Online Food Businesses, Capturing a Piece of the Growing Pie

Food and beverages are top online products purchased by Thai consumers. Regarding EIC’s survey, more than half of online shoppers buy food online regularly every month. The upbeat in this market is driving online food suppliers to use sales strategies and collaborate with other players to create a competitive advantage. Nevertheless, with clearer signs of increasing competition, EIC recommends businesses to adjust their strategies to overcome limitations and attract more customers. In particularly for food producers and traders that do not currently distribute products online, they should reconsider their business model in order to keep pace with latest trends.

Author: Veerawan Chayanon

|

Highlight

|

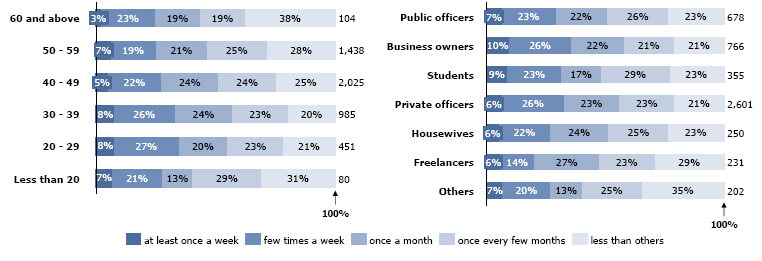

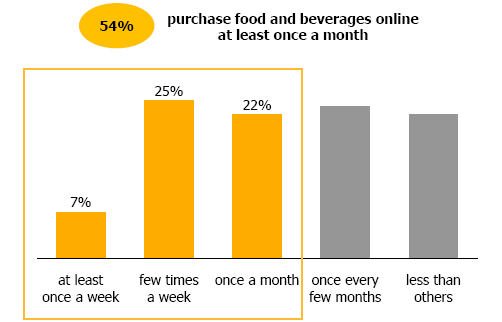

More Thai consumers are turning to online shopping for their food and beverages due to its convenience and cost advantage over traditional channels. Although the majority of consumers are accustomed to buying food and cooking ingredients from markets, restaurants, supermarkets, hypermarkets and convenient stores, latest survey conducted by EIC reveals that over 20% of consumers purchase their food online and more than half of the such group make regular purchases at least once a month (Figure 1). Key reasons for this popularity are home delivery services, convenience, time-saving and superior promotions. Additionally, the survey shows that consumers aged between 20 and 40 years particularly office workers and business owners tend to buy food online more frequently than other consumer groups (Figure 2). Their purchases are mostly made via producers’ or suppliers’ website and the second most popular channel is mobile applications.

Large businesses are aligning their strategies with these consumer preferences and use various tactics to broaden consumer base. Well-known retailers and restaurants like Tesco Lotus, Tops, CP Freshmart, MK Restaurant and KFC have added online food shopping services and use various marketing strategies to increase sales and reach more consumers. Some examples of these strategies are discounts, special promotions varied by periods, customized delivery services that allow customers to choose the date, time and location of delivery, one day delivery services for any purchases made within the certain time, delivery fee waiver or discount for a minimum purchase and various payment channels such as credit cards, debit cards, e-wallet and cash on delivery.

Startups are also entering the online food shopping market but with different business models and consumer focus. For example, Happy Fresh provides quick delivery services from supermarkets or grocery stores that are unable to provide their own delivery services, such as Big C, Gourmet Market and Home Fresh Mart. While Food Panda targets customers who prefer ready-made food from local stores ranged from fast-food shops to fine-dining restaurants. A similar service provider, Ginja, distinguishes itself by using Facebook Messenger as a channel to place food orders rather than creating its own application. Their service is convenient because customers do not need to download additional application and there are no delivery charges or minimum order size in some cases. Other online food stores tend to target niche markets like Green Shop Cafe and Happy Farmers that sell organic products to health conscious consumers.

Players are keen to partner with each other in order to strengthen their businesses and get ready to compete with new entrants. An example is Wongnai, a restaurant review and recommendation application that joined forces with Lineman, a delivery application, to provide food delivery services from top restaurants. Such collaboration has benefited all parties, from restaurant owners, whom gain from additional income from online sales without setting up their own system, Lineman, whom benefits from expanding their consumer base from services such as parcels, documents and groceries delivery, to Wongnai, whom is able to create a unique feature to their business by providing food ordering services. EIC expects there will be more collaboration among businesses, with such partnership covering a wider range of services. Furthermore, other businesses are also convinced to explore these golden opportunities leading to more competition for existing players. A prime example is Uber that started tapping into this business by collaborating with Zomato, a restaurant review and booking application, to provide transportation services in major cities like London, New York and Sydney. Uber later saw an opportunity in the market that led to the creation of UberEats, a food ordering and delivery service that now competes with existing key players like Deliveroo in London and Menulog in Australia.

Nevertheless, growth of online food shopping business in Thailand is still restricted by the coverage of delivery area and lack of consumer confidence. Many operators solely offer services in the Bangkok and metropolitan area, while some applications are only accessible in Bangkok. However, EIC’s survey reveals that users of online food shopping are spread out in every region of the country; therefore, businesses should consider expanding the service area coverage. Furthermore, as consumers are still not confident in quality of food purchased online, especially raw materials. Businesses should therefore adopt better screening procedures, use appropriate packaging and control storage temperature to preserve food quality during delivery. Return policies might be applied like Sainsbury’s and Morrisons supermarkets in the UK that allow customers to refuse the delivery of unsatisfied foods purchased online.

|

|

|

|

|

Figure 1: Number of consumers that purchase food and beverages online, categorized by purchase order frequency

|

Unit : persons (Total of 5,083 people) |

||

|

| Figure 2: Frequency of online food and beverages purchase, categorized by consumer age group and occupation |

| Unit : persons (Total of 5,083 people) |

|

|

|

Source: EIC survey on food and beverage consumption behavior (June 2016) |