What does credit card usage reveal about new consumption trends?

The credit card market maintains a lackluster outlook for household spending, with only high-income individuals spending and investing more. However, EIC has identified a new consumption trend, which is an increase in spending on life experiences, including travel and dining, and online shopping by credit card holders. Meanwhile, other types of consumption remain slack. Business owners are therefore advised to adjust their strategies to this new trend, focusing on services in order to expand the business.

Author: Panjarat Kitticharoonwit

![ThinkstockPhotos-515657264-[Converted].gif](https://www.scbeic.com/stocks/product/o0x0/sp/j7/ej2jspj7k5/ThinkstockPhotos-515657264-%5BConverted%5D.gif)

|

Highlight

|

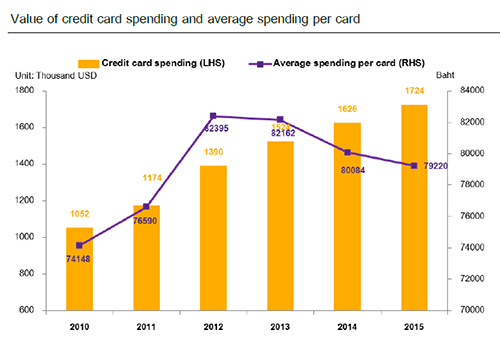

The credit card market suggests that middle-income consumers remain cautious with spending, while those with high incomes continue to spend more. According to data from the Bank of Thailand, credit card spending has grown an average of 7% annually since 2013. However, this is mainly driven by an increase in the number of credit card holders, while average spending per person has remained largely unchanged, with the exception of the small number of high-income cardholders. This is consistent with a National Statistical Office survey that showed flat household spending. Based on credit card spending data from SCB over the past three years, EIC has identified different investment pattern trends, spending patterns, and spending forms across income groups, namely those with lower middle and upper middle incomes (THB 15,000-35,000 and THB 35,000-100,000 baht monthly averages respectively), and those with high incomes (more than THB 100,000 monthly average).

Starting with investment patterns, there has been an increase in gold investment, especially among the high-income group. Meanwhile, investment in real estate continued to contract in the middle-income group and remained flat for the high income group. Although the global price of gold has dropped from USD 1,600 per pound in 2013 (THB 25,000 per 15 grams in the Thai market) to only USD 1,000 per pound in 2015 (THB 18,000 per 15 grams in the Thai market), investment in gold has only picked up among high-income individuals, who have added 9% to gold investment each year mainly by raising the amount of each purchase. For the middle-income group, however, investment in gold has remained roughly unchanged. As for real estate, despite a number of government stimulus measures near the end of 2015, middle-income households are still delaying investment, leading to an average 12% decline in their real estate investments. Meanwhile, the high-income group continues to invest in real estate. This confirms the overall condition of the real estate market last year, in which the majority of growth was concentrated in high-end condominiums, while the market for regular condominiums remained stalled.

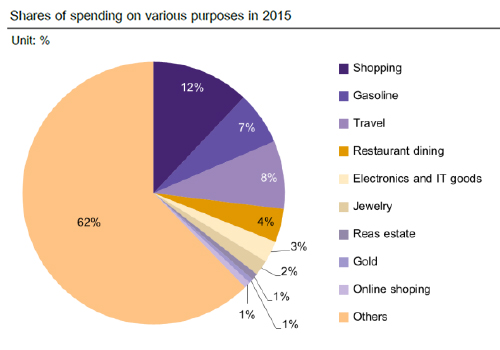

Regarding spending, middle-income consumers were found to maintain a constant level of spending, while those with high-incomes continued to spend more. Impacted by subdued economic conditions recently, middle-income consumers are cautious in their spending and tend to cut back on purchases of luxury goods. For example, spending on jewelry products has dropped by an average of 10% each year. This is true despite windfall benefits from the decline in global oil prices and hence domestic retail oil prices, which has led to a 23% reduction in gasoline expenses. Moreover, middle-income earners also try to curb shopping expenditures, receipt by receipt. This shows that middle-income individuals remained concerned over economic conditions and cautious in their spending. In contrast, high-income consumers do not appear to restrain spending. In addition, they tend to spend more, as suggested by a significant rise in average overall spending per receipt, including 5% annual growth for shopping expenses.

Regarding spending forms, consumers have been found to spend increasingly on experiences. While middle-income spenders focus on a variety of experiences, high-income ones opt for exclusivity. The data shows that credit card holders increasingly prioritize travel and restaurant dining, in line with the current trend among the new generation of consumers. Each year the middle-income group spends up to 10% more on online and offline travel services, and their average number of air ticket purchases has gone up by 15%. But as travel expenditures increase, spending per trip has dropped by around 10%. This can be explained in part by the trend among the new generation of consumers to buy travel packages and search for special price offers. This assumption is supported by an increase in spending amounts on travel websites, where discounts are usually available, while the number making reservations directly through hotels decreased. In particular, the lower-middle group can often find special deals and plan their itineraries such that their flights are up to 30% cheaper than those of upper-middle income travelers. Conversely, for the high-income group, travel frequency has not increased significantly, but spending per trip has soared. For example, their spending on hotels has gone up by 6%. This indicates that these travelers are opting for more luxurious and exotic travel experiences. Spending on restaurant dining also reflects a similar spending pattern.

Furthermore, online shopping is gaining popularity among consumers, with as much as 28% growth in online spending across income groups. Meanwhile, consumers spend less on in-store purchases. The value of in-store electronics and IT purchases is falling at 7% a year in a trend that is expected to continue. This confirms the result from a survey by the Electronic Transactions Development Agency (ETDA) that found that the online consumer market, now exceeding 400,000 million baht in value, has almost quadrupled over the past two years. The most popular items that consumers buy online are electronics and IT products. Similarly, data from credit card users reveals that the value of online purchase per transaction has risen on average as much as 24%, and is expected to increase further. Together, these figures suggest that consumers have gained confidence in online payment methods. Interestingly, the average value of online purchases per transaction is positively related to buyer income, with higher-income individuals spending up to two times the amount spent by the middle-income class and three times the amount spent by lower-income ones.

|

|

|

|

|

Figure 1: Since 2013 spending per person has declined, although the overall value of the credit card market has expanded.

Source: EIC analysis based on data from the Bank of Thailand.

Figure 2: A majority of consumer spending is on shopping and gasoline.

Source: EIC analysis based on SCB credit card spending data.

Figure 3: Spending on experiences and online shopping show robust growth, especially when compared to material goods.

Source: EIC analysis based on SCB credit card spending data.