Rubber prices keep falling. Shall we switch to oil palm?

Recent news of farmers switching crops from rubber to palm trees leads to questions about whether Thai palm oil products are competitive enough in the global market and whether the palm oil industry is an attractive investment option. Based on EIC analysis, the palm oil market has tremendous growth potential. However, Thai palm oil products are less competitive than those of major producers such as Indonesia and Malaysia due to lower productivity and higher cost. In the long run, this industry could suffer from volatile changes in consumer behaviour. EIC therefore opines that smaller entrepreneurs will bear high risk. However, to be ready for this high growth potential, Thailand should develop an integrated system of production to improve productivity and reduce costs to enhance its competitiveness. Additionally, Thailand must find ways to create value-added products, perhaps by using palm oil as input in other industries. This will provide alternatives to solely relying on demand for palm oil products directly.

Author: Veerawan Chayanon

|

Highlight Recent news of farmers switching crops from rubber to palm trees leads to questions about whether Thai palm oil products are competitive enough in the global market and whether the palm oil industry is an attractive investment option. Based on EIC analysis, the palm oil market has tremendous growth potential. However, Thai palm oil products are less competitive than those of major producers such as Indonesia and Malaysia due to lower productivity and higher cost. In the long run, this industry could suffer from volatile changes in consumer behaviour. EIC therefore opines that smaller entrepreneurs will bear high risk. However, to be ready for this high growth potential, Thailand should develop an integrated system of production to improve productivity and reduce costs to enhance its competitiveness. Additionally, Thailand must find ways to create value-added products, perhaps by using palm oil as input in other industries. This will provide alternatives to solely relying on demand for palm oil products directly.

|

Recent news of farmers switching crops from rubber to palm trees leads to questions about whether Thai palm oil products are competitive enough in the global market and whether the palm oil industry is an attractive investment option. Based on EIC analysis, the palm oil market has tremendous growth potential. However, Thai palm oil products are less competitive than those of major producers such as Indonesia and Malaysia due to lower productivity and higher cost. In the long run, this industry could suffer from volatile changes in consumer behaviour. EIC therefore opines that smaller entrepreneurs will bear high risk. However, to be ready for this high growth potential, Thailand should develop an integrated system of production to improve productivity and reduce costs to enhance its competitiveness. Additionally, Thailand must find ways to create value-added products, perhaps by using palm oil as input in other industries. This will provide alternatives to solely relying on demand for palm oil products directly.

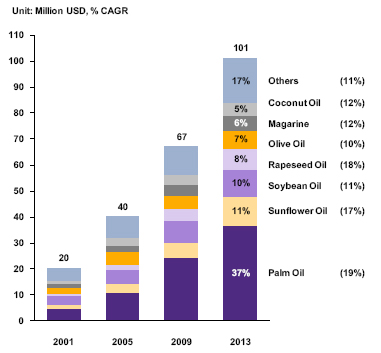

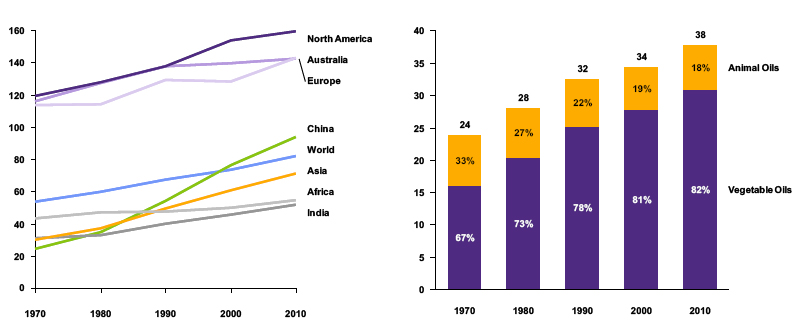

Explosive growth in demand for palm oil over the past decade along with falling rubber prices has garnered investment interest in the palm oil industry. Palm oil is not only the most consumed vegetable oil in the world, it also has the highest import value, which has been growing at 19% per year during the past decade (Figures 1 and 2). Most imported products are refined palm oil, which account for 65% of total import value, while the remainder are crude palm oil imports. Palm oil is primarily used for direct consumption and food products. It can also be used for cosmetics, detergents, and chemicals, and is becoming increasingly popular as a source of alternative energy such as biodiesel. Global demand for vegetable oil continues to increase, with the share of vegetable oil consumption, compared to animal oil, rising from 67% in 1970 to 82% in 2010 (Figure 3). Furthermore, another attractive characteristic of the palm oil market is that historical prices have been more stable than rubber prices and remained above production costs. In the past three years, natural rubber made much less profit per rai than palm trees, and incurred losses in 2014 due to a sharp drop in rubber prices (Figure 4).

