Property Fund for Public Offering (PFPO) in Comparison with the New Real Estate Investment Trust (REIT)

REIT is equipped with more flexible investment regulations, adding to the attractiveness of the REIT market than the PFPO’s. Investors would see more variety of assets in the REIT arena and risks of one single REIT could be better diversified. Trustee and REIT manager will play more fruitful roles in creating value of REIT, as well as, fostering REIT to be more competitive to those in foreign REITs. As a result, we should see each REIT growing bigger and long-term trading performance excel over the PFPO’s. • REIT’s tax benefits for retail investors are the same as the PFPO’s, but for company investors’, tax exemption on dividend is no longer available. For foreign investors, tax exemption on dividend is no longer available. Tax on dividend for foreigner will be 10%, the same as everyone else’s. • One challenge that REIT will face is the issue of discounted trading unit price (declining trading unit price over time), just like that of many PFPO’s. This means capital loss for investors. There are many reasons for discounted trading unit price, such as, asset quality, illiquidity nature of the market, fair valuation issue, and timing of listing. To eliminate the issue, all parties, which including regulators, financial advisors, REIT manager, and trustee, are required to take their roles in selecting good quality assets and promote fair valuation and strong governance.

Author: Srinarin Poudpongpaiboon

|

|

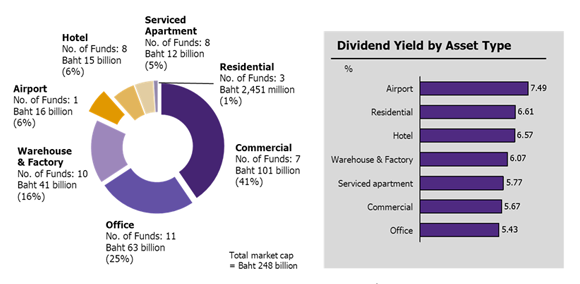

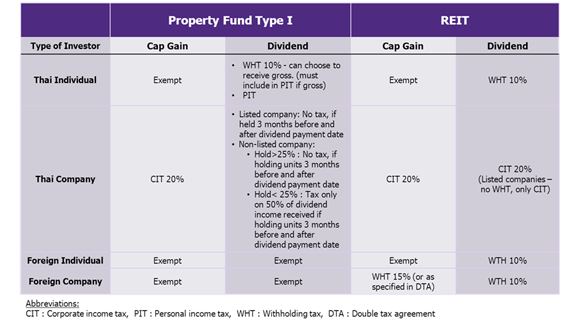

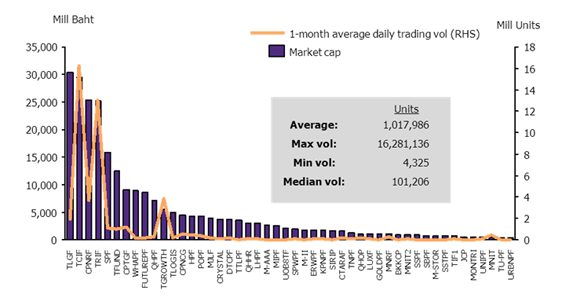

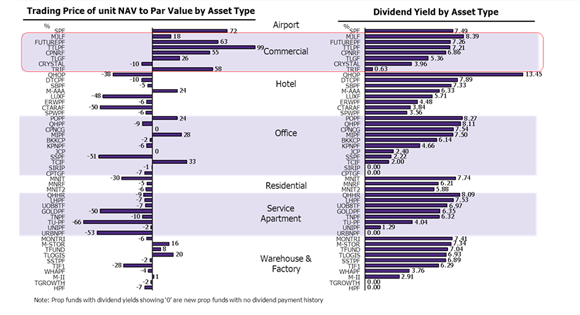

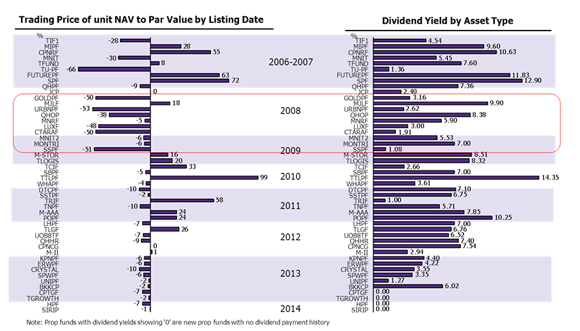

Real Estate Investment Trust (REIT) will substitute Property Fund for Public Offering (PFPO). PFPO scheme in Thailand will be substituted with REIT, a more conformable to international standards and widely used guidelines around the world. REIT is a new set of regulation under The Trust for Transactions in Capital Market Act B.E. 2550. The existing PFPO market capitalization, for the past 10 years, has grown to Baht 248 billion with 48 property funds, 7 types of asset (see Figure 1). Starting 2014, there will be no new PFPO and existing PFPO will not be allowed to raise more capital. Existing PFPO will continue to existing in the secondary market, however, they are encouraged by regulators to convert to REIT. At the moment, the cost of conversion to REIT is high and some tax benefits at the investors' level are taken away under REIT scheme. Despite the absence of such tax benefit for investors, REIT will continue to offer tax benefits at the REIT level, that is, tax exemption on income generated from assets held by REIT. Also retail investors will continue to receive tax exemption on capital gains. REIT scheme allows for portfolio growth through more flexible investment regulations. REIT regulations allow additional investment method as followed; REIT can lend from financial institution up to 35% of total asset, or 60% if the REIT itself has investment grade. Debt financing will allow REIT to achieve higher ROE. On the other hand, REIT can also engage in investment in green field or partially developed asset up to 10% of total asset. Territory-wise, REIT can invest in the asset outside Thailand. Investing abroad not only helps diversify geographical-related risks, but more importantly, it also adds to the attractiveness of the REIT itself. Other positive characteristic of REIT is that it can also invest in various types of asset not restricted by Securities Exchange Committee (SEC). Under PFPO, the fund can only invest in 9 different types of asset; namely, office, shopping center, factory, warehouse, service apartment and residential, hotel, convention center, large distribution center. Under the new REIT scheme, REIT's opportunity is broaden to any businesses that yield rental income, e.g. vacant land for car park rental. Moreover, REIT can also invest directly or indirectly through subsidiaries of 99% share. Investment by acquiring company that holds many assets will benefit investors by saving associated property taxes and fees paid by investors. These investment methods provide for continuous portfolio growth not existed in the PFPO's. Retail investors' related tax benefits on dividend and capital gain remain the same, but company investors' tax exemption on dividend is no longer available. For Thai retail investors, dividend paid from PFPO and REIT subject to 10% withholding tax at the date of payment. Capital gain on sales of unit in both PFPO and REIT are exempted. For Thai corporate investors, tax exemption on dividend used to apply for PFPO (see Figure 2) is no longer available for REIT. This is one of the disadvantages of REIT for Thai corporate investors. However, investors' ROE can be leveraged and risks be diversified with gearing and investment methods allowed under REIT, giving investors a substitute benefit on the dividend tax applied. Thai corporate investors will continue to pay tax on capital gain at the corporate income tax rate of 20%. For foreign investors, dividend received from REIT will subject to a withholding tax of 10% both company and individual. Capital gain tax is exempted