Can Nano Finance unleash the grassroots from loan shark problems?

- EIC expects that within the initial two to three years of the Nano-finance scheme, Nano-finance’s loans will amount 35 to 60 billion baht. Although the program aims to allow the grassroots to have easier access to obtain credits, the loan issuance may be initially concentrated at two main groups: 1) current borrowers of informal loans and 2) bank borrowers that are classed as special mention group. - EIC views that the Nano-finance scheme will alleviate informal loan problems at a gradual pace since 1) the group of businesses interested in becoming Nano-finance lenders are mostly small enterprises, 2) these operators are not as familiar with the customers as their competitors providing informal loans; and 3) even though there is flexibility added in loan issuance processes, credit issuance will still be stringent for new borrowers due to the high risk nature of Nano finance.

Author: Piyakorn Chonlaworn and Pakanee Pongpirodom

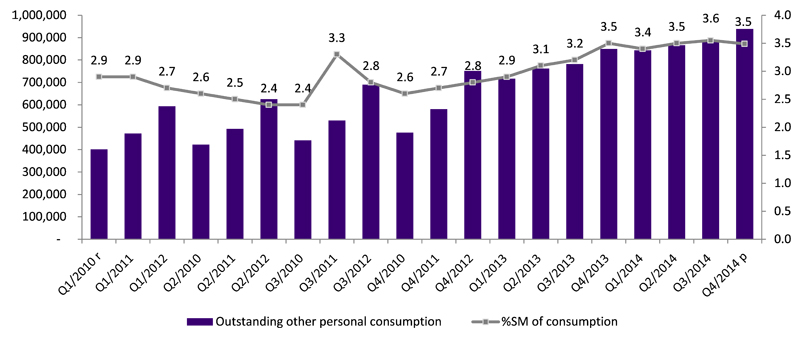

The Nano-finance scheme aims to tackle the problem of informal loans, of which outstanding currently stood at more than 5 trillion baht: a burden shared among 8 million Thai households. In 2014, 8 million households or one third of the total Thai households (22 million households1) had insufficient incomes to cover their living costs. Each household took out illegal loans as much as 600,000 to 1,500,000 baht, totaled to be 5 trillion baht in the economy. The government and related agencies have had a continuous effort to manage illegal lending problems. Most recently on January 26th, 2015, the Bank of Thailand (BOT) have approved the Nano-financing scheme that aims to ease the loan shark problem and promote better access to capital that would expand occupational opportunities of the borrowers. Nano finance is a flexible credit process designed to meet the financial needs of customers, such as new business owners. Each borrower may borrow not more than 100,000 baht at an interest rate up to 36% per annum without any collateral. As for a business operator who wishes to acquire a Nano-finance lender permit, the operator will need a minimum of 50 million baht of registered capital, with a debt-to-equity ratio not exceeding seven times (Figure 1). The pitfall of informal loans is the borrowers’ failure to assess their own debt repayment capacity, while taken into account the high and swiftly rising interest rates of loan shark. This eventually leads to a vicious cycle of rolling over debts. A study on informal loans in Thailand2 revealed multiple reasons why people are dependent on illegal lending. The reasons include the lack of financial discipline and consumerism trends that have led to overspending. The borrowers ultimately fall into a trap of debt rollover—when borrowers take out loans to pay off other more urgent debts, which in turn further exacerbate the borrowers’ debt position. The BOT governor3 has also offered views on the root causes of spending misbehaviors, including 1) poverty which some have insufficient funds to maintain minimum living standards and need to resort to debt finance, 2) rising trends of consumerism which bring about careless spending, and 3) the lack of putting financial knowledge into practice which contributes to the inefficacy of a well-designed personal finance education. These three factors have turned parts of the population towards illegal loans that further create heavy financial burdens from high interest expenses for them. Because of the more flexible process in credit issuance, Nano finance will be probably prone to steer borrowers from loansharking. From the beginning, the government chose state financial institutions or government-owned banks as tools to alleviate illegal lending problems (Figure 2). For example, “People Bank Project” by the Government Savings Bank (GSB) was established to provide funds or revolving funds for work-related investment, living costs, or settling other debts. “Project to Regulate Illegal Lending to Farmers and Householders” by Bank for Agriculture and Agricultural Cooperatives (BAAC) was intended to relieve farmers’ debts that were resulted from unavoidable events. Loan shark has still persisted; however, several measures were carried out to moderate the illegal lending problems. The latest attempt from the government is the Nano-finance scheme with the