4 Strategies to seize opportunities from the rising CLMV

Currently, tremendous attention have been paid to the CLMV from global investors due to various factors such as abundant natural resources, plenty of low-cost labor, open trade policy, and the central location in the heart of ASEAN. As the competition in the global market intensifies due to slow global demand and a weak domestic economy, in order from the businesses to improve their competitiveness to gain from the opportunity in CLMV, EIC proposes 4 strategies 1) cost reduction, 2) value-added, 3) market seeking, and 4) opportunity seeking in related-business. However, the businesses should bring along their existing expertise to be able to compete with potential competitors from other countries. Besides, having a decent local business partner is another ingredient to smoothen the local business operation.

Author: Pitsinee Thitisomboon

|

Highlight

|

The dawn of the ASEAN Economic Community (AEC) in 2015 marks a new step toward ASEAN becoming an important market place especially, the CLMV region (Cambodia, Laos, Myanmar, and Vietnam) due to many reasons such as high levels of economic growth with plenty of young and low-cost labor as well as abundant natural resources. Their governments are also opening up the countries to free trade, establishing service centers for businesses, and providing various investment incentives. Moreover, the CLMV region is conveniently located in the heart of ASEAN, a connecting point for many big trade routes around the world. Additionally, CLMV countries have been investing heavily to develop and improve their infrastructure with support from richer counterparts like Japan, China, the U.S., and Germany. These factors make the CLMV a great option as a new production base and a potential region to expand their market.

Meanwhile, the rising cost of labor in Thailand is pushing Thai businesses to seek out opportunity to adjust strategies and increase their competitiveness. In this respect, the CLMV countries might just be the solution. Rising wages have started to result in a loss of Thailand’s cost competitiveness to neighboring countries. The minimum wage in Thailand is five times higher than that of Myanmar, 4 times that of Cambodia, 3.5 times that of Laos, and 5 times that of Vietnam. Expensive labor in Thailand also pushes up prices for raw materials and other input factors as well. High production costs further reduce the competitiveness of Thai businesses, especially those that are labor intensive. As the competition in the global market intensifies due to slow global demand and a poor domestic economic recovery in Thailand, Thai businesses must seek to take advantage of the rise of the CLMV nations to secure a more sustainable future. We propose four strategies: 1) cost reduction, 2) value-added, 3) market seeking, and 4) opportunity seeking in related-business.

1) Cost reduction strategy is suitable for businesses that are highly labor-intensive. These businesses can improve competitiveness by relocating their labor-intensive operations to the CLMV region to cut labor and raw material costs. This strategy is appropriate for light industries that employ a large amount of unskilled and semi-skilled labor, such as the apparel and shoe industries. These industries can relocate their production bases to Cambodia with its abundant source of low-cost labor. On the other hand, electronics parts and other hi-tech industries can relocate to Vietnam as the country provides them with more semi-skilled labor and highest tax incentives comparing to other non-hi-tech industries. Subcontractors and suppliers for large electronics producers such as Samsung, Hyundai, Nikon, Intel, Nissan, Toyota or LG that have re-based to the Hi-Tech Park in Vietnam can form a cluster to smooth their business processes. The Vietnamese government has extended benefits to a broader definition of hi-tech industries in the Prime Ministerial Decision No. 19/2015/QD-TTg. For example, to qualify as hi-tech industry businesses must earn at least 70% of their revenue from hi-tech products, lowered from a previous 100% requirement, starting in August 2015. One caution with investing in the CLMV region is hidden costs that may be incurred from labor disputes or poor infrastructure such as electricity blackouts in some areas in Myanmar and Cambodia.

2) Value-added strategy greatly benefits the businesses that would like to uplift their competitiveness and avoid competition in current primary product market. Thai exporters whose products include raw materials and primary products are facing intense competition from exporters based in the CLMV due to their lower costs. Industries such as agricultural, apparel, and car seat producers can turn crises into opportunities by adding value to their products. To do so, they can add value by marketing their own brands, improving product appearance and packaging, and adding more uses to existing products. For example, instead of exporting regular rice in sacks, businesses can sell branded rice in modern packaging that meets international standards, or sell flavored dried bananas instead of fresh bananas. Another idea is to export new car electronic circuit designs that meet today’s demand rather than small parts with low value-added. These high value-added products can be exported not only to Europe, the U.S. and China, but also to CLMV countries as well. In fact, Thai products are popular among consumers in this region due to their good reputation and are perceived to have higher standards than products from China, Indonesia, and domestic goods.