for foreign individual just like the Thais, while foreign companies subject to withholding tax of 15% (or as specified by the Double Tax Agreement between Thai and the investors' respective country). EIC believes that REIT will face similar issue on discounted trading unit price as that of PFPO's. Discounted (declining) trading unit price below the IPO price (usually 10 baht per unit) means capital loss for unit holders. There are three main reasons for discounted trading unit price, first, low liquidity in the speculative environment of the stock market. Some investors buy PFPO units expecting to see instant gain, but the PFPO or real estate market do not work that way. PFPO/REIT is more of a long-term investment vehicle since it offers constant income for as long as the asset's useful life. Investors, who do not view PFPO as a long-term investment, will likely sell their unit at loss and invest in something else. Secondly, the timing of IPO can cause discounted trading unit price. Those PFPOs listed some time before the 2008 global economic crisis received high valuation due to preferable economic outlook at the time. As a result, during a less performing economic condition, the trading unit price would theoretically be below the IPO price (Figure 5). But timing is not always the reason to be blamed. Most of the time, we would assume that assets receive fair valuation when they are being priced and listed. Fair means there is no speculation on the asset's ability to generate revenue. For newly listed PFPO/REIT, future cash flow of the assets can be distorted by too positive set of assumptions used in the valuation process. The result is over-valuation or overpriced. Over-valuation is one of the three reasons for discounted trading unit price due to actual performance or yield of an asset is below what is expected. An apparent over-valuation example is PFPO with guaranteed returns from one single tenant, usually the sponsor. As the asset operator in the hotel-type PFPO, such property sponsor is required to lease the whole asset from the PFPO to operate and promise to pay high rents for a specified number of years. The lock-down future cash flows can be risky for investors since after the lock-down or guaranteed period, the rent terms may reduce substantially, adjusting to the real market condition, causing the yield to drop, hence, discounted trading unit price. At times, we may hear equity analysts explain discounted trading unit price that it is caused by the fund size not being big enough or because it is a leasehold asset in which price will keep decreasing over time. EIC believes that the market mechanic works in its very systematic way; that is good quality asset with fair valuation will yield good returns, receive attention from investors, and eventually traded at premium to its IPO price. Great assets are not affected by size or asset tenure because if asset generate good and increasing income, new investors will be willing to pay premium until yield falls to their alternative investments' range. Leasehold assets as well, if the asset gives higher yield over years, can be traded at premium until returns of the remaining leasehold life fall below the price. Therefore, from the described observations of the PFPO market's discounted trading unit price, REIT, as being in the similar market environment, will likely face similar challenge as that of PFPO's. Investors should scrutinize asset's actual performance and its fair value before investing. REIT requires strong governance from Trustee and qualified REIT manager. Trustee is, by regulation, a financial institution such as banks and securities companies. Trustee in REIT will play a more important role as asset owner and represents all trust unit holders to overlook the REIT's operation and performance. Strong governance from trustee, therefore, should be emphasized to protect the benefit of public investors, and their authority not to be influenced by the sponsor (original asset owner), especially at the time of asset valuation when IPO. REIT manager is another important role being added to the REIT structure. REIT manager will be the party that manage REIT's assets and create economics value for all investors. Eligible REIT manager must own proper system and suitable personnel(s) who has at least 3 out of 5 years of asset management and investment experience according to SEC. REIT manager will, most of the time, be the sponsor's subsidiaries due to familiarity with existing tenants and experiences in real estate investment, development, and operation. REIT regulation allows sponsor or related party to hold trust unit up to 50%, instead of 1/3 in the PFPO. The higher share held allowed to original asset owners is to incentivize owners with quality assets to sell their assets to REIT, per se to the public, and uphold good performance as REIT manager and or property manager (REIT manager, focusing on investment side of the REIT, may hire property manager to take care of the day-to-day operation of the asset). Conflict of interest could arise when major unit holders is the sponsor and sponsor's subsidiaries take roles as REIT manager and property manager on management fee paid to REIT manager and property manager. Trustee will be the entity to manage these issues.

