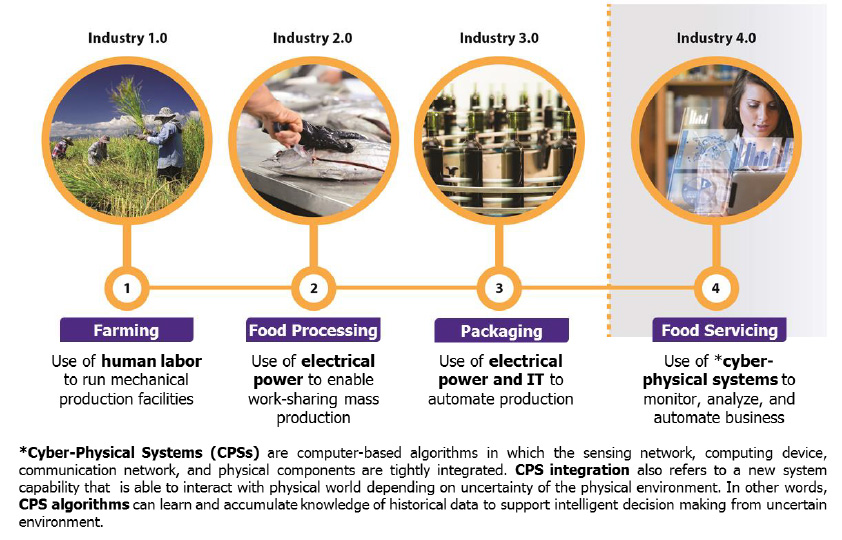

Figure 1: Downstream food businesses are a promising candidate for an Industry 4.0 upgrade due to better access to customer data. This could be used to analyze and integrate the data along with innovative technology to effectively respond to customer needs.

Examples of food industry development in each Thai industry revolutionary stage.

Source: EIC analysis

Figure 2: Networks and connectivity will play important roles in the coming 4.0 era. Sharing information between supply chain players will increase competitive advantages and sustainably raise the growth of Thai food industry businesses.

Comparison of current Thai food supply chain communication patterns with the future Industry 4.0

Source: EIC analysis