Tutoring schools growth opportunities and the impact of tax collection

- Legislation related to tutoring schools in Thailand favors their growth. Tutoring-school tax collection may lead to a rise in tutoring fees and the clustering of tutoring schools in major cities more than in secondary cities. Nonetheless, there is still ample room for growth in the industry since the proportion of students using tutoring school services is still low and our education system still centers around test scores. - After the enactment of tutoring school taxes tutoring school operators will have to invest in accounting systems and tax planning. Moreover, tutoring schools will need more business-oriented management plans. Operators should find their own comparative advantages to distinguish themselves from their competitors in response to higher costs.

Author: Lapas Akaraphanth

|

|

|

Thailand’s laws are quite lax and accommodating to tutoring school growth in comparison to tutoring-school related laws abroad. Laws in each country differ according to how much importance the government places on tutoring services. The Thai government still places much importance on tutoring schools, hence the laws are relatively business friendly. There are very few restrictions on tutoring businesses in Thailand in comparison to other leading countries in Asia that already impose taxes on tutoring schools. In Japan and Singapore there are specific committees functioning separately from the Education Ministry to inspect and regulate tutoring schools. Teachers in Singapore must be qualified to tutor at each grade level, and advertisement controls are in place to prevent tutoring schools from presenting false information or exaggerating. In South Korea and Hong Kong there are limits on the number of students in each classroom to ensure the highest quality. Tax collection on tutoring schools is merely a mechanism to enhance efficiency of the whole education system so that the government can more easily inspect and control tutoring school tuition fees. Currently, Thailand only imposes a rule that tutoring schools’ profits cannot exceed 20%. This, together with relatively lax laws, has led to the rapid expansion of Thai tutoring schools.

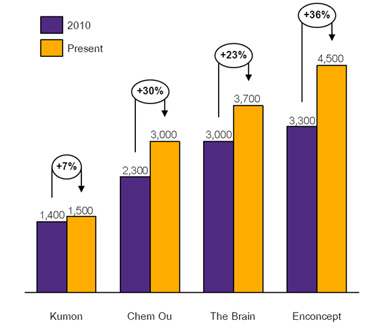

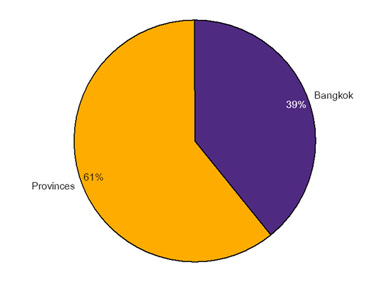

Taxation of tutoring schools will likely increase tuition fees and increase the clustering of tutoring schools in major cities more than in secondary cities. From 2010 until now tutoring fees have increased about 30% on average and are expected to continue to increase as a result of higher costs from taxation. The rise is expected especially for franchise tutoring school operations because these schools have expanded to increase the number of students without raising tuition fees much in the past. For instance, franchise operator Kumon has increased tuition fees only 7% in the past five years, while other tutoring schools have continuously increased their tuition fees. Taxation will likely increase franchise-selling tutoring school tuition fees because of higher cost burdens. Moreover, the higher tax burden will make tutoring school operators more cautious about school locations. There must be a high density of students who can afford tuition in school locations. In turn, this may result in lower accessibility to tutoring schools for low-income families. Presently 39% of students attending tutoring schools are concentrated in Bangkok. Consequently, locations for new tutoring school branches will likely concentrate in major cities rather than in secondary cities.

