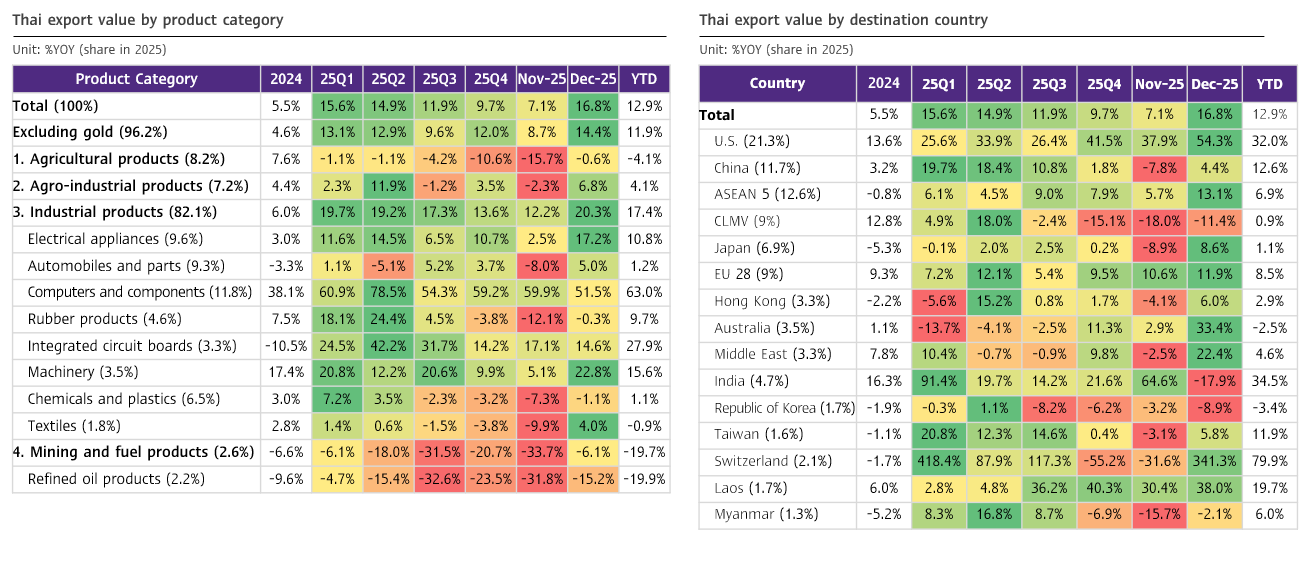

Thai exports grew strongly by 12.9% in 2025, while export growth in 2026 is expected to slow considerably, weighed down by the impact of U.S. tariffs and a high base effect.

