Anti-dumping measures on steel imports protecting domestic industry?

Thailand's attempt to protect domestic steel producers has intensified. The government plans to increase the number of import products levied with anti-dumping (AD) duties from 11 to 15 products in 2017. Added to the list are new products and additional origins for existing steel products. Despite this protection, the market share of imported products continues to rise because of existing tax loopholes and a large price gap between domestically produced and imported steel. In recent years, the performance of Thai steel producers has been subpar, even though new AD measures have been introduced. EIC recommends that domestic steel producers shift to higher-quality products and target niche markets. This strategy should go hand-in-hand with improved customer service as it will be increasingly difficult to compete on price with steel imports.

Author: Kanchanok Bunsupaporn

|

Highlight

|

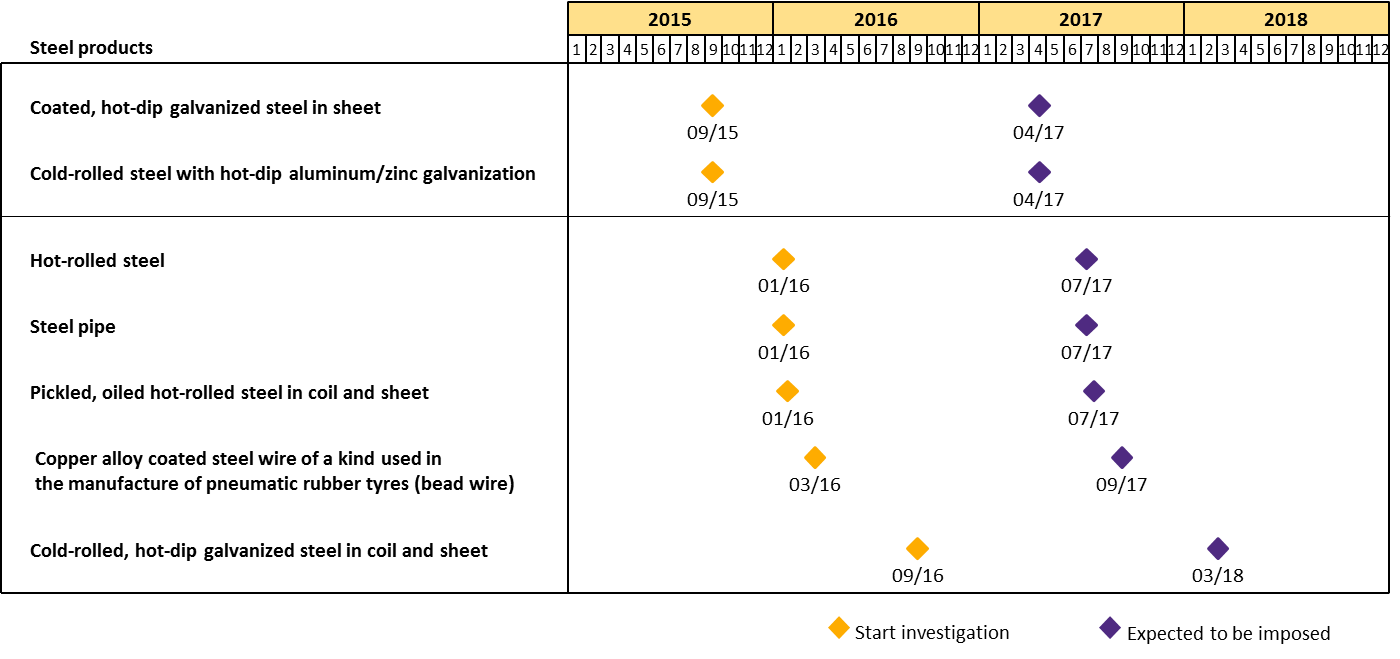

Anti-dumping duties will be imposed on 15 steel-related products in 2017, an increase from 11 items previously. Currently, there are 7 products under investigation for AD (Figure 1). These items are: 1) new products that have never been under AD investigation, such as flat steel products – more specifically, pickled, oiled hot-rolled steel in coil and sheet and cold-rolled, hot-dip galvanized steel in coil and sheet – and 2) new country origins for existing products, such as cold-rolled steel with hot-dip aluminum/zinc galvanization from Vietnam and hot-rolled steel from Brazil, Iran and Turkey as AD measures were previously aimed at products from China. In addition, the government will ramp up enforcement efforts to reduce AD-duty avoidance via product modification or composition change to utilize other custom codes by enforcing anti-circumvention measures. These attempts, especially those covering AD-duty-avoidance categories, will likely make the measures more effective in protecting Thai steel producers against low-cost imports.

