The business of aging and opportunities in care for the elderly

- Changing economic and social contexts resulting from an aging population have raised demand for care businesses. Taking care of older relatives is of great importance in Thai culture. However, an increasing number of elderly and a smaller working age population are putting increasing pressure on the young to work more, and some struggle to find the time to care for elderly family members. Low fertility rates also make matters worse as those without children will be living alone when they get older. - Care businesses top the list of opportunities arising from an aging population. The first wave of opportunities will be short-term care such as daycare and rehabilitation centers. Due to the currently small fraction of older cohorts, elder communities and retirement centers will be unlikely to grow in the short-term. But, demand for long-term residential facilities like this will rise from both Thai and foreign senior citizens. Business opportunities will be up for grab as the Thai population ages, and Thai businesses should start adjusting to accommodate changing market demand.

Author: Lapas Akaraphanth

|

Highlight

|

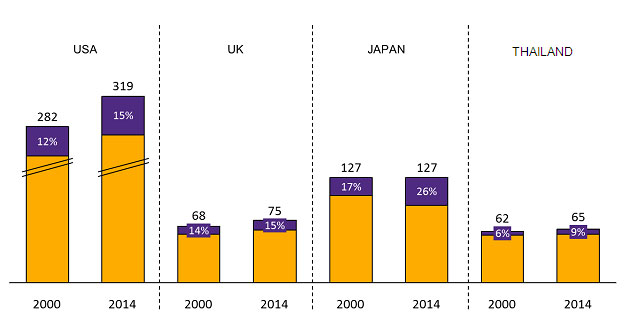

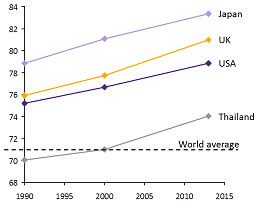

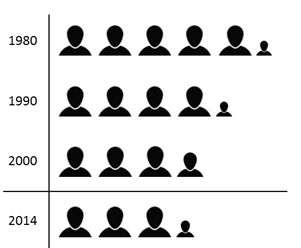

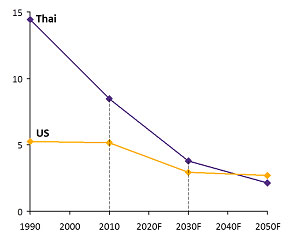

Besides the stimulus of an increasingly aging population, the demand for elderly care is leapfrogging due to other economic and social factors. Global aging trends continue to spur growth for aging-related businesses overseas. In particular, in developed countries like the US, Japan, and the UK people tend to live longer as more advanced medical technology improves life expectancies, increasing the number of older citizens. In comparison with Asia, elderly care businesses are experiencing a huge boom in the West as it is not customary for younger generations to take care of their older relatives. However, the situation in Asia is also changing. Growing economies and urbanization restrain the time available to care for elderly family members. For example, Japan, where older citizens comprise more than 20% of the total population, has experienced an increased demand for elderly care during the past decade despite the fact that it is a Japanese tradition for women to stay home and take care of senior members in a household. Currently an increasing number of Japanese women are entering the labor force, as can be seen from a 3% increase in female labor force participation over the past 10 years, and a 12% fall in the number of stay-at-home wives.

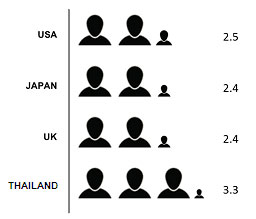

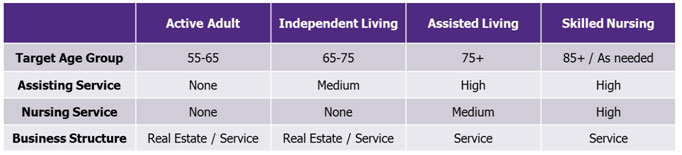

Elderly care businesses are grouped into 2 types: Short-Term Care and Long-Term Care. Short-term care focuses on services and support for daily activities offered both within and outside care facilities. This also includes activities for senior citizens to relax and socialize as well as health services for those with chronic diseases who require constant care. On the other hand, long-term care focuses on residential facilities for older people to move into. These facilities aim to provide convenience after retirement, especially for those who would otherwise live alone. Moreover, support levels can differ according to different needs. For instance, the market for long-term residential facilities consists of those designed for active or independent adults who remain in good health and wish to live in a community with others. Another type targets the elderly with chronic diseases who require frequent care (assisted living). Like long-term care, short-term care businesses can also segment the market for those requiring medical and daily assistance, such as recuperation, and daycare, such as activities during the daytime for those who live alone.

