OTT Services – A Digital Turning Point of the TV Industry

The widespread availability of high-speed internet in developed countries like the US, the UK, and Korea has given rise to Over-the-Top (OTT) service. OTT is a fast-developing new service which delivers contents over the internet without the need for network investment, providing cheap and easy access for customers. It is rapidly gaining popularity and may affect traditional television services in the long run.

Author: Issarasan Kantaumong

|

Highlight

|

Over-the-Top or OTT is a service that delivers audio, video, and other media over the internet without network investment by a service provider. It is a new business trend that is fast becoming more important. OTT is an innovation providing communication and contents through internet applications to meet consumers’ demand for more technological applications over the past decade, and to help service providers differentiate themselves from competitors. Neither customers nor operators need extra equipment or network investment. For example, Netflix and Hulu provide online films and TV programs without requiring clients to install an extra antenna or satellite dish. There are no additional transmission costs to OTT operators as is the case with traditional TV operations.

A study of the US television industry shows that OTT is more attractive than traditional TV in terms of convenience, price, variety, and the ability to analyze consumer behaviors. OTT has revolutionized US media and posed a challenge to the traditional media industry. It can provide video on demand, anywhere and anytime, on any equipment connected to the internet, such as smart phones, tablets, computers, and smart TVs. OTT also offers low-cost packages to customers, with the average monthly subscription rate of around USD8-10 which is at least 8 times cheaper than cable TV or satellite TV membership fees. Even though OTT-subscription fees may be higher than that of free TV, OTT has the advantage of offering binge-watching with a variety of films, TV programs, and popular series as well as OTT-exclusive series, all without interruption by advertising.

Moreover, on-line connections enable the collection of precise and detailed data about individual viewers, which in turn provides feedback for new products to help OTT meet customer requirements. Netflix, for example, has found that no Netflix viewers were ever hooked on the pilot episode, which is in line with the Netflix binge-release strategy whereby viewers can watch the series from beginning to end. With traditional TV, viewers have to wait a week for the next episode and may not follow the entire series if the pilot episode is not attractive.

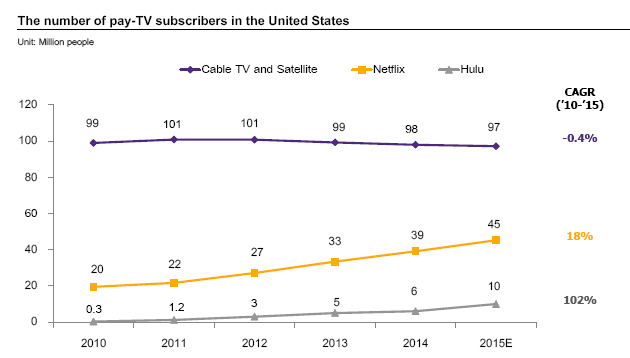

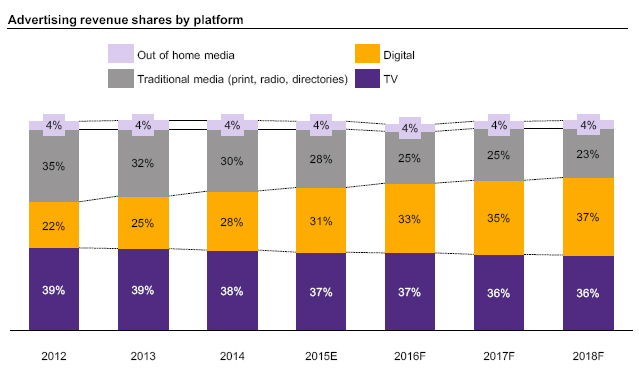

As such, OTT has become highly popular in the US, contrary to the decline in cable TV and satellite TV viewers. Before the arrival of OTT, cable TV and satellite TV in the US were a big entertainment business, worth USD 70,000 million and with over 100 million subscribers, or 90 % of US households. It began to lose market share to OTT of 0.5 to 1% per year or around 1 million viewers a year starting in 2013. On the other hand, Netflix and Hulu OTT subscribers together equal more than half the number of cable and satellite TV subscribers, with average annual growth of 18% and 100%, respectively in the past 5 years. Furthermore, TV advertisements, with a 37% share of total advertisement in 2015, are losing out to other forms of media. According to leading US market research firm eMarketer, TV advertising will fall by 0.5% a year while advertising on digital media will increase from 31% in 2015 to 37% by 2018, surpassing TV advertising and reflecting a decline in the popularity of traditional TV.

