Keep watchful eye on the future and effect from China’s peak steel supply

The large excess supply of steel in China caused China’s steel exports to rise to a record high last year. Low prices have also undermined the competitiveness of local steel producers in importing countries. Many countries have thus imposed anti-dumping duties (AD), including Thailand, which has continually extended its AD program on steel imports. Moreover, China’s steel industry adjustment policy will not sufficiently address the problems. Steel producers in importing countries, including Thailand, will face fierce competition from China until, at least, the end of 2016, and the continued impact of declining prices. Meanwhile, domestic demand in Thailand will likely remain subdued this year. To increase competitiveness, Thai manufacturers should develop their own products in terms of variety and quality in order to fit the needs of a more diversified customer base. Enabling the transfer of technology, specialization, maintaining cost and logistical time advantages, and trade alliances with high quality steel producers overseas will also add to their ability to hold on to their current domestic market share.

Author: Vipavadee Srisopa

|

Highlight

|

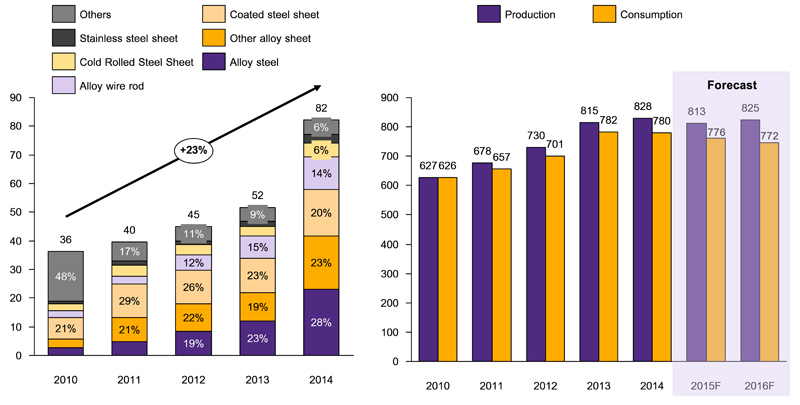

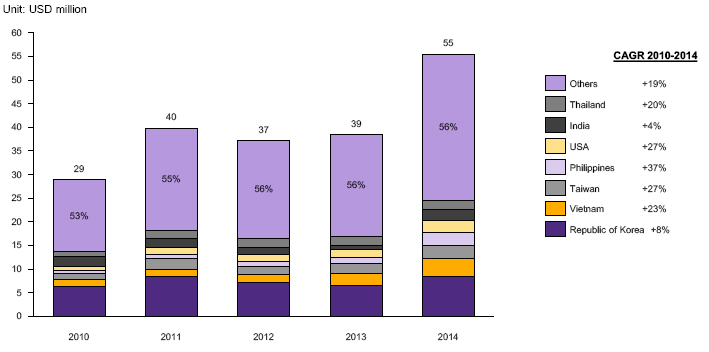

The large excess supply of steel in China pushed China’s steel exports to a record high last year. The rapid growth of the Chinese economy drove the increase in domestic demand for steel and responding investments in domestic steel production. However, due to recent slowdowns and structural changes to the economy, China’s growth rate will drop to 7% from an average of 11% seen during 2005-2011. The slowdown will cause domestic demand for steel to fall short of production capacity that earlier expanded, and in turn lead to the export of the surpluses. In 2014, China’s steel exports totaled 82 million tons, jumping by an astounding 59% (YOY) from the preceding year, or an average annual growth of 23% from 2010 (Figure 1). Countries that saw the largest growth in China’s steel imports during the past four years include Vietnam, Taiwan, the Philippines, the US, and Thailand, with average increases in imports of 23%, 27%, 37%, 27% and 20%, respectively (Figure 2).