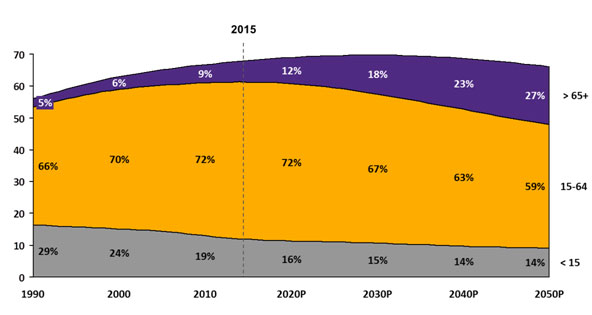

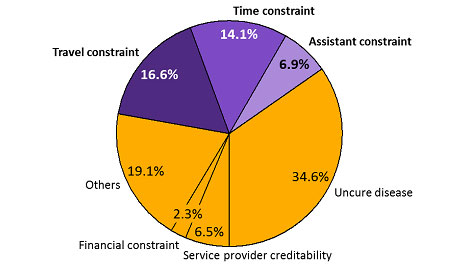

Despite the great importance placed on family care in Thai culture, care services are in high demand as an aging population grows and the working age shrinks. Young generations now have to work harder, limiting the time they have to care for elderly family members. Thailand now has 840,000 citizens aged 65 or more, comprising 9% of the total population. The ratio of elderly persons living alone is accelerating while birth rates continue to fall. The older population is therefore expected to be 18 million in 2050, 27% of the total population, putting Thailand entirely within the aging society category. While Thai culture places great importance on caring for older family members, the time spent by the young on taking care of older relatives has fallen as they face more demanding work. China is an interesting case in that it is a society that shares the values of caring for older family members as Thailand. The growing economy provides incentives to those of working age who move to other cities for work and sometimes leave elderly parents behind. As a result, the Elderly Rights Law was enacted to persuade the young to visit their parents back in their hometown. As for Thailand, The National Committee on the Elderly has found that 38% of elderly Thais are unable to access healthcare services due to commuting and time constraints and a lack of assistance. These reasons reflect an opportunity to expand elderly care businesses in the future, although young Thais traditionally care for their senior relatives within family.

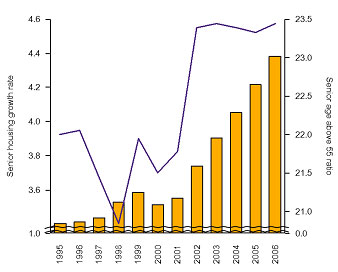

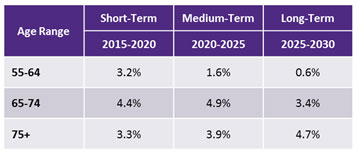

Elderly care businesses will prosper despite the existing small market. Most current businesses provide short-term services, but the market should expand following an aging population where the number of elderly will grow by more than 50% over the next decade. The currently low demand for care businesses is due to the small share of the elderly relative to the total population. In 5-10 years, however, the population aged 65-74 years old will grow rapidly. In the long term, those aged more than 75 years old will increase most quickly because advanced medical technology will extend life expectancies. Therefore, short-term care businesses will experience high growth in the next 5-10 years as these elderly people mostly live with and still depend on their families. After that, long-term care businesses will steadily develop as an aging population increases and the old tend to increasingly live alone. Based on statistics from the American Seniors Housing Association, room prices for the elderly have largely increased since 2000. This is in accordance with the rapidly increasing ratio of older persons to the total population. Comparatively speaking, the demand for long-term residential facilities in Thailand will swiftly increase as the fraction of elderly persons to total population soars by more than 20% over the next 10 years.

Nonetheless, long-term care businesses can, in the short term, benefit from foreign retirees and expats. Statistics show that elderly tourists, especially those aged above 65, consider Thailand a popular travel destination and continue to visit, with an 8% increase every year. Ranked among the top ten places to retire, Thailand has a relatively low cost of living and efficient medical services. Investment in elder communities has been made in many tourist spots, such as Chiang Mai, Koh Samui, and Hua Hin. Such places offer a good environment and are less busy than other popular cities like Bangkok and Pattaya. In Chiang Mai, the number of long-term residents registered by the Japanese totaled 4,000, up by 500 from 2013, plus approximately 2,000 unofficial long-term residents. They tend to spend around 300,000 baht per person each year, totaling one billion baht in tourism income.

|

|

|

|

|

|

Figure 1: Increase in senior population and decrease in family size in each country pushes demand for senior care businesses |

| Proportion of elder age 65+ per total population |

| Unit: million persons, % of total population |

|

|

| Source: EIC analysis based on data from CEIC |

| Life expectancy |

Family size |

|

| Unit: years old |

Unit: persons |

|

|

|

|

|

Source: EIC analysis based on data from World Bank |

|

Figure 2: Elderly care business can group into various types depending on the characteristic of service provided and the target market |

||

| Senior care business type | ||

|

||

|

Source: EIC analysis based on data from American Senior Housing Association |

|

Figure 3: Thailand will fully enter into aging society in 2025 |

||

|

Thailand’s population structure projection |

||

|

Unit: million persons, % of total population |

||

|

||

|

Source: EIC analysis based on data from US Census Bureau |

|

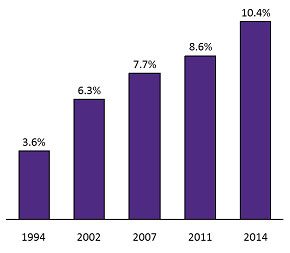

Figure 4: Thai elderly care services are in high demand as an aging population grows and family size shrinks |

||

| Thailand’s family size | Proportion of Thai elderly persons living alone | |

| Unit: person |

Unit: % of elderly persons living alone per total elderly population above 60 |

|

|

|

|

|

Source: EIC analysis based on data from NSO |

||

| Ratio of elderly Thais which are unable to access healthcare services | ||

|

Unit: % |

||

|

||

|

Source: EIC analysis based on data from TGRI: Situation of Thai elderly 2013 |

||

|

Figure 5: In the short-term, elder housing is unlikely to grow. But as fraction of elderly population increase, the demand for long-term residential facilities in Thailand will swiftly increase in accordance to US senior housing market statistic |

||

|

% of US room rate index growth VS % of senior population age above 55+ |

Caregivers ratio* |

|

| Unit: % YOY(LHS), % total US population(RHS) | Unit: person | |

|

|

|

|

Source: EIC analysis based on data from American Senior Housing Association and CEIC |

||

| Forecast of Thais elderly growth with compound annual growth rate | ||

|

Unit: % 5 year CAGR |

||

|

||

|

Source: EIC analysis based on data from US Census Bureau |

||