Unveiling 4G Business Models in the Digital World

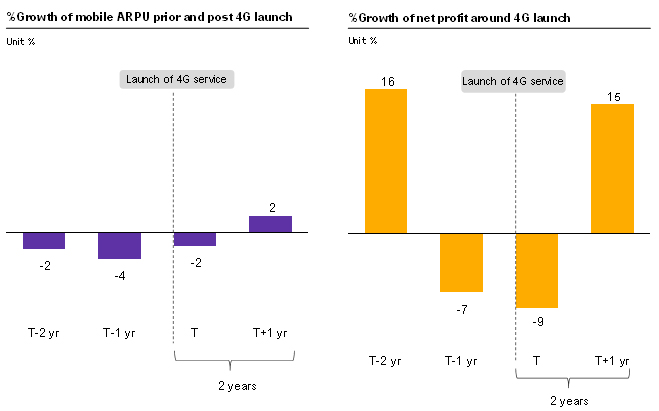

Consumption preferences in the digital age have switched from voice services to data usage, and 4G technologies can help mobile operators take advantage of this shift by increasing customer data usage and boosting revenues. In other countries, the introduction of 4G wireless technologies has raised revenue per user by 2-3% annually after continuously contracting by 2-4% annually prior to the introduction of 4G.

Author: Issarasan Kantaumong

|

Highlight

|

Employing 4G technology is pivotal for business operators in promoting the continuous growth of mobile data usage and revenues. With 4G speeds three to five times faster than those of 3G, consumers can view content via their mobile phones at higher speeds. For mobile operators, higher speeds mean increased data usage by customers and higher monthly charges. Our study of 16 mobile operators in Asia shows that 4G is vital in raising data usage and average revenue per user (ARPU). ARPU expanded by 2-3% annually within two years of the introduction of 4G services, whereas it had been shrinking by 2-4% annually prior to that time.

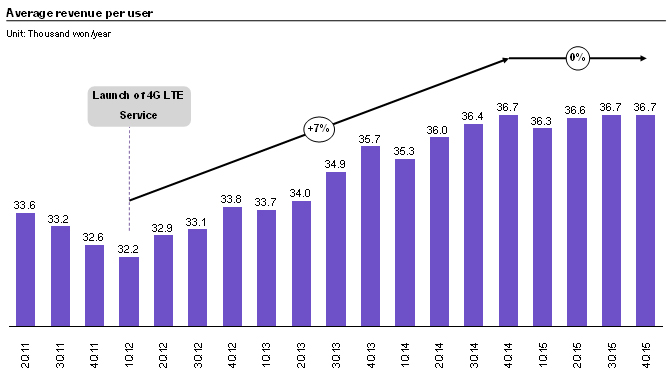

However, the introduction of 4G networks may boost revenue only in the short run. Revenue growth could stall in the long run if mobile operators continue their current business models. Mobile operators, therefore, need to develop new business strategies to utilize 4G to its fullest potential. A sign of mobile usage saturation can be seen in countries where 4G networks have been available for a while. For instance, ARPU of SK telecom, the number one mobile operator in South Korea, had no growth in 2015, despite annual growth of 7% three years earlier. For this reason, mobile operators need to adjust and innovate business models that address changes in modern consumer preferences in order to sustain growth in 4G usage. EIC sees three potential business strategies that will maximize 4G technologies: 1) partnering with Over-the-Top (OTT) operators, 2) developing digital platforms, and 3) connecting the Internet of Things (IoT) with mobile networks.

1) Partnering with Over-the-Top (OTT) operators who provide services that deliver audio or video content over the Internet is one way to turn competition from OTT operators into opportunities. OTT operators offering open communication over the Internet, such as Line and Whatsapp, are taking significant market share away from traditional SMS services provided by mobile network operators. Analysis Mason, a leading telecommunication consulting firm, forecasts that traditional SMS users will account for fewer than 4% of all users within the next three years. In addition, OTT operators use networks and bandwidth provided by mobile operators without having to invest or share revenue. This inflicts a tremendous loss on mobile operators, both in revenues and the enormous investment made to develop their mobile networks.

With the growing popularity of OTT services mobile operators need to cooperate with OTT operators in order to retain their market shares. In other countries, some mobile service providers have already allied with OTT operators. For instance, German mobile operator E-Plus joined hands with Whatsapp to launch sim-cards that give users unlimited access to Whatsapp. This strategy helps increase revenue shares for mobile operators while differentiating them from competitors.