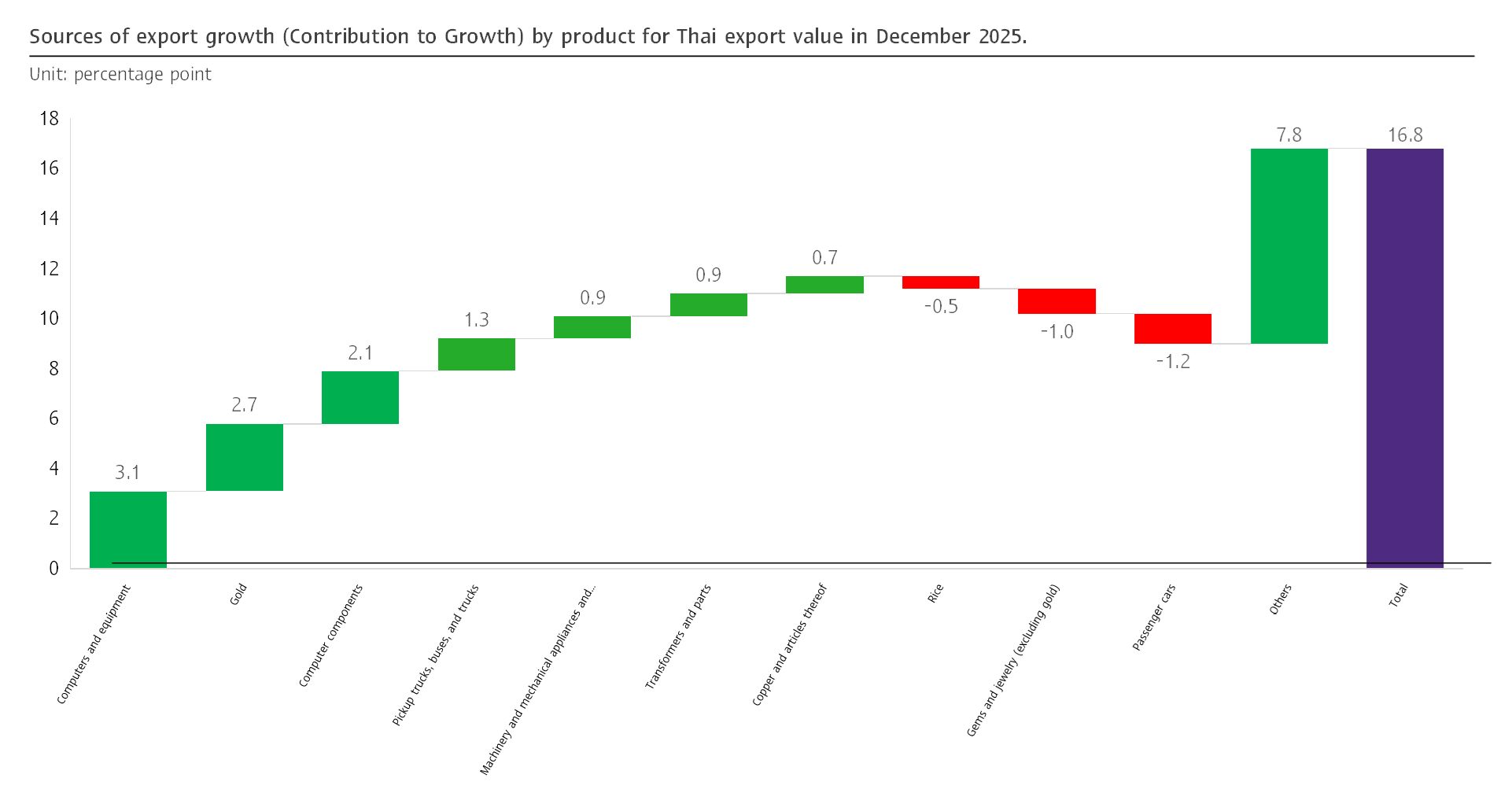

The value of Thai merchandise exports in December 2025 stood at USD 28,835 million, expanding sharply by 16.8%YOY.

The value of Thai merchandise exports in December 2025 stood at USD 28,835 million, expanding sharply by 16.8%YOY, accelerating from 7.1%YOY in the previous month and exceeding expectations (SCB EIC estimate: 10.5%; Reuters Poll median: 8.7%). On a seasonally adjusted basis, exports rebounded to a strong expansion of 6.9%MOM_SA, after contracting for two consecutive months.

Exports of electronic products and exports to the US remained the key supporting factors, while gold exports rebounded to strong growth once again.

- Thai exports to the US continued to expand strongly by 54.3%YOY in December 2025, despite higher tariff barriers imposed on many products. Exports to the US accelerated further toward the end of 2025 compared with 37.9%YOY in November. Even when excluding electronic products—which remain exempt from US import tariffs—exports to the US still recorded robust growth of 21.7%YOY, reflecting strong demand for Thai products in the US market despite tariff pressures.

Despite facing higher tariffs, 13 out of 15 major Thai export products to the US posted solid expansion, particularly electronic and electrical products. These included computers, equipment and parts; teleprinters, telephone sets and parts; electrical transformers and parts; machinery and parts; and air conditioners and parts, which expanded by 123%, 117.3%, 86.6%, 48.4%, and 46.5%, respectively. Exports to the US contributed 10.2 percentage points (CTG) to Thailand’s export growth this month, accounting for more than half of the total export expansion of 16.8%. - Exports of electronic products continued to expand strongly, supported by shipments to the US market, the global electronics upcycle, and the expansion of investment in the electronics industry and data centers worldwide. Electronic exports recorded a robust growth of 52.8%YOY, accelerating from 46.2%YOY and 38.8%YOY in November and October, respectively, and extending the expansion streak to 21 consecutive months.