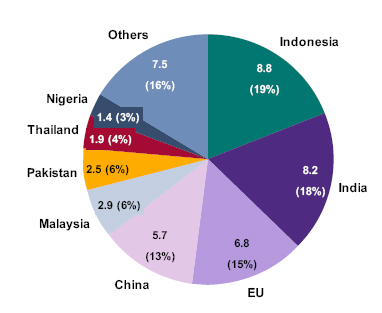

Despite being the third largest palm oil producer in the world, Thailand maintains a very small share of the export market because most products are used for domestic consumption. Two other producers with the highest production levels and largest export values are Indonesia and Malaysia, whose shares of the world's export market are 47% and 37%, respectively. More suitable climate and soil conditions for growing palm trees make Thailand the third largest palm-oil producer in the world, yet its export market share is only 1.3%. This is partly because the Thai palm oil industry only focuses on meeting domestic demand, which accounts for 90% of total production. Only the remaining 10% is exported to key trading partners India, Germany, and Myanmar. On the other hand, Indonesia and Malaysia devote much more farm area for palm tree plantation and thus yield higher production levels. As the result, they generally export as much as 80% of total production despite being the world’s leading consumers of palm oil (Figure 5).

EIC finds that the main causes of Thailand's low competitiveness in the palm oil market are its high production costs and low productivity. Small-scale farmers operate in 75% of total plantation areas. On the other hand, in Indonesia and Malaysia 60% and 80% of plantation areas, respectively, are operated by large and state-owned enterprises that also own refineries and other downstream operations. With better production chain management, Indonesian and Malaysian producers can fully control production processes and efficiently manage costs. They also benefit from economies of scale. In Thailand, there has been an attempt to form agricultural cooperatives to empower small famers and strengthen their bargaining power. However, only 20% of small Thai farmers participate in such groups. Moreover, plantation areas in Thailand are generally small plots whose narrow planting rows affect planting and harvesting productivity. Additionally, one major problem that Thai oil palm growers are encountering is palm oil loss between the harvesting and refining processes because of the distance between farms and refineries. These factors make Thailand's palm-oil extraction rate lower than that of Malaysia and Indonesia (Figure 6).

Furthermore, oil palm farmers in Malaysia and Indonesia have acquired more harvesting know-how and better management skills than farmers in Thailand. Several official organisations in Malaysia and Indonesia are constantly fostering this industry. For example, the Malaysia Palm Oil Board (MPOB) and Indonesian Palm Oil Board (DMSI) play important roles in setting strategic direction for industry development and invest in research and development for new varieties of palm trees in order to improve quality and yield. Additionally, there are organisations that support farmers in setting up plantation plots, help boost extracting and refining efficiency, promote value-added uses, and support other marketing activities. Meanwhile, in Thailand, there are the National Palm Oil Policy Committee and a sub-committee setting policy direction and handling domestic oil-palm consumption, but farmer supports and product promotions are not concrete like Indonesia and Malaysia.

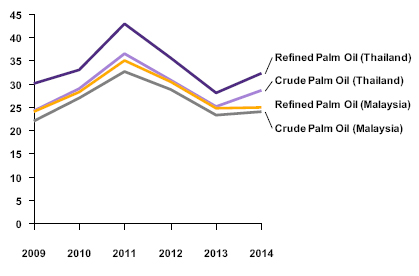

Given its higher cost and lower productivity, Thailand's refined palm oil cannot compete in the global market. Instead, the industry exports crude palm oil that is in excess of domestic demand. EIC finds that 80% of Thai palm-oil exports are crude palm oil and sometimes major importers, such as Germany and Malaysia, turn crude palm oil from Thailand into refined palm oil for re-export. This is because the production of Thai palm oil has high refining costs and mark up 20-30% higher price than its competitors (Figure 7). Therefore, Thai producers cannot capture a large share in global palm oil market, especially for refined oil products.

Disadvantages in terms of productivity and costs will leave Thailand's palm oil industry exposed to risks when several free-trade agreements commence. Under the WTO, AFTA, and FTA trade agreements, Thailand lowered its tariff on palm oil and palm kernel oil from ASEAN to 0% as of January, 1st, 2010. However, the government assigns the Public Warehouse Organization (PWO) to manage palm-oil imports for domestic uses under a Safeguard Measure that prevents a sudden surge in imports within the WTO framework. In the past, the PWO has imported crude palm oil from neighbouring countries when domestic supplies are scarce. This, however, affects palm-tree farmers in Thailand because of the lower cost of crude palm oil from Indonesia and Malaysia. If the safeguard measure is lifted in the future, there will likely be a large influx of cheap palm oil, hurting Thai producers who cannot compete on price.