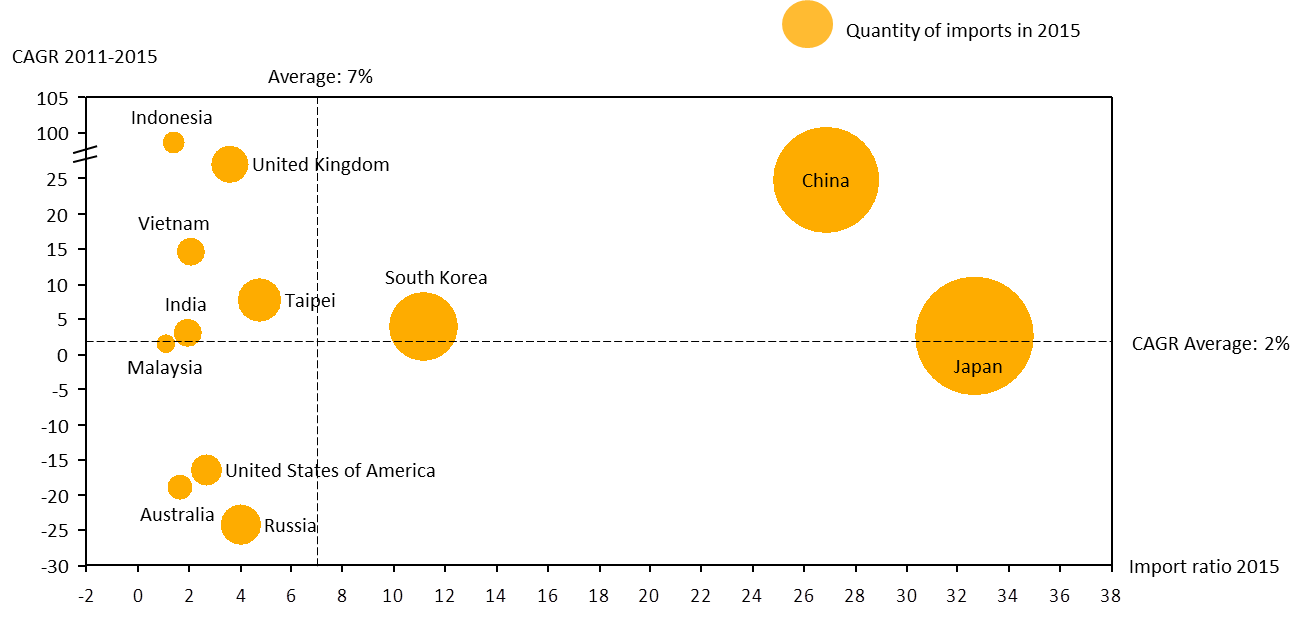

Nonetheless, AD measures have been ineffective in the past as seen in the increasing market share of steel imports. This is because there are many existing loopholes for avoiding AD duties. Including, 1) tariffs can be avoided by importing similar products from countries that are not on the AD list. For example, AD duties have been imposed on cold-rolled, hot-dip aluminum/zinc galvanized steel from China, Taiwan, and South Korea. Subsequently, imports from these origins dropped to 47,000 tons in 2015, a decline of 37% per year, since the AD duties were first imposed in January 9, 2013. Meanwhile, imports of the same product from Vietnam jumped to 120,000 tons in 2015, a climb of 7% per year since 2013. 2) importers can also evade the tariff by importing steel products under a different custom code or by changing product composition slightly. For example, imports of low-carbon wire rod from China were temporarily imposed AD duties on September 7, 2015. However, if mixed with specified composition the products qualify for 0% duty on the CIF price. This exemption resulted in a rapid growth of qualified imports from 850,000 tons to 1.1 million tons in the subsequent year, equivalent to 26% growth. These loopholes allow imported products to compete for market share with domestic producers. Thailand's steel imports are mostly from Japan and China, with market shares of 33% and 27% of total steel imports in 2015 (Figure 2). Nevertheless, imports from China are of most concern because import behavior displays signs of dumping. Thai steel producers for both flat and long products are losing domestic market shares, from 45% and 76% in 2009, to 23% and 58% in 2015, respectively.