By market, 13 out of the top 15 destinations for Thai electronic exports posted growth, with 10 markets expanding by more than 15%YOY. Exports to the US, Mexico, and India surged by 114.2%, 122.8%, and 152.6%, respectively. Overall, exports of electronic products contributed 10.1 percentage points (CTG) to Thailand’s export growth this month, accounting for more than half of the total export expansion of 16.8%. - Unwrought Gold returned as a key export product. Exports of unwrought gold rebounded sharply, expanding by 163.6%YOY, following consecutive contractions of -53.3%YOY and -76.9%YOY in November and October, respectively. This rebound was partly attributable to the rise in gold prices in December. Exports of unwrought gold contributed 2.7 percentage points (CTG) to Thailand’s total export growth this month, out of the overall 16.8% expansion.

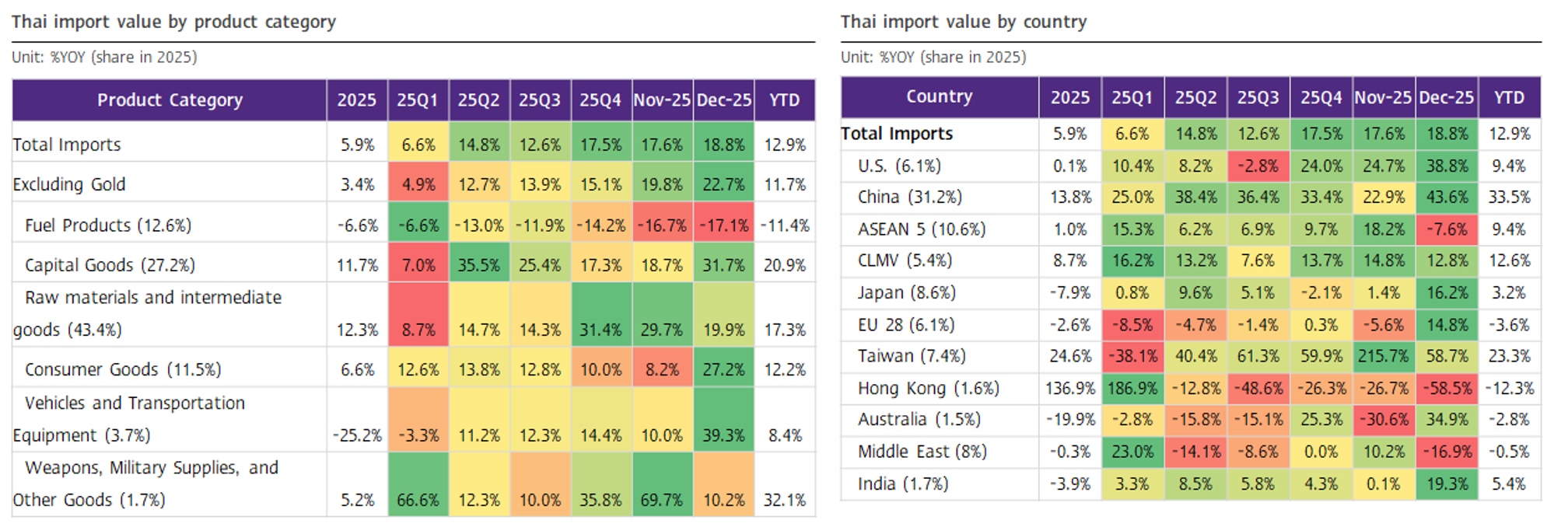

Imports continued to accelerate, resulting in Thailand recording a trade deficit for three consecutive months.