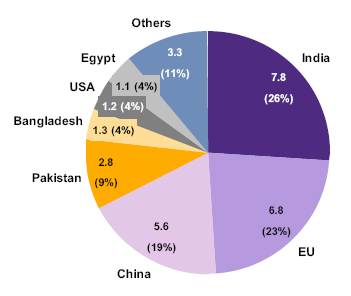

The end of Thailand's GSP privileges in the EU market have made Thai crude palm oil even more expensive than its competitors and further damaged Thailand's competitiveness in palm oil products. The GSP privileges ended on the last day of 2014, after Thailand met the criteria as an upper-middle income country for over three years. Even though Malaysia also lost the same privileges, Thai crude palm oil prices are still 20% higher than those for palm oil from Malaysia. At the same time, Indonesia is still qualified for the privileges. The loss of GSP will make Thailand even less price-competitive in the EU market, which is the second largest importer after India (Figure 8). This is reflected in the sharp 50% drop in Thai palm-oil exports to the EU in the first quarter of 2015. Nevertheless, a lack of palm oil supply in Thailand in late 2014 also contributed to this fall as well.

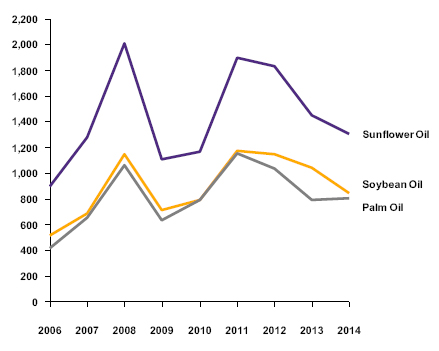

Although the palm oil industry has strong growth potential, EIC finds that much uncertainty remains because health-conscious consumers are switching to other types of vegetable oil. Palm oil contains a high level of saturated fat that causes obesity, cardiovascular disease, and stroke. Health awareness trends anticipate a shift from palm oil to other vegetable oils with less saturated-fat content and similar prices such as soybean oil that contains 70% less saturated fats than palm oil. Moreover, soybean oil prices have been falling over time (Figure 9) because production levels in the Americas are rising. These trends could affect demand for palm oil in the future.

Additionally, increasing awareness about the environmental impact of palm plantations will present obstacles to the industry. Oil-palm trees grow well in a tight tropical belt. In Indonesia and Malaysia, palm plantations replaced large areas of tropical rainforest especially Indonesia which has the largest area of palm plantations and the fastest expansion rate. Indeed, deforestation affects the ecosystem, wildlife, and climate. Regarding this issue, Germany, one of the largest palm-oil importers, has been campaigning against palm oil products from unsustainable sources by establishing The Roundtable on Sustainable Palm Oil (RSPO) to certify products under the "Green Palm Sustainability” scheme. Today, only 18% of palm oil sources around the world meet RSPO standards. In Thailand, only six large producers and 18 refineries (out of 97) are certified. The RSPO standard is therefore an issue that Thailand should take into account in order to enhance its competitiveness and decrease risks might be occurred in Thailand’s export if RSPO is considered as a non-tariff trade barrier in the future.

In sum, the palm oil industry has strong growth potential and should be able to cope with future uncertainties. This industry should be considered as a potential growth driver for the Thai economy. Nonetheless, Thailand still needs to improve on its productivity and lower production costs in order to compete in the global market. It should also find other ways to utilise palm oil to reduce risks from any changes in consumer behaviour regarding vegetable oil in the long run.

|

|

|

|

|

|

Figure 1: Global consumption of vegetable oils in 2014 |

Figure 2: Global import of edible oils during 2001 and 2013 |

| Unit: Million Tonnes, % | Unit: Million USD, % CAGR |

|

|

| Source: EIC analysis based on data from USDA | Source: EIC analysis based on data from Trade Map |

|

Figure 3: Global fats consumption during 1970 and 2010 |

|

|

Unit: grams / capita / day |

|

Source: EIC analysis based on data from FAO |

|

| Figure 4: Products price and profit of palm comparing to rubber during 2007 and 2014 | |

Source: EIC analysis based on data from DIT, OAE, and Thai Rubber Research Institute of Thailand |

|

| Figure 5: Major consumers of palm oil in 2014 | Figure 6: Palm oil extraction rate comparison |

| Unit: Million Tonnes, % | Unit: % |

|

|

| Source: EIC analysis based on data from USDA | Source: EIC analysis based on data from FAO |

| Figure 7: Thailand’s crude and refined palm oil price comparing to Malaysia | Figure 8: Major importers of palm oil in 2014 |

| Unit: Baht/Kilogram | Unit: Million Tonnes, % |

|

|

| Source: EIC analysis based on data from DIT | Source: EIC analysis based on data from USDA |

|

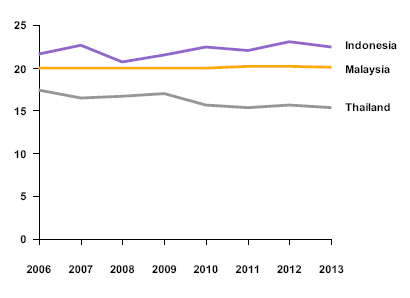

Figure 9: Global palm oil price comparing to sunflower oil and soybean oil during 2006 and 2014 |

|

| Unit: USD / Ton | |

Source: EIC analysis based on data from USDA |

|