Outlook Quarter 4/2018

EIC expects the Thai economy to expand at 4.5%YOY in 2018, before decelerating slightly to 4.0% in 2019. In 2018, the Thai economy continued to gain further traction on the back of improved external demand, benefitting both export and tourism sectors. Such strong external demand starts to benefit household income and employment more clearly.

- Thailand economy 2018 and 2019

- Global economic outlook in 2018 and 2019

- Box: The US 2018 Midterm Election

- Box: No deal Brexit– What it means to the future of the UK and EU, and the opportunities for Thailand

- Box: What changes were made in BOJ’s latest policy adjustment?

- Bull - Bear: Oil Prices

- In focus: Risks of tightening global financial conditions, implications on EM and Thai corporate bond market

- Box: Risks of tightening financial conditions to debts of Thai listed firms (Debt-at-risks)

- Summary of main forecasts

Thailand's economy 2018-2019

EIC expects the Thai economy to expand at 4.5%YOY in 2018, before decelerating slightly to 4.0% in 2019. In 2018, the Thai economy continued to gain further traction on the back of improved external demand, benefitting both export and tourism sectors. Such strong external demand starts to benefit household income and employment more clearly. The growth momentum is expected to continue through the rest of 2018, although the pace may slow somewhat due to the high-base effect and the deceleration in global trade. In 2019, growth is expected to continue at 4.0%YOY. Although lower than in 2018, this rate of growth is considered high for Thailand, especially when compared to the past 5 years when growth averaged at below 3%. Nevertheless, Thai export is expected to be softer following slower growth of Thailand’s trading partners, which were affected by global trade war and tightening financial condition. Moreover, the expansion of Thai tourism sector will be constrained by airport capacity. Nonetheless, domestic investment is expected to rise, driven by public investment in large infrastructure projects which would help smoothing the impacts to economic expansion in the short term, and supporting the country’ competitiveness in the longer term.

Household income is recovering gradually, but it will take some time before spending picks up in a broad-based and stronger manner. Despite an improvement in Thailand’s household income in the first half of 2018, with 1.7%YOY growth in agricultural income and 2.4% increase in wages of Thai workers, EIC does not expect spending to accelerate significantly soon as household income has only started to recover after agricultural income has contracted consistently from the second half of 2017 to the first quarter of 2018. Moreover, wage growth has been persistently low for the past 3 years, averaging at below 2% per year, thus making real household income growth (after deducted by inflation) stayed flat. In addition, the level of household debt remains elevated. In our view, one of the reasons why wage growth has been so low even with relatively low unemploymet rate is the remaining slack in the labor market. Slackness can be reflected by the decline in average work hours, the drop in over-time, and the rise in the share of people who remain unemployed for more than 6 months, which were results of both cyclical and structural factors. EIC believes that for the labor market slack to diminish and wages to rise firmly, economic expansion has to continue for a longer period. Nevertheless, in the longer run, wage will depend on labor productivity. Therefore, it is crucial to help improve Thai labor productivity through improving their essential skills required to take advantage of new technologies in order to support their strong and sustainable wage growth.

Thailand is soon entering an interest rate hiking cycle. EIC assessed that as economic growth continued to gain traction and headline inflation has moved within the target band, monetary policy committee (MPC) will vote to raise the policy rate in order to curb financial stability risk arising in the prolonged low interest rate environment. The first hike could come in early 2019, or possibly as soon as late 2018, depending on the timing that MPC would beconfident of average 2018 headline inflation staying in the policy target. However, unlike the previous hiking cycles, this one is expected to be more gradual, considering much higher debt to income ratio and lower average headline inflation compared to the past. EIC expects that MPC will raise the policy rate two times within first half of 2019 at 0.25% per hike, with pauses between MPC meetings, so that the interest rate increase will not impact significantly overall economic growth and inflation momentum. In addition, MPC is likely to utilize additional macro-prudential measures to address pockets of vulnerabilities that could threaten financial stablity risks. Subsequent interest rate path will depend on incoming economic data and future MPC communications. Although Thailand’s strong external stability and ample liquidity in Thai financial market could provide cushion against short-term volatilities and tightening in global financial condition, all parties especially households with floating-rate debt and businesses with relatively high leverage should prepare and manage properly possible risks associated with rapid increase of cost of fund (or yield snapback) as well as roll-over risk