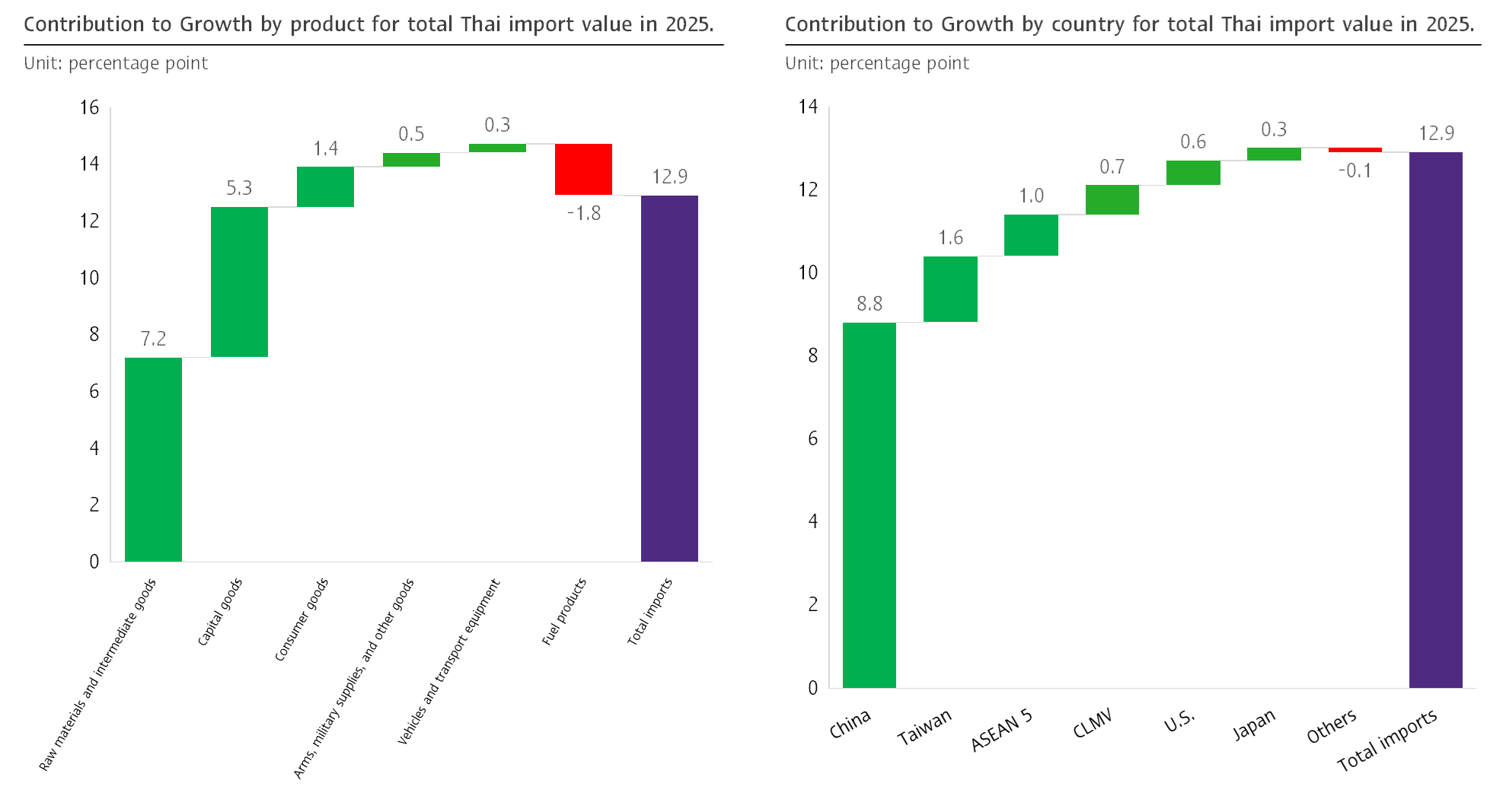

The value of Thai merchandise imports in December 2025 stood at USD 29,280.4 million, expanding sharply by 18.8%YOY, accelerating from 17.6%YOY and 16.3%YOY in November and October, respectively, and exceeding expectations (SCB EIC estimate: 12%; Reuters Poll median: 15.8%). Overall, total import value for 2025 expanded strongly by 12.9%, matching the full-year export growth rate.

In December, imports of vehicles and logistics equipment, capital goods, and consumer goods accelerated markedly by 39.3%, 31.7%, and 27.2%, respectively. Meanwhile, imports of raw and intermediate materials (including gold) as well as arms and ammunition, although moderating somewhat, continued to expand at double-digit rates of 19.9% and 10.2%, respectively. Fuel products imports were the only category to record a sharp contraction of -17.1%, close to -16.7% in the previous month, marking four consecutive months of decline (Figure 3).

- Imports of capital goods and raw materials and intermediate goods were largely related to electronics products. Imports of electronic integrated circuits, semi-conductor devices, transistors and diodes, and printed circuits expanded sharply by 56.3%, 86.3%, and 89.3%, respectively, accounting for 32.7% of total imports of raw materials and intermediate goods this month. Meanwhile, capital goods imports were dominated by electrical machinery and parts and machinery and parts, which expanded by 60.6% and 22.8%, respectively, representing 61% of total capital goods imports in December. Imports from China accounted for a high share in both categories, comprising 48.8% of capital goods imports and 28.7% of raw materials and intermediate goods imports this month.

- Consumer goods imports expanded strongly across 14 out of 15 major categories, led by electrical appliances, miscellaneous manufactured goods, and household goods and furnishings, which grew by 52.3%, 33.6%, and 21.8%, respectively. These categories together accounted for 38.1% of total consumer goods imports in December. Notably, more than half of consumer goods imports (54%) were sourced from China.

