Spotlight on ethanol industry...opportunities and challenges for Thailand's agricultural sector

The Thai ethanol industry continues to grow steadily, propelled mainly by Thai government policies. This growth greatly benefits the upstream sector, especially cassava, sugarcane, and sugar producers. However, current low global oil prices present a major challenge for the industry as the reference prices of ethanol are still 12 baht higher than ex-refinery prices for high octane gasoline like ULG 95 gasoline. Moreover, ensuring an adequate supply of raw materials is another challenge facing the industry as ethanol demand is projected to rise. The development of this industry will require collaboration among multiple stakeholders.

Author: Teerayut Thaiturapaisan

|

Highlight

The Thai ethanol industry continues to grow steadily, propelled mainly by Thai government policies. This growth greatly benefits the upstream sector, especially cassava, sugarcane, and sugar producers. However, current low global oil prices present a major challenge for the industry as the reference prices of ethanol are still 12 baht higher than ex-refinery prices for high octane gasoline like ULG 95 gasoline. Moreover, ensuring an adequate supply of raw materials is another challenge facing the industry as ethanol demand is projected to rise. The development of this industry will require collaboration among multiple stakeholders.

|

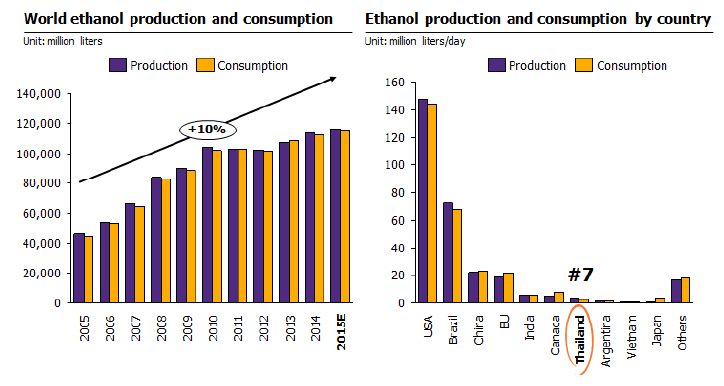

Over the past 10 years the ethanol industry has continued to grow steadily, supported by a global shift towards a Green Economy. The U.S. and Brazil are the world's leaders as the two largest ethanol consumers and producers. On the other hand, Thailand ranks the 7th largest ethanol producer, with a production capacity of around 3.4-3.5 million liters per day (Figure 1), most of which is used for bio-fuel production. Engines using bio-fuel release much less carbon dioxide than those using gasoline, thus helping improve the global warming situation. With growing awareness of the Green Economy philosophy along with support from the government, Thai consumers are turning to ethanol (gasohol) in increasing numbers. This has substantially boosted the ethanol industry in Thailand.

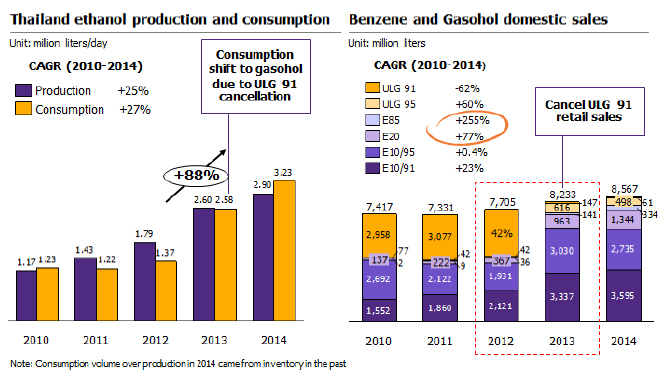

Policies and support from the government will be the key growth drivers for the Thai ethanol industry in the future. In 2013, the Ministry of Energy announced the cancellation of 91-octane gasoline (ULG 91), which accounted for 40% of Thailand's gasoline consumption at the time. During that era the price of 95-octane gasoline (ULG 95) was still high. These two factors combined made consumption of gasohol, containing ethanol, jump by 88%YOY in 2013 (Figure 2). The Ministry of Energy also released a 20-year plan, called the "Alternative Energy Development Plan: AEDP 2015" aiming to boost domestic consumption of gasohol. The goal is to increase demand for ethanol to 11.3 million liters per day by 2036. If everything goes as planned, the Thai ethanol industry will grow at a rate of 7% per year (Figure 3), and demand for cassava and sugarcane (molasses), the main raw materials for ethanol production, will reach 59.5 and 182 million tons per year, respectively in 10 years to achieve the goals set by AEDP 2015. This will be a big step up from current production levels of 30.6 and 112 million tons per year, respectively.