objective to increase accessibility of legal loans. The major characteristic of Nano-finance scheme, comparable with this of informal loans, is its flexibility in credit issuance. The borrowers do not need to have a steady income, payroll, financial history, or collateral. It also allows those with the default of credit bureau to lend (Figure 3). EIC expects that within the initial two to three years of the Nano-financing scheme, Nano-finance’s loans will amount 35 to 60 billion baht. The demand for Nano finance would probably stem from two groups. First are the existing loan shark customers, and the others are the existing debtors of legal lenders who cannot settle their debts. EIC also expects 0.5 to 1 percent or approximately 25 to 50 billion baht of the illegal loans will relocate to the Nano finance. However, with the familiarity and simplicity of illegal lending, borrowers may not transit into the Nano finance as much as expected despite of being faced with high interest rate. Furthermore, the customers of Nano finance may borrow to settle illegal debts rather than to invest in other economic activities. If this takes place, borrowers will unavoidably relapse into loansharking when the loan is used up. The second group is the debtors who are already in the legal lending system and classed as special mention (SM) group. Indeed, these are debtors who cannot make repayment within 30 days but no longer than 90 days. The SM will use the loan to repay other legal debts to maintain their credit scores. The value of debts for this group at the end of 2014 stood at 32.7 billion baht. EIC expects that 10 billion baht or 30 percent of the SM loans will move into Nano finance in lieu of loan sharks since the maximum interest rate of Nano finance is at 36 percent per annum, which is very low in comparison to illegal lending. However, the eradication of loansharking will take time since it has been a persistent problem for a long time. Even though Nano finance may help alleviate the problem to a certain extent, it still has some shortfalls. EIC views that the amount of Nano-finance credit issuance will be based on who are the Nano finance operators and the amount of Nano-finance loan may be limited for three reasons. Firstly, most of the interested operators of Nano finance that have applied for the lending licenses are small enterprises (Figure 5). Moreover, these establishments are aware of the high risks of late payments or defaults in Nano finance. To limit the risks, they will probably lend to their existing customers first before expanding credits to new customers. Secondly, unlike loan sharks, Nano-finance lenders may not get familiar with borrowers and do not have channels to access borrowers. Finally, although the Nano finance scheme has high flexibility in credit granting, it is also high risk due to the lack of collateral between the lenders and the borrowers. As a result, lenders would impose stringent criterions in loan issuance, which leads to low accessibility to credits. Due to the three factors mentioned above, the reallocation of illegal loans into the legal credit system is expected to happen slowly. To attack the illegal lending problem seriously, other assistive measures are needed. These measures include educating people about saving and financial planning, following up borrowers’ behavior in order not to relapse into creating debts, and assisting them in finding occupations that can provide them with income sustainably.

1 The National Economic and Social Development Board (NESDB) 2 Pataichit Aekchariyakorn cited in the article on informal loans in Thai society 3 https://www.bot.or.th/Thai/PressandSpeeches/Speeches/Gov/SpeechGov_%2016Dec%202014.pdf

|

|||||||

Figure 1: Requirements of Nano Finance Operators and Borrowers

|

Source: EIC analysis based on data from BOT

Figure 2: Chronicles of government schemes against illegal lending

|

Source: EIC analysis based on data from the BOT, MOF, and MOJ

Figure 3: Comparison of Informal loans, Nano Finance, and Personal Loans

|

Source: EIC analysis based on data from BOT and related commercial bank websites

Figure 4: Outstanding for Consumer Loans and Percent of Special Mention Loans

Source: EIC analysis based on data from the BOT

Figure 5: Business Operators that have applied for Nano Finance Lending Licenses

|

Source: Analysis by EIC using data from SETTRADE and the companies’ websites