The trade balance (customs basis) in December 2025 recorded a deficit of USD -352 million, narrowing significantly from the previous month’s deficit of USD -2,726.9 million. The outturn was close to SCB EIC’s estimate of a USD -200 million deficit, while the Reuters Poll median had expected a much larger trade deficit of USD -1,800 million.

Overall, in 2025, Thai export value expanded strongly by 12.9%, despite facing challenges from US import tariffs. However, import value also rose sharply by 12.9%, suggesting that the value added from exports to the Thai economy may be limited.

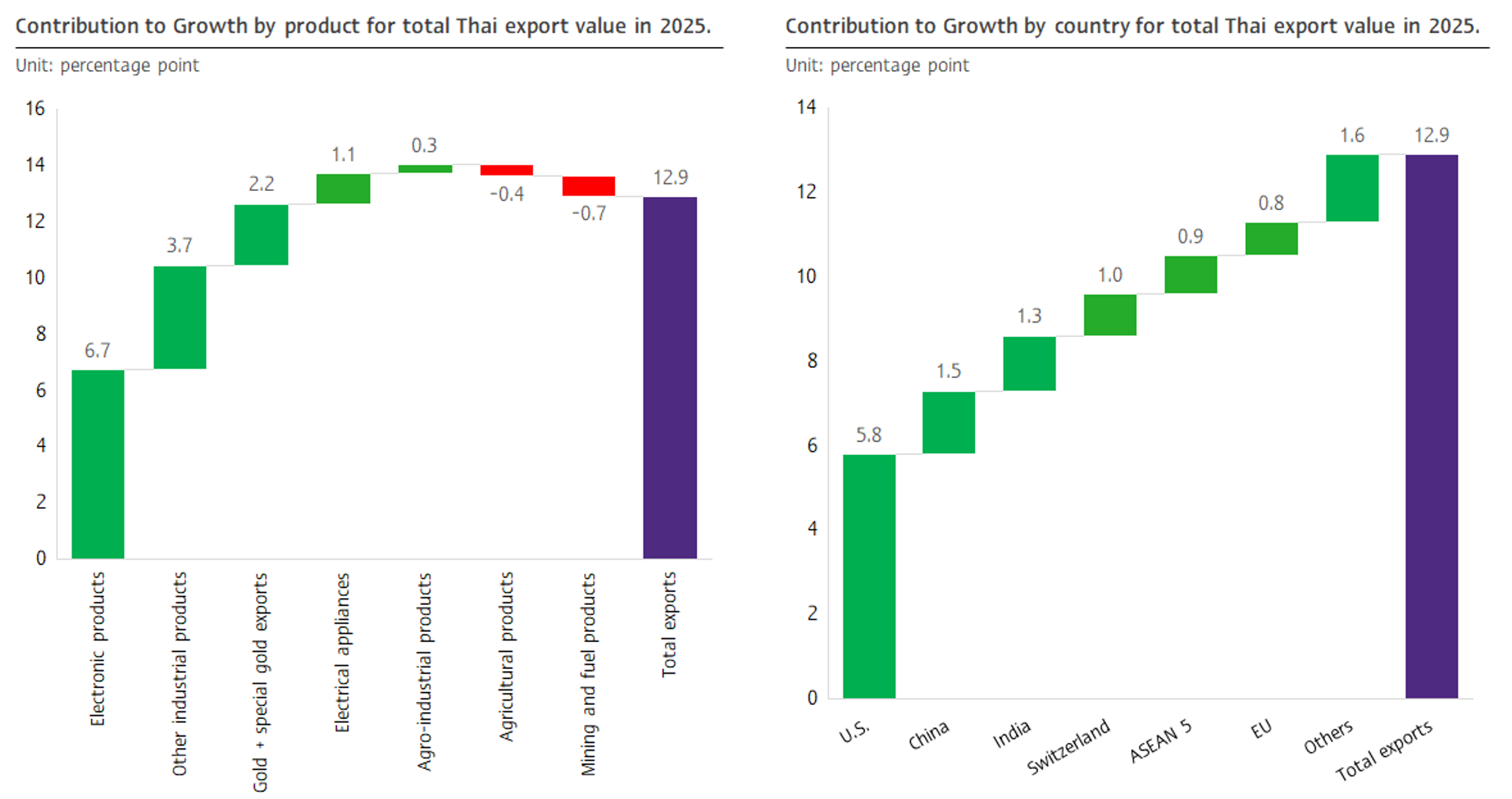

Overall, Thailand’s total export value in 2025 amounted to USD 339,635 million, expanding by 12.9%, the highest growth in four years. This represented more than double the export growth recorded in 2024, which stood at 5.4% (customs basis), and exceeded the forecasts by SCB EIC and the Ministry of Commerce, which had projected growth of 10.7% and 10.7%–11.4%, respectively. The main supporting factors were as follows (Figure 4).