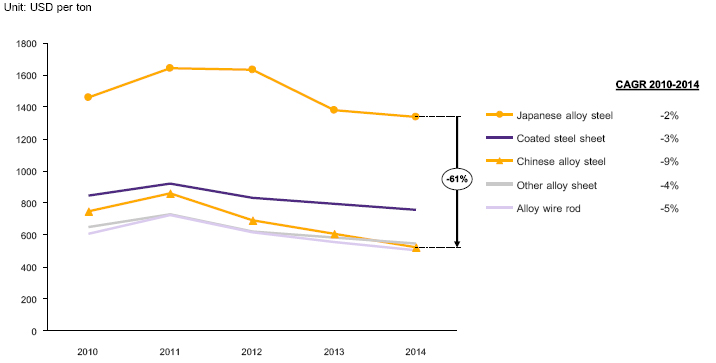

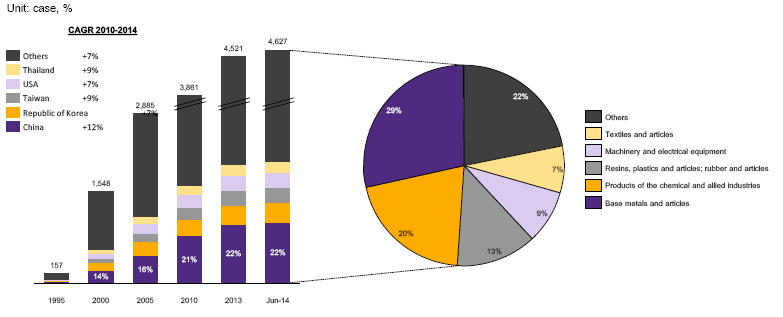

The variety of cheap steel from China puts pressures on domestic producers in steel importing countries and may lead to more anti-dumping duties going forward. Since 2010, a notable decline in prices of the top four steel exports in 2014 has been observed, including alloy steel (-9%), alloy wire rod (-5%), alloy steel plate (-4%) and coated steel sheets (-3%) (Figure 3). Besides the general declining prices, prices of each type of steel from China are much lower than those from other countries. The large price gap, such as the 61% difference between Chinese and Japanese alloy steel prices, has already triggered trade defense measures in many countries. According to the World Trade Organization, China has seen the fastest growing anti-dumping measures (AD) imposed on its exports. This share grew from an average of 12% of total AD measures exercised in 2000-2014 to 22% of total AD measures exercised in 2014. Furthermore, the share of AD imposed on steel and steel products has continuously grown, with the current share standing at 29% of total AD measures being exercised in 2014 (Figure 4). Some countries extended tariff coverage on Chinese steel imports, including the US, which extended AD to 21 types of steel from 18 during 2010-2014 and Thailand, which increased AD coverage to cover eight types of steel from a single type during the same period.

China’s steel industry adjustment policy will not sufficiently address the problems and, therefore, reduce the overcapacity. Even though the adjustment policy aims to make the market forces play a decisive role in the development of China’s steel industry, the role of the market will remain secondary to the role of the government. According to the Ministry of Industry and Information Technology of China, the policy also set the objective that the top ten steel makers should produce over 60% of the country’s total steel production by 2025. In order to achieve this target, the government will encourage merger and acquisition among steel makers and also set higher industry standard so that the enterprises that cannot meet the standard would be shut down. However, in our view, a smaller number of companies do not necessarily mean lower total steel production and capacity. Instead, this could worsen the overcapacity problem. The local government could in turn provide supports and subsidy to upgrade and expand the companies to prevent the consolidation, which hence increase the total capacity. With this, EIC expects slight change in the China’s steel industry. Production would remain ample as long as government intervention still exists. The total capacity is currently estimated at around 1,250 million ton a year while the 2014 production level was at 823 million tons, resulting in an excess capacity of 425 million tons.