Figure 1: Number of property fund by type currently available in Thailand, market capitalization contribution and average dividend yield by asset type. Market average yield of property fund is 6%. Source: EIC analysis based on data from SET, Yields as of April 2013

Figure 2: Summary of investors' tax benefits for PFPO and REIT Source: EIC analysis based on data from SEC

Figure 3: Market capitalization of each property fund ranking from highest to lowest and 1-month average daily trading volume for each fund. Thai property funds have low daily trading volume. The lowest daily trading volume is as low as 4,000 units in a day. Only some high market cap funds show high daily trading volume, though, only as high as 16 million units in a day. Such illiquidity leads to discount unit trading price, hence, capital loss for investors. Source: EIC analysis based on data from SET

Figure 4: PFPOs' trading unit price percent discount to par, grouped by asset type. Yield is calculated based on dividend paid per year divided by the funds' market cap. Commercial properties are most valuable as yields are attractive and units are mostly trading at premium. Source: EIC analysis based on data from SET

Figure 5: PFPOs' trading unit price percent discount to par, ranking by date of listing. PFPOs listed before the 2008 economic crisis show discounted trading unit price caused by high valuation that based on preferable economics assumptions. Source: EIC analysis based on data from SET |

Investors should look at the following when investing in PFPO and REIT;

More Tips

|

|