- The reciprocal tariffs imposed by the United States were significantly less severe than initially announced.

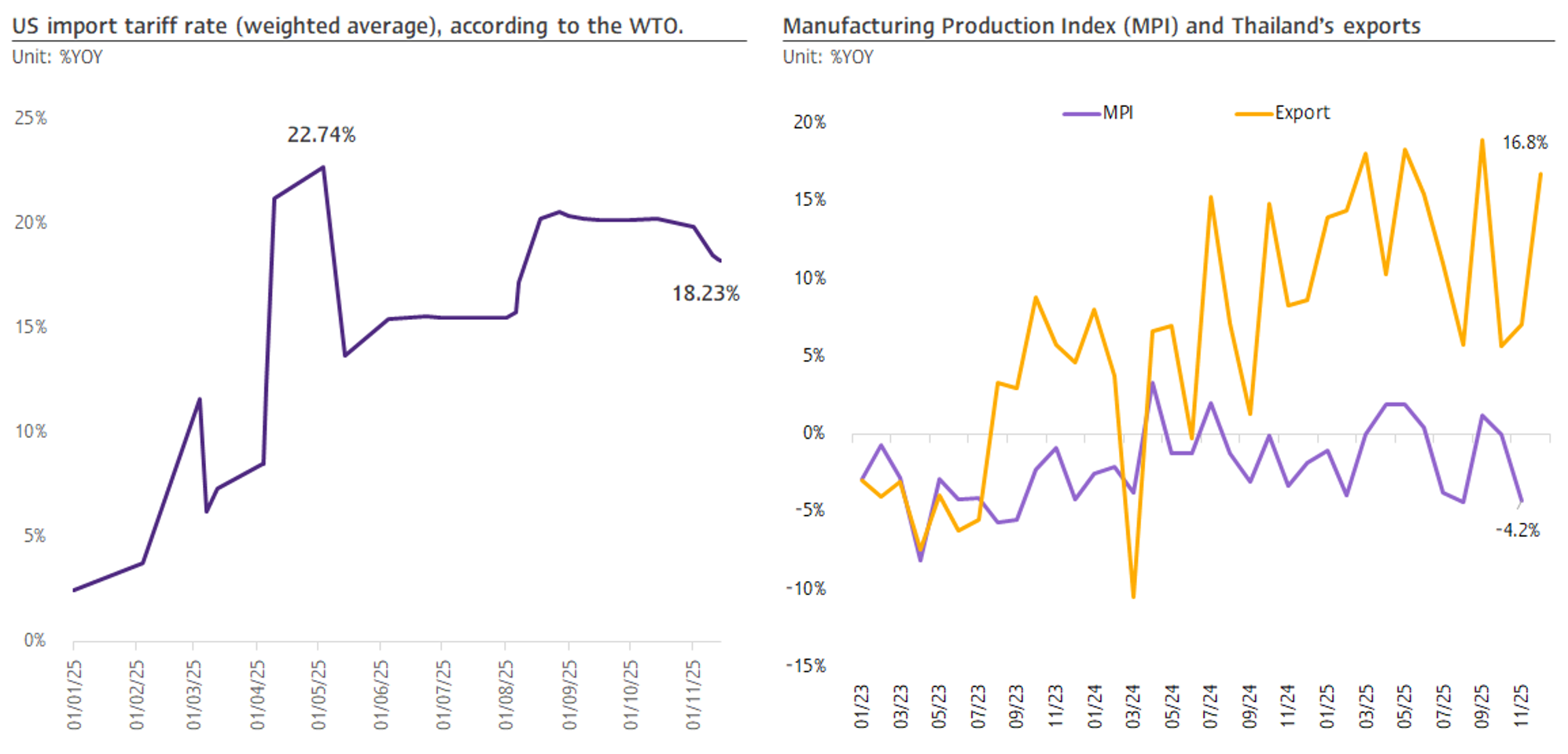

- The US imposed reciprocal tariffs at levels lower than those announced on Liberation Day (2 April). The weighted-average additional tariffs imposed by the US on imports from the rest of the world declined from 22.7%, as previously estimated by the WTO in May, to 18.2% in November (Figure 6, left). For Thailand, the US reduced import tariffs by nearly half—from 36% to 19%—bringing them broadly in line with regional competitors. As a result, Thailand did not lose significant competitiveness in the US market, alleviating earlier concerns that Thai exports might face higher tariff barriers than those of regional peers such as Malaysia and Vietnam.