Local steel manufacturers should expect competition from Chinese imports to continue until the end of 2016. Meanwhile, they will adjust to the competition by capacity reduction, employee layoffs, as well as mergers and acquisitions. The World Steel Association projects that steel consumption in China will contract by 0.5% annually in 2015 and 2016, suggesting no sign of recovery in the country’s demand for steel. However, production will continue to rise until the end of next year. Cutting back on production has proven difficult, since most Chinese steel manufacturers are state-owned or strongly connected to local governments. Although some have temporarily halted production, cuts are still outpaced by the fall in consumption. Furthermore, AD measures have been insufficient in reducing imports. To illustrate, Malaysia’s imports of wire rods from China edged up by 18%YOY in 2014, although AD measures were announced the previous year. Similarly, Thailand, for which AD measures came into effect in mid-2014, saw as much as a 57%YOY rise in imports in 2015 Q1. Amidst such import competition, steel manufacturers in various countries have begun to rethink their business strategies. Some have ceased production or shut down less-competitive facilities in order to cut costs. For example, U.S. Steel temporarily halted blast furnace operations and permanently shut down coke production in Granite City last January. Similarly, ArcelorMittal, which accounts for 38% of total production in America, announced a permanent shutdown of iron mines in Georgetown and the process is expected to be completed in September. Moreover, in order to develop new technological know-how and retain market share the firm engaged in acquisitions and partnerships with industry players. It acquired ThyssenKrupp AG, based in Calvert, U.S., and entered into a partnership with Nippon Steel & Sumitomo Metal Corporation last year under the name AM/NS Calvert. By doing so, ArcelorMittal will be able to raise capital utilization from 75-80% to 83%, which corresponds to 5.3 million tons of production. Some firms expanded their market bases via partnerships with local companies, both up and down the supply chain. Such moves not only reduce market entry barriers, but also introduce the firms to new steel resources as well as wider customers. For example, Korea-based POSCO expanded its presence in the international arena by investing in Indonesia, India, Vietnam, and Mexico, in addition to its export strategies.

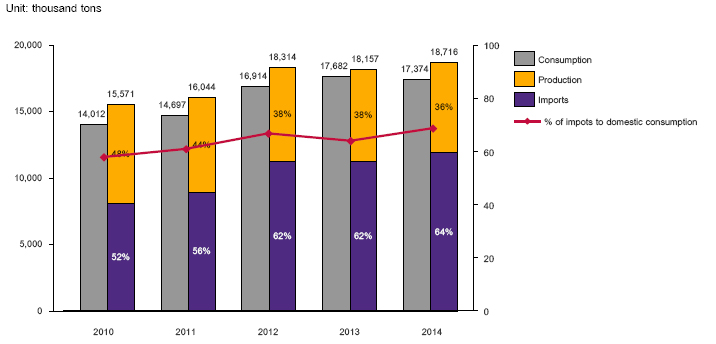

The Thai steel industry will not only suffer from heightened competition from China, but also from subdued demand and falling prices. The construction industry, the biggest consumer of steel, shows no sign of recovery, as government disbursement remains below target and construction area permits, an indicator of private construction, continue to trend downward. Moreover, global prices of materials throughout the production chain, from raw materials like iron ore, which is in excess supply, all the way to various steel products, remain depressed. As a result, producers and traders suffer from inventory loss. To make matters worse, rising imports over the past four years mean ever-increasing reliance on imports and receding market share for domestic producers. Imports have grown by 8% on average, compared to only 2% growth for local production, raising the import share from 58% in 2010 to 69% in 2014 (Figure 5). The phenomenon can be explained partly by larger production capacity among Chinese manufacturers, which impairs the price competitiveness of Thai firms. Large Chinese steel mills stand to gain from economies of scale (Figure 6). China’s comparative advantage also benefits from a lower production cost due to low labor costs and cheaper iron ore, the main raw material in making steel, whose value has dropped due to the increased mining capacity of large mining firms in Australia. Such factors, along with tax benefits for local exporters, allow China to maintain low export prices. As prices still show no sign of recovery in the near future and Thai firms lack the economy of scale, permanent loss of competitiveness poses a major concern.

|

|

|

|

|

Figure 1: Chinese export quantity by product type and Chinese steel production and consumption

Source: EIC analysis based on data from Trademap and ISIT

Figure 2: Value of Chinese steel exports by destination

Source: EIC analysis based on data from Trademap

Figure 3: Chinese export prices by product type

Source: EIC analysis based on data from Trademap

Figure 4: Accumulated anti-dumping initiations by exporter 1995 - June 2014 and Proportion of goods that have implemented in 2014

Source: EIC analysis based on data from WTO

Figure 5: Production, consumption and imports of steel in Thailand

Source: EIC analysis based on data from ISIT

Figure 6: Production capacity of steel manufacturers

Source: EIC analysis based on data from WSA and company’s annual reports