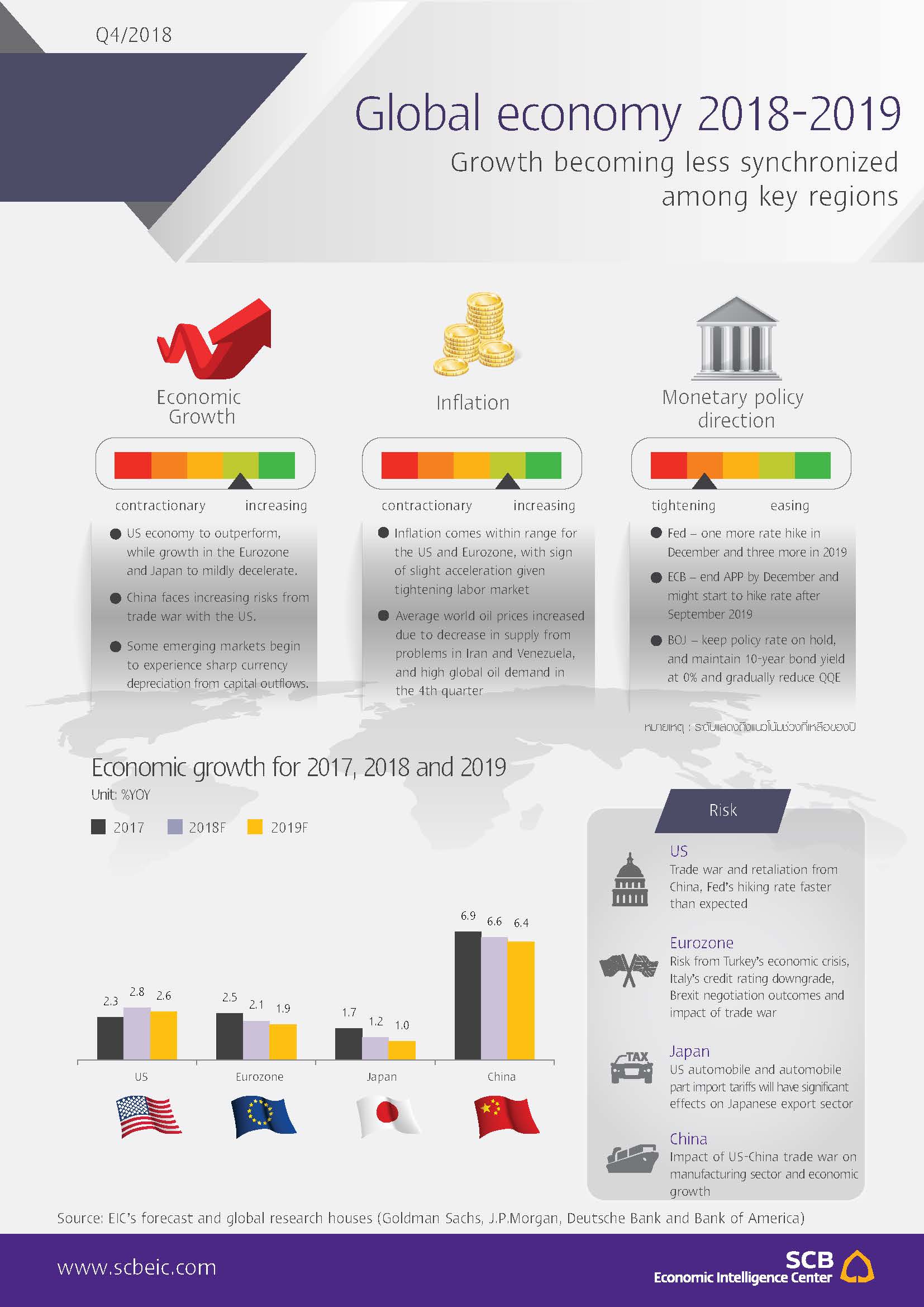

Global Economy 2018-2019

The global economy from the end of 2018 until 2019 is set to continue its consumption-led upward trend driven by strong labor markets and accommodative monetary policy, but growth is becoming less synchronized in many regions.For the remainder of 2018, the global economic upswing will be driven by the outperforming US economy, while growth in the Eurozone, Japan, and China begins to slow down. The overall growth outlook of developed markets (DM) remains positive, thanks to private consumption boosted by continually recovering labor markets, global trade recovery, and accommodative monetary policy. However, signs of less synchronized growth have become more apparent in many regions. Only the US economy, among all other major economies, will keep pace with its outperforming growth, while the Eurozone, Japan, and China grow at a slower pace with their economic figures not as outstanding as those of the US. Moreover, among emerging markets (EM), asynchronous growth and higher risks are also observed with Argentina, Venezuela, and Turkey facing economic crises spurred by domestic issues and weak fundamentals as well as a continually tightening monetary policy of the Fed. This might have an impact on growth and capital flows of the EMs going forward. Nevertheless, EIC expects the global economy to continue performing well in 2019, thanks to 3 driving factors. These include 1) private consumption which will benefit from strong labor markets as reflected in decreasing unemployment rate in key regions, 2) global trade that will still support exporting countries and inter-regional trade and investment cooperation such as CPTPP which will help alleviate risks from the US trade protectionist measures, and 3) economic fundamentals of EMs especially in Asia which