- The U.S. delayed the enforcement of the reciprocal tariffs from April to August, allowing Thailand to continue accelerating exports to the US for several additional months. As a result, exports to the US for the full year expanded sharply by 32%, accelerating significantly from 13.6% growth in 2024. Exports to the US contributed 5.8 percentage points (CTG) to Thailand’s total export growth of 12.9% in 2025.

- The US also continued to exempt many of Thailand’s key export products from tariff measures, particularly goods that are essential to the US economy or that the US cannot produce, or produces only in limited quantities. These include certain electronic products, LED bulbs, graphite, some pharmaceutical components, and selected agricultural products. As a result, countries that rely heavily on exporting these products to the US—such as Thailand, Taiwan, and Vietnam—were still able to record strong export growth. In Thailand’s case, electronics exports to the US expanded by 52.5% in 2025, contributing over 20% (CTG) of the total growth in Thailand’s exports to the US for the year, which expanded by 32%. - The upcycle in electronic products, which are Thailand’s key export category (accounting for 21.5% of total Thai export value in 2025, up from 17.6% in 2024), was supported by strong demand for AI-related technology products and the continued expansion of global investment in the electronics industry and data centers. In addition, exports of these products were further boosted by the front-loading to the US, as some electronic products remained exempt from additional tariff measures. As a result, Thailand’s electronic export value expanded by more than 38.3% in 2025, contributing 6.7 percentage points (CTG) to Thailand’s overall export growth of 12.9%.

- Exports of unwrought gold expanded by more than 48.5%, supported by the sharp increase in gold prices, in line with stronger global demand for gold as a hedge against heightened global risks. Exports of unwrought gold contributed 1.4 percentage points (CTG) to Thailand’s total export growth of 12.9%. Including the special factor of gold exports to India in Q1/2025, Thailand’s gold exports as a whole accounted for 2.2 percentage points (CTG) of the overall export growth of 12.9% in 2025.

- China–US tensions eased significantly, as the US reduced import tariffs on Chinese goods to just 20%, down from over 100% in early 2025. This shift led to a more favorable outlook for the global economy and global trade volumes. For example, the WTO had projected in April that global trade volume in 2025 would contract by -0.2%, but revised its outlook in October to an expansion of 2.4%. As a result, Thai exports to non-US markets expanded well, including China, the EU, and ASEAN-5, which grew by 12.6%, 8.5%, and 6.9%, respectively.

Although Thailand’s export value expanded strongly in 2025, total import value also accelerated markedly. Overall imports amounted to USD 344,943 million, rising by 12.9%, the highest growth in four years, in line with export growth. The main drivers were raw materials and intermediate goods and capital goods, which expanded by 17.9% and 20.3%, respectively. Together, these two categories contributed 12.5 percentage points (CTG) to total import growth of 12.9% in 2025 (Figure 5).

- Imports of raw materials and intermediate goods (CTG = 7.2%) were driven mainly by gold and electronic components, in line with the continued expansion of Thailand’s exports of electronic products and gold. However, due to Thailand’s structural limitations in producing upstream and midstream electronic products, the country remains highly dependent on imports of key components—particularly printed circuit boards, which expanded by more than 41.3%—from major producers, especially China and Taiwan, to support rising export-oriented production. Gold imports also expanded strongly by over 36%, largely reflecting imports to offset export volumes, as well as a possible increase in domestic gold accumulation demand.

- Capital goods imports (CTG: 5.3%) were driven mainly by imports of electrical machinery and parts, machinery and parts, and computers, equipment and parts, which expanded by more than 47.1%, 16.2%, and 4.1%, respectively. This is consistent with data showing continued expansion in investment in the electronics industry and data centers in Thailand, which has been a key factor supporting the particularly strong growth of capital goods imports in 2025.

