Thailand’s Special Economic Zone – National roadmap and new opportunities to watch out

EIC expects Mae Sot, Aranyaprathet, and Sadao to be the three leading Special Economic Zone (SEZ) pilot areas with the greatest potential for development and sustainable growth. These three areas have better infrastructure, production-based business activities, and trade portfolios in place compared to other areas. Textiles, processed food, and labor-intensive industries will benefit from the movement of production bases to SEZ. Meanwhile, warehouses, distribution centers, logistics, retail and wholesale consumer goods, and healthcare industry will benefit from investment promotion privileges.

Author: Chotika Chummee and Srinarin Poudpongpaiboon

|

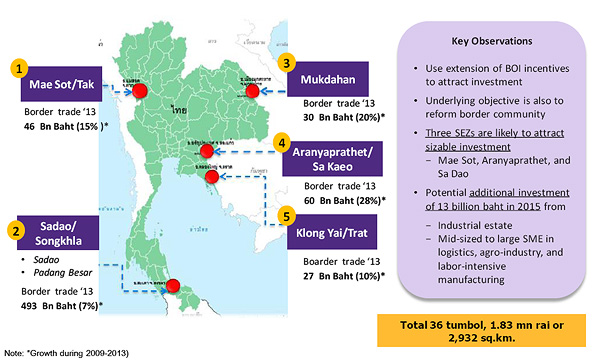

In July 2014, the government approved initial SEZ development covering the five border areas: 1) Mae Sot district, Tak 2) Aranyaprathet, Sa Kaew 3) Khlong Yai, Trat 4) Mueang, Mukdahan, and 5) Sadao, Songkhla (Sadao and Padang Besar checkpoints)(Figure 1). The main objectives of this development are to attract foreign directive investment (FDI), generate employment, improve living conditions through income distribution, improve border area security, and enhance Thailand's competitiveness to prepare for entry into the impending AEC in 2015. Moreover, SEZ establishment will also help tackle the smuggling of migrant workers and goods from neighboring countries. The five pilot areas, which cover the total area of 1.83 million rai or 2,932 sq. km., have great potential for border trade expansion due to their existing production-based business activities, infrastructure, and labor abundance. These areas also have geographical advantages as they are not prone to natural disasters and have sound international security records. In terms of work force, Mae Sot is a destination for low-skilled workers from Myanmar. These workers will be essential for labor-intensive industries, such as textiles, apparel, and leatherwear. Geographically, Mae Sot also benefits from being on the west side of the East West Economic Corridor (EWEC), with great potential for warehouse, distribution center, and logistics industries. EIC sees these activities as interesting and having positive growth potential.

As for Aranyaprathet, the area also has a great potential as a labor-intensive manufacturing base and other businesses such as wholesale and retail trade centers, transportation, and international warehouses. Like Mae Sot, Aranyaprathet benefits geographically from being on the east side of the Southern Economic Corridor (SEC), with a connecting route to the Poipet O'Neang SEZ (POSEZ) and the Sisopon industrial estate in Cambodia. In addition, Aranyaprathet has access to the sea via seaports in Vietnam. These factors are vital for the transportation and international warehouse industries.

Sadao is a suitable location for the manufacture of agricultural by-products, especially rubber and seafood. It also has potential to be a trading center and a major gateway for exports to Malaysia, Singapore, and Indonesia. The fact that Sadao is located close to Penang port, Central Port, heavy-duty industrial sites, Halal industrial sites, and rubber industrial sites in Malaysia will help expand Thailand's exports of primary processed natural rubbers, such as rubber gloves, tires, and auto parts to Malaysia. It is worth noting that the Sadao and Padang Besar customs checkpoints have the highest border trade value in Thailand. In order to prepare the country for the SEZ promotion, the government currently has a plan to expand the customs checkpoint areas and is in the process of designing infrastructure. The preparations also include building of the Had Yai - Sadao motorway and the Had Yai - Padang Besar double-track railway. The private sector in the SEZ area has requested the allocation of duty free zone within the SEZ, along the border areas between Sadao and Padang Besar. The proposed duty free zone will focus not only on sales of merchandise, but also serve to promote commercial and lifestyle spending to Thai, Malaysian, and Singaporean visitors. EIC feels that the duty free zone will be fruitful for trade, investment, and tourism, especially as the country is preparing for entry into the AEC early next year.

Thailand's three leading pilot areas have greater investment promotion privileges and infrastructure readiness for attracting FDI compared with SEZs in neighboring countries; Myanmar, Cambodia, and Malaysia. Cambodia appears to have a similar level of investment promotion privileges as Thailand's. Eligible projects in Cambodia will be granted a 9-year corporate income tax exemption, exemption of import duty on raw materials, and permission to own land for up to 99 years. These privileges are similar to Thai policy, putting Cambodia into a state of rivalry with Aranyaprathet district in Sa Kaew. However, infrastructure in Thailand is in considerably better condition, such as utilities (electricity and water), road conditions, and transportation routes. EIC therefore expects that Thailand will perform better in attracting FDI than Cambodia. Nevertheless, one of the drawbacks that can hinder foreign investment is the acquiring of affordable land. The price of the land has sky-rocketed since the announcement of SEZ locations. Mae Sot, for example, has seen the price of land increase up to five times and it continues to rise. Investors could feel discouraged, as high land prices might affect the investments' viability.

In order for a SEZ to achieve its goals, it is advised to encourage infrastructure development for regional connectivity, and truly integrated one-stop services at checkpoints to support impending trade and investment expansion effectively. Investment promotion privileges for SEZs will bring more traffic, footfalls, transportation, and communication activities to these areas, so it is vital to have infrastructure in place beforehand. Transportation development will become essential, such as expanding roads from three to four lanes on routes heading toward border areas, the construction of a motorway route from Hat Yai to Sadao, the construction of double-track railways from designated SEZs to ports near lorry stopover points, and the expansion of Mae Sot airport. In addition, electricity, water supply, and communications utilities in each province must be sufficient to catch up with rapid economic growth in border areas.

|

|||||||

Figure 1: Five border areas will be developed as SEZs at the initial stage to boost Thailand's border trade and prepare for the arrival of AEC

Source: NESDB, Department of Foreign Trade

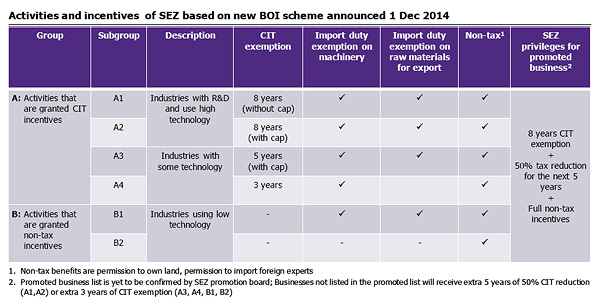

Figure 2: Labor-intensive industries which located in SEZ will be given an 8-year corporate income tax exemption and receive a 50% reduction in corporate income tax for extra five years

Source: Data from BOI