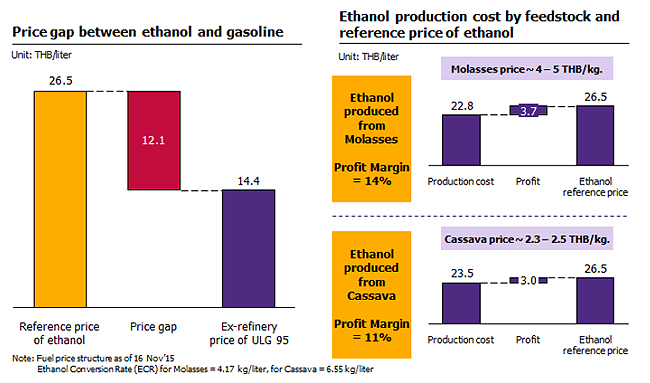

Ethanol and raw material producers, especially cassava, sugarcane, and sugar, will benefit from government policies to boost domestic consumption of bio-fuel. Several government measures point to strong growth prospects for the Ethanol industry in Thailand. For example, the government's Oil Fund has kept gasohol prices lower than those of ULG 95 gasoline. Moreover, the government is preparing to adjust the reference price formula for ethanol to reduce retail prices for gasohol. These measures will incentivize more consumers to switch to gasohol. In terms of profit margins, ethanol producers still maintain a margin of 11-14% because the difference between production prices and reference prices of ethanol is around 3-4 baht per liter (Figure 4). Given this policy direction, the government will have to support the agricultural sector, benefiting farmers and related-businesses in the immediate term, especially cassava, sugarcane and sugar producers.

Nonetheless, persistently low oil prices today present a great challenge for the ethanol industry. For Thailand, the economy receives additional benefits from using ethanol instead of imported crude oil because doing so adds value to domestically produced agricultural products. In the past year, the price of crude oil has been halved, leaving ex-refinery prices for ULG 95 as low as 14 baht per liter (Figure 4). This is 40% lower than the production cost of ethanol, hurting the use of ethanol as an ingredient for gasohol. To keep consumers from switching away the government uses the Oil Fund to subsidize gasohol prices, especially for the E20 and E85 formulas. Given that Thailand can produce ethanol with domestically sourced raw materials, using ethanol instead of imported crude oil will also benefit the economy by adding value to agricultural products. The value-added increase is estimated at 15,000 million baht per year, assuming the current price gap between the reference price of ethanol and the ex-refiner price of ULG 95 gasoline at around 12 baht per liter (Figure 4). Note that this price is partially supported by government subsidy. Nevertheless, switching to ethanol will reduce the burden of crude oil imports as well as increase the export volume for refined fuel. This increases Thailand's trade balance by 19,000 million baht per year (based on an export price of refined gasoline of 15 baht per liter). Moreover, using ethanol will also create more jobs and value-added for agricultural products in Thailand.

Another challenge for the Thai ethanol industry is the adequacy of raw materials to match with the rising demand for ethanol. According to the government's goals for the industry set in its long-term plan, the upstream sector, especially cassava, sugarcane, and sugar producers, will have to increase their production capacity to match the rising demand laid out in the government development plan. According to the plan, sugarcane producers will have to expand sugarcane cultivation areas by 6 million rais from the current 10 million rais to achieve adequate sugar molasses for ethanol production at 4.88 million liters per day in the next 10 years. In addition to achieve cassava supply for ethanol production at 2.50 million liters per day, cassava producers will have to focus on increasing productivity due to the constraint of plantation areas that are limited to 8.5 million rais. Therefore, cassava producers will need to increase yield of cassava from 3.5-3.6 tons per rai to 7 tons per rai. The two cases mentioned here are priorities that stakeholders should pay attention to. However, will the Thai ethanol industry achieve the growth target planned by the government? EIC see that much risk remains and there is still room for businesses to improve to ensure sustainable development in the future.

|

|

|

|

|

|

Figure 1: World ethanol production - consumption and daily ethanol production - consumption by country sorted by world top ethanol producers |

|

|

|

Source: EIC analysis based on data from the OECD-FAO |

|

Figure 2: Daily ethanol production - consumption in Thailand and share of gasoline and gasohol in Thailand |

|

|

Source: EIC analysis based on data from the Department of Alternative Energy Development and Efficiency (DEDE) and CEIC |

|

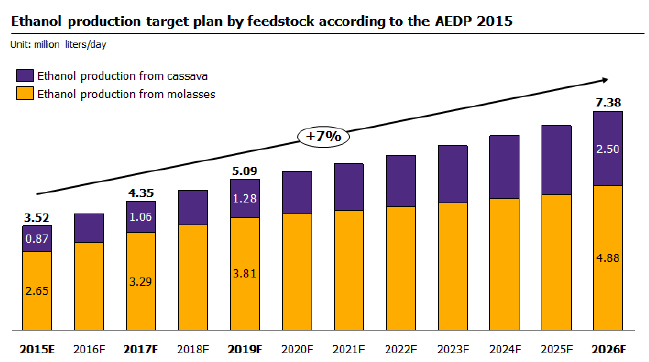

Figure 3: Thailand's production capacity for cassava and sugar molasses for ethanol production according to the AEDP 2015 |

|

|

|

Source: EIC analysis based on data from AREA |

|

Figure 4: Gap between the reference prices of ethanol and 95-octane gasoline and production cost of ethanol |

|

|

|

Source: EIC analysis based on data from AREA |