- Thailand’s imports were concentrated mainly in China and Taiwan, with import values from China and Taiwan expanding sharply by 33.5% and 23.5%, respectively, in 2025. Together, imports from these two economies contributed 10.4 percentage points (CTG)—8.8% from China and 1.6% from Taiwan—to Thailand’s total import growth of 12.9% in 2025. In particular, the strong increase in imports from China may partly reflect excess production capacity following trade restrictions imposed by other countries, especially the US, combined with weak domestic economic conditions in China. As a result, Chinese producers have increasingly shifted exports toward non-US markets, particularly Southeast Asia.

The Manufacturing Production Index (MPI) for Thailand, as shown in Figure 6 (right), did not expand in line with the strong export trend. This suggests that Thailand’s exports in 2025 generated relatively limited value added for the domestic economy. Meanwhile, Thailand’s trade balance (customs basis) in 2025 recorded a large deficit of USD -5,307.9 million, marking the highest deficit in three years.

The outlook for Thai exports in 2026 (as of December 2025) points to a significant slowdown to -1.5%, in line with global trade trends and a high base effect. Nevertheless, there remain several upside factors that could support exports.

SCB EIC assesses that Thai exports will weaken in 2026. Global economic growth and global trade volume in 2026 are expected to slow, as the impact of US tariff measures under the Trump administration becomes clearer and fully impacted. In addition, several temporary supporting factors in 2025 are expected to fade, including the front-loading of production and exports ahead of trade war impacts, the special factor of gold exports to India, the appreciation of the baht, which could undermine the competitiveness of Thai products, as well as the high base effect following the strong 12.9% expansion in 2025.

Nevertheless, the outlook for global trade, digital investment trends, and gold demand has improved, despite an overall deceleration. As a result, the previously assessed Thai export growth of -1.5% in 2026 (as of December 2025) still carries several upside factors.

- Global trade volume in 2026. International organizations (as of January 2026), such as the International Monetary Fund (IMF), project that global trade volume will expand by 2.6% in 2026. Although this represents a slowdown from 4.1% growth in 2025, it is higher than the previous projection of 2.3% made in October 2025.

- Digital investment trends, particularly in AI, are expected to remain strong in 2026, although moderating somewhat from 2025. This will continue to support strong demand for advanced electronic products, such as semiconductors and integrated circuits. High-frequency data show that South Korea exports during the first 20 days of January 2026 expanded by 14.9%YOY, with exports of semiconductors and wireless communication equipment surging by 70.2% and 48%, respectively.

- Demand for gold accumulation as a safe-haven asset remains elevated, in line with the sharp rise in geopolitical risks in the Trump 2.0 era. In addition, the World Gold Council has indicated that central banks remain net buyers of gold to build up international reserves. Moreover, several major global investment research institutions expect gold prices to continue rising this year. Historical evidence suggests that Thailand’s gold exports tend to move in line with global gold prices, implying continued support for Thai gold exports.

SCB EIC is closely monitoring and reassessing economic conditions and Thailand’s export outlook, and will release an updated forecast in February. Meanwhile, the Ministry of Commerce projects that Thai export value this year will grow in a range of -3.1% to +1.1%.

Figure 1: Thai Export Value by Product Category and Key Markets.

Source: SCB EIC analysis based on data from the Ministry of Commerce.

Figure 2: Computers and equipment, gold, computer components, and pickup trucks supported exports in December 2025, while rice continued to contract.

Source: SCB EIC analysis based on data from the Ministry of Commerce.

Figure 3: Thai Import Value by Product Category and Key Markets.

Source: SCB EIC analysis based on data from the Ministry of Commerce.

Figure 4: In 2025, electronics, gold, and electrical appliances were the main export products, while the US market accounted for nearly half of Thailand’s overall export growth for the year.

Note: Other industrial products refer to industrial products excluding electronic products, electrical appliances, and gold + special gold exports.

Source: SCB EIC analysis based on data from the Ministry of Commerce.

Figure 5: Raw and intermediate materials and capital goods were the main import products in 2025, with most imports sourced from China and Taiwan.

Source: SCB EIC analysis based on data from the Ministry of Commerce.

Figure 6: The weighted average US import tariff rate declined from early 2025, supporting stronger-than-expected global and Thai trade growth, while Thailand’s manufacturing sector may derive limited value added from the surge in exports.

Source: SCB EIC analysis based on data from the Ministry of Commerce, the Office of Industrial Economics, and the World Trade Organization (WTO).