remain strong and are still at the early-to-middle stage of the economic cycle with fewer trade and investment links with EMs that are now in crises. Overall EM firm fundamentals will help boost global growth, especially when growth of most DMs and China begins to slow from next year as growth of DM reaches the peak of its upcycle, while global monetary policy continues to tighten.

EIC identifies three key risks facing the global economy for the remainder of 2018 and in 2019: 1) trade war 2) economic vulnerabilities in some EMs, and 3) tighter-than-expected financial conditions in DMs. The first risk is that trade war between the US and China is likely to escalate and highly uncertain. Besides, a major impact would be felt across the global economy if the US were to implement national security tariffs (Section 232) on imports of automobiles and auto parts due to the industry’s complex supply chain linking together many adjacent industries both among manufacturers and suppliers, all of which support employment in many regions. The second risk refers to economic crises facing some EMs, such as Argentina, Venezuela, and Turkey, as well as highly vulnerable EMs such as South Africa, Brazil, India, and Indonesia. Although crises in the former three sprang from domestic issues and are unlikely to cause a domino effect due to limited inter-regional links, close monitoring is inevitable as global interest rates rise and especially if the US dollar continues to strengthen which can affect countries with high external debts and low international reserves. Lastly, risks from tighter-than-expected financial conditions, especially in the US, may have repercussions in the global financial market through dollar’s appreciation, which could have a sudden impact on cross-asset and cross-regional capital flows in the period ahead.