Moreover, forming an alliance with OTT operators who deliver media content over the Internet, such as Netflix, iFlix and Line TV, is one strategy used by mobile operators abroad to increase data usage. Indeed, the amount of data used for 1 minute of video streaming is equivalent to sending 500 emails.

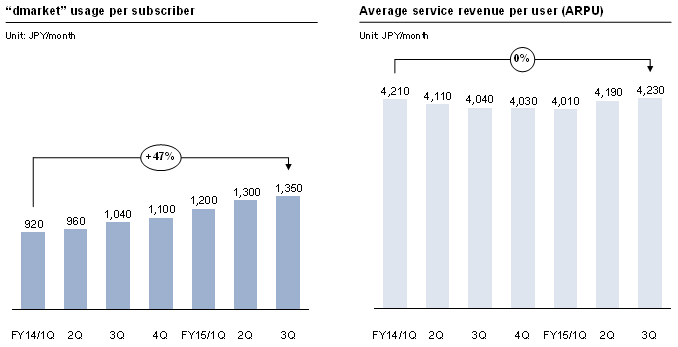

2) Mobile operators should develop digital platforms in response to changing consumption behavior in the age of 4G. People all over the world are increasingly adopting digital lifestyles. For instance, entertainment consumption through phones, tablets, and computers now takes up about half of total media consumption time. Online shopping may account for 12% of all retail sales in 2019, compared to only 7% in 2015. Therefore mobile operators should develop digital platforms in response to such changing consumer behavior. For example, NTT Docomo, Japan’s number 1 mobile operator, developed “dmarket”, a digital platform for games, cartoons, movies, music, and online shopping. This platform answers the needs of modern customers while creating another revenue channel for NTT Docomo. Customer spending through dmarket rose as high as 50% within two years, while their revenue from phone services stayed almost the same.

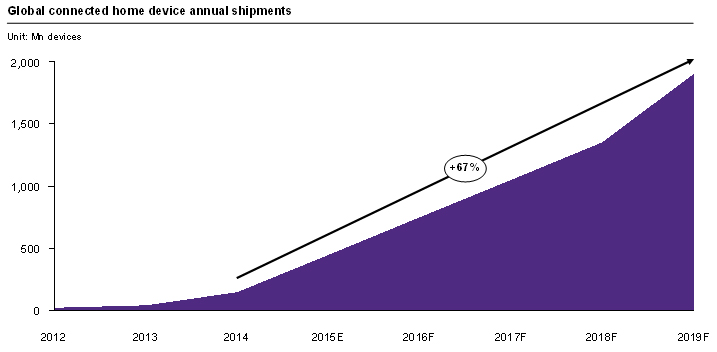

3) Connections between the Internet of Things (IoT) and mobile networks is another opportunity for mobile operators to sell both products and services. IoT is a technology used to connect devices via Internet networks. For instance, IoT lets consumers use their mobile phones to control household electrical appliances such as fridges, TV, washing machines, coffee makers, and indoor thermostats. The number of devices connected through the IoT globally may be as high as 1.8 billion units by 2019, equivalent to 67% annual growth. This is an opportunity for generating income through offering technology, products, and service revenues from connecting IoT devices with the mobile networks. Mobile operators can also expand their revenue channels by analyzing big data in the future.

IoT is not only limited to day-to-day usage, but also extends to connecting equipment or machines to IoT networks in business and industrial settings, allowing mobile operators to expand their customer base into businesses and industries. One success story is AT&T, one of the largest mobile operators in the US, which employs IoT as a tool to expand its customer base into many businesses, including smart houses for general users, smart cars for general users and businesses, and smart grids for industrial customers.

|

|

|

|

|

|

Figure 1: 4G technology significantly boosts Average Revenue per User (ARPU) and mobile operator net profits |

||

|

||

|

Note: Use the average value of SingTel, SKT, STH, KT, LGT, M1, TWM, FET, CHT, DIGI, Celcom, Maxis, China Mobile, GLOBE, PLDT and NTT Docomo T = The year that operators launch 4G LTE service Source: EIC analysis based on data from Bloomberg and Deutsche Bank |

|

Figure 2: ARPU growth of SK Telecom slowed down in 2015

|

||

|

||

|

Source: EIC analysis based on data from SK Telecom

|

|

Figure 3: Revenues from dmarket by NTT Docomo increased by 50% in 2 years, while revenues from phone services remained flat |

||

|

||

|

Source: EIC analysis based on data from NTT Docomo |

|

Figure 4: Connected home devices will likely reach 1.8 billion items by 2019 |

||

|

|

||

|

Source: EIC analysis based on data from Business Intelligence |