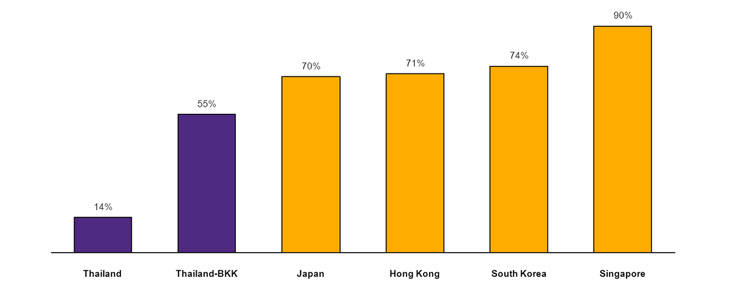

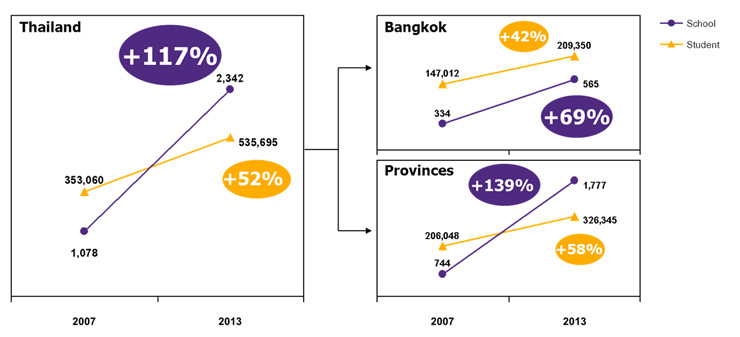

The ratio of tutoring students to regular school students is not yet very high—a promising prospect for tutoring school expansion in the future. Tutoring school income totaled 10 billion baht from approximately 535,000 students, who comprise only 14% of the nation's total number of students. In Bangkok, tutoring students account for 55% of the total number of students, which is still a small number compared to other countries in Asia. For example, 74% of students attend tutoring schools in South Korea, 70% in Japan, and 90% in Singapore. Moreover, South Korean families spend 16% of their expenditures on tutoring fees, while Thai families only spend 2 to 3%. This shows the high growth capacity for tutoring schools in Thailand, especially outside of Bangkok where the number of tutoring schools and students leapt during 2007-2013. Tutoring schools outside Bangkok showed 139% growth in comparison to 69% growth in Bangkok, while there was a growth of 58% in the number of tutoring students outside Bangkok in comparison to 42% growth in Bangkok. This shows high growth potential in provincial areas, especially considering the large population living outside of Bangkok.

Additionally, the test-score driven education system, especially for university admissions, helps sustain the growth of tutoring schools. Thai education favors test-score based assessments. Test scores and the rankings of applicants’ previous schools are the main determinant in admissions to primary schools, secondary schools, and universities as well as to jobs. Based on university admission process statistics, Thai universities put the most weight on previous test scores, rather than achievements. In contrast, Western and other Asian countries, such as South Korea and Malaysia, put more emphasis on an individual’s previous achievements, such as jobs, internships, and volunteering experiences. Moreover, 2013 statistics reveal that the top five universities in Thailand admit only 7.8 % of all first-year undergraduates. This highly competitive nature of Thai undergraduate admission consequently steers parents and students toward tutoring schools to gain an edge over other students.

|

|

|

|

|

Figure1: Comparison of laws and regulations on tutoring schools in different countries

|

Source: EIC analysis based on data from NCSPE, CPE Singapore, and UNESCO

|

Figure 2: Tutoring fees have increased 28% from 2010 |

Figure 3: Most tutorial service customers are in Bangkok |

| Unit: baht per course | Unit: % student |

|

|

Source: EIC analysis based on data from the Ministry of Education and tutoring school websites

Figure 4: The proportion of tutored students to total secondary school students is still low

Source: EIC analysis based on data from the Ministry of Education and UNESCO

Figure 5: The expansion of tutoring schools and their students in Thailand

Unit: school, student

Source: EIC analysis based on data from the Ministry of Education

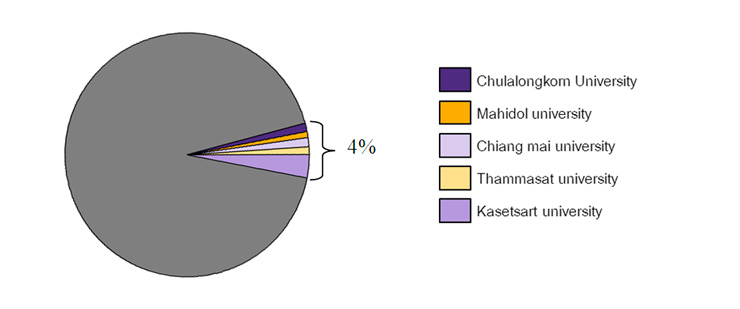

Figure 6: The proportion of first-year undergraduates in top universities to all first-year undergraduates in Thailand in 2013

Unit: %

Source: EIC analysis based on data from the Ministry of Education

Figure 7: Criteria used by universities to determine admission in each counties

|

Source: EIC analysis based on data from OECD