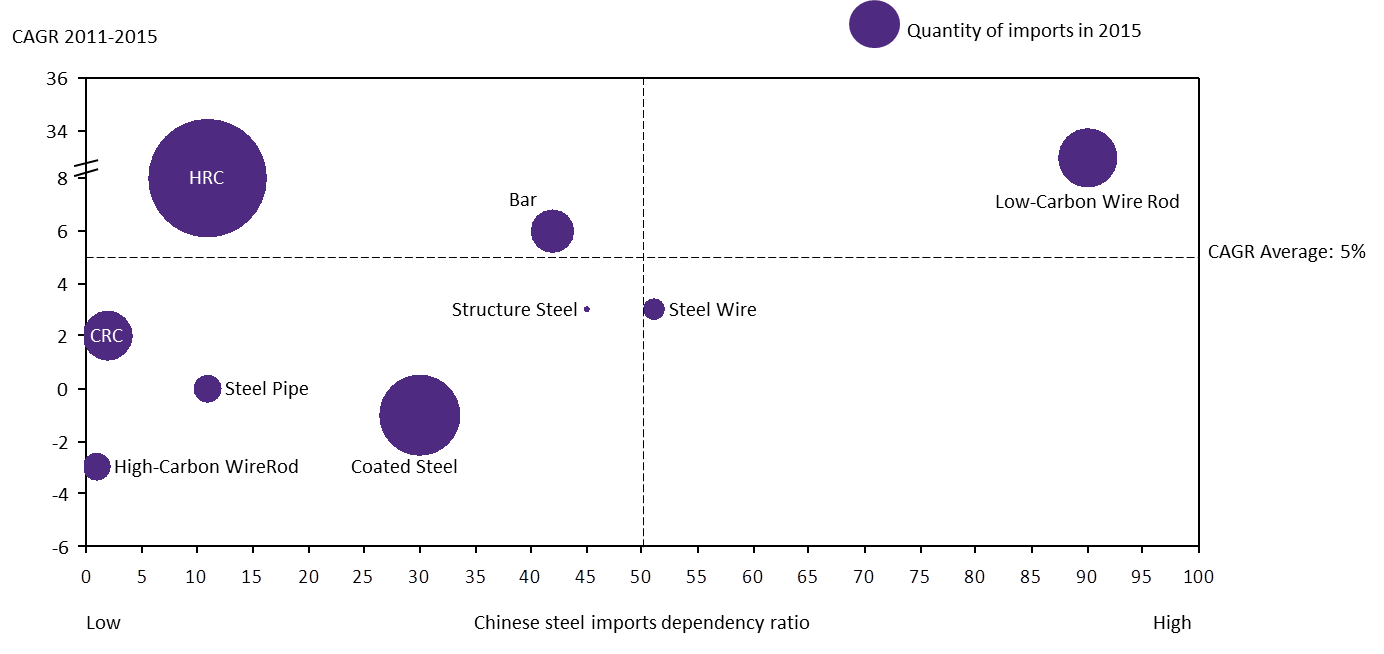

Keep an eye out for low-carbon wire rod produced in Thailand as it will likely lose more market share to imported products in 2017 despite the use of AD duties and mandatory Thai Industrial Standards. Thailand's demand for steel will reach 18 million tons in 2017, supported by construction expansion in both the public and private sectors. Yet, domestic producers of low-carbon wire rod will not benefit that much, despite the use of AD duties and mandatory Thai Industrial Standards (TIS), because there are multiple ways to avoid AD duties for low-carbon wire rod from China. Also, imported wire rod is not stamped with a permanent embossed logo as required by the TIS, differing from other types of steel products including round bar, deformed bar, and structural steel. The practice adds another step in the production process and helps protect domestic producers from imports. Thailand imports as much as 90% of all low-carbon wire rod from China (Figure 3). The price of Chinese imports currently stands at 13,000 baht per ton, compared to the domestic price of 16,000 baht per ton. This 20% price gap attracts more imports from China. Currently, revisions of the AD measures are under consideration to close tax loopholes, especially through the modification of product composition in low-carbon wire rod from China. The process should take approximately 1 year. Therefore, EIC expects import volumes for this product will continue to increase in 2017, as importers and users will try to accumulate stocks of Chinese products before revised measures go into effect. The trend will slow down in 2018 due to enforcement of the revised measure.

The performance of Thai steel producers has suffered, even though AD measures are in use. On the other hand, consumers benefit from cheaper intermediary products that are imported by avoiding AD duties. The market share of domestic producers of carbon wire rod shrank from 73% in 2011 to 59% in 2015. Import growth of low-carbon wire rod accelerated to 50% per year in 2015 from 28% the previous year. The effect is widespread among producers, who produce various products including wire rod, structural steel, and steel bar and producers with a long supply chain from semi-finished products like wire rod to final products like steel wire and nails. Sales growth of Thai producers has been falling at 16% annually since 2013, resulting in a net loss. On the other hand, consumers of low-carbon wire rod, such as producers of steel wire, nuts, bolts, and rivets, benefit from lower cost of raw materials. Their cost-to-sales revenue ratio dropped from 90% in 2012 to 82% in 2015, boosting profit margins. Taken together, EIC expects that price competition with imports will intensify, especially for steel products for general construction purposes. In this regard, AD measures can only alleviate the impact for a short period of time. Therefore, Thai producers should switch to produce special-grade wire that specifically targets consumers of final products. Examples include welding rods, motorcycle choke springs, nuts and bolts for vehicles, and electrical appliance makers.

|

|

|

|

|

Figure 1: Projection of Anti-Dumping (AD) measure use

EIC expects new AD measures to be imposed on several steel products in 2017

Source: EIC analysis based on data from the Bureau of Trade Interests and Remedies, Department of Foreign Trade

Figure 2: Thailand's steel imports by origin

Most of Thailand's steel imports came from Japan and China, with market shares of 33% and 27% of total steel imports, respectively.

Unit: %

Source: EIC analysis based on data from Trademap

Figure 3: Thailand's steel imports by product

As much as 90% of Thai low-carbon wire rod imports are from China.

Unit: %

Source: EIC analysis based on data from Trademap