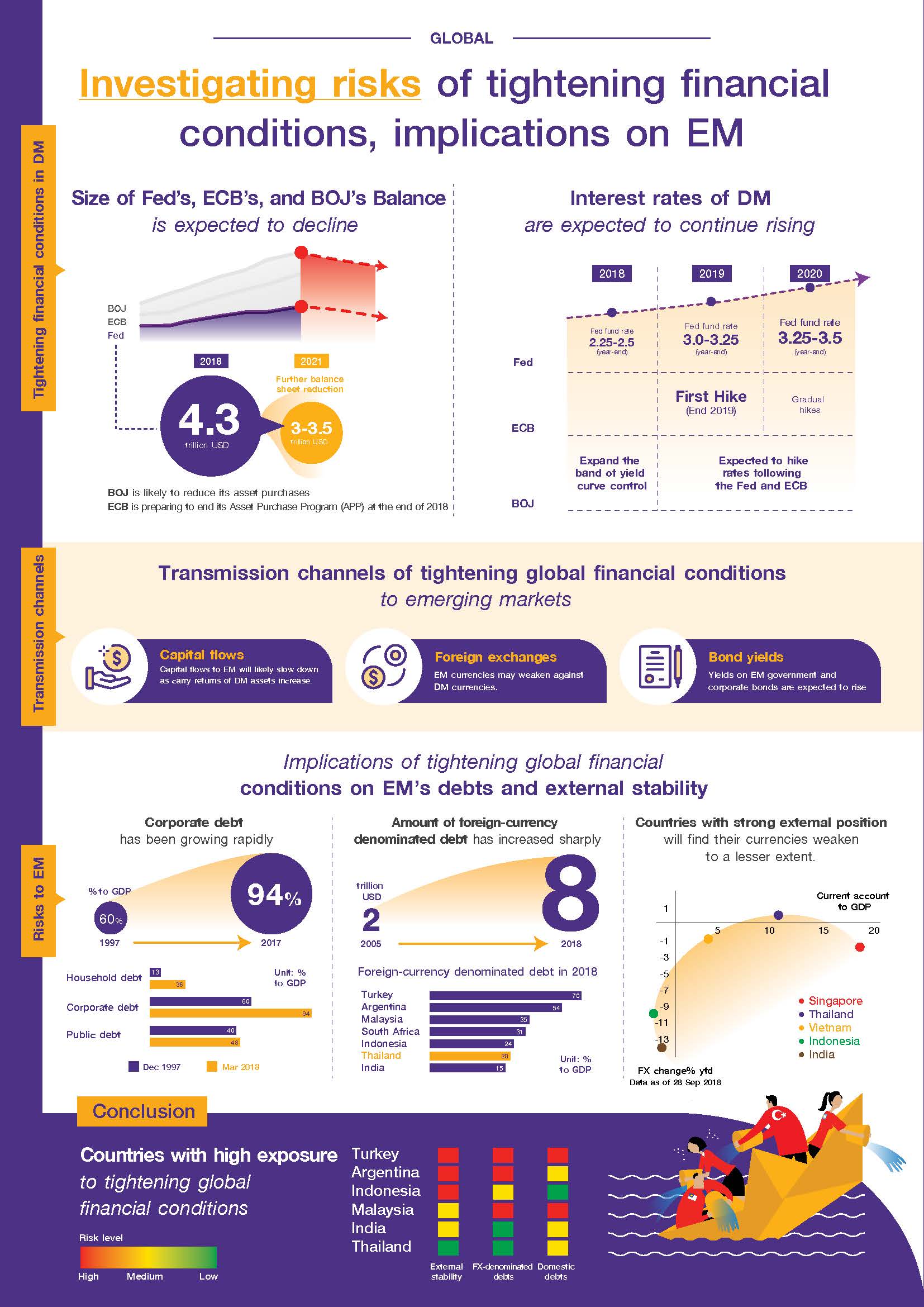

In Focus : Risks of tightening global financial conditions, implications on EM and Thai corporate bond market

The tightening global financial conditions resulting from monetary policy decisions in developed countries (DM) may impact emerging markets (EM) through a number of channels, particularly as emerging market’s debt keeps expanding. This article will tackle how the impact transmits to EM, and identify key vulnerabilities in certain countries. We found that in addition to Argentina and Turkey, market should also pay attention to South Africa, Indonesia, and India.

Furthermore, EIC studies how tighter financial conditions following interest rate hikes would pose some risks on listed Thai companies that raise funds via corporate bond issuance. We found that default risk is limited,with vulnerability concentrated only in a few sectors. However, if interest rate rises sharply, default risk of corporate bonds may become significantly higher.