3) Market seeking strategy is important for industries or services that are related to improving standards of living, and answering the need especially for the ever-expanding middle-class households in the CLMV region. Household consumption in Thailand has continued to slow, growing only 1 % from the previous year. Thai businesses have felt the pressure to push demand for their products from intensifying competition, and that this situation also forces businesses to compete for customers. Therefore, new markets such as the CLMV present good opportunities for businesses to diversify away from slow growth and highly competitive domestic market. The expanding middle class of the CLMV creates a surging demand for consumer products and service. This surging demand is reflected in fast rising household consumption over the past several years. Businesses with high chance of success to expand to these new markets include construction and materials, retail businesses, convenience stores, beauty shops and spas, ready-to-eat food, consumer products, restaurants etc.

4) Opportunity seeking in related businesses could be profitable, particularly for industries linked to infrastructure investment of the CLMV. A big leap in economic development in the CLMV group after opening up to free trade led to a large investment in infrastructure and rapid urbanization. Economic powerhouses as well as international organizations such as the World Bank and the Asian Development Bank help fund many of these infrastructure projects, such as new roads, highways to connect major cities, urban railway systems, and other means of public transportation. In response, businesses that can take direct advantage from this development are construction, buy/sell/rent real estate, media businesses, telecommunication businesses and various services such as security guards, security systems, consulting businesses etc.

|

|

|

|

|

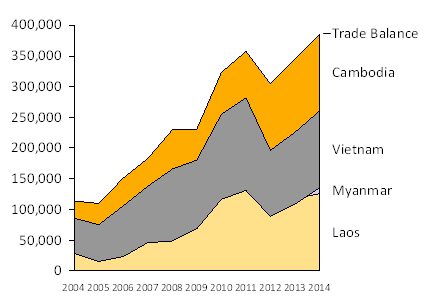

Figure 1: Trade Balance between Thailand and CVMV 2004-2014

Unit: Million THB

Source: EIC analysis based on data from MOC, Customs Department

Figure 2: Average GDP Growth 1996-2011

Unit: %

|

Source: EIC analysis based on data from ERIA (2014)

Figure 3: Thailand and CLMV minimum wage rate for 2015

Unit: Thai Baht per month

Source: EIC analysis based on data from from ILO and BBTV CH.7

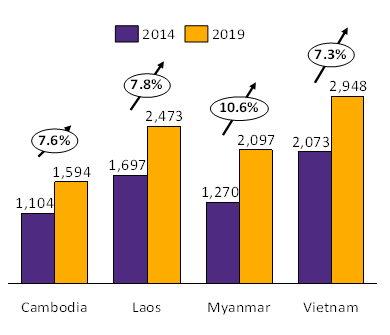

Figure 4: Income per Head during 2014-2019

Unit: Per capita GDP, nominal (USD)

Source: EIC analysis based on data from World Bank and IMF WEO

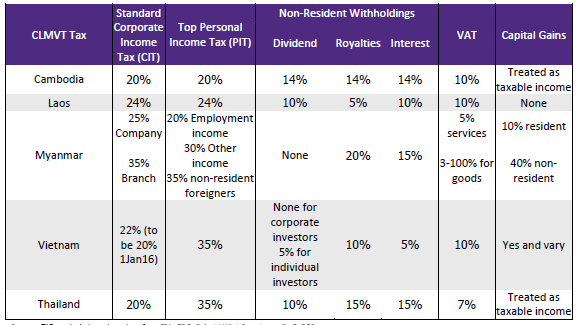

Figure 5: Summary CLMVT Tax Rates

Source: EIC analysis based on data from FIA, CDC, Polastri Wint & partners, PwC, BOI