In addition, the arrival of set-top boxes such as Apple TV, Roku, and Chromecast as well as changing consumer preferences towards on-line viewing will push further growth in OTT. Findings by market research firm Park Associates show that almost 20% of US households with high speed internet have at least one set-top box that allows them to enjoy internet TV. Widespread use of this equipment will make OTT use on TV screens easier and more convenient. The media consumption behavior of young people is also shifting. As discovered by large US cell phone company Verizon, 60% of Gen Y (15-34 years of age) use on-line entertainment channels instead of traditional TV. All these factors will help OTT to expand further.

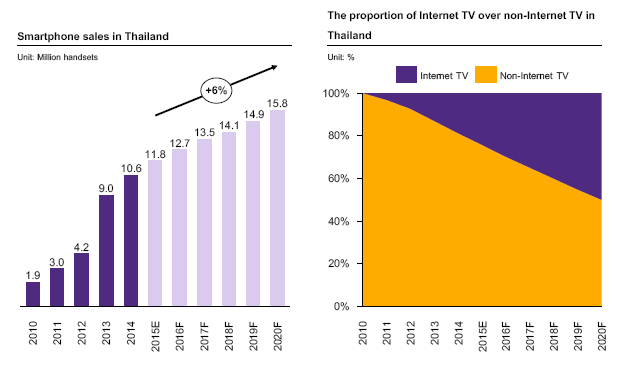

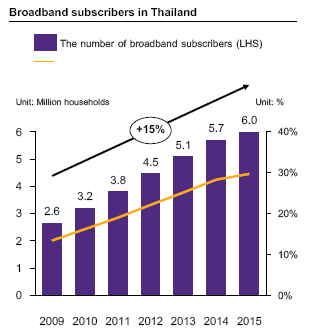

Although OTT is not yet widespread in Thailand, the steady increase in technology access may affect media consumption behavior in the long run. At present, Thailand’s total sales of internet connectible equipment is quite high at 12 million smart phones a year, with a trend of 6% annual rise predicted for 2016-2020. Some 50% of Thai households will use internet TV by 2020 as a result of increased availability and prices of less than 10,000 baht a set. Furthermore, household access to broadband internet in Thailand continues to increase at a high rate of 15% a year, while consumption of IT products also continues to rise. All these factors point to a jump in access to technology. Apart from this, the expansion of mobile phone 4G networks is also underway. The giant information and telecommunication firm Ericsson has found that when 4G roaming service is available, more than 50% of users will use video on demand at least once a day, which means that more and more Thais will consume media online.

While increasing OTT service in Thailand will be an opportunity for OTT operators, it will also provide a major disruption to the internet service providers and traditional TV operators, as well as change TV and media ecosystems. A jump in online traffic can be expected upon the arrival of OTT services. As in the case of the US and Canada, OTT service providers like Netflix use 36% of internet traffic, which is high enough to affect internet service providers (ISP) and discourage investment in network expansion as the providers will not get any return from OTT operators. In addition, traditional TV operators may lose market share as advertisements will be allocated to other media formats, including online media which has more eyeballs. Although 60% of advertisements are still concentrated in the traditional TV media, there are signs of a drop in advertising in other traditional media like print and radio, from 26% in 2010 to 21% in 2015, and a trend towards online media and out of home media. In the future, TV media may face a fate similar to that of other traditional media.

It is clear that some traditional TV operators are beginning to adapt to the changing needs of consumers. Since TV advertising income of 60-70 billion baht a year in Thailand is growing at a slower pace due to a sluggish economy, there is a need for operators to adapt to compete for maximum advertising revenues and audiences. At present, many operators are beginning to make the move to OTT service. For example, Channel 7 has opened a new website and mobile applications, Bugaboo.tv, for online TV programs and live sports with some contents available only on websites. GTH, Workpoint and Thairath TV have joined hands with Line to launch Line TV applications for movies, series, and music on mobile phones, tablets and computers as a means to increase viewers and gain additional revenue for TV operators.

|

|

|

|

|

|

Figure 1: There is a strong jump in OTT subscriptions in the US while there is a gradual downward trend in cable TV and satellite TV membership |

|

|

|

Source: EIC analysis based on data from Statista, TDG Research, Netflix and Hulu |

|

Figure 2: TV advertisements in the US are declining and will be surpassed by digital media by 2018 |

|

|

|

Source: EIC analysis based on data from eMarketer |

|

Figure 3: The sale of internet-connecting devices in Thailand has been growing exponentially |

|

|

|

Source: EIC analysis based on data from Euromonitor |

|

Figure 4: Access to broadband internet in Thailand continues to grow steadily and can affect public media consumption patterns in the long run. |

|

|

|

Source: EIC analysis based on data from National Broadcasting and Telecommunication Commission (NBTC) |